- ECB delivers another hawkish pivot…

- ...by speeding up APP taper plans…

- ...and indicating rate hikes could start as soon as September…

- ...while leaving themselves maximum optionality around hike timing

- US CPI landed on the screws…

- ...ahead of much greater upward pressure

The more hawkish than anticipated ECB stole the thunder away from US CPI that landed on the screws. As a consequence, much of the global rates complex saw yields push higher and almost exclusively due to the ECB’s actions that I’ll start with.

THE ECB’S HAWKISH PIVOT

The ECB statement (here) and President Lagarde’s press conference opening remarks (here) and Q&A can be briefly summarized as follows:

1. The Pandemic Emergency Purchase Program is ending this month as previously guided and as expected.

2. Purchases under the Asset Purchase Program—that encompasses all other purchase programs of public sector, corporate sector, ABS and covered bond instruments—were unexpectedly tapered at a faster pace than previously guided and purchases are conditionally guided to end some time during Q3. Prior statement guidance was:

"monthly net purchases under the APP will amount to €40 billion in the second quarter of 2022 and €30 billion in the third quarter. From October onwards, the Governing Council will maintain net asset purchases under the APP at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of its policy rates. "

And has now been replaced by two references:

"Monthly net purchases under the APP will amount to €40 billion in April, €30 billion in May and €20 billion in June."

And

“If the incoming data support the expectation that the medium-term inflation outlook will not weaken even after the end of its net asset purchases, the Governing Council will conclude net purchases under the APP in the third quarter.”

Lagarde emphasized in the press conference that the conditional ending of the APP could occur at any time in Q3 from July though the September meeting.

3. Rate guidance changed in a subtle way that leaves all options on the table in terms of timing lift-off. The prior statement said that the APP would end “shortly” before raising rates and now the current statement says that raising rates could happen “some time” after ending APP purchases. What’s meant by “some time”? Lagarde did not reintroduce language around how a 2022 hike would be “very unlikely” that she had been saying before the hawkish pivot at the last meeting. Instead, Lagarde said that "some time after is all encompassing" and "it could be the week after" or “it could be months after."

With that kind of guidance, markets will always price the earliest scenario which is probably that they end purchases as early as July and then hike as soon as at the next meeting in September. All options from that point forward are on the table conditional upon, well, just about everything from inflation tracking to growth tracking to further developments in the war in Ukraine and stability considerations.

4. Breadth of opinions.

Lagarde was asked about how much agreement there was around accelerating the policy exits. She said that the discussion started off with widely divergent views around the table, but that all Governing Council members ultimately supported the decisions that emphasize optionality. She somewhat defensively noted that the decisions made today were not to accelerate normalization but rather to progress step-by-step and to acknowledge uncertainty and add optionalities in order to be able to respond in all circumstances in an agile way.

Overall, they sped up the APP taper, brought forward its conditional end and guided that hikes could commence as soon as right after. In all, that’s a hawkish set of messages and they were taken hawkishly by markets.

5. Forecasts

The ECB staff revised down GDP growth this year while revising up inflation forecasts for 2022 and leaving both variables’ forecasts little changed in subsequent years. Lagarde emphasized increased confidence that inflation expectations will durably converge upon the ECB’s 2% target which added to the general sense of hawkishness around the communications.

GLOBAL CENTRAL BANKS ON THE MOVE

So there you go. The Ukraine war isn't obviously dovish for the front-end across central banks as some believe. If it isn't obviously dovish for the ECB which has the war on its doorstep, then it’s hard to see it as such for the Fed and the BoC. Quite the opposite, in fact, as they are likely to pivot toward sounding increasingly hawkish going forward.

It’s for this reason that we saw some spillover effect of the ECB’s actions on markets in the US and Canada. We're now getting several central banks who are behaving in an expedited hurry to get out of asset purchase programs and to varying degrees move toward policy tightening. The RBNZ went cold turkey on purchases with no reinvestment and managed sales. The BoC reinvested for what will likely be ~5 months and is likely to fully end reinvestment next month. The ECB is ending net purchases in ~4–6 months from now before it pivots to reinvestment. The BoE has already acted including hiking. The Fed will end net purchases next week and while we've heard no further decisions will be forthcoming at this meeting on balance sheet plans, I think it's likely the presser will jawbone rapid roll-off.

