- Canadian core inflation suddenly decelerated

- It’s just one month on a hot trend...

- ...so expect the BoC to take it in stride while markets over-react

- Time may tell if El Niño was a factor

- Canadian CPI, m/m NSA // y/y, January:

- Actual: 0.0 / 2.9

- Scotia: 0.6 / 3.5

- Consensus: 0.4 / 3.3

- Prior: -0.3 / 3.4

- Core inflation, m/m SAAR // y/y, January:

- Trimmed mean CPI: 1.2 / 3.4

- Weighted median CPI: 1.7 / 3.3

It’s just one month folks. Chill. That’s the line I would expect the Bank of Canada to apply here and perhaps by repeating their prior references to taking the ‘ups and downs’ of the measures in stride as one of their Deputy Governors once put it.

Mind you, that’s not what markets are doing in reaction to softer inflation readings than anyone expected and I’m not too thrilled about the miss. That market over-reaction is not particularly surprising given a) positioning swings in markets, and b) the heightened data sensitivity of markets in response to both stronger and weaker than expected indicators.

Details

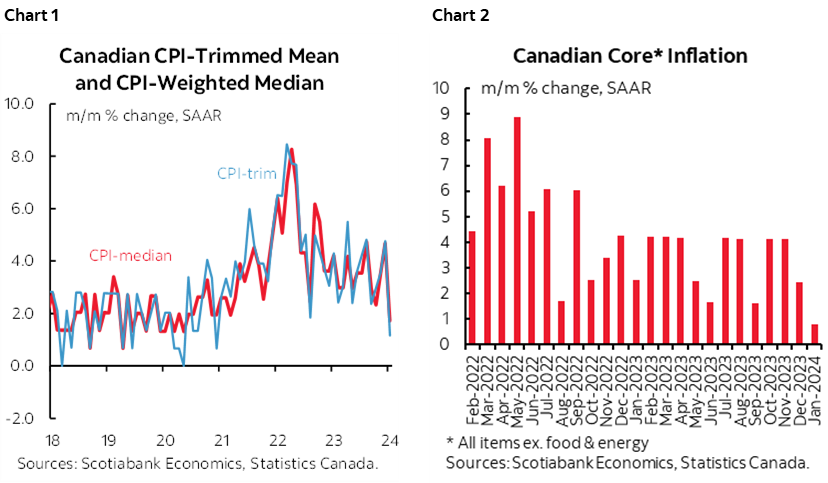

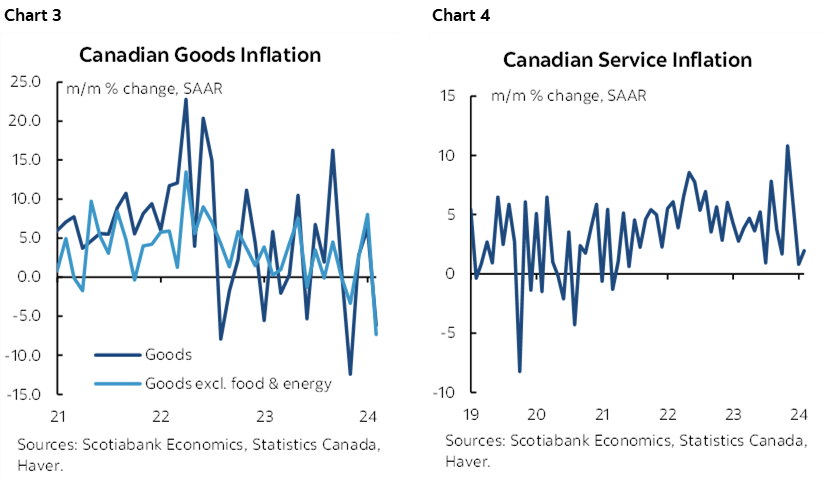

The BoC’s two preferred core gauges of inflation landed sharply softer than the recent trend and there was significant breadth to the softening. Trimmed mean CPI was up by just 1.7% m/m SAAR in January and weighted median CPI was up by just 1.2% (chart 1). Those are indeed soft readings. In fact, they were the softest prints since May 2020 (weighted median) and December 2020 (trimmed mean). Traditional core CPI (ex-food and energy) was also unusually weak (chart 2).

