- FOMC leaves all policy unchanged as widely expected

- A September cut “could be on the table”

- FOMC statement-codifies that it’s no longer just about inflation

- Our call for a first cut remains September…

- ...which may be teed up at Jackson Hole

- Iran’s tape bomb distorted the market reaction

The FOMC left all policy variables unchanged as widely expected including the 5.25–5.5% policy rate band and its quantitative tightening program, but the key was Chair Powell’s reference to September being a possible meeting at which to cut but without any firmer commitment than that. Scotia Economics continues to forecast a first cut at that meeting. Powell signalled growing confidence they are on track toward achieving their dual mandate goals to ease, but not quite there yet. There were modest statement tweaks.

Markets initially responded to the totality of the communications by driving the two-year Treasury yield about 5bps lower entirely during the press conference after largely shaking off the statement. Another move 2bps lower followed on Iran’s headlines. The S&P500 is very slightly higher. Initial market moves gave way to volatility when headlines struck that Iran’s Supreme Leader ordered a retaliatory attack on Israel. Stay calm and observe, recalling that the last time this happened Iran attempted to save face by firing off inaccurate missiles that were shot down as both sides sought to avoid all-out war.

SEPTEMBER LOOKS LIKE A LIVE MEETING

Powell commenced his press conference by stating that inflation has eased "substantially," that broad labour market readings have returned to where they were on the eve of the pandemic and are strong but not overheated, while Q2 inflation data have added to their confidence to begin easing and more good data would strengthen this confidence.

The opening signal was therefore that they’re not there yet with enough confidence to ease, or perhaps don't wish to communicate as much just yet.

The first question asked if market pricing for a September rate cut is reasonable. Powell said:

“We have made no decisions on September. The Committee is moving closer to this point. We will be data dependent but not data point dependent, looking at the totality of the data. A reduction in our policy rate could be on the table as soon as September."

I think the signal there is that it would probably take negative surprises to knock them off course from easing on September 18th, as opposed to much better data in a slanting of the bias. There are two more CPI reports, one more PCE report, and two more nonfarm payrolls reports before that meeting.

When probed further about this matter and whether any further improvement in inflation makes a cut in September the baseline scenario now, Powell was cagey:

“If we were to see inflation moving down, growth remains reasonably strong and the labour market remains similar to its current condition, then a rate cut could be on the table in September. If inflation disappoints then we would weigh that along with the other things. It's going to be the totality of the data and risks."

Powell emphasized that “We just need to see more data. We had a quarter of poor inflation data in Q1 and then saw good data again after seeing seven months of good inflation at the end of last year. More good data would help us gain more confidence.”

FORWARD GUIDANCE

Powell provided nothing when asked if the June dot plot is still an accurate guide. He said:

“The path ahead is going to depend upon the way the economy evolves. We will do another SEP at the September meeting. I can imagine a scenario in which there would be anywhere from zero cuts to several cuts. I wouldn't want to lay out a path for you today.”

INCREASINGLY SENSITIVE TO THE JOB MARKET

Powell was asked ‘if the labour market is back in balance, then why is restrictive policy warranted right now?’ He said “The data in the labour market shows an ongoing normalization of conditions from overheated to more normal conditions. We are watching labour market conditions quite closely. We're well positioned to respond. We are prepared to respond if we see more than a gradually normalization of conditions. I would not like to see material further cooling of the labour market." Enter Friday’s nonfarm payrolls.

MORE CONFIDENCE THIS INFLATION SOFT PATCH COULD STICK

Powell was asked whether recent inflation reports look like last year’s disinflation is back on track with disinflationary momentum after a reversal earlier this year and sounded dismissive:

“Actually I think it's more. This is a broader disinflation. Last year it was goods prices. We're also seeing progress in housing services and non-housing services now. I would say the quality of this is higher, but it's only a quarter. But we need to see more. Our confidence is growing.”

This answer is consistent with my bias that the underlying rebalancing of the US economy should lend more confidence to US inflation staying lower albeit no doubt volatile.

