- The BoC cut 25bps to an overnight rate of 4.75%

- Macklem’s forward guidance remains untrustworthy

- We forecast a cut in July and add 25bps to the year for 100bps of cuts in 2024

- Macklem said the BoC is “not close” to the limits of undershooting the Fed…

- ...and doesn’t seem the least bit concerned about the currency

- Monetary and fiscal policy are likely to add upside risk to the 2025 election year

- The BoC is gambling that inflation risk will be durably lower than the US

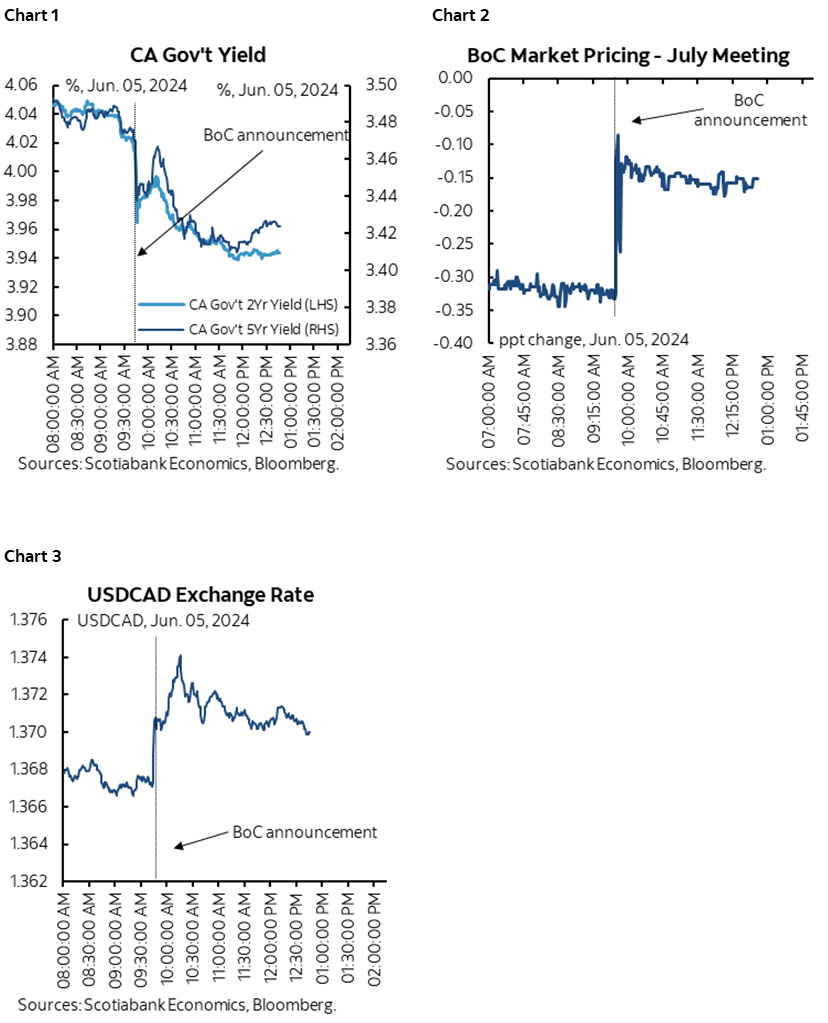

The Bank of Canada cut the overnight rate by 25bps to 4.75%. Markets responded as shown in charts 1–3 by driving the Canada 5-year yield even lower to 3.42%, further emboldening the rally from 3.8% just a week ago while driving the 2-year yield well under 4% for about a 40bps rally over the past week. Variable and fixed rate mortgage rates are going to be cut on the back of this which should add strength to the ongoing Spring housing market. The Canadian dollar depreciated by a third of a cent to the USD on a combination of the BoC and a very strong US ISM-services report.

First off, hats off to the folks who got the call right. Congratulations. You won the battle, we’ll see about the war that lies ahead. Scotia Economics was at the leading edge of shops and against markets throughout this year when we were saying June would be the earliest point for a first BoC cut until we recently delayed that call. It’s been quite a long while since Scotia has blown a rate call on game day but we take it in stride for the following reasons.

The BoC’s Inconsistency Has Implications

The ones who got it right listened to a different Governor in my opinion. I listened to one named Governor Tiff Macklem when he told us one month ago that “in the months ahead” they will be evaluating additional evidence before deciding when to deliver a first cut. He was very explicit. He said that in written, carefully prepared testimony on two separate days. Just weeks later he turned around and cut. Go figure. More galling is that not one of the gaggle of reporters in his press conference asked him how he can do that with a straight face.

Credible monetary policy relies upon clear and consistent communications. The BoC has a consistency problem and this is not helpful to businesses, consumers, governments and markets as they draw up forward-looking plans. ‘Trust’ is not part of the vocabulary to use in discussing the BoC’s moves.

