- Statistics Canada is understating Canadian inflation….

- ….by a lot, and by the most in the pandemic so far

- fwiw, officially reported inflation met expectations

Canadian CPI, m/m / y/y %, November:

Actual: 0.2 / 4.7

Scotia: 0.2 / 4.7

Consensus: 0.2 / 4.7

Prior: 0.7 / 4.7

Canadian core CPI, y/y % change, November:

Average: 2.7 (prior 2.7)

Weighted median: 2.8 (prior 2.8)

Common component: 2.0 (prior 1.8%)

Trimmed mean: 3.4 (prior 3.4%)

Official inflation landed on the screws last month, but diverging core readings added a tiny amount of intrigue to the picture. Canadian short-term yields rallied and CAD depreciated despite weak US retail sales. Why? Two reasons. One is that this market reaction was likely due in part to position covering by market participants that have grown accustomed to looking at consensus estimates and expecting more. Today they didn’t get that. Nuances—like how Canadian inflation is likely understated anyway—don’t capture market minds in the moment.

Markets also responded this way because they got fake data on what’s really going on with Canadian inflation. Before turning to the details, the bigger issue is that last month led to the biggest understatement of Canadian inflation to date. It’s worth a reminder of why official Canadian inflation continues to be plagued by uncertainties and is probably understated. By a lot.

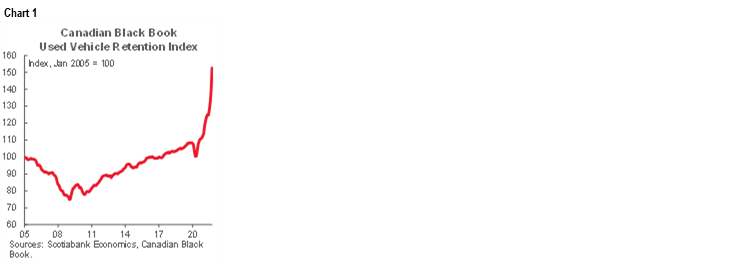

- For one thing, StatsCan still excludes one of the hottest areas of inflation in North America, namely used cars and trucks. Chart 1 provides one measure that skyrocketed last month with a 9.5% m/m SA gain while the y/y reading is up by about 38%. The month-over-month change more than doubled the previously largest pandemic-era single-month rise of 4% back in March.

So what? Well, if we applied a similar weight to that which the US BLS applies to used vehicles that it includes in US CPI (about 3.35%) and used this measure of used vehicle prices in Canada, then Canadian headline inflation would be higher by 0.3% m/m SA and about 1.3 ppts in year-over-year terms. If we crudely tacked that onto official CPI at 4.7% then the resulting ~6% y/y inflation rate would be very close to the US at 6.8%.

Why do the US and UK include used vehicles in their inflation readings, but Statistics Canada does not? The only answer the agency has given in the past is that they don’t have reliable data for used vehicle prices. The US and UK have had such data for years and years so frankly that excuse has worn a little thin by now. We don’t know if the measure cited in chart 1 is the best measure for used vehicle prices but the absence of an effort to include some measure in CPI is unacceptable.

The issue is hugely important at a time of heightened sensitivity toward inflationary pressures. Many things hinge upon accurate inflation readings, yet in Canada, markets and mainstreet businesses and consumers are not being well served by this ongoing omission. Inflation bonds priced off official CPI are at risk of being materially mispriced. Anything indexed to cost-of-living measures in CPI—from wage settlements to indexed transfers—will be based off incorrect inflation figures. Monetary policy decisions affecting the cost of borrowing are the other obvious example of something that needs accurate inflation gauges.

- For another, when StatsCan adjusted spending weights in CPI to reflect pandemic realities, they adjusted them starting in July 2021 CPI onward; all prior weights are still set at well before pre-pandemic spending levels. The agency said they’d have other measures with real-time spending patterns available later in the year. We’re still waiting.

- Third, recall the flap over adjustments to seasonal treatment of some parts of the basket earlier in the year when StatsCan made changes, caused a flap with the BoC and others because apparently it wasn’t well communicated in advance, then under pressure went back to the prior seasonal treatments by revising a couple of days later with the promise to revisit the issue in future. We’re still waiting.

