- Policy rate held at 5.5% as expected

- The FOMC projected fewer cuts than markets were pricing…

- …yet bonds and equities rallied, dollar sold off

- Markets may have reacted this way on positioning away from more hawkish fears…

- …and/or because of sentiment the Fed tends to chase inflection points

- Time will tell if a further easing of financial conditions is appropriate

The Fed had already shown 2024 cuts in its prior projections and so this was no grand pivot, but they added a touch more easing that nevertheless continues to fall short of market pricing into the communications and afterward. Statement changes make it appear more likely that they are at a terminal rate of 5½%. Macroeconomic forecast changes generally reinforce the pattern of projected rate cuts. The press conference alluded to a greater discussion on easing in the minutes three weeks from now. Full coverage follows.

MARKET REACTION

Markets lapped it up from beginning to end and there will be more reaction through the Asian overnight session. The USD softened on a DXY basis by almost 1% including moves like just under a penny’s depreciation relative to CAD. The two-year Treasury yield fell by 24bps. The 10-year Treasury yield fell by about 14bps. The S&P rallied by 1¼%.

There was spillover into Canada as well. The Canada two-year yield fell by about 22bps and the 10-year yield fell by 11bps after the full suite of communications.

The market reaction was resoundingly positive. We’ll all take it I’m sure. The reaction was more than what I had expected, notwithstanding the main point about how what they did to the dots etc was largely what had been expected but it remains less than markets were pricing for cuts during 2024 going into the communications and afterward.

STATEMENT CHANGES

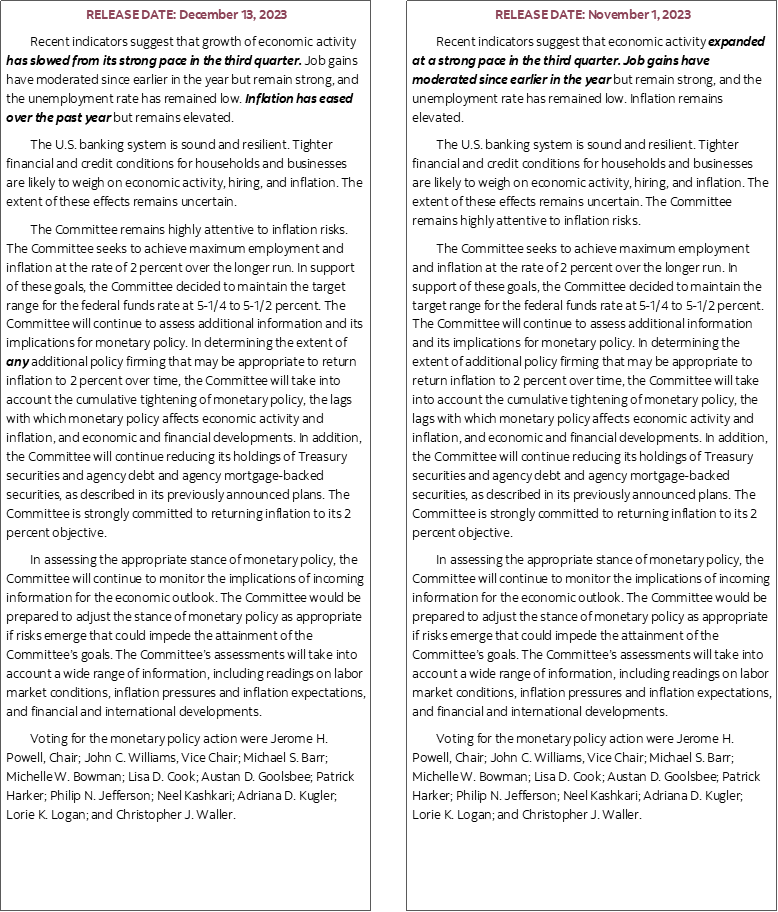

There were very few, but impactful statement changes. Please see the appendix for a full statement comparison.

One tiny three-letter word was impactful. They inserted “any” in now saying “In determining the extent of any additional policy firming that may be appropriate to return inflation to 2 percent over time….” which indicates greater skepticism toward any further need to hike again.

The statement revisions flagged softening growth by now saying growth “has slowed from its strong pace in the third quarter” which shouldn’t surprise anyone’s tracking.

The opening paragraph also changed from saying inflation “remains elevated” to now statement-codifying that “inflation has eased over the past year.”

