- Fed hikes, sharply raises projected rate hikes in line with Scotia Economics' forecasts

- Securities holdings could start to shrink as soon as May…

- ...with an estimated equivalent effect of another quarter-point hike

- Growth forecasts are still strong, but revised down…

- ...as inflation forecasts revised sharply higher

- Treasuries sold off while stocks rallied and the USD depreciated

The FOMC delivered a more hawkish set of messages than markets anticipated this afternoon. The (short) statement is here and the Summary of Economic Projections is here.

Markets had a mixed reaction that indicated it was mostly the rates market that was hawkishly surprised. The two year Treasury yield shot up by 11bps at its peak before settling at about 7bps higher into the close. The 10 year Treasury yield initially shot higher by about 5bps but ended roughly unchanged compared to before the communications. The USD initially appreciated, but closed softer on a DXY proxy basis. Stocks initially fell but the S&P500 closed about 1% higher than pre-2pmET. Higher stocks and a weaker dollar were probably because Powell sounded confident on the projected state of the economy and its ability to handle tighter policy. I agree with him.

What follows is a summary of the salient points drawn from the suite of communications.

WE HAVE LIFT OFF

The Fed funds target range was hiked by 25bps to 0.25–0.5% as expected.

AN 8–1 VOTE

There was minority appetite on the committee for a larger hike. St. Louis Fed President Bullard preferred a 50bps hike at this meeting and dissented accordingly.

FOMC ADDS TO RATE HIKE PROJECTIONS

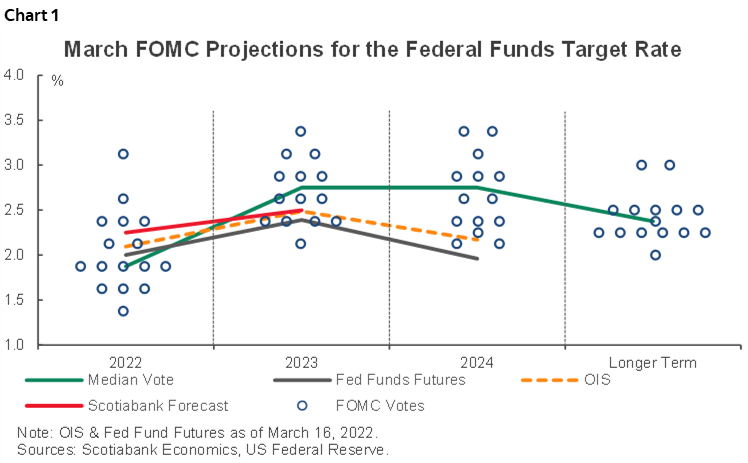

The revised dot plot now guides 175bps of cumulative rate increases this year including today's 25bps hike which would translate into the equivalence of 7 rate hikes this year if they proceed at a steady 25bps/meeting pace. The target rate ends 2023 at 2.8%. The dispersion of the individual committee members’ dots in relation to our forecast and market pricing is shown in chart 1.

The FOMC’s median expectations have one less hike than we do this year as we project the fed funds target rate to rise to 2.25%, and at least one more hike than we project next year. The FOMC projects the policy rate to hold steady into 2024 with no further rate increases. Recall that Scotia led consensus by pivoting last Fall toward a large number of projected hikes this year.

A MILD TERMINAL OVERSHOOT OF NEUTRAL

The implication of the FOMC’s forecasts is that they are engineering a mild terminal rate overshoot of the neutral policy rate. The longer-run fed funds rate is projected to be 2.4% (down a tick from 2.5%, but not meaningfully and more of a math issue) versus the peak rate for the cycle being 2.8% which means a roughly 25–50 point overshoot of the guesstimated longer run equilibrium rate.

PACE—STILL OPEN TO BIGGER HIKES

Powell was asked about prospects for hiking at a faster pace than quarter point moves and largely repeated prior guidance he gave at the January FOMC press conference. He said “Every meeting is a live meeting. If we think it will be appropriate to move at a quicker pace then we will do so and that is certainly a possibility as we move through the year.” I would say that the reference to certainly is meaningfully new information this time.