In all, review the details below if so inclined, but I have weakened trust in Canadian inflation data and think it is very likely to be materially understated. This isn’t the place to re-hash other arguments, but regular readers probably know that I’ve also felt that the central bank’s tendency to talk through evolving inflation went too far.

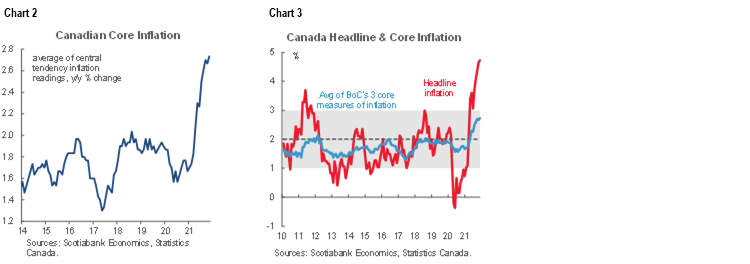

Average core inflation was unchanged at 2.7% y/y. Chart 1 shows a slight up-tick but that’s only apparent if we go to the second decimal point.

ALL THE MILDLY RELEVANT DETAILS!

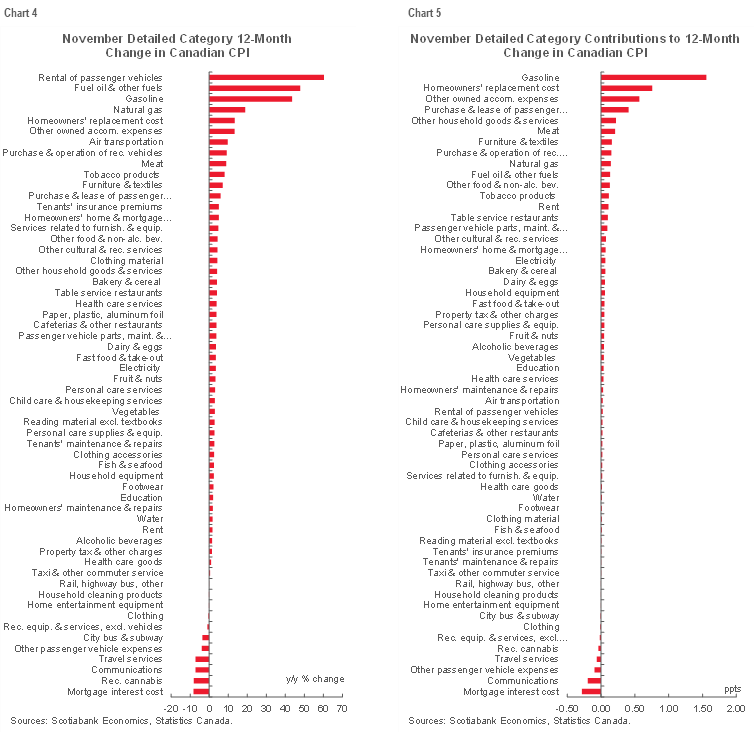

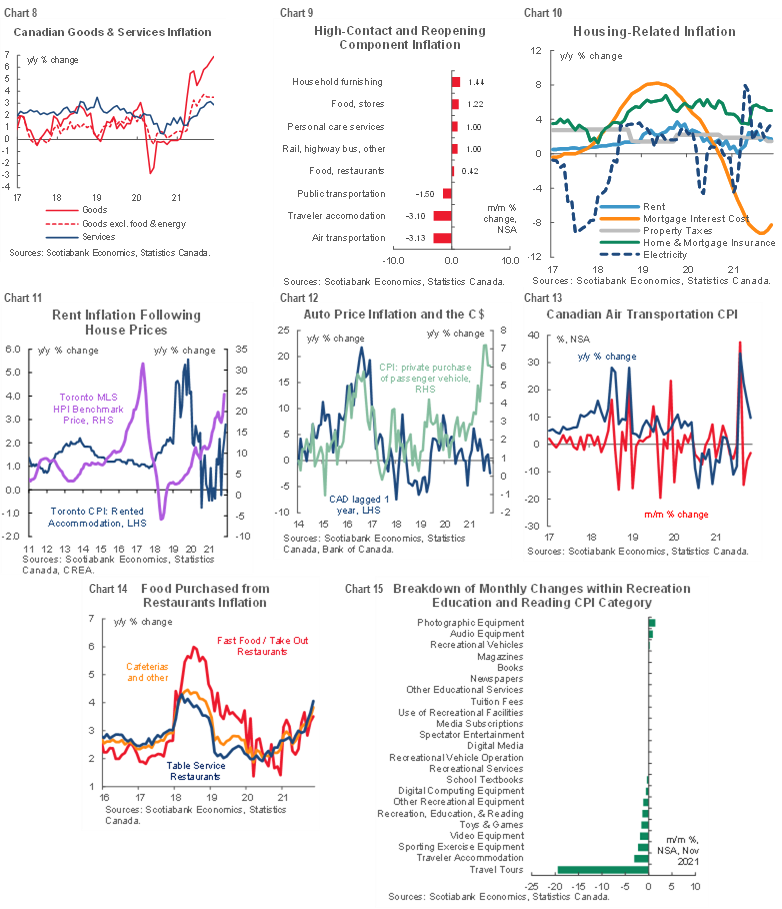

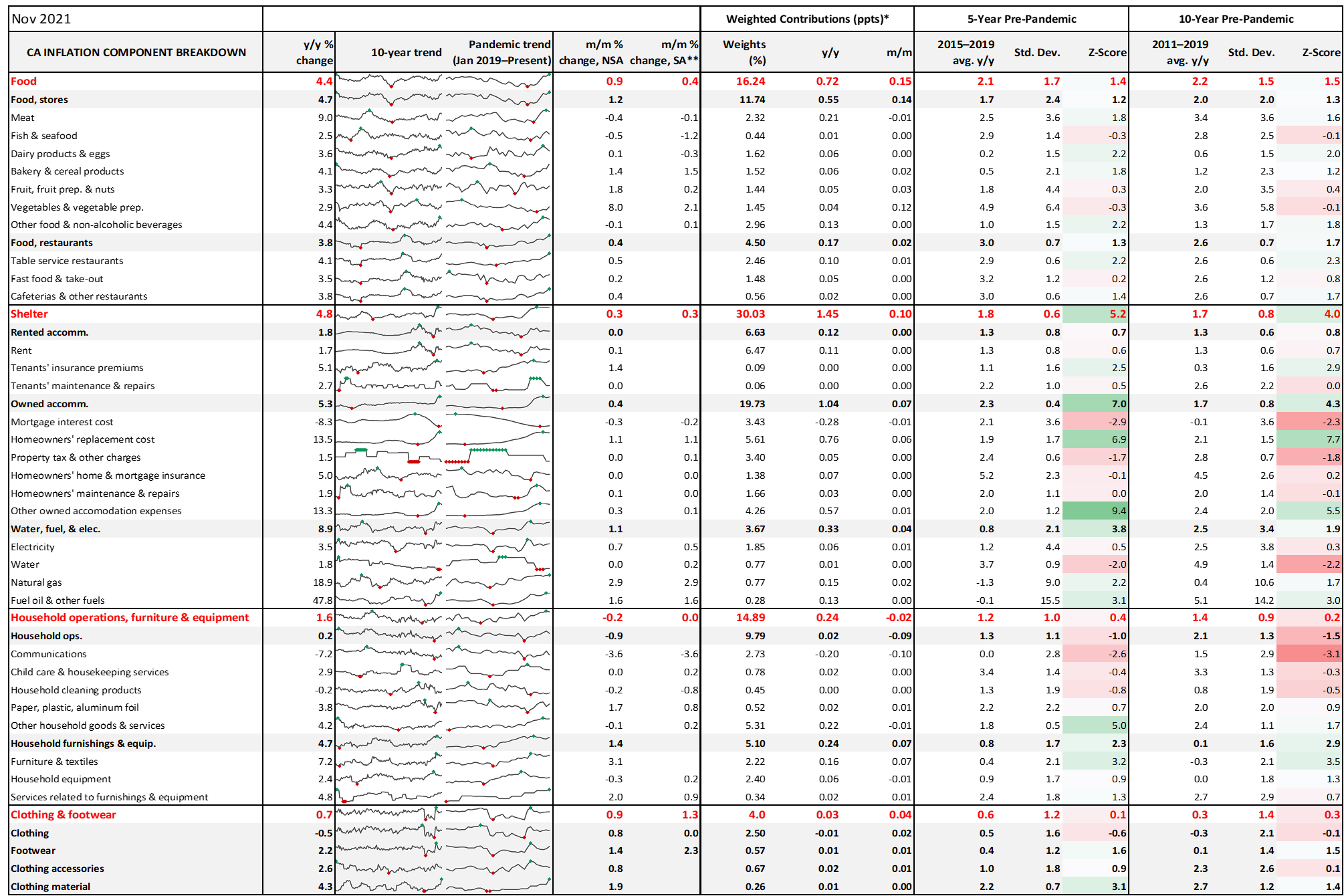

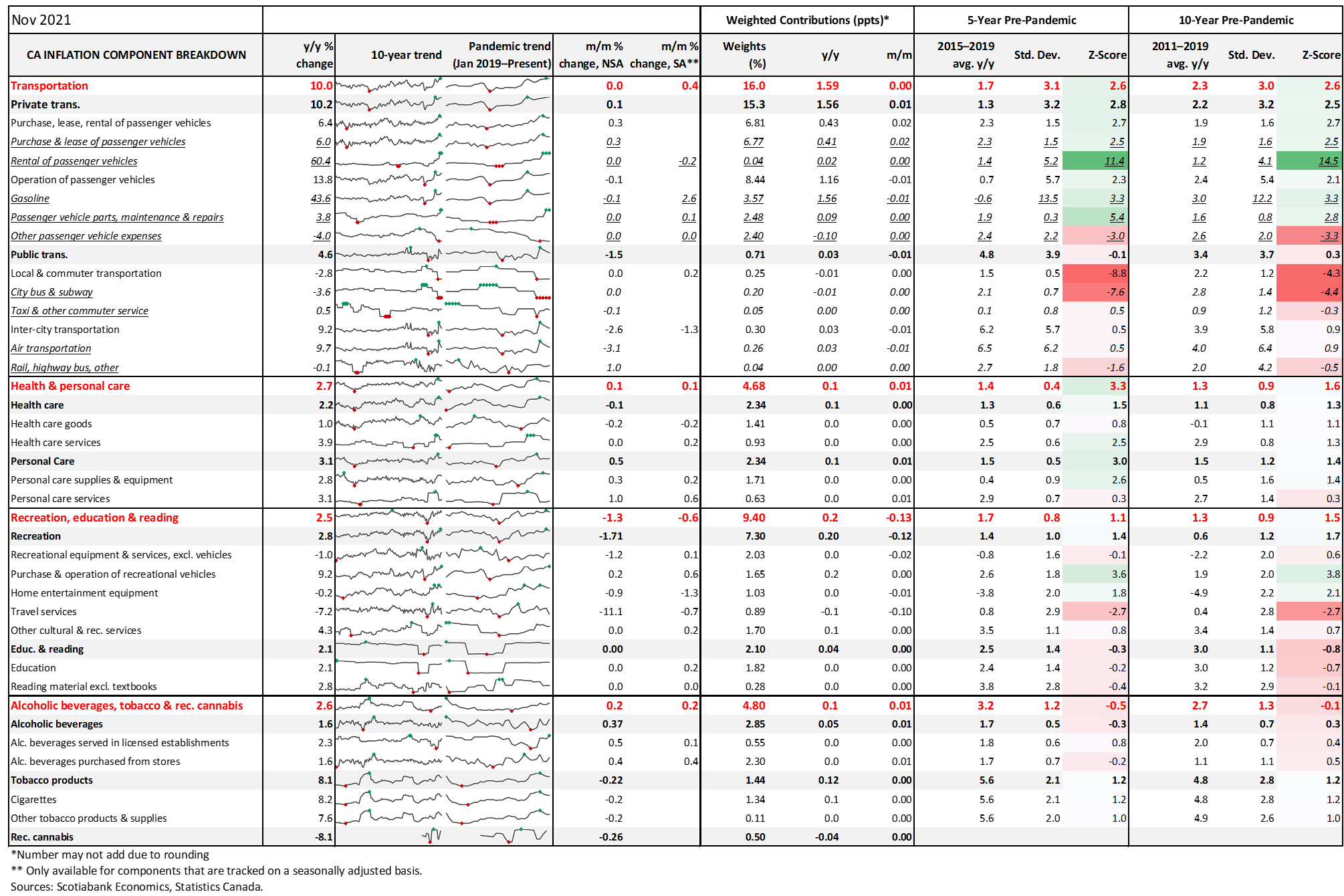

Charts 2 and 3 show where we are in tracking inflation in Canada. Average core inflation using the BoC’s central tendency measures was unchanged at 2.7% y/y and so was headline inflation at 4.7% y/y.

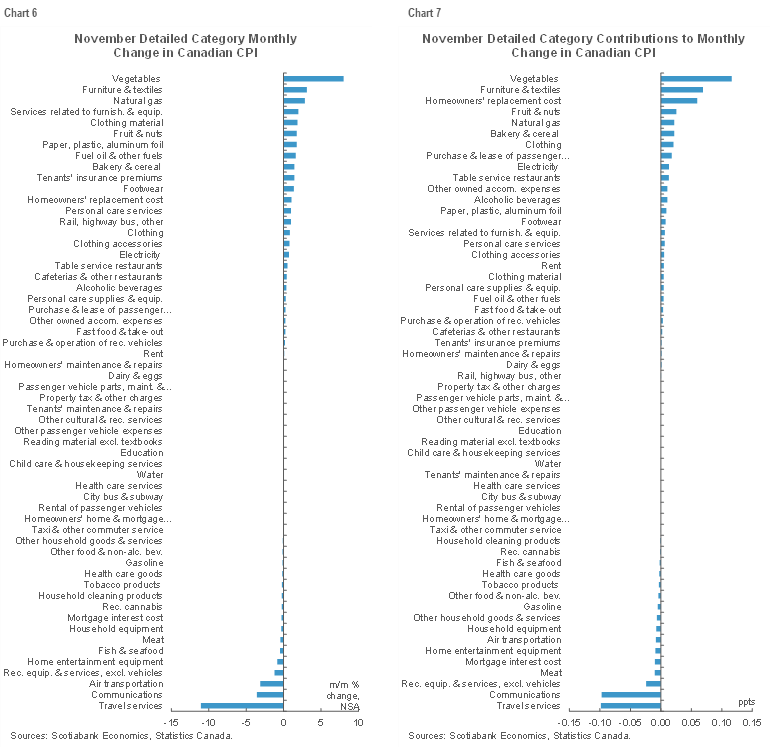

In seasonally adjusted terms, m/m CPI was up 0.3% while simple core ex-food and energy was up 0.1% m/m SA which is soft. Across components in seasonally adjusted terms clothing/footwear prices were up 1.3% m/m to lead the upsides, while recreation/education/reading led the downsides at -0.6% m/m. Soft breadth.

For more details in terms of what’s driving official inflation please see the charts on the following pages and the detailed table at the back that breaks down the basket with mini-charts for each component and z-scores to show how today’s moves by component compare to statistical norms over different time periods.

Where to from here? I hope the BoC doesn’t pounce on these figures as evidence that inflation is stabilizing or turning lower. For one thing, it’s mismeasured as explained. For another, we’re at a point of transition; if omicron further damages supply chains and the economy moves into excess demand alongside maximum employment and beyond as we think it will in 2022, then another up-leg of inflation drivers may be ahead. The transitory debate is about the full cycle; not just one report.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.