There are multiple scenarios around the war in Ukraine, but short of the deepest and darkest ones, the message coming from global central banks is that they are much more concerned about how far behind they are in the fight against inflation. This is an environment in which to expedite monetary tightening at central banks like the Fed and BoC.

US CPI DETAILS

US CPI m/m % // y/y %, February:

Actual: 0.8 / 7.9

Scotia: 0.7 / 7.8

Consensus: 0.8 / 7.9

Prior: 0.6 / 7.5

US core CPI m/m % // y/y % change, February:

Actual: 0.5 / 6.4

Scotia: 0.5 / 6.4

Consensus: 0.5 / 6.4

Prior: 0.6 / 6.0

The release didn’t much matter to markets because it landed on the screws and because the ECB was first to grab the mic with Lagarde out-shouting US CPI. Charts 1 and 2 show the rise in year-over-year terms and what it could mean to the Fed’s preferred PCE measure plus how month-over-month annualized price increases indicate no slowdown of inflationary pressures whatsoever. Further, markets are more focused upon what lays ahead in line with expectations for much higher inflation numbers to be forthcoming. The oil price effect alone is likely to add multiple tenths to core inflation going forward (chart 3).

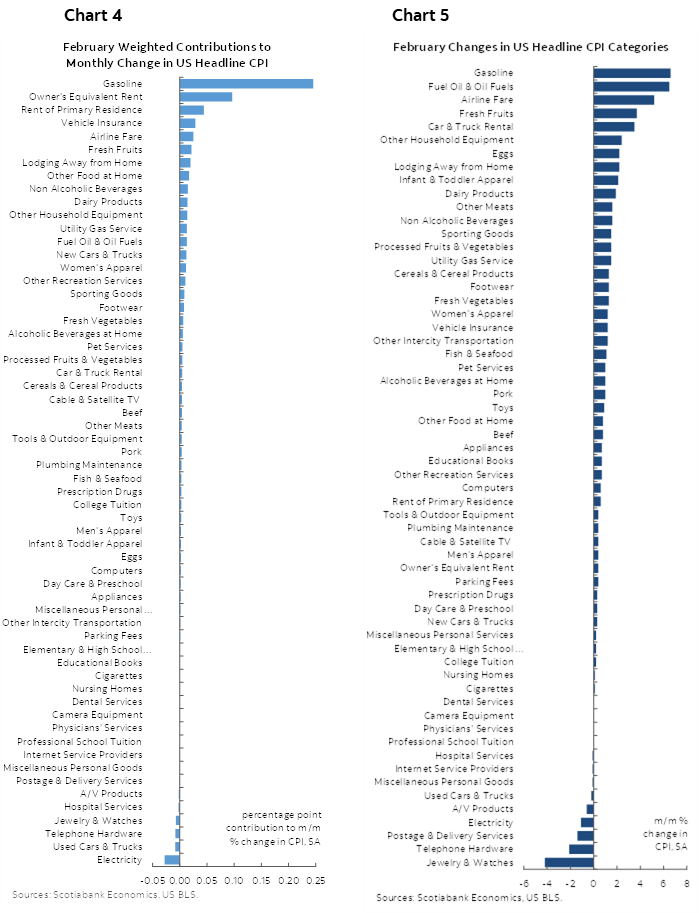

