- Headline inflation soars to 1983 rate, above consensus, in line with Scotia’s estimate

- Average core inflation hit the highest on record

- Markets shrugged, largely because of aggressive pricing for the BoC’s policy rate

- BoC’s Rogers passively reinforces 75bps priced for July 13th

- BoC’s Governing Council is weakened by two retirements

CDN CPI m/m % NSA // y/y %, May:

Actual: 1.4 / 7.7

Scotia: 1.2 / 7.8

Consensus: 1.0 / 7.3

Prior: 0.6 / 6.8

Average ‘Core’ CPI: 4.7% y/y (4.4% prior, revised up from 4.2%)

Canada’s inflation rate continues to soar. Inflation exceeded consensus expectations and came very close to my estimate at the top end of consensus. 7.7% y/y inflation is the hottest since January 1983 and there are no signs of cooling given high breadth, upward revisions and the continuation of hot gains inflationary pressures at the margin.

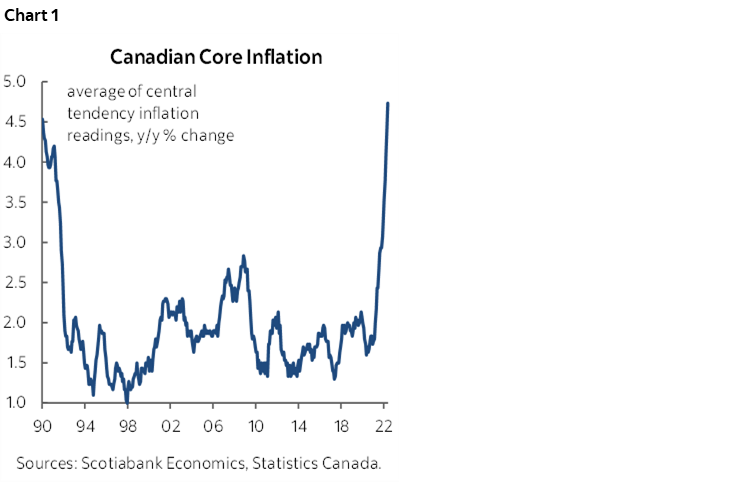

Average ‘core’ inflation using the Bank of Canada’s preferred inflation readings climbed to 4.7% y/y which is the highest since at least 1990 when the series began (chart 1). The prior month’s average of these measures was revised up to 4.4% from 4.2% previously. All of the three measures are well above the BoC’s target with trimmed mean at 5.4% y/y, weighted median CPI at 4.9% and common component at 3.9%.

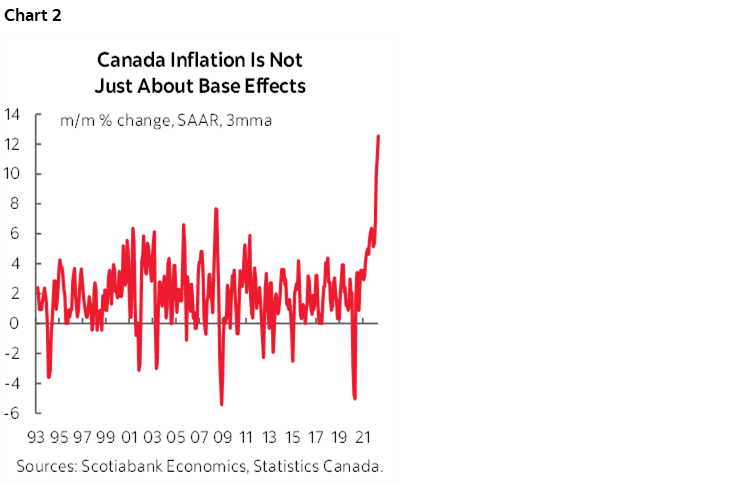

CPI on a month-over-month, seasonally adjusted basis at an annualized rate (SAAR) hit 13.6% for the hottest such gain on record. Here too there is no evidence of cooling pressures; in fact, it’s the opposite (chart 2).

Prefer to take out energy and food inflation because, ya know, who pays that anyway?? Well ok, if you must, but CPI ex-food and energy was up 8% on the same m/m SAAR basis which matches the prior month’s reading after hitting 9% in March. CPI excluding the eight most volatile items that the BoC used to target back in the Mesozoic era was 7.7% m/m SAAR which is cooling from 12.4% in March and 9.5% in April.