But they come on the heels of the prior month’s 4.7% and 4.8% readings in the same trimmed and median measures respectively and they were the hottest since August. Charts 3 and 4 show softness in both core goods and services prices.

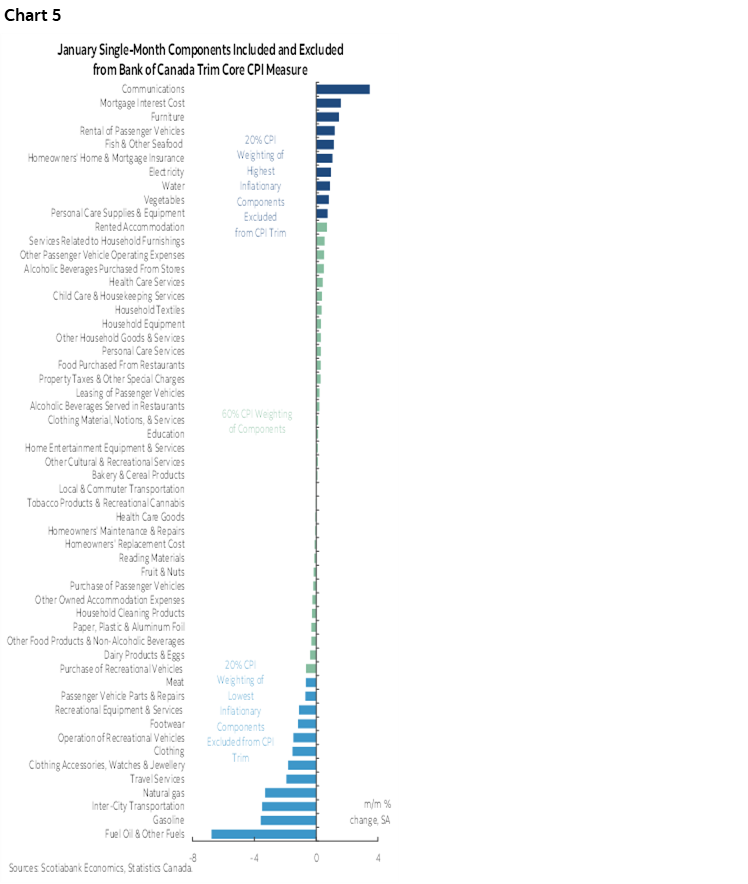

Chart 5 shows what was in and out of trimmed mean CPI this time.

The Bank of Canada is searching for a more convincing trend. One month doesn’t cut it; call it mean reversion off of a hot prior reading for now and wait for more evidence. The 3- and 6-month averages are now running at about 3¼% m/m SAAR.

Therefore we may have only just begun to enter phase 1 of assessing progress on core inflation from the BoC’s perspective as communicated since last Fall. Phase 1 requires sustained evidence that underlying inflation is moving toward 2%. Phase 2 requires evidence that this is going to be sustainable. Phase 3 could then begin to discuss when to ease if phase 1 and phase 2 go well. One month’s data doesn’t say much at all about that process. Over reacting to it could come back to bite markets in the tender spots given ongoing inflation risk in Canada.

That said, I am surprised by the breadth of the price softness in January.

- clothing and footwear prices have usually been down by -0.1% during months of January in recent years, but this time they fell by -3.9%

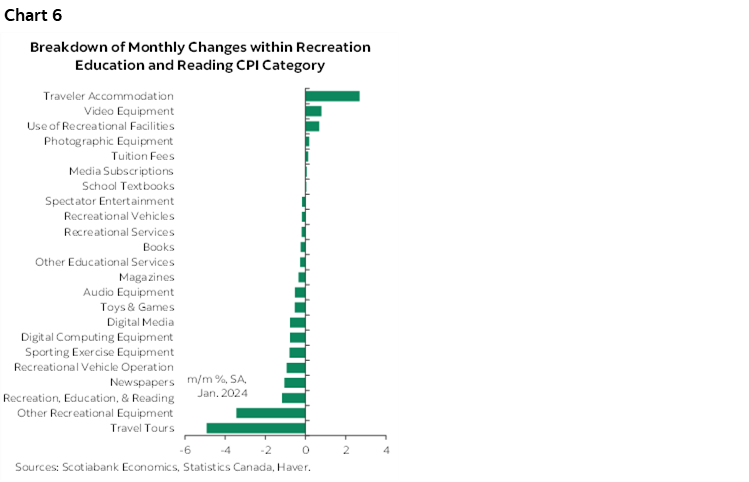

- recreation/education/reading is usually up by an average of about 0.7% m/m NSA but this time fell –0.7%. Chart 6 breaks down this component.