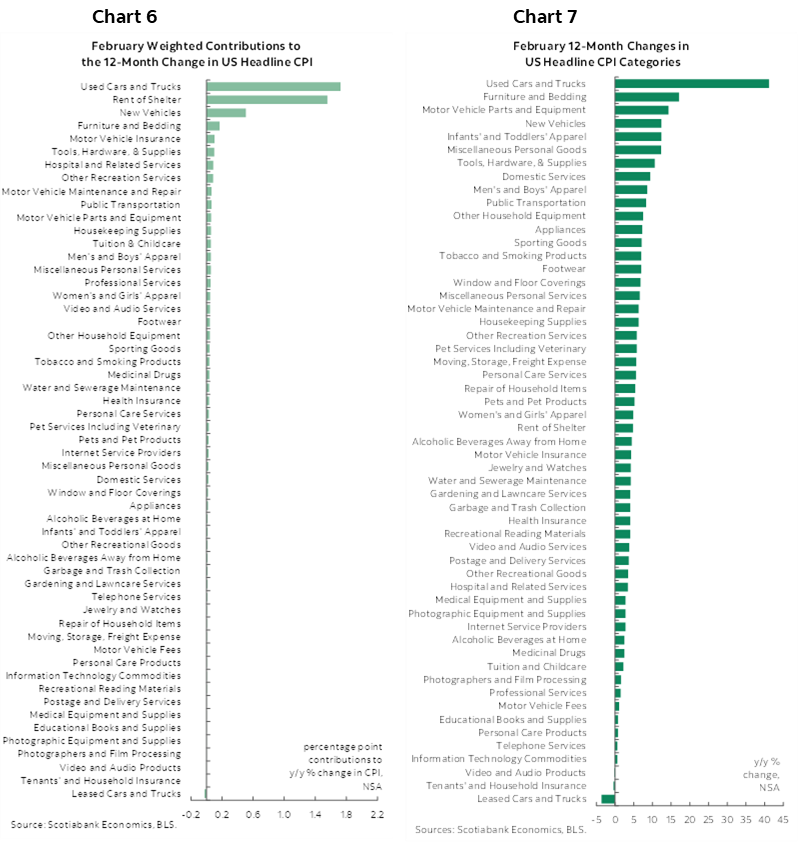

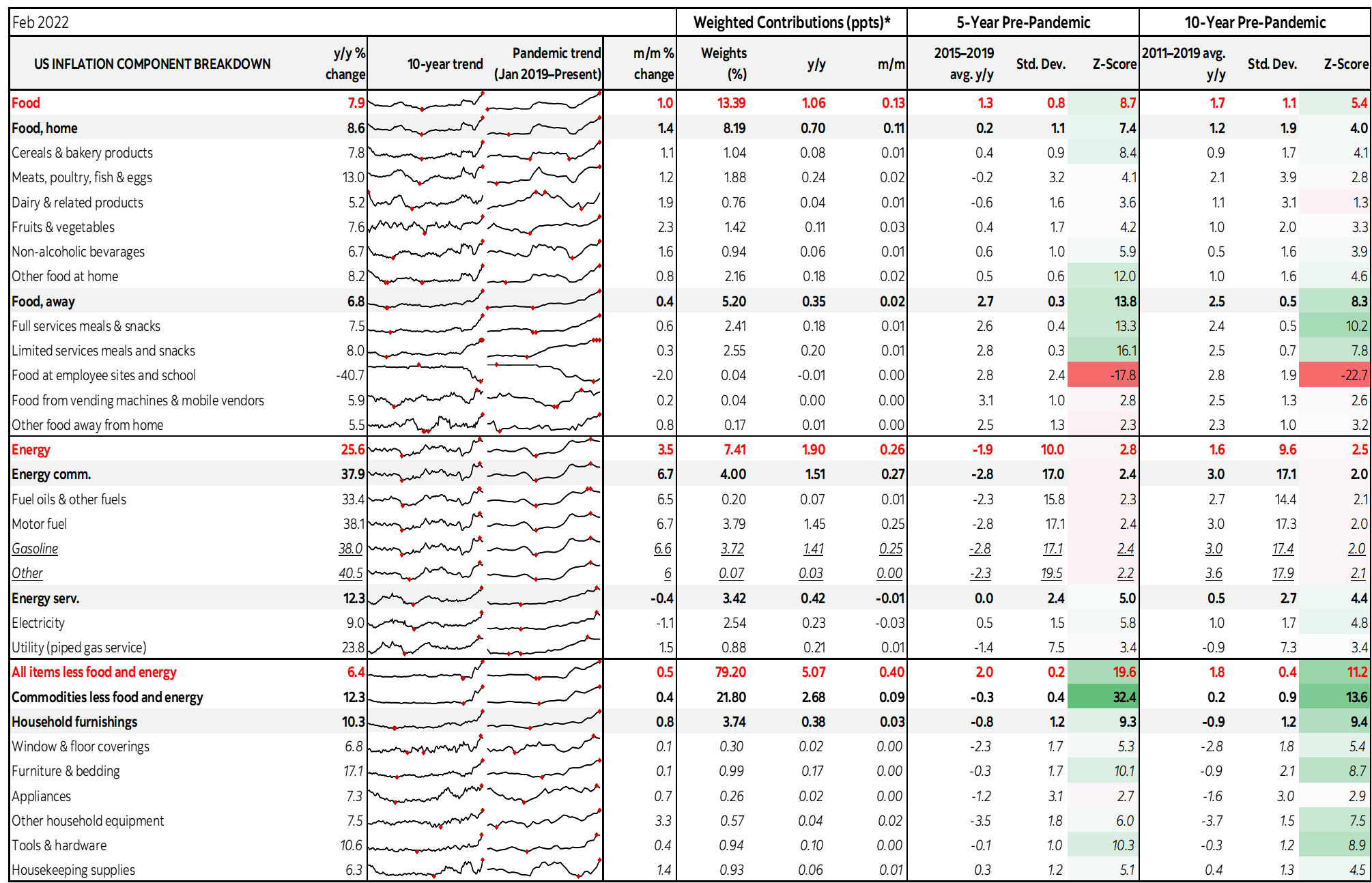

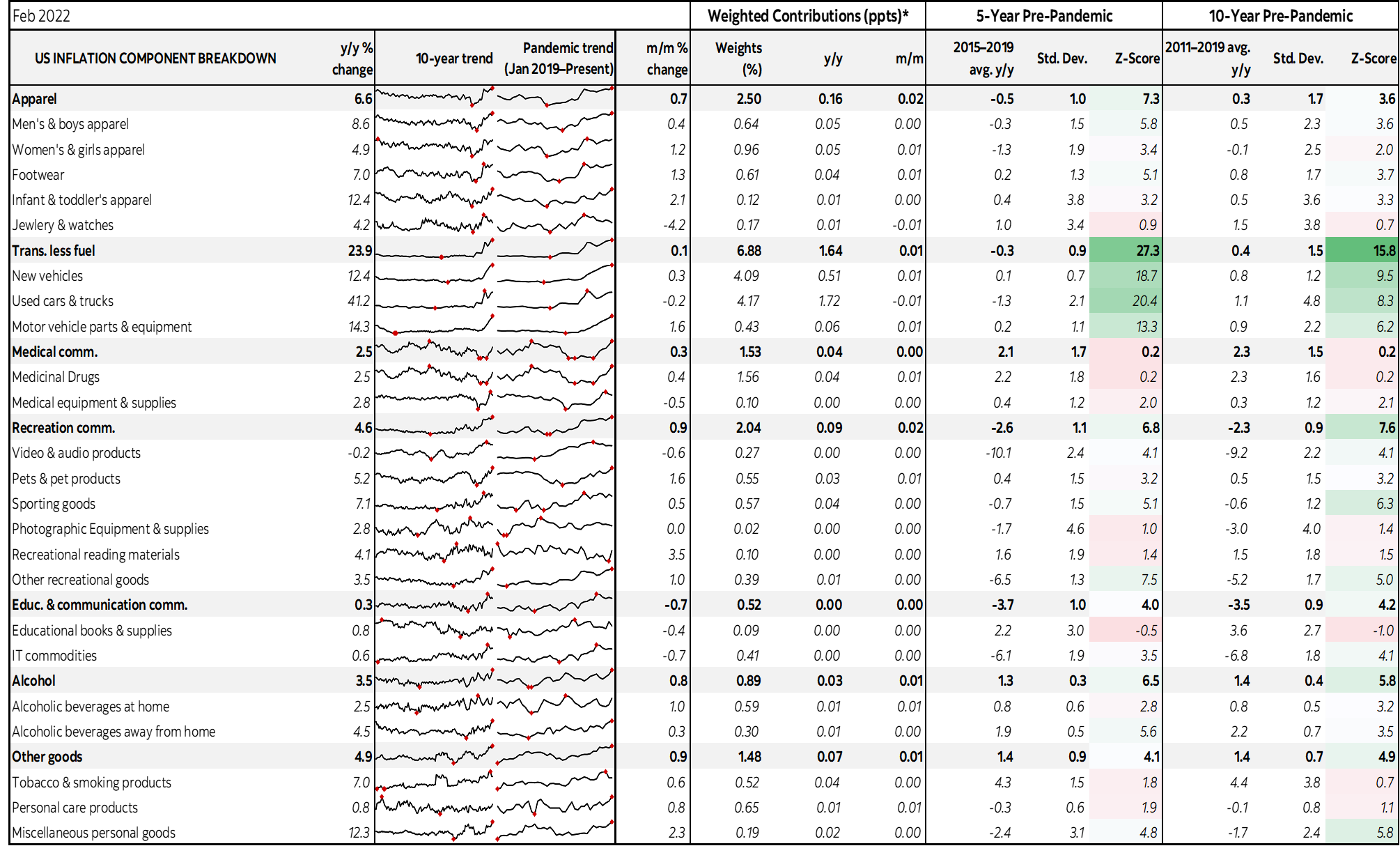

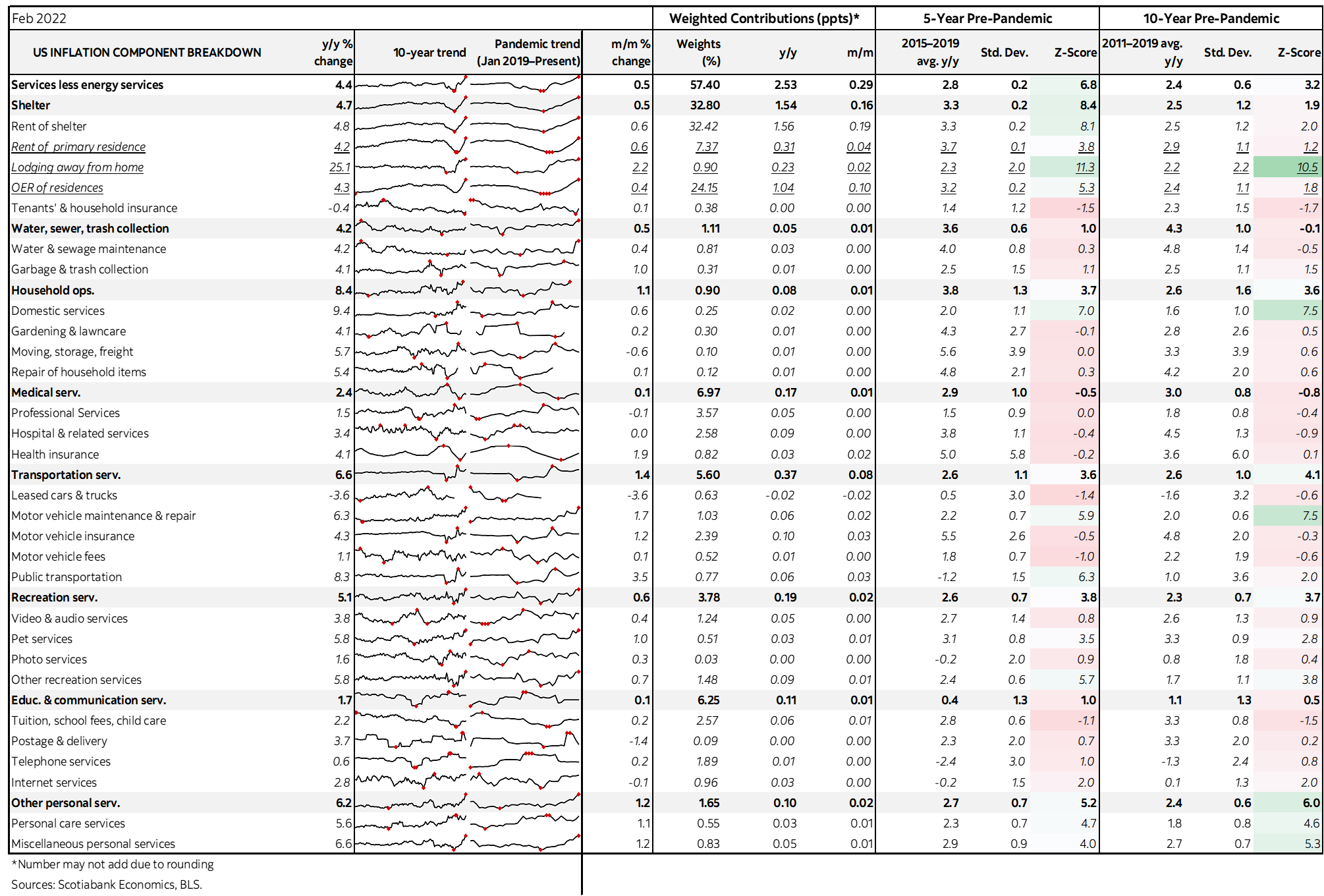

Charts 4 and 5 (next page) show the weighted contributions to the change in US CPI and unweighted changes by price category in month-over-month terms. Charts 6 and 7 do the same things for the year-over-year changes in prices. There remains substantial breadth.