ROLL-OFF AS SOON AS MAY

The statement referenced how holdings of Treasuries and MBS will likely begin to decline “at a coming meeting.” That’s a bit softer language compared to when the Fed uses “soon” to imply a move at the next meeting, but Powell’s press conference kept the door open for an announcement as soon as the May meeting. It sounds like there will be little if any gap between an announcement and implementation given the statement reference to “begin reducing,”

During his press conference, Chair Powell said “We made excellent progress on a plan. We are in a position to finalize and implement that plan as soon as our next meeting in May. The framework will look familiar to people who saw this the last time, but it will be much faster and is coming sooner in the cycle. There will be a more detailed discussion in the minutes in three weeks.”

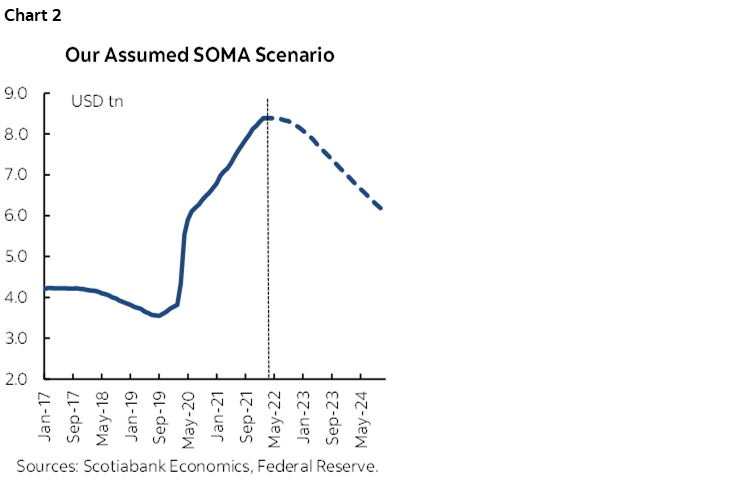

Our projection for the SOMA portfolio’s holdings before today’s meeting is shown in chart 2. It had been assuming that roll-off would commence by July after a June announcement. We will perhaps need to bring that forward. The pace may also turn out faster than we project. Furthermore, we have not incorporated any asset sales at any point at this juncture.

RUN-OFF’S RATE EQUIVALENCE

Powell said during his presser that the pace of balance sheet run-off they have in mind is roughly equivalent to another 25bps rate increase and so in essence the amount of tightening they are guiding for this year is equivalent to 8 hikes, seven of which are to the fed funds target rate and the remaining one hike being due to the estimated effects of shrinking the balance sheet. Powell was asked this same question at the January meeting and did not have an answer and so this is new information.

