- US core CPI inflation surprised higher and is back on an upward trend...

- ...that will likely translate into an up—tick in the Fed’s preferred core PCE reading

- The jump in core service prices will alarm the Fed

- Treasuries got smacked as Fed rate cut pricing was pushed out again

- BoC cut pricing was also pushed out on Fed implications...

- ..with CDN CPI tracking a solid jump

- US CPI // core CPI, m/m % SA, January:

- Actual: 0.3 / 0.4

- Scotia: 0.2 / 0.3

- Consensus: 0.2 / 0.3

- Prior: 0.2 / 0.3 (revised from 0.3 / 0.3)

US core CPI walloped Treasuries and sent shivers down the spines of anyone who still thinks the Fed should be in a big rush to cut.

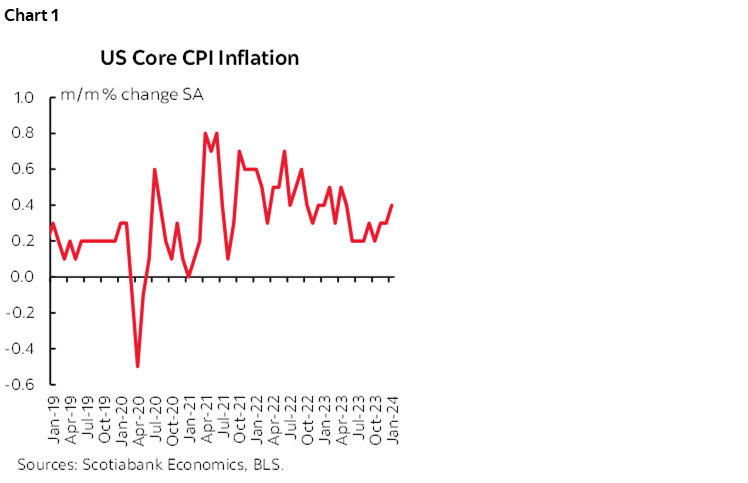

Core CPI was up by 0.4% m/m (0.39% to be exact) which only three out of 68 forecasters guessed correctly, 15 who went with 0.1 or 0.2 did not, and 50 others came close to. It was hotter than the nowcast estimates from the Cleveland Fed. The readings are starting to creep higher again over recent months from the summertime lows (chart 1).

The core CPI reading probably means that core PCE that is due out on February 29th is tracking about 0.3% m/m SA. If so, then that would be meaningful after prints of 0.14, 0.06 and 0.17 over the prior 3 readings because it would send a caution against assuming that such a soft patch will continue.

There was a large market reaction and the details were arguably even more impactful.

Markets

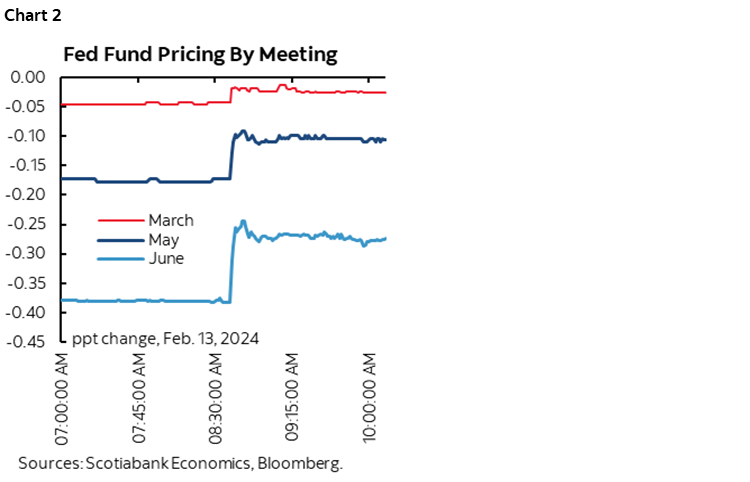

The upside surprise and the firm details send yields soaring with the two-year yield jumped by about 15bps to 4.6% and the 10-year Treasury up by about 14bps to 4.28%. Pricing for a cut at the March 20th decision was completely eliminated with May’s pricing reduced by 7bps to just about 10bps. Chart 2 shows the intraday moves in Fed pricing over the next three meetings. I cannot see the Fed cutting at the May meeting on the back of numbers like these and the fact that Q1 US GDP is likely to come in strong just days before the meeting. Our call for the first cut to land in Q3 is on the fence between July and September and an awful lot has to go right to get a cut by then. I can’t rule out tightening.