- airfare has dipped -14% m/m NSA in a typical January but by fell 24% now.

- auto prices are usually up by +1.5%, but this time they slipped by -0.1%

- restaurant prices are usually up 0.6% m/m but this time fell by 0.1%.

- several food categories were unusually weak (meat, dairy, bakery). Politics?

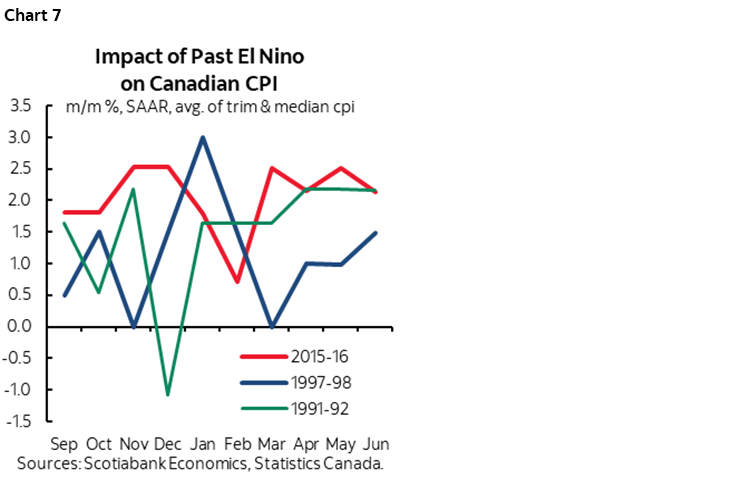

You could speculate that some of this weakness was due to El Niño but the historical evidence isn’t all that compelling. For instance, little to no snow and warmer than usual temperatures in big parts of the country probably restrained demand for winter sports equipment. Ditto for winter clothing and footwear, and demand for getaways down south. Weaker than normal natural gas and other home heating fuel prices also contributed to softness in headline inflation.

Chart 7 shows the evidence over past El Niños. If you really stretched it you could say that the peak weakness in past strong El Nino events varied each time and was then followed by rebounds, but it’s hardly a strong point. You could also argue that El Nino is tougher to evaluate in the current pandemic era.