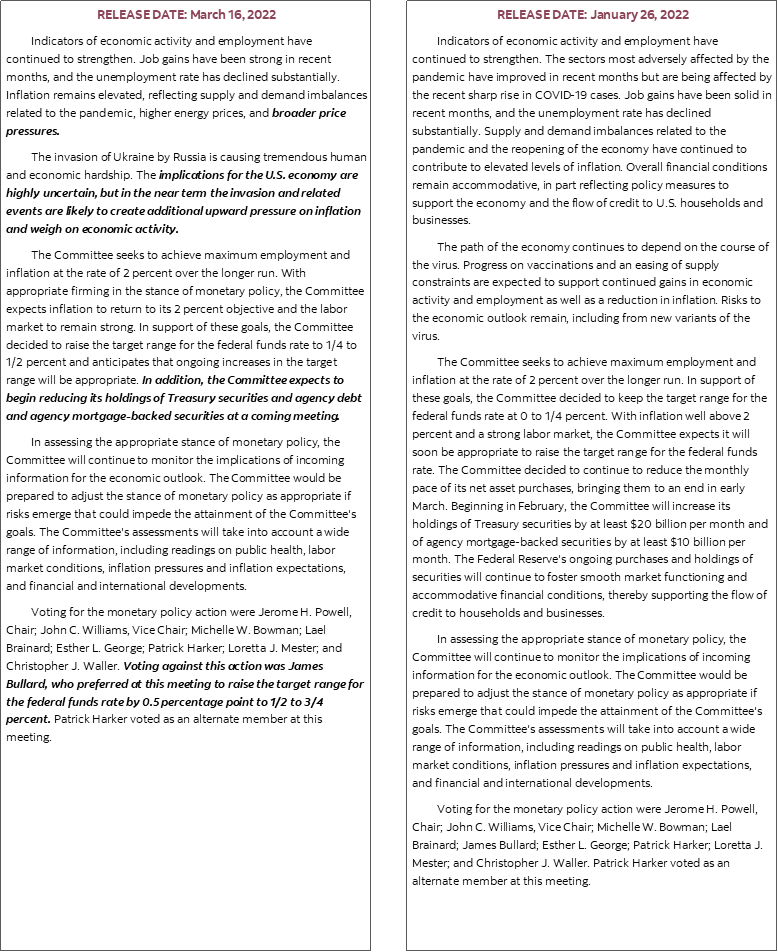

STATEMENT CHANGES

This was a rather short statement that, well, was short on meaningful changes beyond what’s above. Statement language changed to signal greater concern over inflation by adding 'broader price pressures' in the opening paragraph.

The war in Ukraine was statement-codified as carrying "highly uncertain" effects.

INFLATION FORECASTS UPGRADED

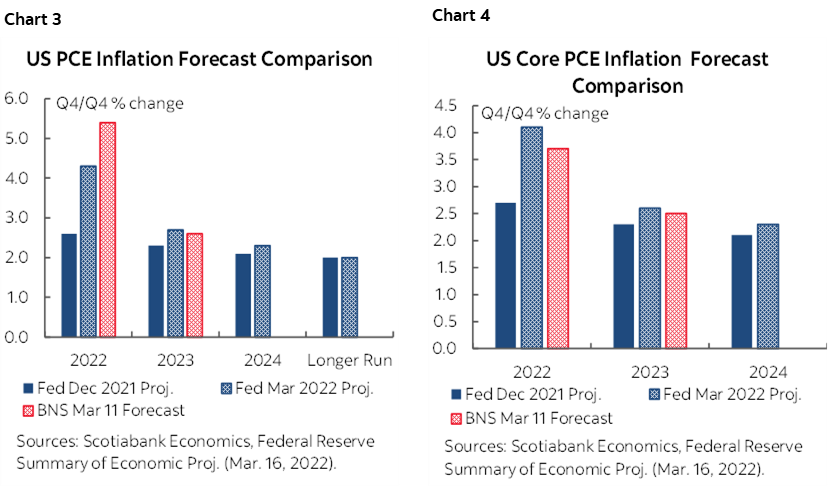

The FOMC is indicating it expects a persistent overshoot of its 2% inflation target. The FOMC raised projected inflation in each of 2022, 2023 and 2024 on both a PCE and core PCE basis (charts 3, 4). It now anticipates headline inflation of 4.3% in 2022 (2.6% prior), 2.7% in 2023 (2.3% prior), 2.3% in 2024 (2.1% prior) and the longer run goal is unchanged at 2%. Core PCE is projected to rise by 4.1% this year from 2.7% in December, 2.6% next year from 2.3% previously, and 2.3% in 2024 from 2.1 previously.

During his press conference, Powell said “Before the war I would have said inflation peaks in the first or second quarter of 2022. Now we're already seeing short-term upward pressure in inflation due to oil prices and other commodities. The relief we were expecting on supply chains is being pushed out by the war.”

Powell remarked that the FOMC is looking for month-by-month inflation to be coming down. It’s not fully clear that he meant month-over-month annualized readings versus month-by-month year-over-year readings. I’d prefer a more direct reference to the former interpretation that is freer of base effects and hence a better indicator of inflation’s durability.