Breadth is ginormous. 75% of the CPI basket is rising by 3% y/y or more, 71% is up by 4% + and 57% of the basket is up by 5% or more (chart 3).

By province, the hottest pressures are in little ol’ PEI at 11.1% y/y. Other Atlantic provinces plus BC and Manitoba are 8-handled, while Ontario, Quebec , Alberta and Saskatchewan are all seeing inflation at a 7-handled y/y pace.

Chart 4 shows that while core goods price inflation may be topping out recently at still high rates over recent months, service price inflation continues to accelerate.

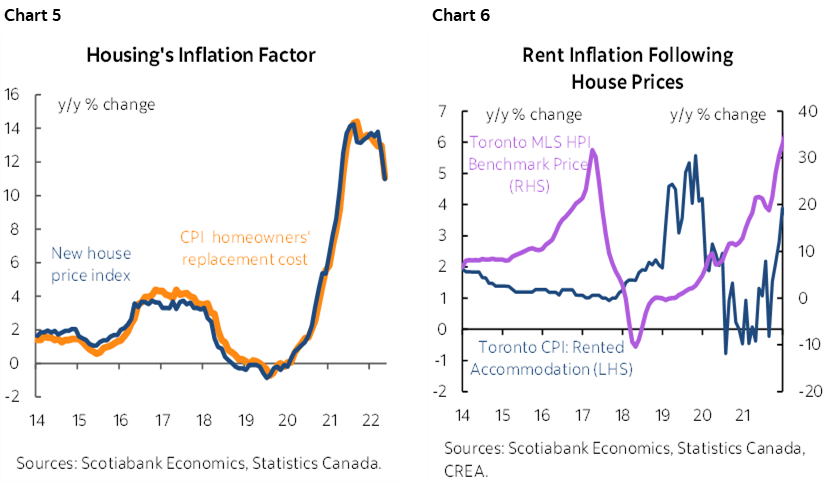

Charts 5 and 6 show the housing drivers of inflation. Canada does not use owners’ equivalent rent like the US and instead uses the replacement cost concept that is driven by the house-only component of the new house price index. In other words, a cooling pace of builder price increases is softening the direct contributions of housing to inflation. Still, the lagging effects of past big gains in house prices and uncertainty toward future changes in house prices are driving more pressures in rental markets in the context of tight supply. The rotation of demand from owner-occupied toward rental housing is continuing to add to inflationary pressures.

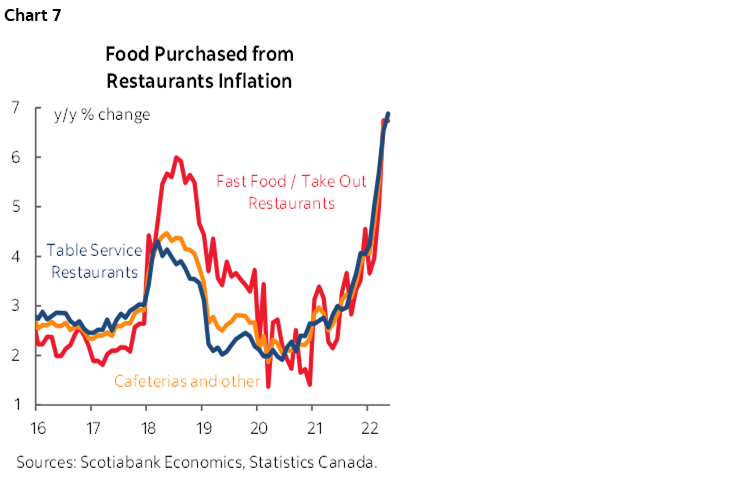

Chart 7 breaks down some of the key measures of food price inflation that are connected to more people getting out and re-engaging in more normal activities at the same time that food commodity prices have risen. Some of this activity is indeed within the Bank of Canada’s influence in my opinion since some of it is demand-driven and not just a function of imported food price shocks. It remains too convenient for the BoC to deflect responsibility for high inflation in favour of pointing toward global forces.

