- Rates rallied, USD depreciated...

- …because traders got a little too punchy!

- Nevertheless, CPI was strong with high breadth

- The readings are probably stale…

- …with key FOMC decisions likely pre-set…

- …and as the pandemic turns

US CPI, m/m headline/core %, SA, November:

Actual: 0.8 / 0.5

Scotia: 0.5 / 0.4

Consensus: 0.7 / 0.5

Prior: 0.9 / 0.6

US CPI, y/y headline/core %, November:

Actual: 6.8 / 4.9

Scotia: 6.8 / 4.9

Consensus: 6.8 / 4.9

Prior: 6.2 / 4.6

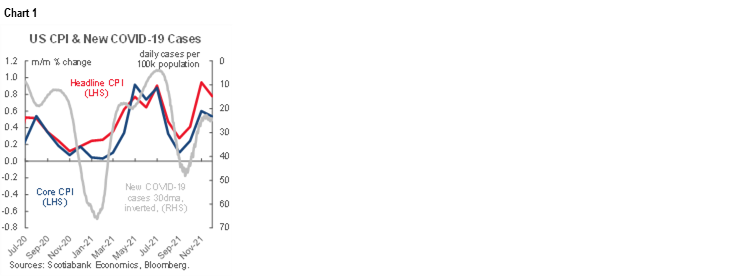

Chalk up another hot month for US inflation, but it was stale on arrival anyway. The Fed’s expected decisions out of next week’s meeting are largely made, and the renewed turn in pandemic cases with more to come casts fresh risk into nearer term inflation readings. CPI performed broadly in line with the evolution of pandemic cases last month (chart 1), but a renewed rise in cases may dampen future gains in some of the more pandemic-sensitive categories.

Nevertheless, inflation estimates—especially core — were in the ballpark of consensus estimates across economists, but a touch softer than swap market measures of expectations. Because traders got a little too punchy into the print, we’re seeing some of them cover and hence rates are rallying and the dollar is depreciating a bit on the back of the numbers. That’s a market issue around traders’ pricing rather than a substantive matter relating to what actually happened to inflation.

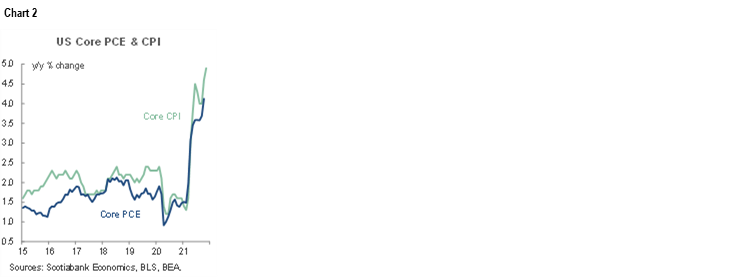

So on we go with a look at what drove a reported disturbance at Paul Volcker’s grave site at 8:30amET (kidding, sort of…). Headline inflation climbed by 6.8% y/y for the hottest reading since 1982 and in line with expectations. Core inflation at 4.9% y/y was also in line with our expectations and the hottest reading since 1991. Core PCE is likely to continue to lag behind somewhat when we get that at month-end (chart 2).

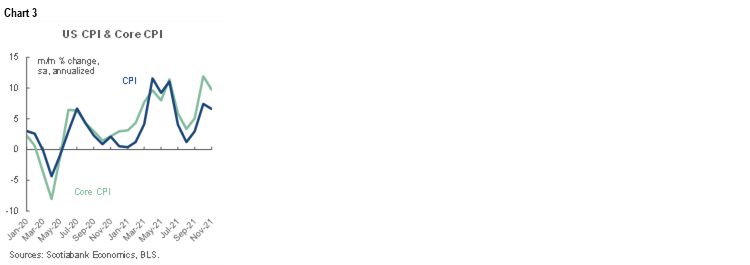

Headline inflation was up 0.8% m/m and hotter than the 0.5% m/m rise in CPI ex-food-and-energy. At annualized rates, we’re still seeing very strong gains which continues to reinforce how inflation is not just a year-ago base effect issue and has not been throughout the year (chart 3).