Bank of Canada Pricing Dragged Higher

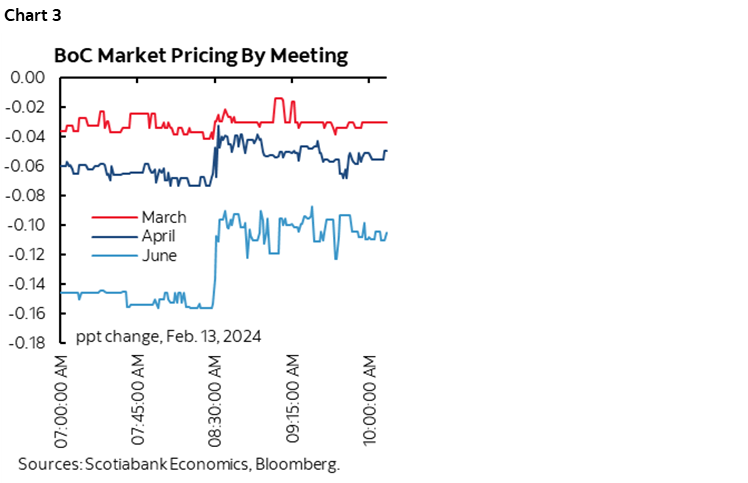

Market pricing for Bank of Canada policy rate moves was also affected. It was shaved a little by way of spillover effects via the relative central bank influences (chart 3).

Now it's onto next Tuesday's Canadian CPI. I have estimated a headline rise of 0.6% m/m NSA or 0.4% m/m SA and 3.5% y/y up from 3.4%. Traditional core CPI is estimated at 0.5% m/m SA. Add to that tomorrow's ripping home sales data and expectations for a strong Spring housing market and just keep pushing out timing for BoC rate cuts while retaining a material risk of tightening. Our call for a first cut in September needs a lot to go right and I continue to think that there is higher inflation risk and hike risk in Canada than the US.

Details—Core Service Prices Surged

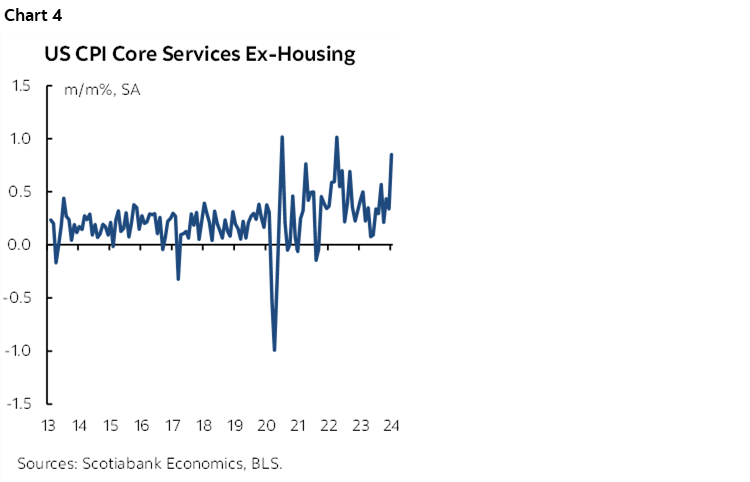

Core services inflation (ex-energy and housing) soared by 0.85% m/m SA which is the hottest reading since April 2022 (chart 4). That works out to 10.7% m/m at a seasonally adjusted and annualized pace (SAAR). In other words, the 0.7% m/m SA jump in total services prices excluding energy wasn’t just because of housing; it was because of much more widespread upward pressure on service prices.

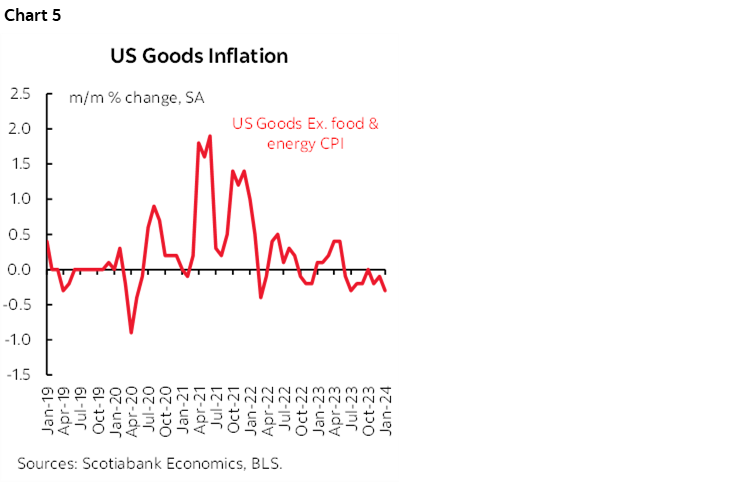

That surge in service prices was more than enough than what was required to offset core goods disinflation of -0.3% m/m SA (chart 5). Core goods disinflation remains intact.

