- Nonfarm payrolls revised down by 818,000 jobs as at March 2024

- Monthly payrolls up by 174k March to March instead of 242k pre-revision

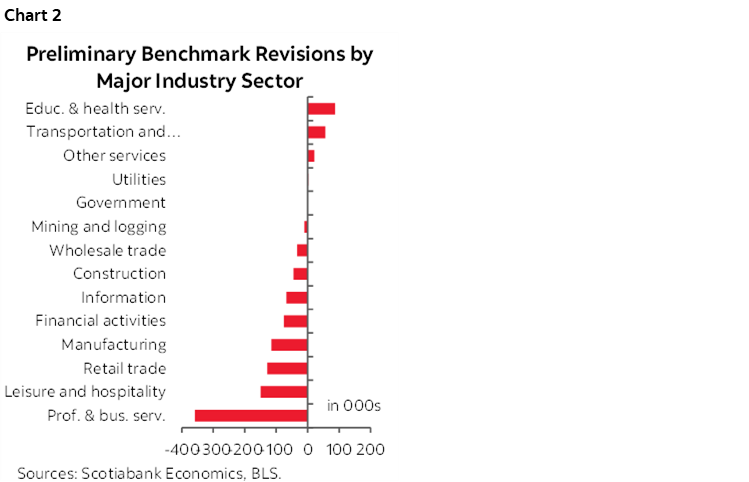

- A handful of sectors bore the brunt of the negative revisions, few were positive

- This looked like a highly unequal dissemination process

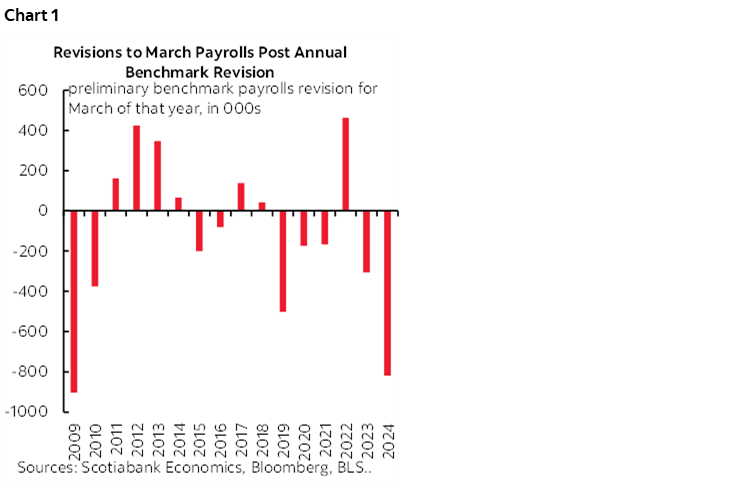

Annual US nonfarm payroll revisions were released just after 10:30amET and recorded the second biggest downward revision to the reported level of nonfarm payrolls on record since the GFC (chart 1). The way the numbers were disseminated looked awfully fishy.

818,000 jobs were taken away from reported job growth over the March 2023 to March 2024 period, which translates into an average monthly reduction of 68k fewer jobs created over the period from April 2023 to March of this year. Instead of nonfarm payrolls being up by 2.9 million between April 2023 and March 2024, the figure is now 2.082 million jobs created for an average monthly amount of jobs created of about 174k. That’s still decent, but materially lower from the previously understood pace of 242k per month.

Chart 2 shows where the downward revisions were focused on a sector by sector basis. It was all in the private sector. Professional and business services took the biggest hit by far, followed by manufacturing and then the trade/transportation/utilities sector. There were minor upward revisions in a handful of sectors.

MARKETS SHRUGGED

Markets barely flinched, perhaps because the size of the revisions fell shy of a widely advertised higher estimate of up to 1 million jobs lost to revisions. Markets continue to price about 34bps of a cut at the September FOMC. Pricing for a full percentage point of cumulative cuts by the December meeting remained unchanged. US 2s were little changed. The S&P initially rallied a touch but is back to little changed post-release.

REASON TO BE CAREFUL

I would be careful with the figures especially in terms of viewing them as justifying more than a quarter point cut at the September meeting. It’s widely understood that the US has seen population growth of about 3½ million in each of the past two years including undocumented workers. Nonfarm payrolls count undocumented workers (illegal migrants). The QCEW source that is used for this annual benchmarking exercise to revise nonfarm payrolls does not include undocumented workers because it comes from unemployment insurance tax records and by definition undocumented workers don’t file. Therefore, there is the strong risk that the downward revision to payrolls is overstated.

UNEQUAL DISSEMINATION BY THE BLS?

The BLS promised a release (here) for 10amET. They didn’t release at that site until after 10:30amET. Media outlets apparently did not have access to the figures either, including Bloomberg that didn’t report the figures until after 10:30amET when the BLS posted them. Bloomberg put out a story at 10:19:37amET titled “Release of Preliminary US Payroll Data Revisions is Delayed” that included the line “calls and emails to BLS representatives were not immediately answered.” And yet select US dealers obtained the figures directly from the BLS reportedly by phone call. One US dealer reported the figure before 10:20amET and another at 10:27amET. Does the BLS choose what calls to take? Who does? Do they delay until after giving advantage to a select few? What firms knew in advance of the release? I have placed a call asking about the release process and was told someone will get back to me and I’m still waiting. I am not certain, but it feels like another case of unequal dissemination of an important U.S. government report that should be investigated including whether select few enjoyed unusual advantages from early access.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.