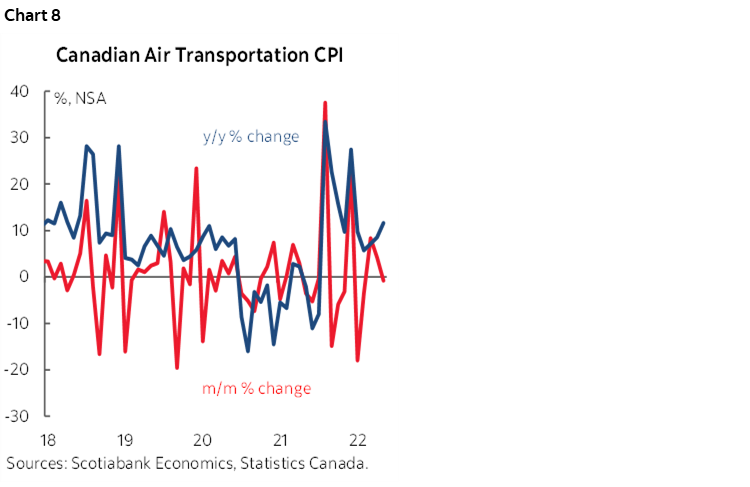

Chart 8 shows that airfare was a cooler contributor to m/m inflation than I had thought. Maybe I just got ripped off, ha.

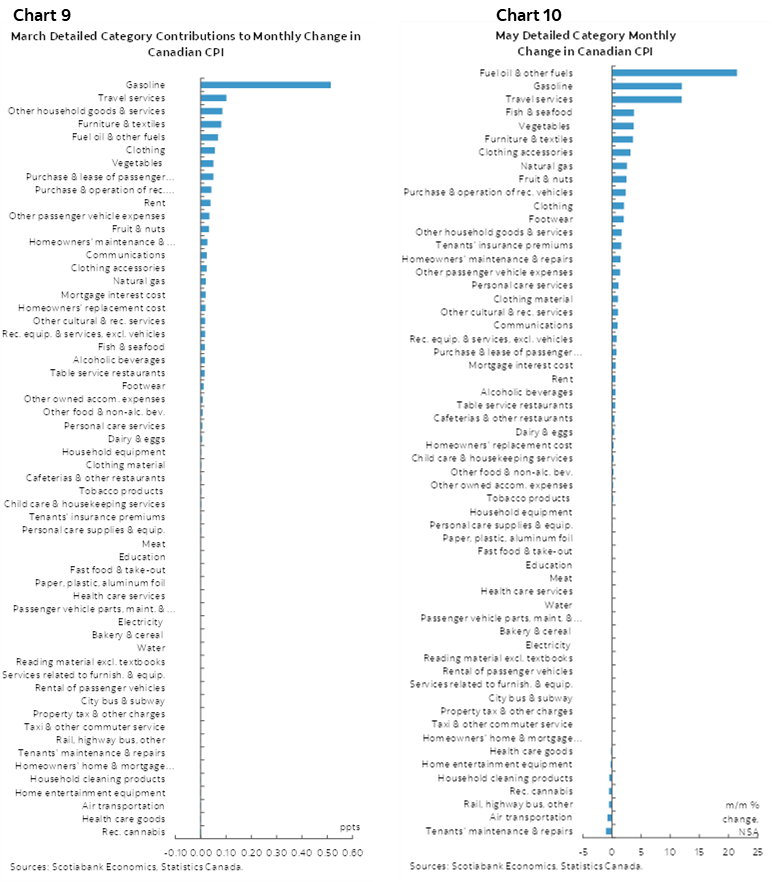

Chart 9 shows the weighted contributions to the month-over-month change in seasonally unadjusted prices and chart 10 shows the unweighted changes. The top contributors by this measure were led by higher gasoline prices but there was high breadth across more limited individual contributions in the rest of the basket.