Also notable is that they did not change what they could have. They did not soften reference to ‘tighter financial and credit conditions’ despite the moves we’ve seen. Today’s market reaction added to the financial market easing in a significant way.

There were no dissenters but that doesn’t mean there isn’t a wide spectrum of opinions on the likely magnitude of easing next year and beyond, a point that is addressed below.

DOTS—MORE, BUT LESS

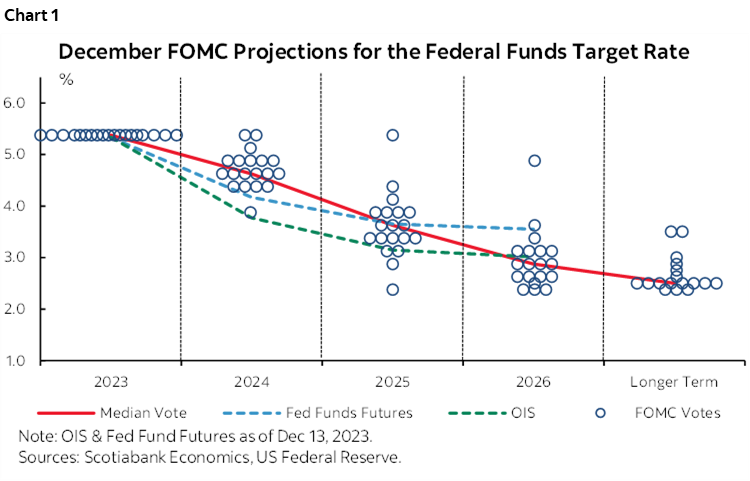

Enter the dot plot of what the Committee thinks might happen to the policy rate (chart 1).

The FOMC’s ‘dot plot’ lowered the end point for the fed funds target rate for this year to 5.375% as expected by removing the hike they previously showed in September’s dot plot.

They then added 75bps of cuts next year down to 4.625%. That indicates 75bps of cuts from the present 5½% policy rate.

They also lowered 2025 by 25bps to 3.625% at year end.

The breadth of the dots in 2024 does not show a whole lot of conviction toward -75bps. Six participants expect -75bps and define the median estimate for the magnitude of easing next year. Four participants expect -100bps. One expects -150bps. But 5 expect just -50bps, 1 expects only -25bps and two expect no cuts next year. There is a tail skewness in the distribution toward less than 75bps of cuts in 2024.