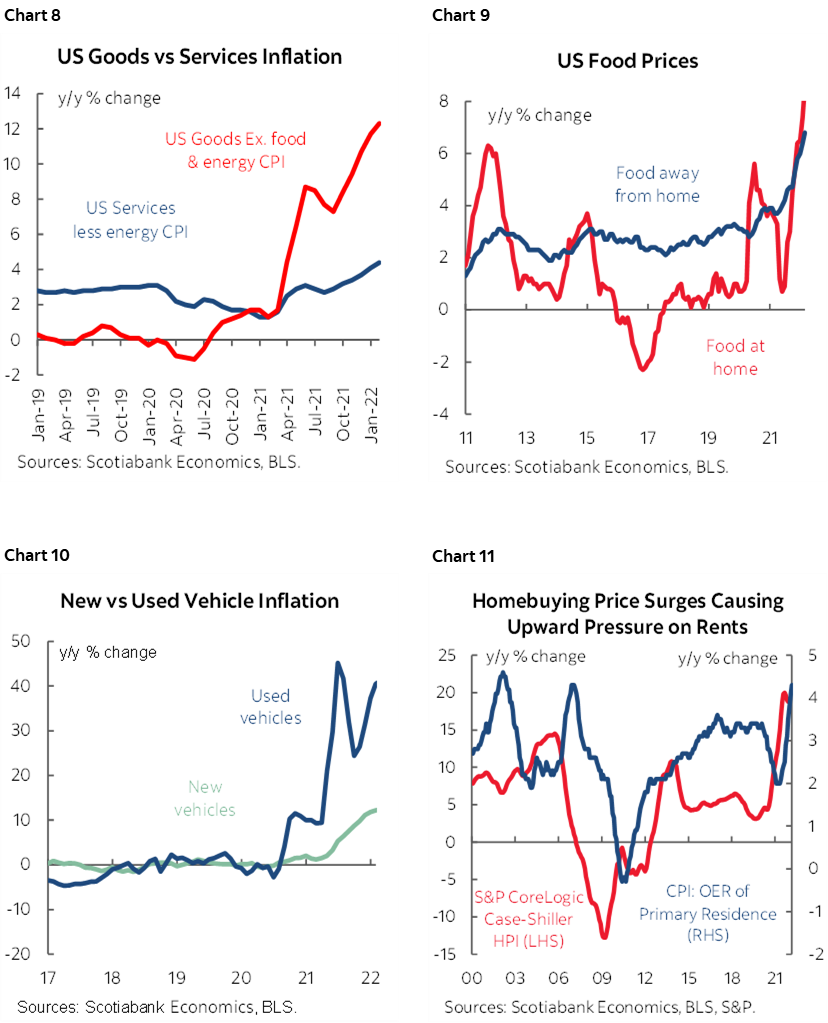

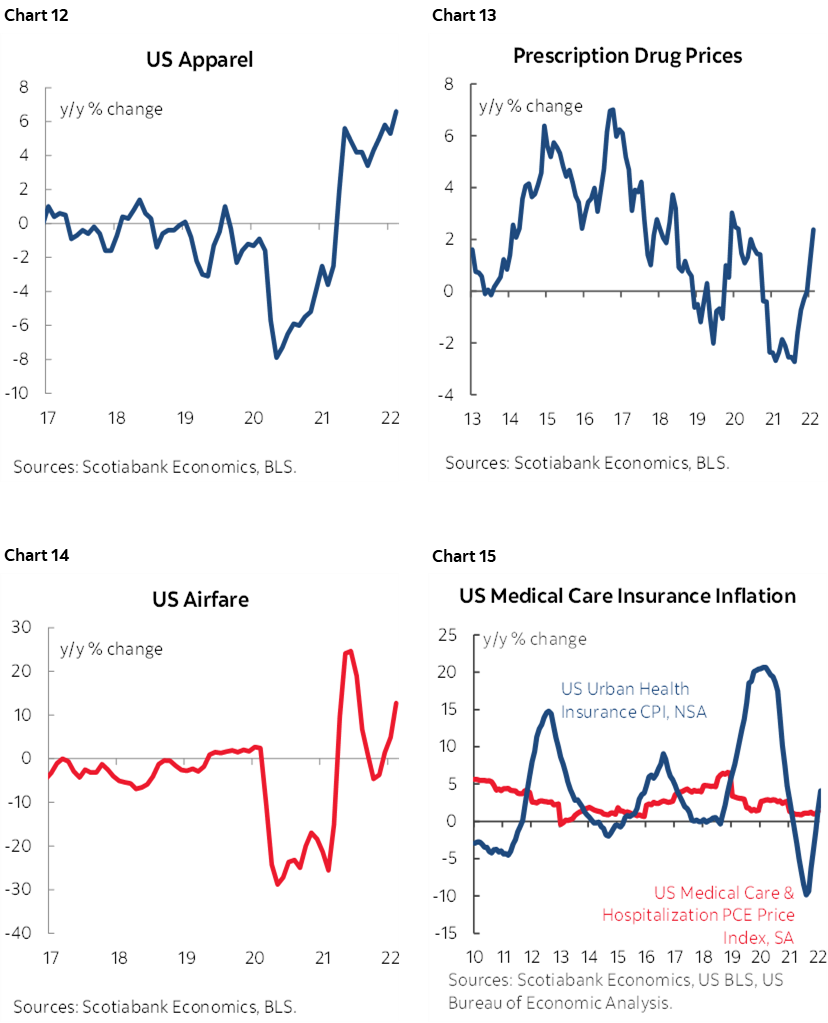

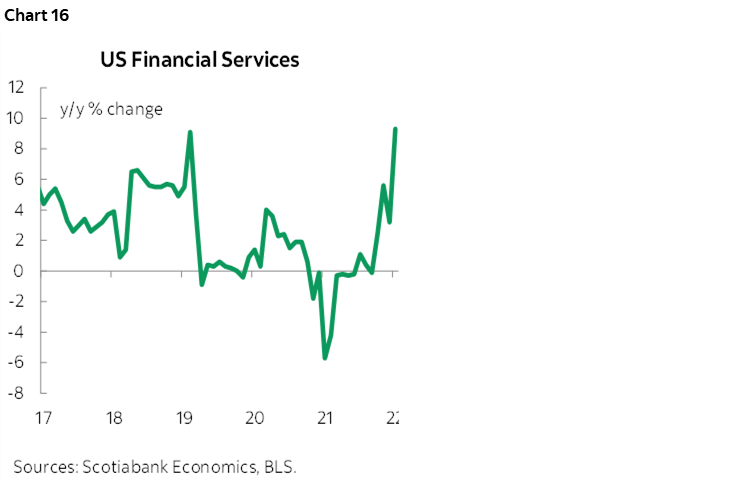

Charts 8–16 break out some of the key components in year-over-year terms. The accompanying table at the back provides much richer information on the drivers of inflation and uses z-scores to indicate how far out of the norm have been recent price changes compared to years past.

Natural gas and gasoline prices lifted overall energy up 3.5% m/m for the largest weighted contributor to the change in CPI.

The pandemic-affected high contact areas saw prices light up. Airfare was up 5.2% m/m. Intracity transportation was up 1.1%. Intercity transportation increased by 1.2%. Car/truck rental prices were up 3.5% m/m. Lodging was up 2.2% m/m. The pick-up in mobility post-omicron fed high contact price pressures.

Food prices are indeed accelerating, up 1% m/m led by groceries ("at home") with take-out ("away from home") up only 0.4%

Apparel prices were up +0.7% m/m led by women's clothing.

New vehicle prices were up 0.3% m/m and used vehicle prices fell 0.2%, which together roughly cancel each other out in terms of weighted contributions. That's the expected net influence.

Shelter costs were up 0.5% m/m with owners equivalent rent up 0.4%.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.