This is a serious issue. Macklem’s communications and forward guidance were awful during the pandemic. He unwisely lured in mortgage borrowers by promising them that the policy rate would be on hold for several years, only to have to back pedal from this overreach. He owns much of the mortgage resets challenge, proving that trust or lack thereof has real effects. He had a chance to deliver more consistency and repair past damage by being consistent today and he balked. Canada remains in the wild west of central banking relative to other central banks that put more of a premium on sticking to their word.

In any event, Governor Macklem was very dovish sounding today. Much more so than I would have expected for a first cut. The BoC basically delivered a total rejection of our narrative which sets up a contest going forward straight into 2025.

What follow are reasons for interpreting his remarks as very dovish.

“Not Close” to the Limit of BoC Versus Fed Policy Divergence

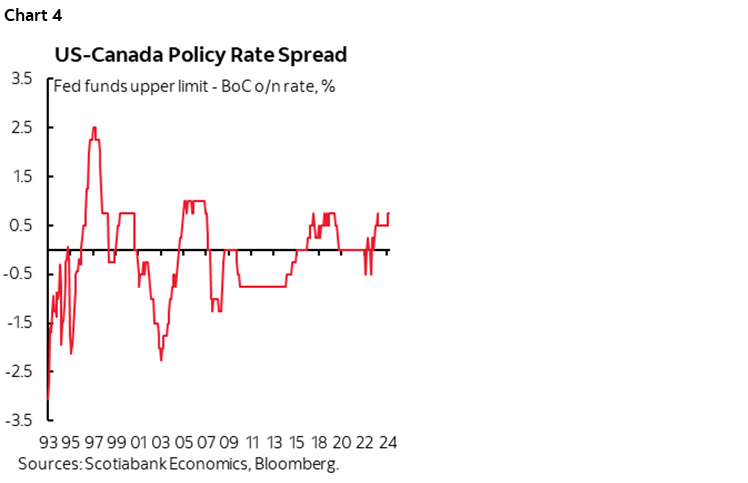

Macklem said that the BoC is "not close to the limits" of Fed divergence. That spread is now -75bps. To say “not close” is way more aggressive than he needed to be. He advised looking back in history at prior deviations on the policy rate (chart 4). The BoC has undershot the Fed quite deeply at times—about three times as much as the current 75bps undershoot. Some of those periods didn’t work out so well mind you, like 1996 when they went 250bps below the Fed and then had to reverse it all with hikes. Still, ‘not close’ signals comfort going far below the Fed, say 150bps+?

When explaining his stance, he said that “in Canada we have a flexible exchange rate and independent monetary policy. We don't need to move lock and step with the Federal Reserve. What happens in the US has an impact on Canada and we take that into account, but we can take decisions that are geared to what the Canadian economy needs. Our judgement is that the Canadian economy doesn't need as restrictive policy. There are limits to the Federal Reserve but we're not close to those limits.”

A clear caution is that the history of that policy spread has to acknowledge the unique circumstances during prior deviations and ask whether there is as strong a case to deviate today.

Green Light to Sell CAD

As a follow-on to the policy rate spread point, Macklem sounded remarkably indifferent toward the currency. When asked about the currency and implications for importing inflation, he said:

“One of the ways monetary policy works is through the exchange rate. We don't have a target for the exchange rate. We believe in flexible exchange rates. By being clear about our forecasts, markets have a very good idea of what's on our mind which is going to be reflected in markets.”

I choked on “clear” in their forecasts considering he just cut when he said he wouldn’t, but the main point here is not to disagree with his comments on CAD but to view them as signalling he would tolerate a lot further currency weakness from here. That easily leaves open a 1.40-handled currency imo.

The Door is Wide Open to Go in July

When Macklem was asked whether prior guidance that they would proceed gradually in cutting rates meant they won’t be cutting again in July, he basically rejected the suggestion and left the door open to going again:

“We'll be taking our decisions one meeting at a time. If the economy evolves as expected and inflation evolves as expected, then it's reasonable to expect further cuts. The timing depends on data and the future path of inflation. We are still above target. There are a number of risks that we are watching carefully. We'll be taking our decisions one meeting at a time.”

And:

“If the economy continues to evolve broadly as we expect then it is reasonable to expect further cuts in our policy rate but the timing of further cuts will depend upon incoming data.”

What I hear in those remarks is setting a high bar against not cutting again in July when they roll out fresh forecasts to boot.

In a separate question on housing and mortgages, SDG Rogers backed that up by saying: “We know that mortgage holders will welcome this change and it's reasonable to expect further easing.”

Where Did ‘Gradual’ Go?