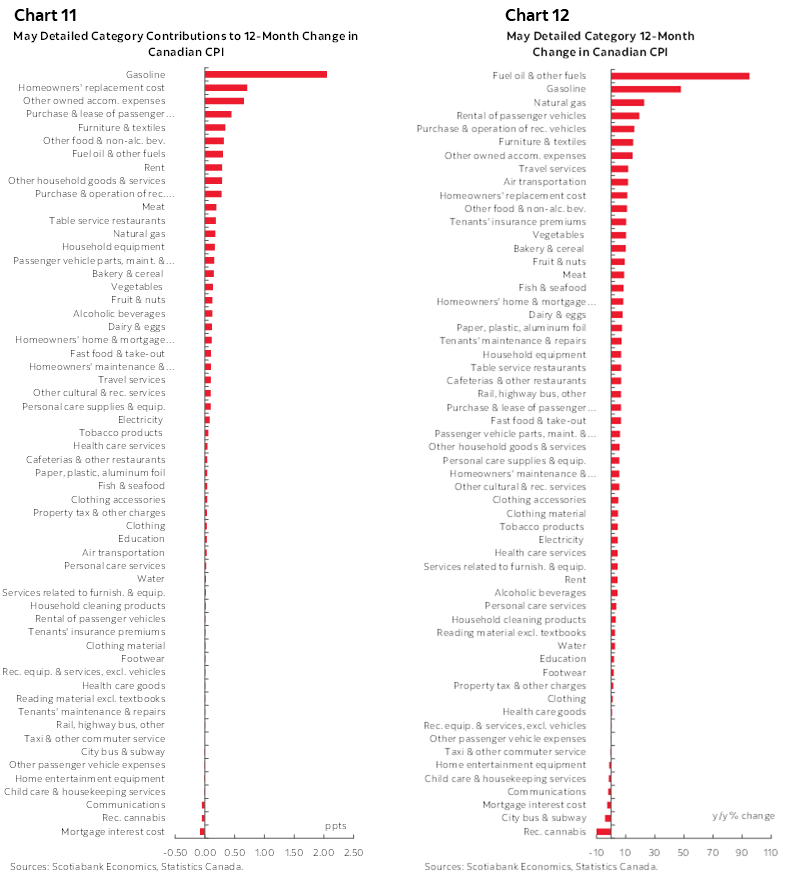

Chart 11 shows the weighted contributions to the year-over-year change in CPI and chart 12 breaks down the basket in raw, unweighted y/y terms. The top weighted contributor to year-over-year inflation is gasoline that accounts for 2.1 percentage points out of the 7.7% headline, but the other 5.6 percentage points is driven by a very broad array of price pressures.

BANK OF CANADA IMPLICATIONS & MARKETS

There was only a modest reaction to the figures. The Canadian dollar slightly appreciated in the aftermath and the yield on the 2-year Government of Canada bond that aligns toward what markets are thinking in terms of the BoC’s rate path had climbed 2–3bps initially but has since rallied back toward where it began. Still, Canada is underperforming Treasury yields. Global forces are dominating markets.

Still, it would have taken a lot to impact what is already priced for the Bank of Canada. 75bps is done for July 13th from a markets standpoint and I think they hike by that amount. By year-end, markets have about a 3½% policy rate which is toward where I see it going and without ruling out further upside risk.

BoC’S ROGERS PASSIVELY REINFORCES 75BPS HIKE

BoC Senior Deputy Governor Rogers’ appearance at a Globe and Mail fireside chat after CPI offered nothing new of direct relevance to market expectations for Bank of Canada policy. It was a general discussion of views previously expressed in BoC communications and continued to err on a rather defensive side.

Having said that, since Rogers is the last BoC official scheduled to speak before the Bank of Canada goes into communications blackout on Tuesday, July 5th, it may be material that she did not use the opportunity to explicitly lean against market pricing for a 75bps rate hike on July 13th or even in veiled fashion. She did not explicitly say they’ll hike 75bps, but if the BoC wishes to avoid abrupt surprises to markets and cares at all about this after all the legitimate knocks against its credibility—which under present circumstances it absolutely should—then it passed on the opportunity to correct expectations. Between now and the July 13th statement, MPR and press conference we’ll get the BoC’s twin consumer and business surveys including measures of inflation expectations that probably moved up again, plus another jobs report on July 8th.

After Rogers’ appearance, the BoC announced that Deputy Governor Tim Lane will be retiring after the September meeting. This follows the retirement of Larry Schembri. The BoC will be replacing one of the spots and sticking to its “usual complement of six people.” Lane is respected for his depth on monetary policy theory and practice, transitions and crises, and digital currencies and other payments system issues. We’ll see who is appointed going forward but at the moment the BoC’s Governing Council is entering Fall in a weakened position having lost two significant members of its Governing Council.