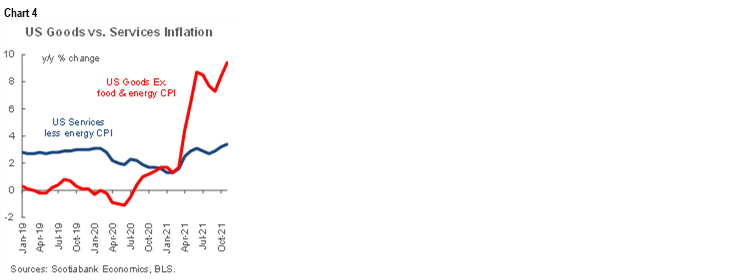

Chart 4 shows that most of the pick-up last month was in the core goods category that continues to have the hottest price pressures.

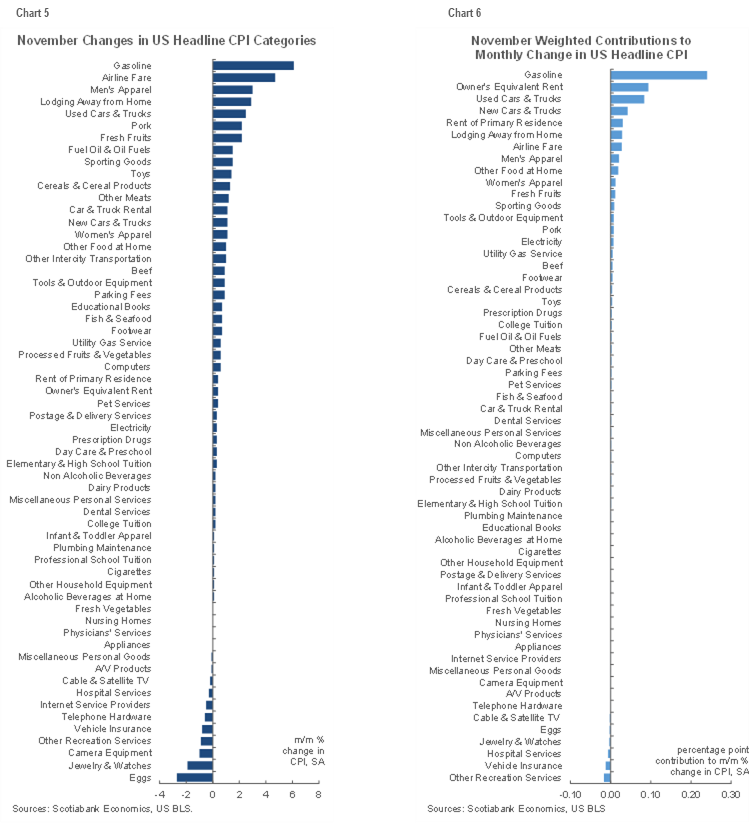

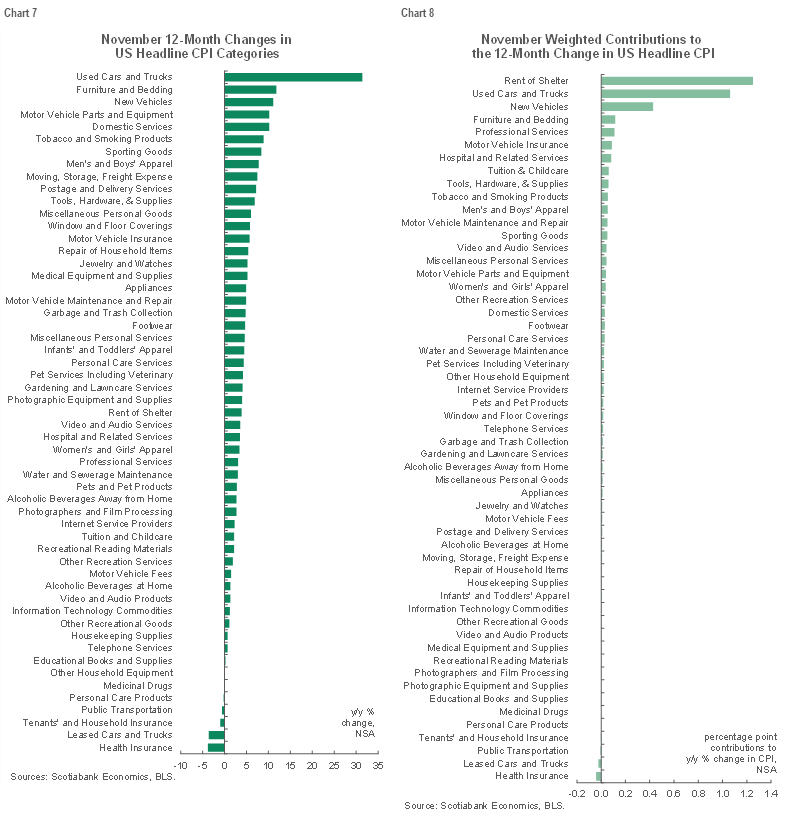

In terms of drivers, see chart 5 that breaks down the m/m changes across basket components and chart 6 that does the same thing in terms of weighted contributions to the m/m price changes. Charts 7 and 8 do likewise to the year-over-year CPI changes.

