- The economy shrank materially less than early guidance

- Growth is broadly tracking the BoC’s revised April forecast…

- ...but vaccinations are occurring a lot faster than they assumed

- StatsCan’s ‘flash’ guidance has a persistent negative bias

- Markets ignored the release with an eye on Q3

CDN GDP, m/m %, SA, April with May flash:

Actual: -0.3

Scotia: -0.8

Consensus: -0.8

Prior: 1.3% (revised up from +1.1)

May 'flash': -0.3

That’s it? That’s your best punch, third wave?? Hmph. While the human toll and the strain on health systems and some sectors are pronounced and real, the impact of the third wave on the broad economy is so far looking rather slight as the economy transitions toward rebounding over in a two-dose kind of summer.

April GDP fell by considerably less than the preliminary 'flash' guidance from Statistics Canada. On June 1st, the agency said April GDP was tracking a decline of 0.8% m/m and today they revised that to -0.3% for a notable half point upward revision. Less is not always more it seems as CAD couldn’t have cared less about the backward looking estimates.

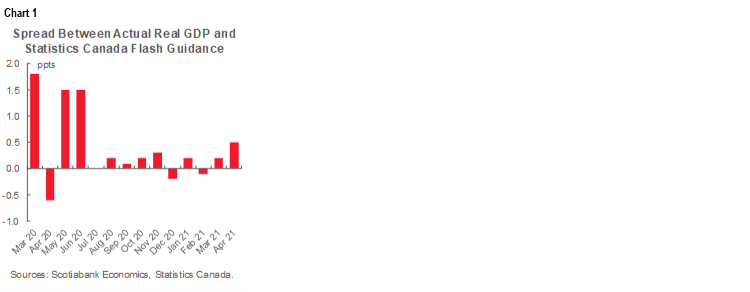

The flash guidance is appreciated, but not terribly accurate even with all of the internal data that the agency has at its disposal and that we don’t. As chart 1 demonstrates, actual GDP growth as we presently understand it net of all revisions to date has exceeded preliminary flash guidance in 10 out of the 14 months that it has been provided during the pandemic and with only one notable overshoot back in April of last year. Despite internal data advantages, StatsCan keeps surprising itself and it might be helpful to hear an explanation for a fairly persistent positive bias to the surprises. One might expect some mean reversion that cancels out the overshoots and undershoots and not exceeding advance estimates 70–80% of the time.

With that rather large caveat, May’s ‘flash’ guidance is for another 0.3% m/m decline which probably means the economy was flat or may have even posted growth. If not for the positive upward revision to April’s estimated growth, then May would have posted positive GDP growth. Also note that March GDP growth was revised up to 1.3% m/m from 1.1%.

Monthly Canadian GDP is tracking 1.5% below Feb 2020 up to May of this year (chart 2). It’s likely that Q3 will see GDP return to the pre-pandemic level. With less supply side expansion, we're on track to see spare capacity shut into early 2022.

So what kind of growth is Canada tracking? How does that compare to the Bank of Canada’s projection?

One approach is to use today’s monthly production-based GDP figures that indicate Q2 growth tracking 1.9% q/q annualized (chart 3). That assumes flat GDP in June only to focus upon the effects of what we know so far and without imposing artificial judgement toward June GDP when we don’t have any actual data for the month. If June shows preliminary evidence of positive reopening effects, then this estimate could push higher.

The more common approach to tracking growth is to use expenditure-based quarterly figures. Scotia’s Nikita Perevalov runs a ‘nowcast’ model that tracks this concept and he gets 3.5% for Q2. That would be in line with the BoC’s Q2 forecast from the April MPR which is based on this expenditure-based GDP concept. Q2 tracking will obviously be further informed as June data rolls in with potential revisions to prior months. Between now and the July 14th BoC communications, however, there won’t be much added information other than next Friday’s jobs that I estimate at +175k for June.

Recall that two of the main differences between the two ways of tracking GDP growth that are both derived from the fact that quarterly GDP considers how higher output was achieved whereas monthly GDP does not. The ‘how’ part is informed by factors like inventory and import swings. Our tracking suggests that inventories fell at a slower pace in Q2 than in Q1 which in a GDP accounting sense means a positive contribution to Q2 GDP growth. Our tracking also leans toward a decline in imports which means less of a leakage effect from the economy during Q2 which means imports add a positive contribution to Q2 GDP growth.

In any event, the BoC is unlikely to care much whatsoever about Q2. It’s water under the bridge and they generally knew at the time of publishing the April MPR forecasts that the economy was going into third wave lockdowns that were expected to begin easing in May which they did (and much more so over June into July).

Further, the April MPR had assumed that vaccinations would lead to herd immunity ‘later in the year’ after the US achieved this milestone around mid-2021. Canada might be at a 75% double dose level of herd immunity as soon as Macklem's press conference on July 14th. If not, then it’s likely this milestone will be hit shortly thereafter.

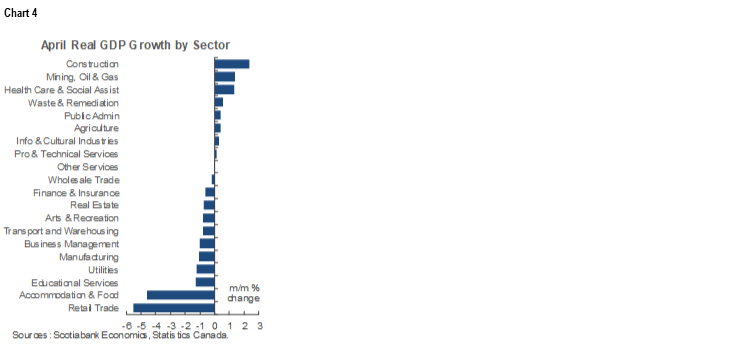

As for what drove April GDP, chart 4 shows that it was dragged lower by sectors you would expect to have suffered the most during the restrictions. Statistics Canada does not break down their preliminary guidance for May, but loosely indicated that weakness was focused upon retail trade, construction and real estate rental/leasing while finance and insurance and wholesale picked up.

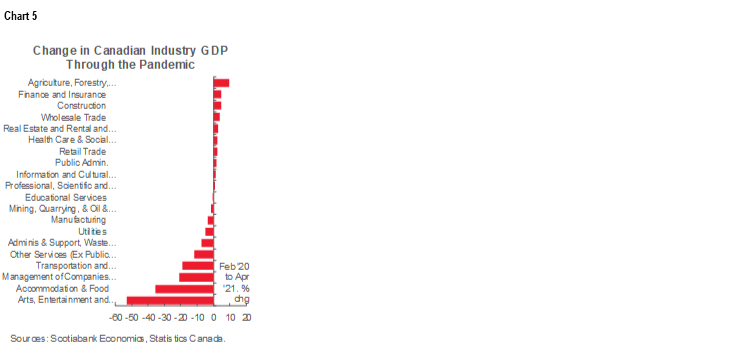

Chart 5 shows cumulative GDP changes by sector since the start of the pandemic.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.