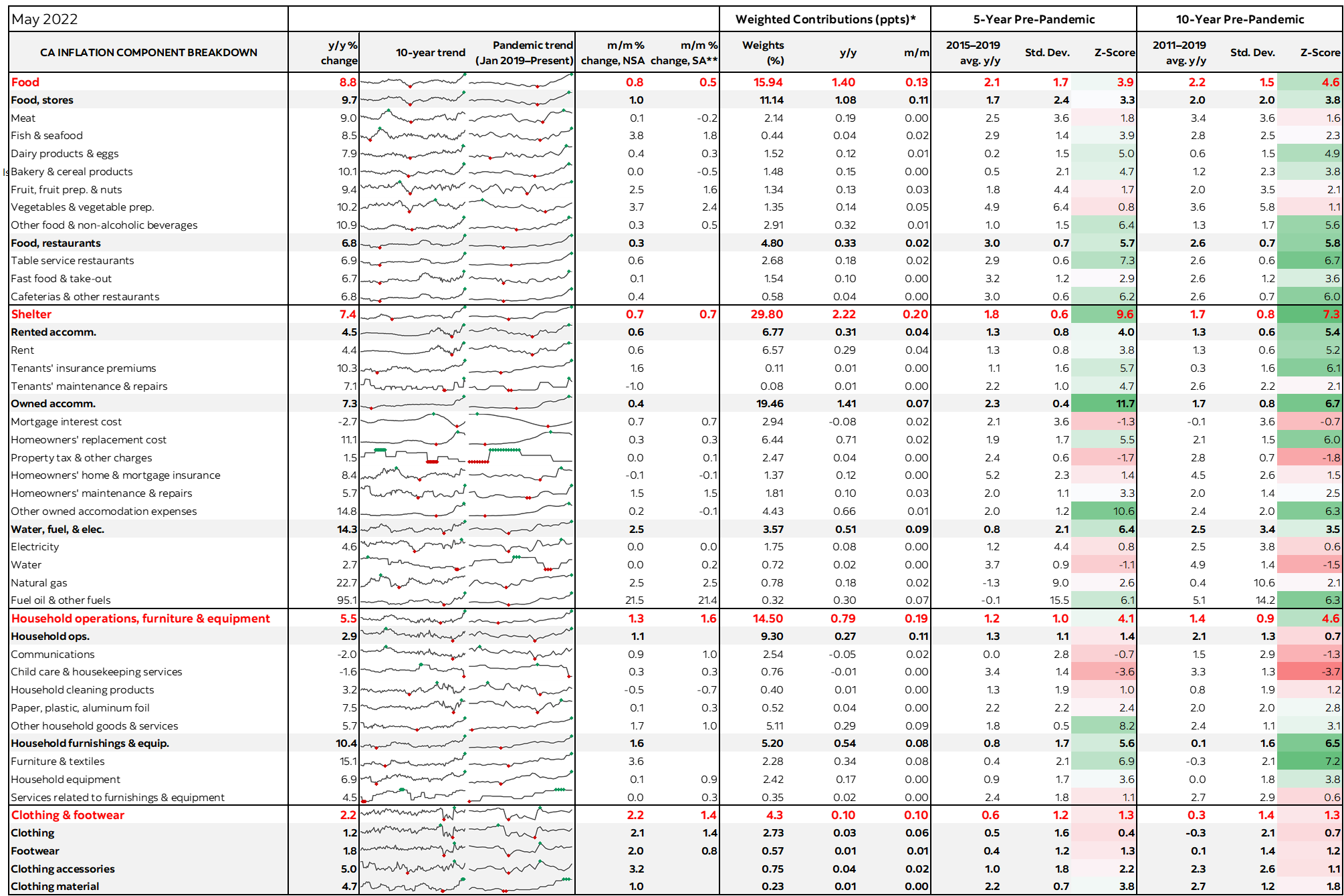

The accompanying table provides a more detailed breakdown of the CPI basket including weighted and unweighted contributions, micro charts of components, and z-score measures of deviations from trend by component.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.