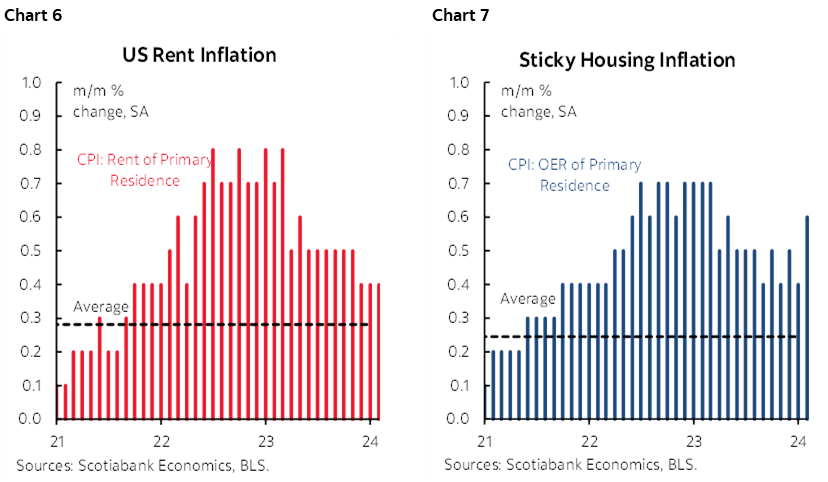

Housing did, however, contribute to overall services inflation with shelter up 0.6% m/m SA as rent of primary residences was up 0.4% (chart 6) and owners’ equivalent rent was up 0.6% (chart 7).

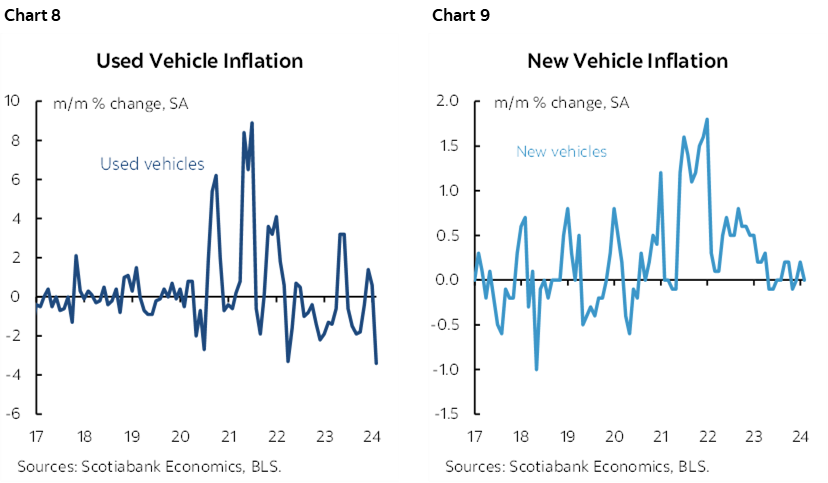

Within goods prices, disinflation was partly driven by vehicle prices. Used vehicle prices fell by 3.4% m/m SA (chart 8) and new vehicle prices were flat (chart 9). That shaved about 0.1% m/m SA off of core CPI in weighted terms.