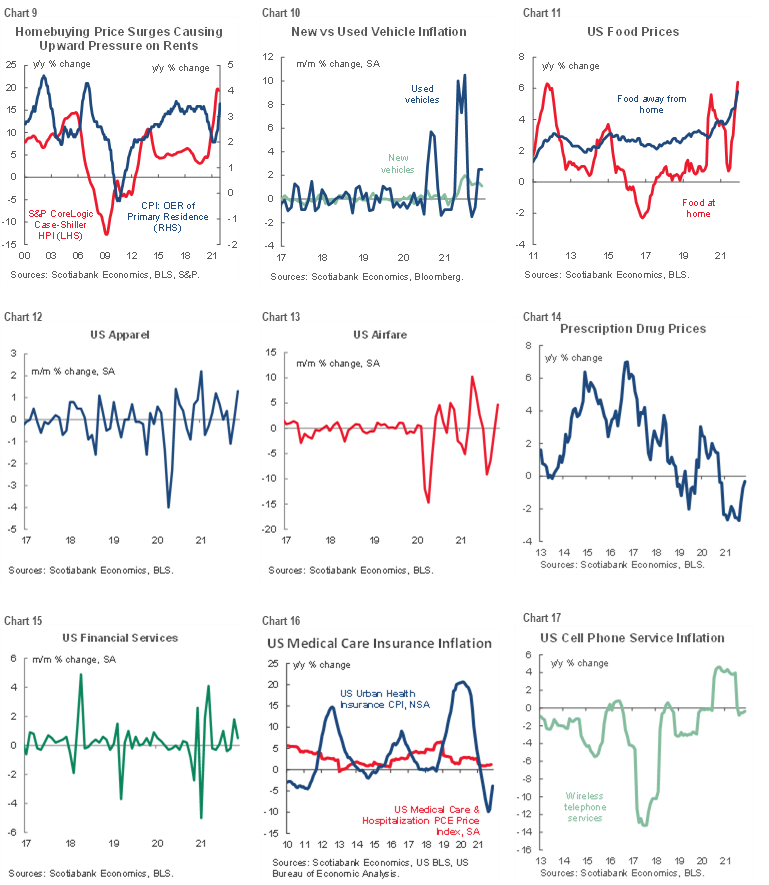

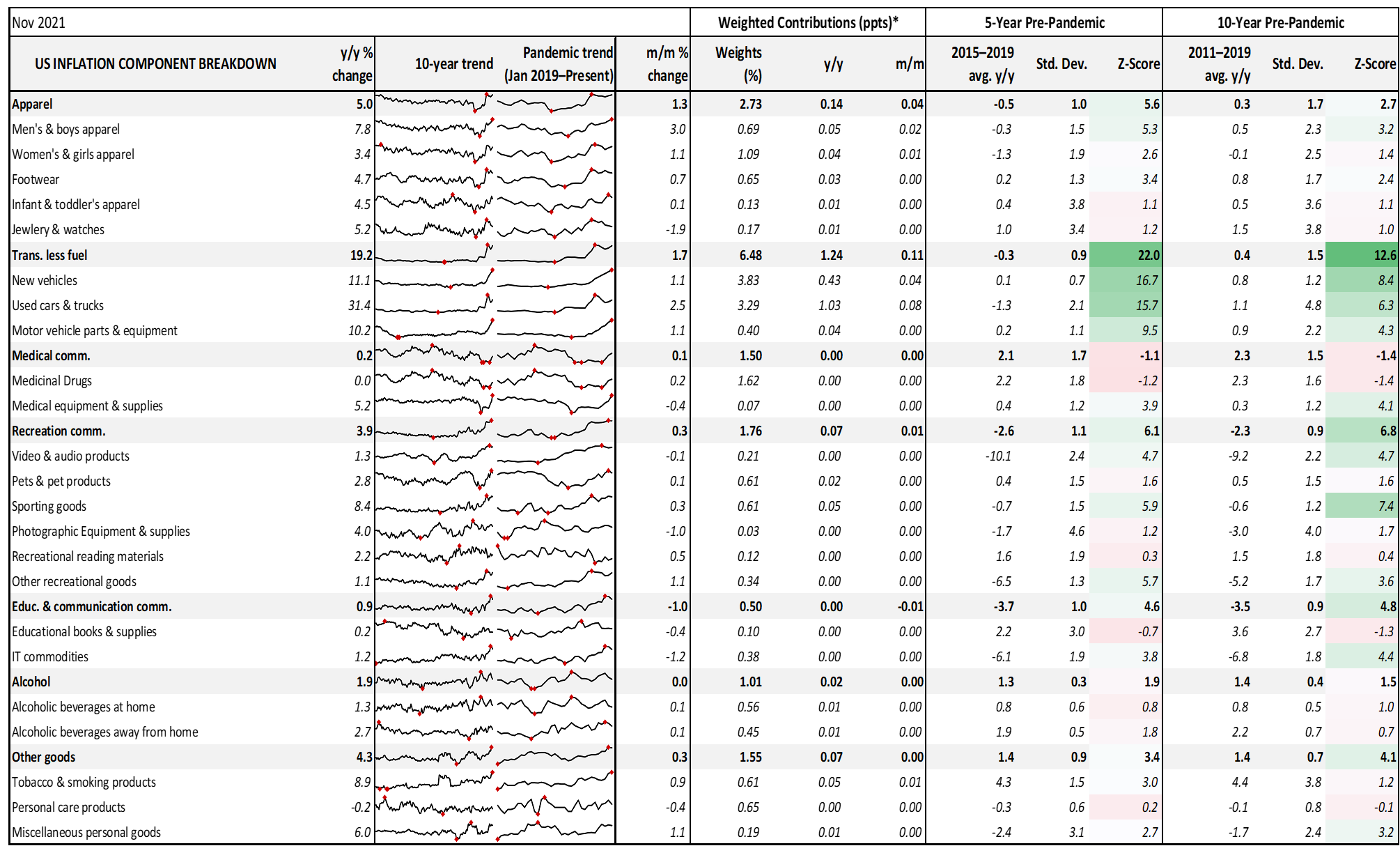

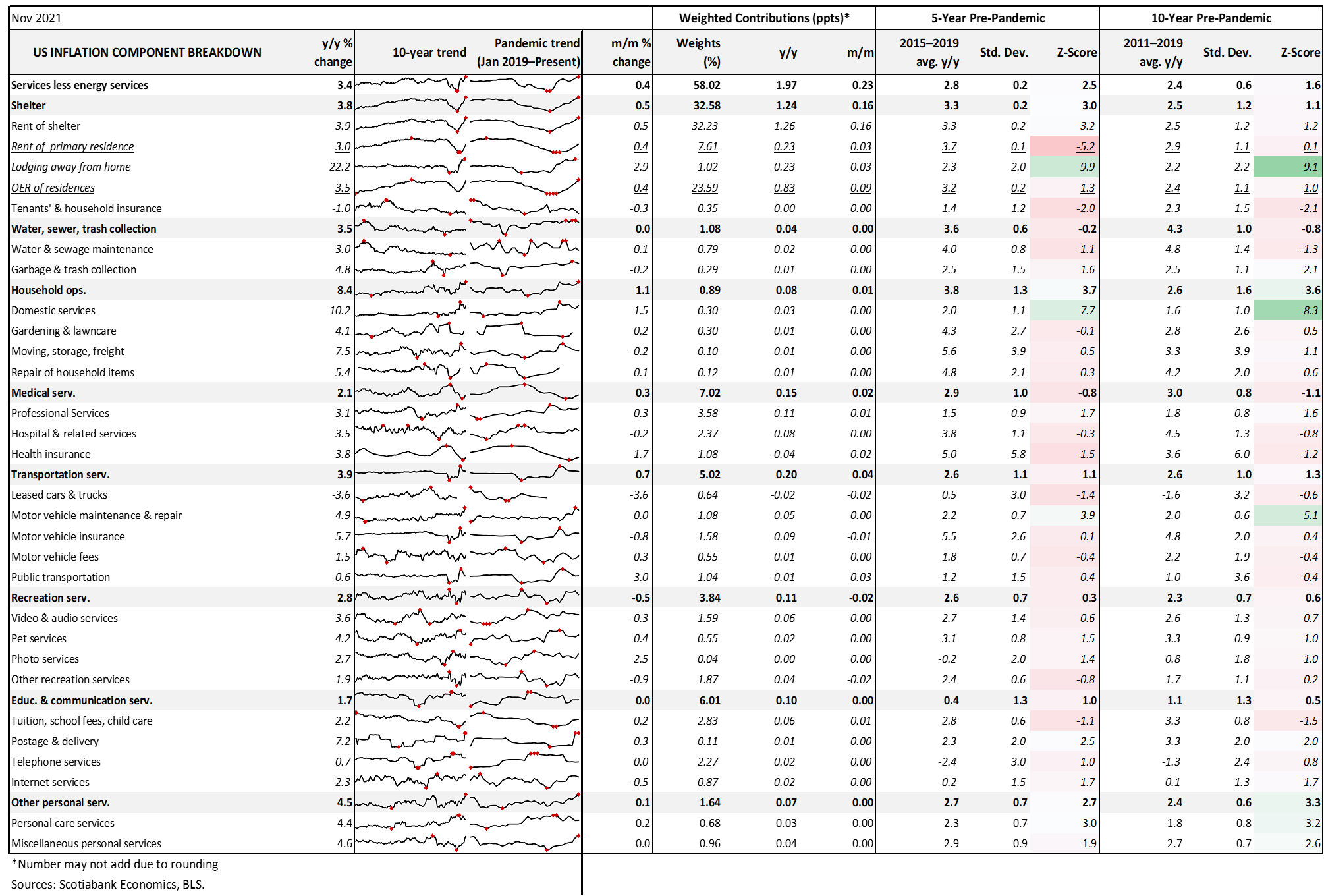

Please also see charts 9–17 on the following page that breaks out trends across individual components.

The headline m/m seasonally adjusted gain in CPI was partly because gasoline prices were up 6.1% m/m in seasonally adjusted terms which is a bit hotter than what I had been tracking. Overall energy prices were up 3.5% m/m with fuel oil (+3.5% m/m) reinforcing gasoline gains. Energy services were up 0.3% m/m as electricity was up 0.3% and gas utilities were up 0.6%.

Headline CPI was also driven by food prices that climbed by 0.7% m/m and continue to register very strong gains through most of the year back to April. This was driven by both groceries—approximated via the ‘food at home’ category—that were up 0.8% m/m, but also by take-out and other categories reflected in ‘food away from home’ that saw a 0.6% m/m rise. The latter is one of the most sensitive CPI components to the pandemic.

There was also fairly high breadth within the core CPI changes. Used vehicle prices were up 2.5% m/m SA. New vehicle prices were up another 1.1% m/m.

Shelter’s 32% weight in CPI remains hot at 0.5% m/m due to rent being up 0.5% and with hotels/lodging up 2.9%. Owners equivalent rent (OER) was up another 0.4%.

Airfare prices were up 4.7% m/m which is likely a return to something more normal by way of a Thanksgiving effect but carries a very minor weighted influence.