PROJECTIONS—SLIGHTLY FASTER EXPECTED PROGRESS ON INFLATION

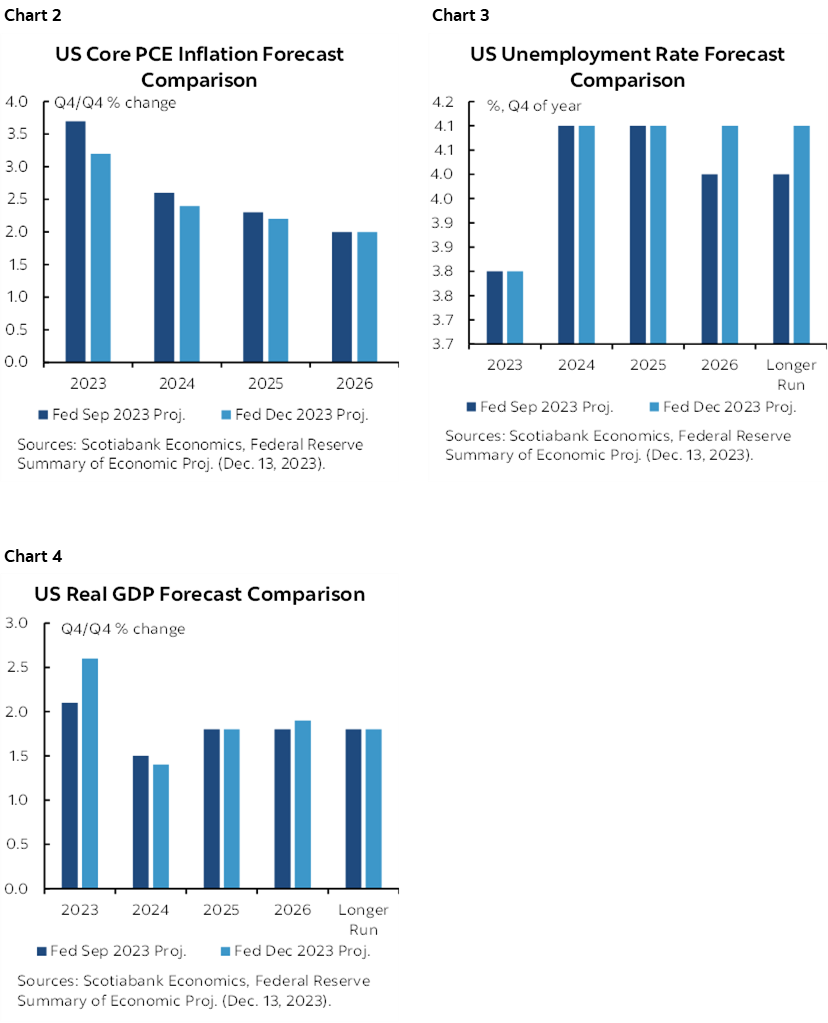

Charts 2–4 show updated macroeconomic projections.

The GDP growth forecast was raised to 2.6% from 2.1% for this year as expected, but next year’s growth was revised down a tick to 1.4% and there were minimal changes thereafter.

The unemployment rate was left at 3.8% this year and left unchanged at 4.1% over the next two years.

Core PCE projections were revised down a half point this year to 3.2% which is just marking to market, but next year was revised down two-tenths to 2.4% and the year after that was revised down by one-tenth to 2.2%.

There were no changes to the neutral rate as expected, and minimal changes to the longer run guideposts other than a 0.1 up-tick to the long-run UR at 4.1%.

PRESSER—KEY IS THAT THERE IS MORE TO COME ON THE EASING DIALOGUE IN THE MINUTES

Additional remarks during Chair Powell’s press conference reinforced the market’s initial reaction and here are the most salient points that were made during the Q&A.

Q1. What does 'any' in front of additional firming mean? Are you done hiking?

A1. We added it as an acknowledgement that we are likely at or near the peak rate for the cycle. Participants didn't put down additional hikes but didn't want to take the possibility off the table.

Q2. Governor Waller said that the FOMC could be cutting interest rates in the next several months if inflation keeps falling. Comment?

A2. I don't comment on any other officials. The first question was how fast to hike. The second question is how high to hike. We think we're at the peak but don't want to take the option off the table. The next question is when it will become appropriate to begin easing. We are seeing strong growth that appears to be moderating. We are seeing a labour market coming back into balance. We are seeing inflation progress. These are the things we want to see but we still have a ways to go. When will it begin to become appropriate to begin easing? That was a discussion point in our meeting today.

Q3. What was the nature of that discussion on when to begin to ease?

A3. This will be a topic of discussion going forward. I can't do a head count for you today in terms of who said what.

Comment: This last question was a strong hint at the importance of watching for the meeting minutes in three weeks time when additional colour on the criteria and potential timing of easing may be provided.

Q4. What motivates the projection for a lower fed funds rate next year? Are you simply calibrating it in relation to the inflation forecast as opposed to stimulating the economy?

A4. It’s nothing that mechanical. We're very conscious of real rates and monitor them but it's broader financial conditions that matter and it's so hard to know what the real rate is and exactly how tight policy is. You can't follow that as a rule. The expectation is that the real rate will fall.

Q5. Do you want to front-load this easing in 2024?

A5. We're moving carefully. One issue is the assessment over whether we've done enough and we're thinking we have but aren't feeling that strongly. Another hike is no longer a base case. We'll be having a discussion going forward on when to begin easing.

Q6. Markets are pricing a first cut as soon as March. Is this something you are broadly comfortable with?

A6. We focus upon what we have to do and how we use our tools to achieve our goals. People will have different forecasts, but we have to do what we think is right. It's important that financial conditions are aligned with what we will do and in the long run they will. In the meantime there will be back and forth.

Comment: This last question gave Powell the opportunity to confront market pricing even in nuanced fashion and he passed. He could just as easily have slammed the door on early cuts and chose not to do so which may be meaningful.

Q7. Do you believe we're at the point where inflation is coming down credibly?

A7. I welcome the progress. We're still well above 3% on core. We need to see continued further progress toward getting back to 2%.

Q8. How will you decide when to cut rates and how will you determine you are not behind the curve?