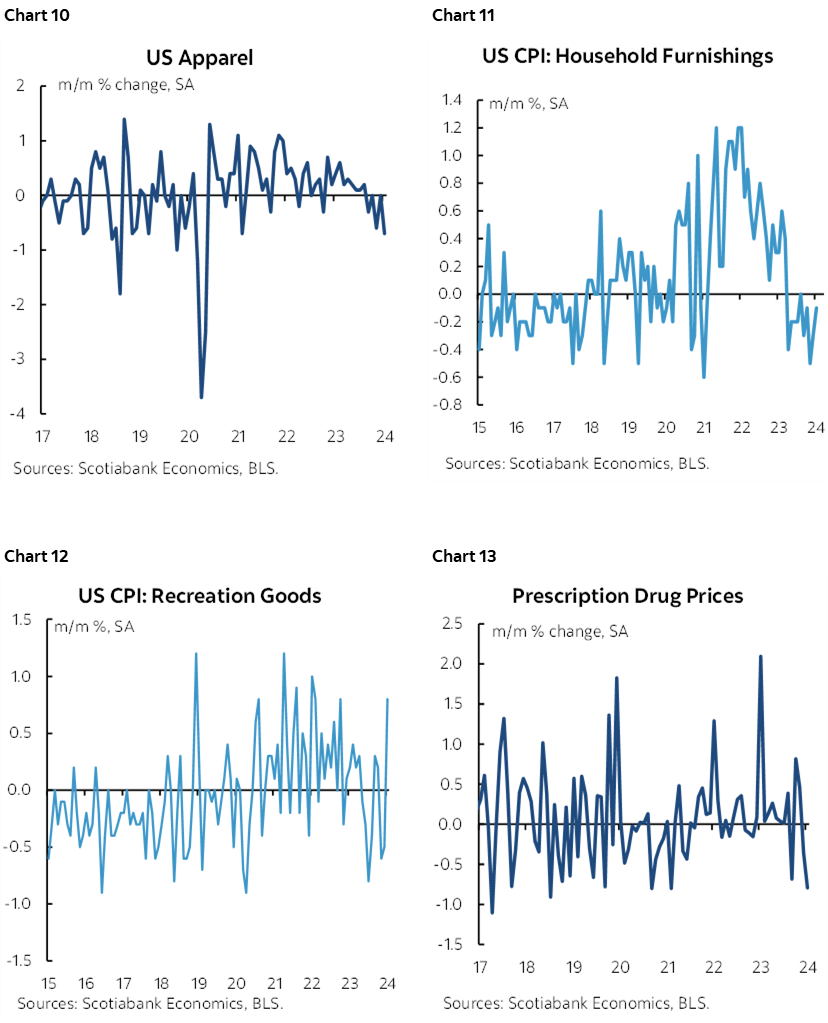

Clothing also dented goods prices (chart 10). So did household furnishings (chart 11), recreation goods (chart 12) and drug prices (chart 13).