When then asked whether the inflation readings earlier this year were blips that could have allowed for cuts by now, he said:

“If it's just seasonality that drove higher inflation earlier then that implies inflation would be stronger later in the year with the opposite seasonal adjustment problems. This is why we look at 12 months.”

FUTURE DISSENTERS?

Even though there were no dissenters in today’s decision, Powell did note that a "strong majority" supported not moving today. That’s not the same as saying “unanimous.” That either indicates that a minority of non-voting FOMC members advocated easing today and/or that some voting members were leaning that way. This suggests scope for potential dissenters in September depending upon circumstances.

STATEMENT CHANGES

The overall tone to statement changes was slightly more dovish in nature, yet it remained noncommittal toward the coming decision in September. Before turning to the changes, key is what did not change. They retained reference to how they still need to achieve greater confidence and are not there yet by repeating this:

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

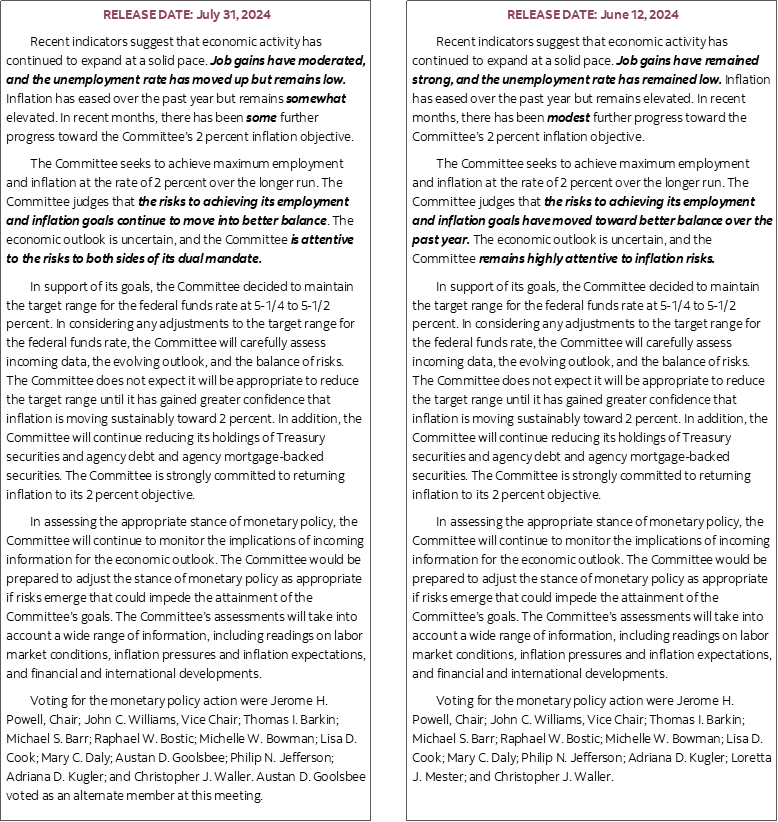

Here are the things they did change and also see the accompanying statement comparison.

- Key is that they statement-codified a more balanced focus upon the overall dual mandate by now saying they are “attentive to the risks to both sides of its dual mandate” of full employment and price stability, versus previously stating that the Committee “remains highly attentive to inflation risks.”

- They also now say that they judge that “the risks to achieving its employment and inflation goals continue to move into better balance” versus saying “have moved yoward better balance over the past year.”

- They now say that “Job gains have moderated and the unemployment rate has moved up but remains low.” This contrasts with previously saying “Job gains have remained strong and the unemployment rate has remained low.”

- They says “there has been some further progress” toward 2% inflation, versus previous saying “modest further progress.” This is minor.

- Inflation is now described as “somewhat” elevated which adds ‘somewhat’.

Overall, pending data, the August 22nd–24th Jackson Hole Symposium may be the place for Powell to more firmly tee up a September cut.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.