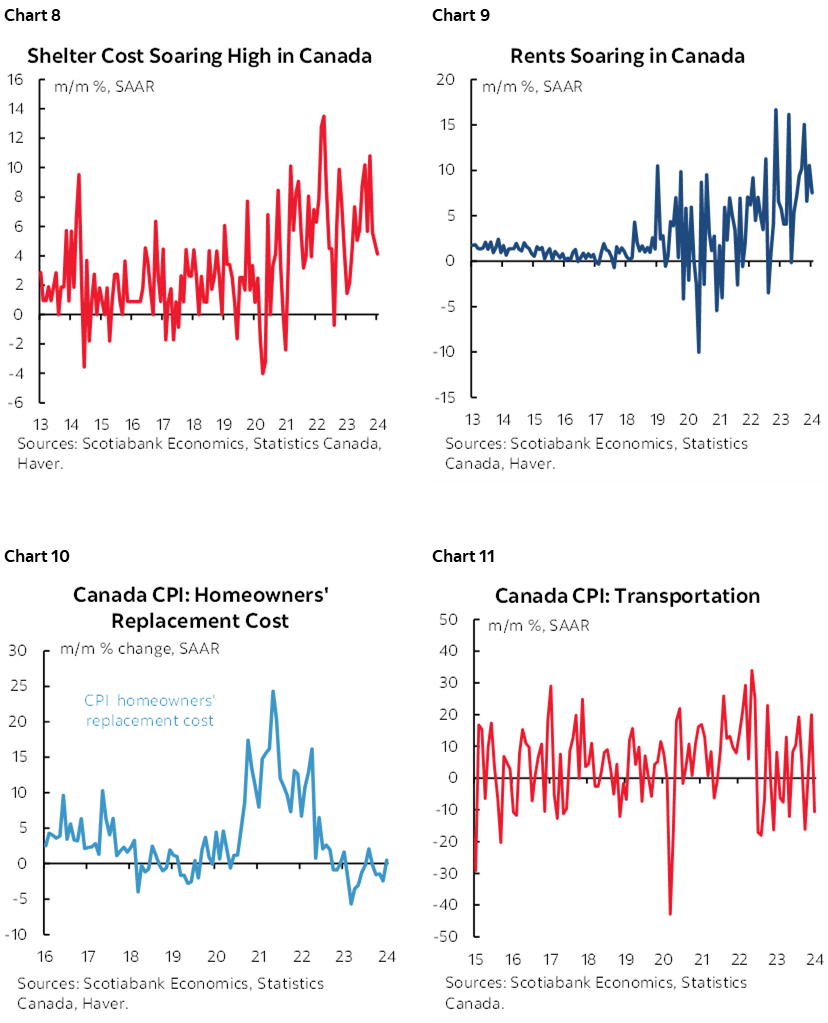

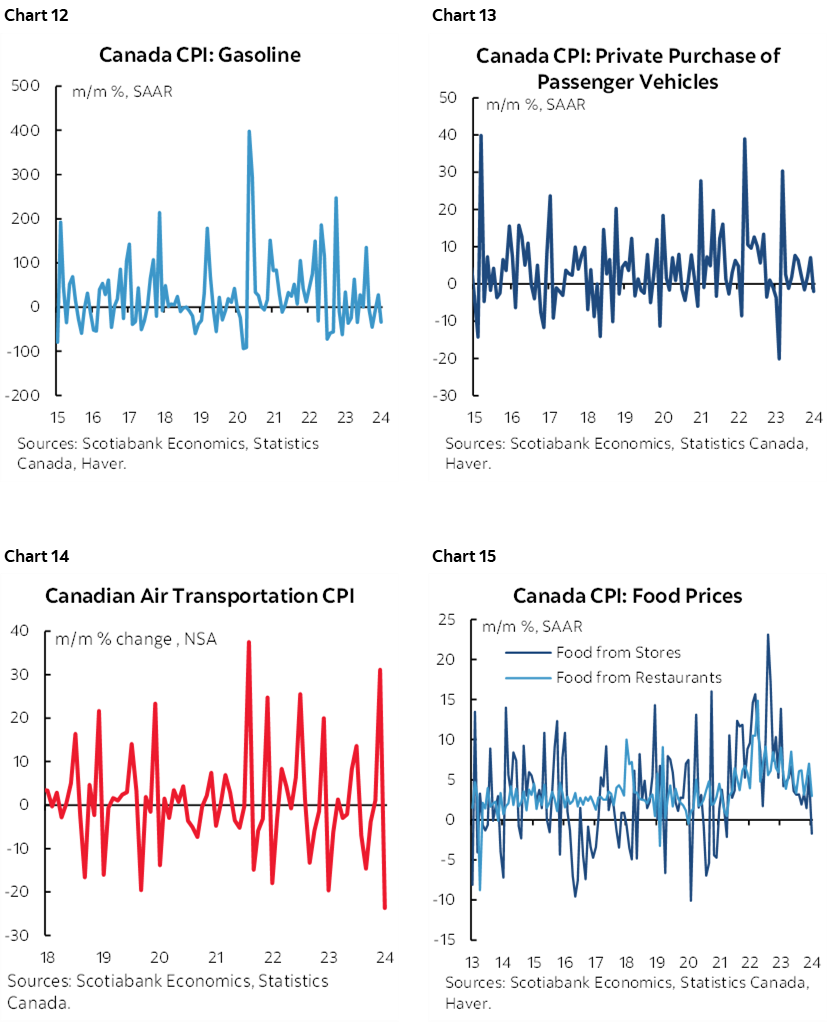

Charts 8–15 shows other CPI components.