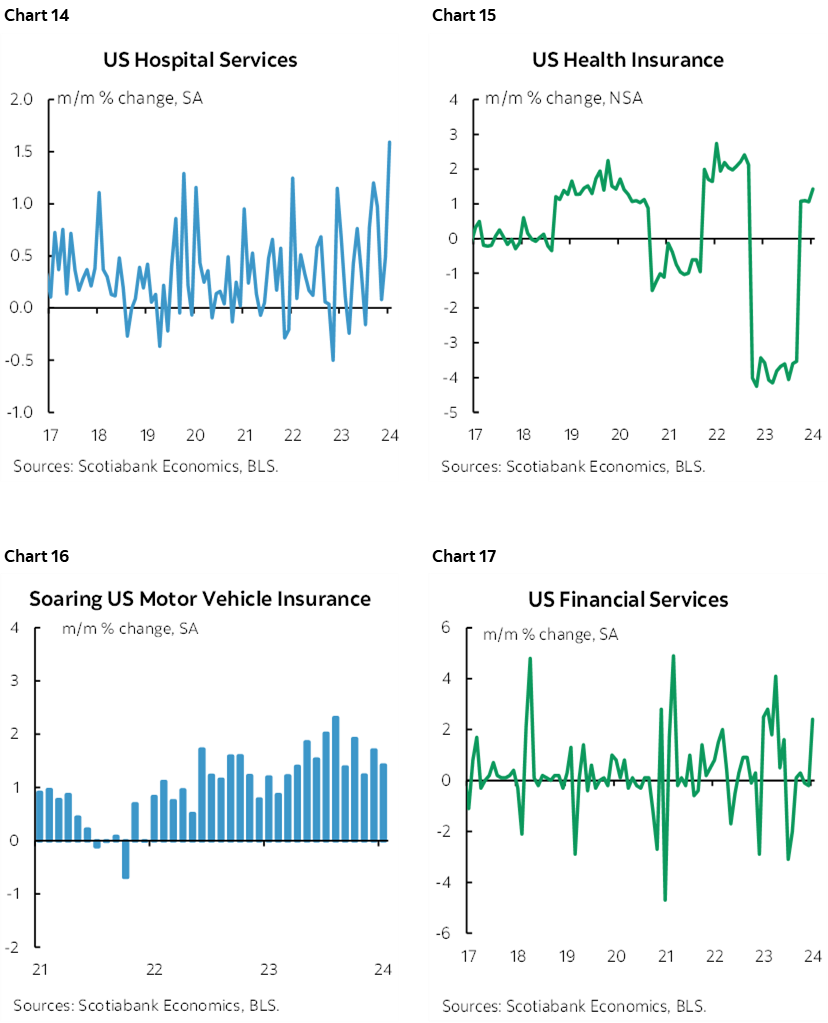

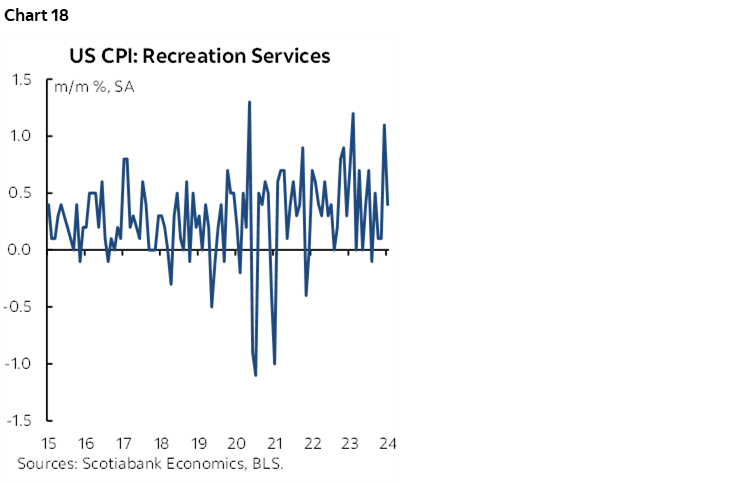

What drove services inflation other than housing? Here’s a word of advice: don’t get sick (charts 14, 15). And if you drive, then I don’t need to tell you what’s going on with soaring auto insurance premiums (chart 16). Financial services prices are also rising (chart 17). Don’t have fun either (chart 18), or maybe folks are having so much of it.

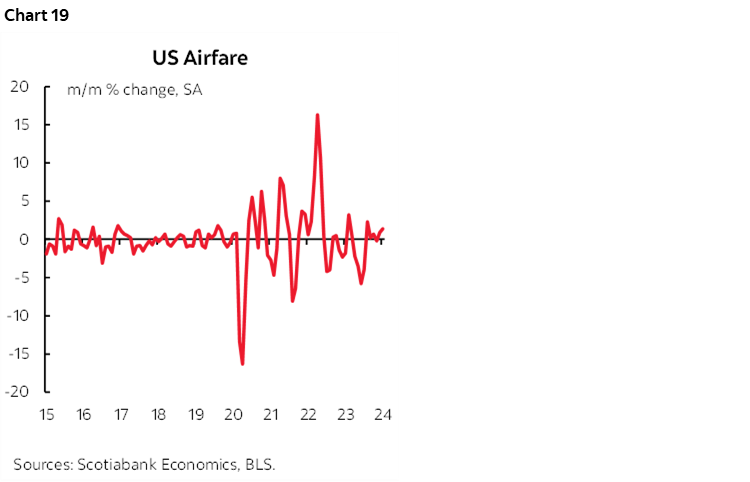

There were also gains in airfare (chart 19), plus auto repair services were up 0.8% m/m. Medical care services increases 0.7%.