The WSJ probably asked the best question in the presser when Macklem was reminded that “In testimony last month you said rate cuts would be done gradually and there are limits relative to the Fed. Why is 'gradually' and limits to the Fed absent from the statement?”

Macklem was clearly caught off guard as he stuttered and stammered his way through trying to answer. He largely just said that as inflation is expected to ease gradually, the interest rate should ease gradually.

Markets will debate ‘gradually’ until the cows come home. It may rule out large single meeting moves. It doesn’t rule out a series of back-to-back quarter point moves in the slightest.

A Long Way to Pre-Covid Levels

Macklem was asked whether it is reasonable to expect that as inflation gets back to 2% should the policy rate get back to the neutral rate?

The key part of his answer was saying “It would be prudent to assume that rates will not go back to pre-covid levels.”

That doesn’t really help much, Governor. The pre-covid policy rate was 1.75%. That’s 300bps below where it is now and all you are ruling out is going below that?

He expanded upon this by saying “I don't think Canadians should pay much attention to neutral estimates. It's a perfect world with no shocks with everything on target and we'll never get there. It's highly uncertain. We have to put it in our models. We updated it in our last MPR in April and we increased it by 25bps to 2.75%. I really think talk of the neutral rate is getting ahead of yourselves. If you want to know where interest rates are headed, then it depends on arriving at our 2% inflation.”

Filtering Out the Good News

When discussing the economy, Macklem chose to emphasize softer than their April forecast for Q1 instead of robust details and instead of relative to being wrong in his earlier year guidance when he said that peak pain for the economy would arrive in 2024H1.

The BoC did not even mention that final domestic demand grew at its fastest pace since 2022Q1 by growing 2.9% q/q SAAR in Q1. This measure is a purer measure of the domestic economy that is free of inventory and trade swings. By this measure, the economy put in a strong performance in Q1.

The BoC did not mention anything about Q2 and said to wait until they have fresh forecasts at the July meeting. It would have been preferred to have those forecasts today.

They barely even mentioned that the consumer is ripping with growth of 3.2% q/q SAAR in 2023Q4 and 3.0% in Q1. Despite the all the negativity, consumer spending is not screaming out for rate cuts.

Implications

The Governor’s sudden rush has us revising our call in favour of another cut in July and 100bps of easing this year from 75bps previously. We think they will wish to deliver this 100bps in a straight line fashion until the October meeting. At this point we’re nervous toward the December meeting that follows the US election and have penciled in a pause for that one while nevertheless bringing forward our forecast for a 3.25% policy rate by one quarter to be achieved by 2025Q3.

In my opinion, fiscal and monetary policy have to be viewed as adding upside to our projection for 2.1% growth next year with inflation landing on 2% toward the end of 2025. I believe that monetary policy is sending strong signals that it is moving toward becoming much less restrictive over the next 6–12 months just as fiscal policy is likely to be becoming more incrementally stimulative to the Canadian outlook into an election year. Governments doing this badly in the polls do not spend less; watch for Trudeau/Singh/Freeland to spring the spigot in a Fall economic update and next Winter’s budget ahead of calling a vote. They’ll be able to count on having their chosen pick to run the BoC in their corner as monetary policy becomes more growth supportive into 2025. With the help of monetary and fiscal stimulus, the bias is to raise next year’s growth and inflation forecasts.

We’ll see how all of this works out into 2025. In my opinion, Canada continues to face higher full-cycle inflation risk than the US and the BoC should be much more careful than the Governor sounded today, but we have to incorporate his reaction function at least for a time.

There are several drivers of relative inflation risk that go well beyond fudged output gaps. Wage growth remains in excess of productivity in Canada by contrast to the US. Fiscal policy is still adding to growth and likely to add even more into an election year. Severe housing shortfalls are very likely to persist and maintain high upward pressure on shelter costs. Immigration is expected to remain high especially on the permanent resident side and we still face years of integration challenges for the sudden burst over recent years. The economy is outperforming the BoC’s expectations coming into the year with the consumer doing rather well. The BoC’s fudging of potential growth is how they get spare capacity to where they estimate it to be and that’s key in understanding the motives to cut.

I also continue to think that the Governor is overplaying the per capita discounting of GDP growth. He shouldn’t be including all if any of the temp category that has driven so much of the population growth. Curtailing that population should—all else equal—but renewed upward pressure on per capita GDP within their forecast horizon.

We'll see about the policy path over the longer run but what I heard today was a Governor in a hurry.

Statement Changes

Please see the appendix for a statement comparison. This was a very short statement, especially considering it kicks off an easing cycle when one might have thought they’d have put more effort into explaining themselves in statement-codified fashion.

The key change was in the final paragraph of the statement that now says:

“…monetary policy no longer needs to be as restrictive……Recent data has increased our confidence that inflation will continue to move towards the 2% target.”

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.