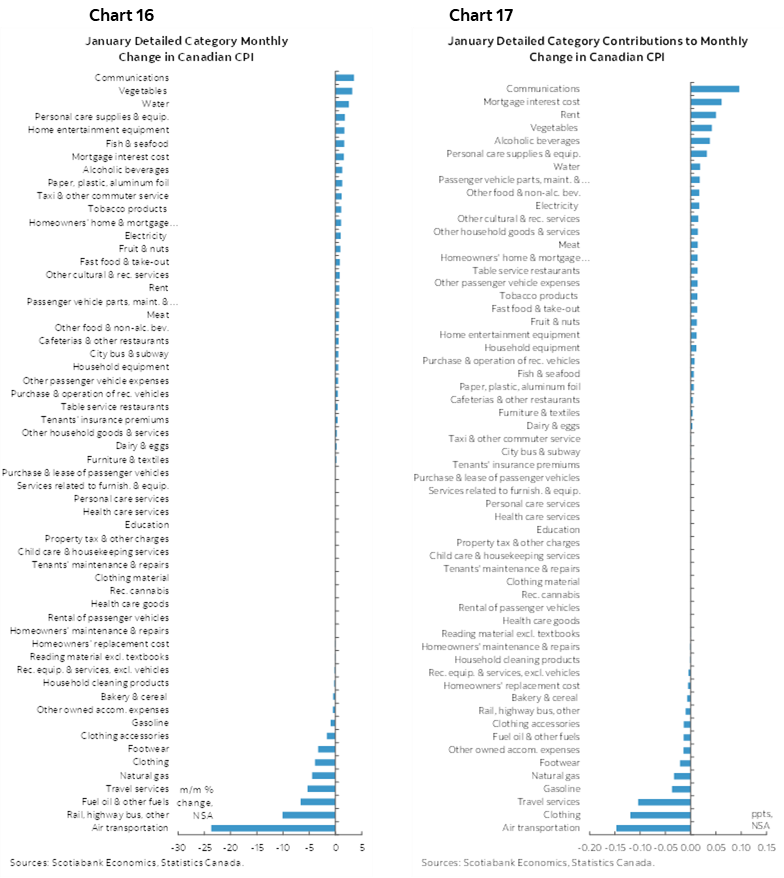

Chart 16 shows the breakdown of the CPI basket in m/m terms and chart 17 does likewise in terms of weighted contributions.

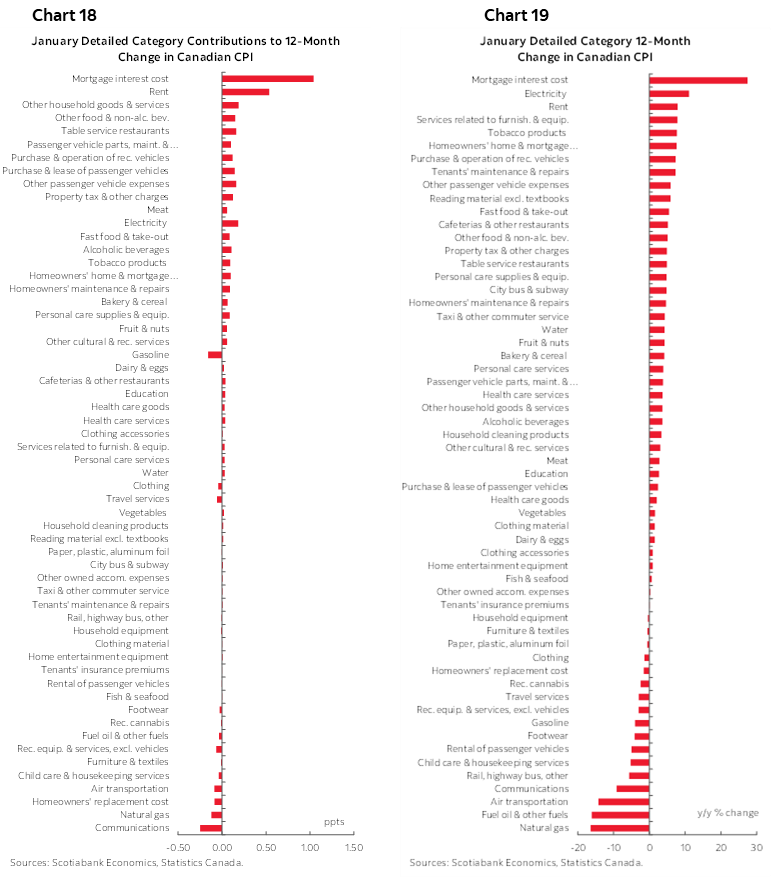

Charts 18–19 shows the same concepts in y/y terms.