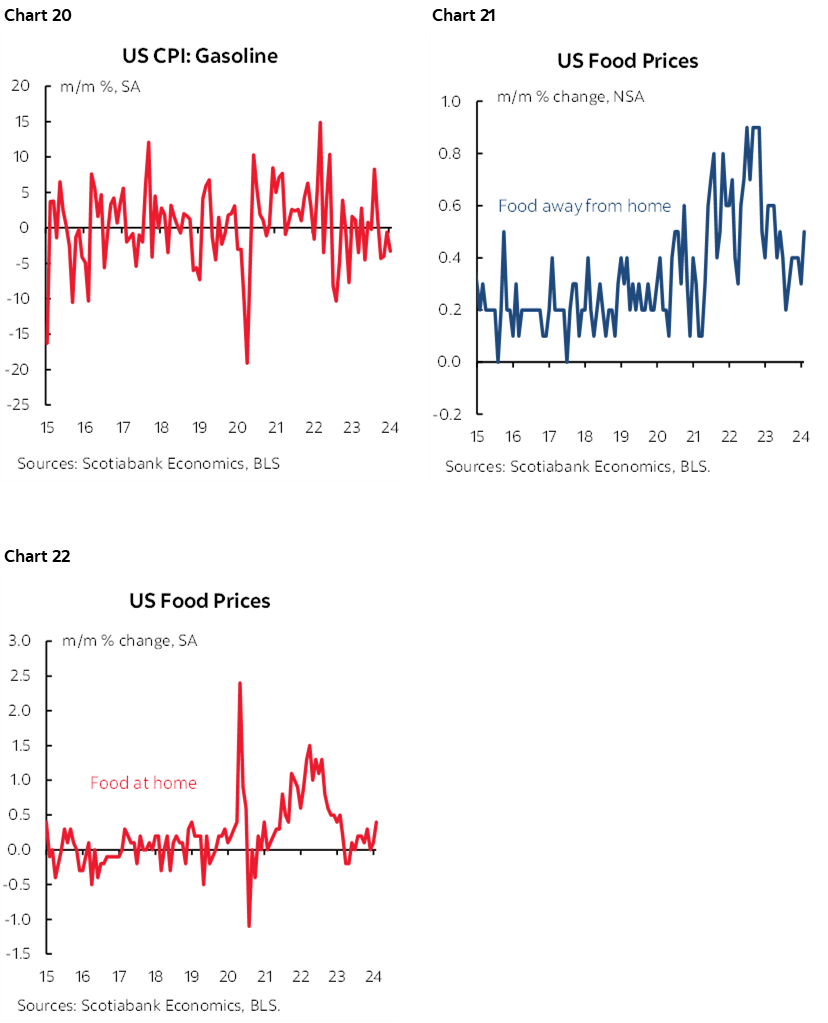

As for why headline surprised higher, it was principally because of the higher than expected core reading. Gasoline prices (chart 20) behaved about as estimated (-3.3% m/m SA) and so did food prices (+0.5% m/m) as food at home was up 0.4 and food away from home was up 0.5. Charts 21 and 22.

More Details!