A8. We're aware of the risk we hang on for too long. You see our forecasts. We'll be looking at further progress across our dual mandate.

Q9. Will you tie a rate cut to a specific threshold or achievement?

A9. These are things we haven't really worked out yet. We're just at the beginning of that discussion.

Q10. How much closer do you need to be to 2% before cutting?

A10. You need to cut well before. I can't give you a precise estimate. I think in the SEP you'll see a reasonable assessment of the lags in terms of what it would take.

Q11. Has there been any discussion about altering the pace of QT?

A11. No. Powell went on to repeat earlier guidance on their plans and targets for QT and when to tweak them and there was nothing new.

CONCLUSION — WHY SUCH MARKET JUBILANCE?

So what gives? Why such a jubilant market reaction if the FOMC fell short of validating market pricing in line with what was largely expected?

One possibility is market positioning in that markets were cautiously fearing a more hawkish stance that could have only removed the extra hike this year but retained only 50bps of cuts next year instead of 75bps. If so, then this positioning reaction may be vulnerable going forward. We’ve seen wild reactions only to be shaken off later.

Another possibility is that the market is inclined to discredit the Fed’s credibility and thinks ah-hah, if they’re thinking and showing -75bps next year, then there will be more than that because the Fed messes up at inflection points.

Unless it’s one of those two arguments, then the rest of what they did wasn’t really a big surprise.

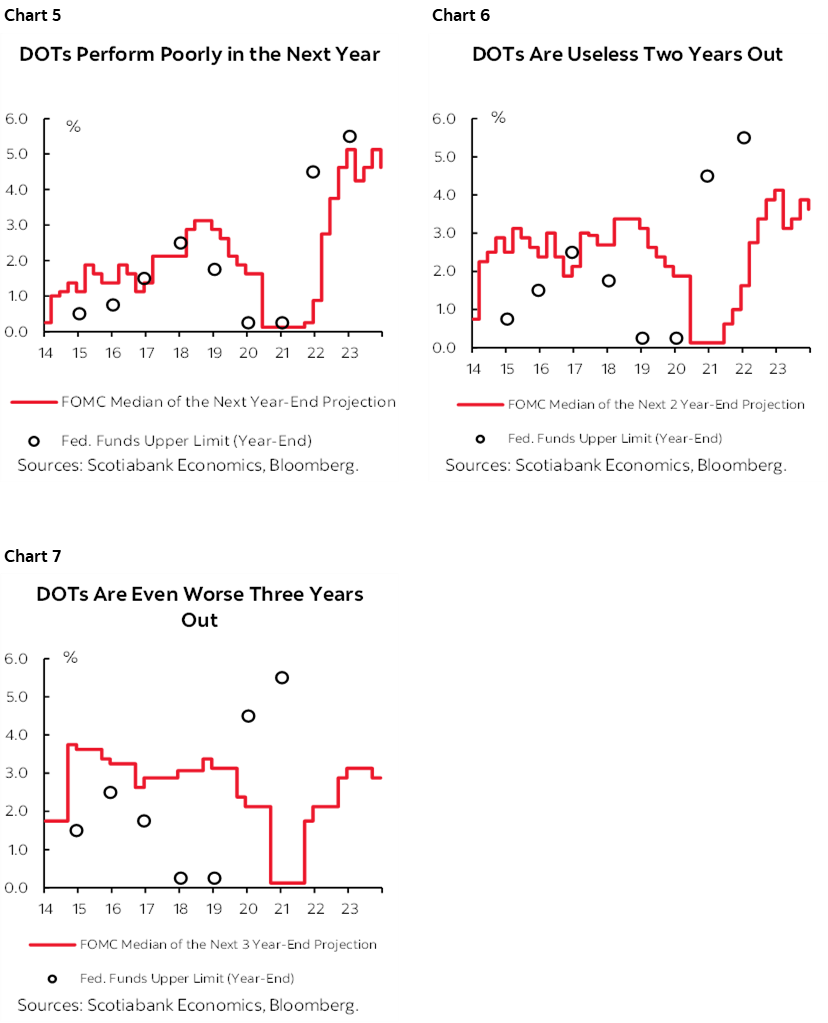

And finally as a reminder, one should probably always err on the side of dissing the dots as shown in their performance in charts 5–7. Time will tell in which direction the dots may be wrong and whether today’s outcome that easing financial conditions further was justified, not enough, or premature.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.