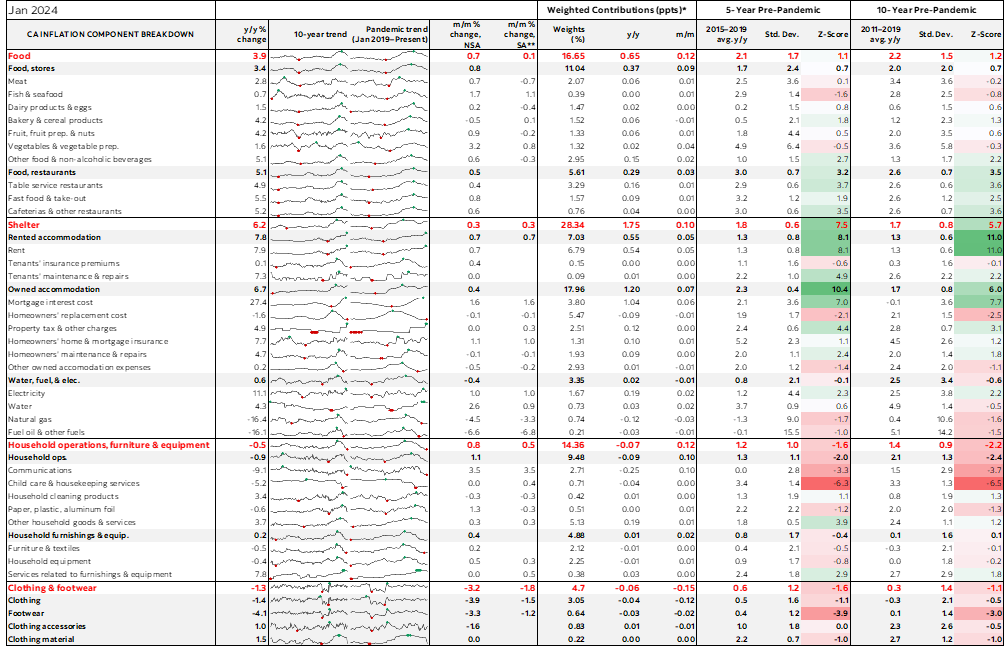

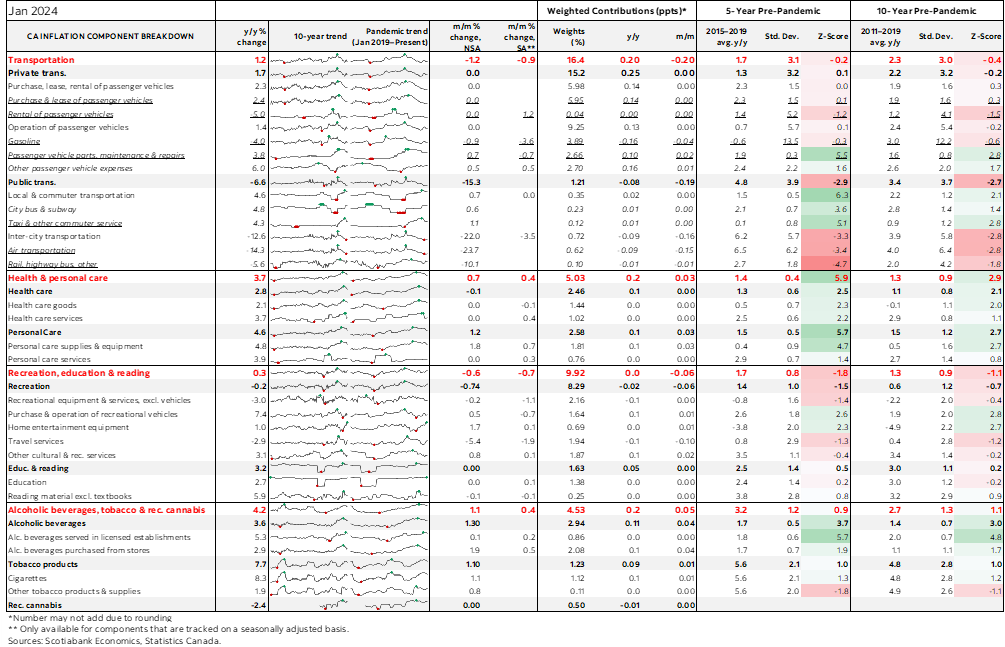

Finally, the accompanying table includes further details, micro charts, measures of standard deviations and z-score deviations from norms.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.