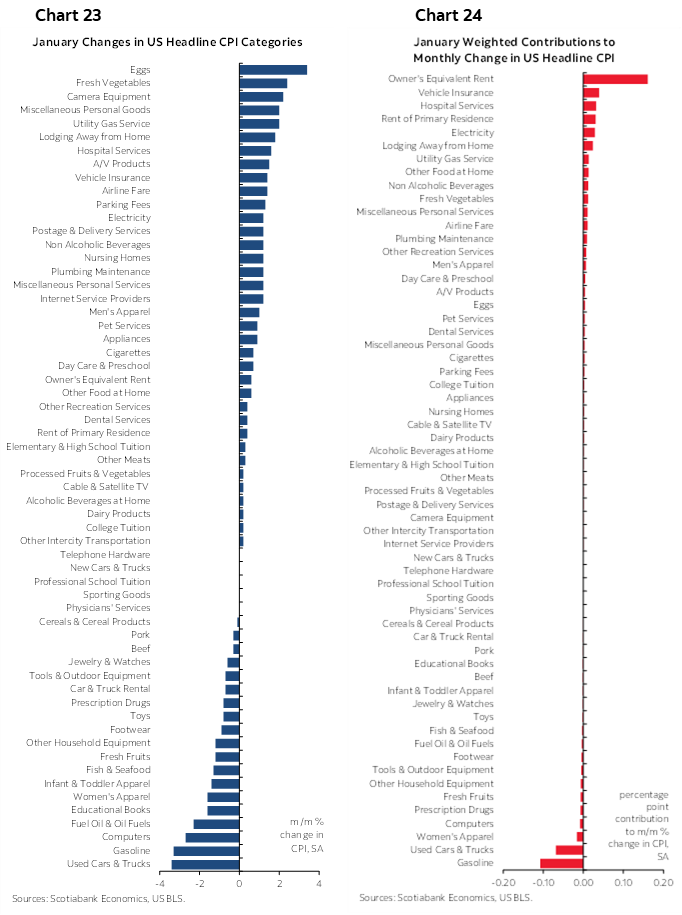

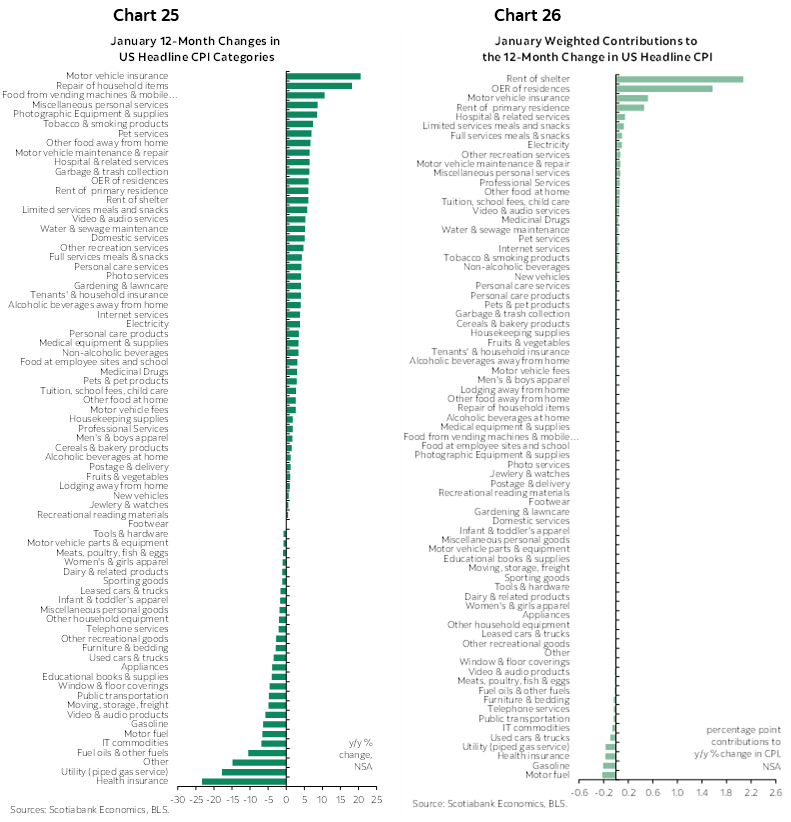

Please also see chart 23 that breaks down the whole CPI basket and chart 24 that does likewise in terms of weighted contributions to the m/m change in CPI. Charts 25 and 26 do likewise for y/y inflation by component.