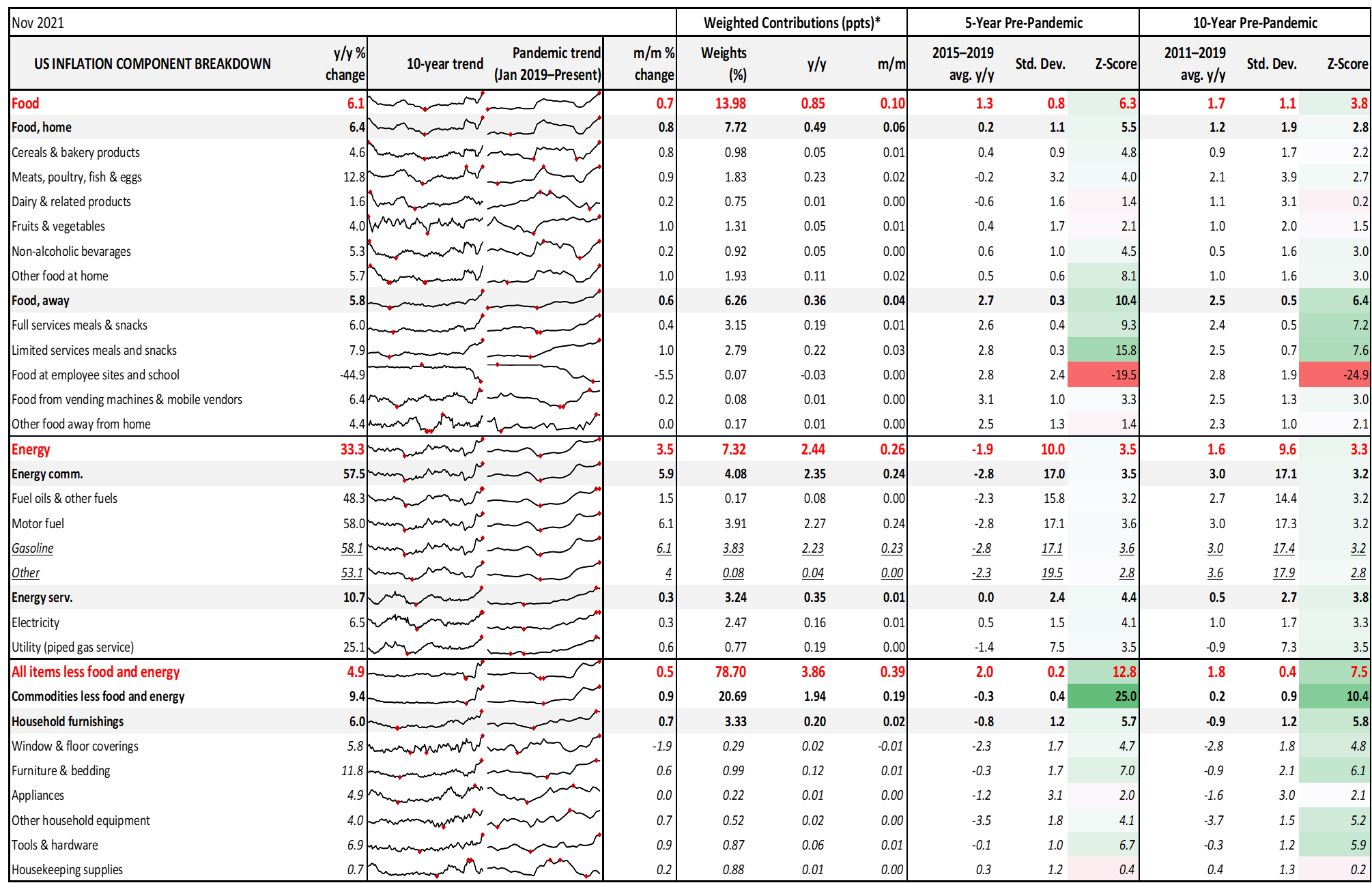

For more detail, see the US CPI dashboard on the last page of this report that breaks down components with micro-graphs and Z-scores that help to inform the extent to which CPI component changes are out of the norms.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.