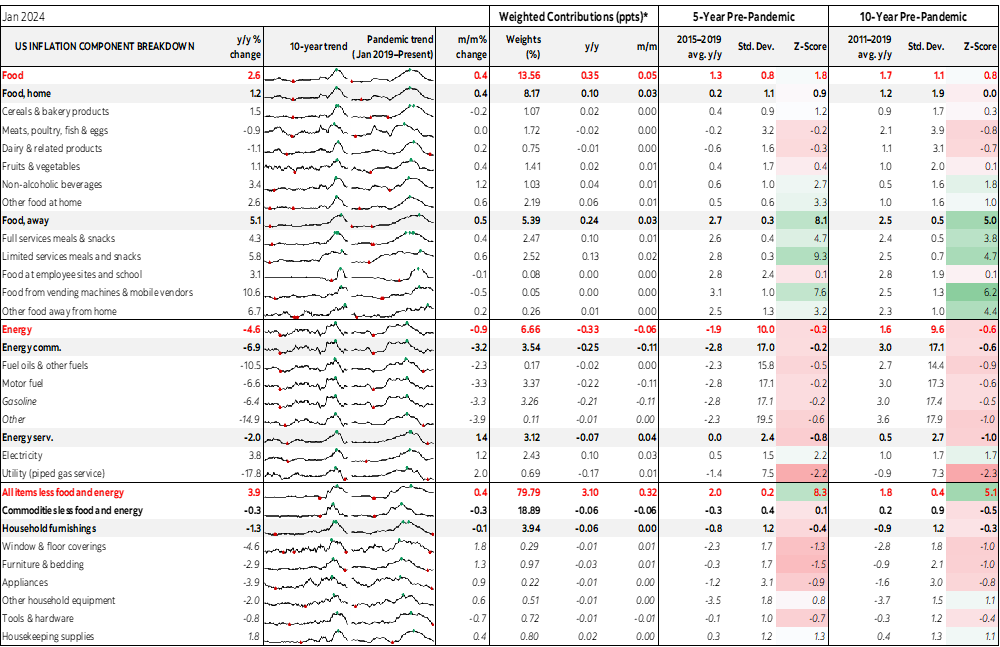

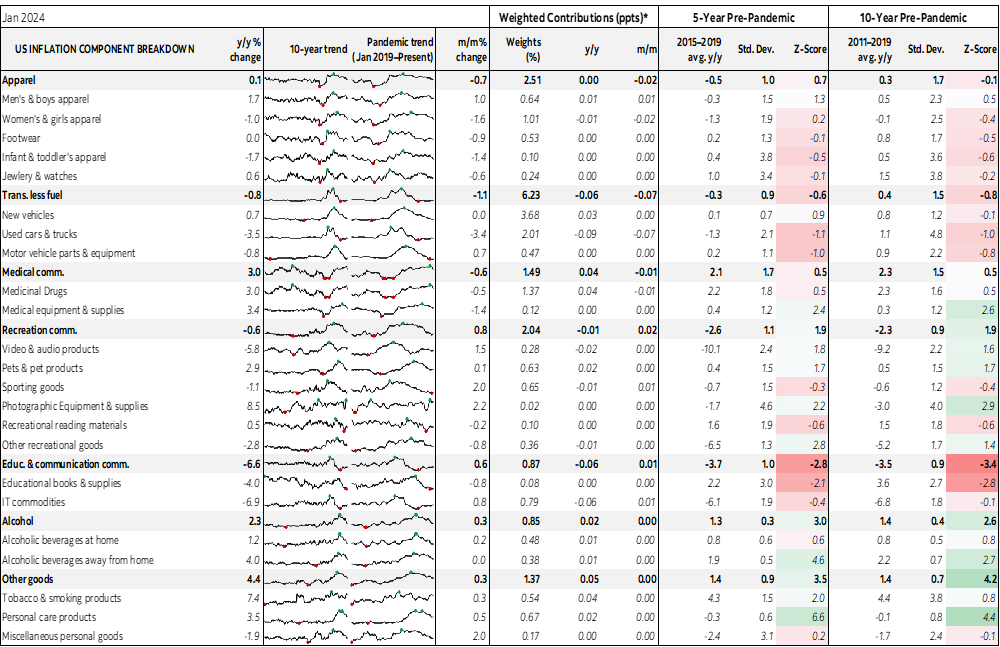

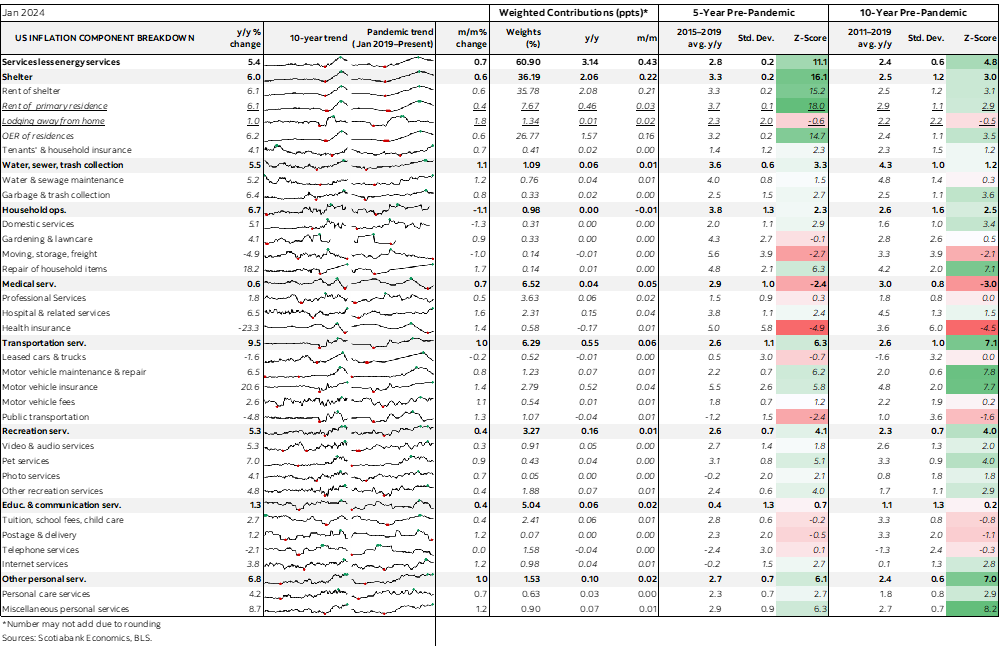

Please also see the detailed table at the back that breaks down the basket with micro charts and z-score measures of deviations from recent trends by component.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.