GROWTH FORECAST DOWNGRADED

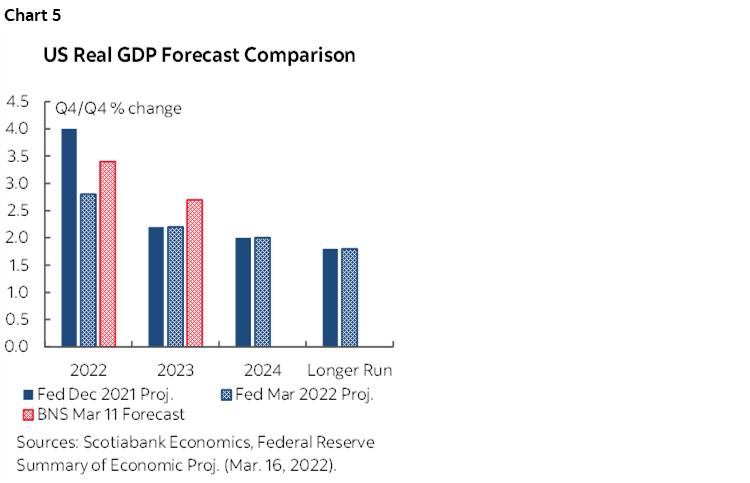

The median FOMC projection for GDP growth this year was downgraded from 4% to 2.8% while next year’s growth was left unchanged at 2.2%, 2024 remained at 2% and the longer-run potential growth rate was also left at 1.8% (chart 5).

The 2022 projection is well below our forecast at 3.9%. When Powell was asked about the downgrade in his presser he said “It's an early assessment of the effects of the spillover from the war. Higher oil and other commodity prices will weigh on GDP to some extent. Monetary policy works with a lag so some tightening will be behind that. Still, 2.8% is still very strong growth that is well above potential GDP growth.”

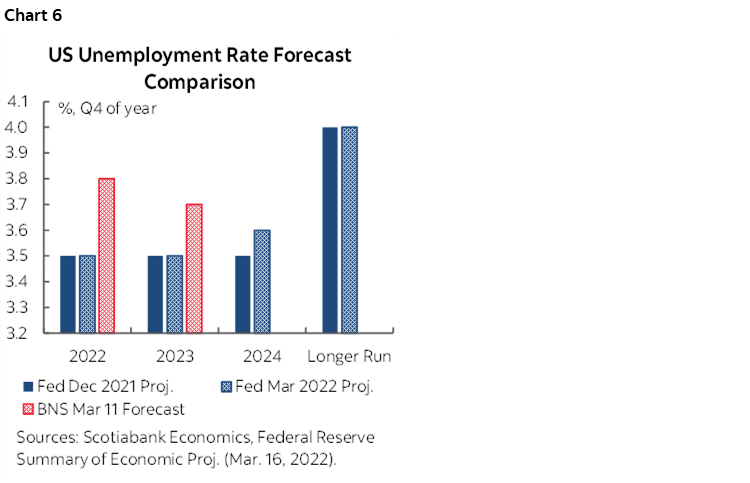

UNCHANGED UNEMPLOYMENT PROJECTIONS

The committee’s forecasts for the unemployment rate were almost entirely left unchanged. 2022 is still 3.5%, 2023 is still 3.5%, 2024 ticked up to 3.6% and the longer-run natural rate of unemployment is still thought to be around 4%. See chart 6.

RECESSION?

When asked about recession risk if the FOMC goes through with this plan, Powell said flatly that “The probability of a recession in the next year is not particularly elevated. Aggregate demand is very strong, payroll growth is strong, household and business balance sheets are strong. All signs point to an economy that can flourish in the face of tighter monetary policy. The economy is very strong.” I think he’s right on that assessment as argued in the Global Week Ahead.

THE REAL POLICY RATE

The FOMC projects the real policy rate to rise from its deeply negative level now toward zero in 2023 and positive and hence marginally restrictive by 2024. Powell pointed to this fact when asked during his press conference about the degree of concern toward the nearer term likelihood that further inflation surprises will offset the effects of policy tightening by keeping real rates at levels that are not providing real restraint to the economy, Of course, much depends on the FOMC’s ability to get its inflation forecasts right….

PRICE STABILITY GOAL DOMINATES

Powell was asked a question that reinforced our earlier understanding that the FOMC has pivoted toward greater concern around inflation than risks to full employment at this stage of the cycle. He was asked whether a higher unemployment rate in response to policy tightening or other forces could temper the committee’s appetite for higher rates. Powell bluntly answered by saying “Price stability is an essential goal. It's a pre-condition to achieving a strong and sustained labour market.”

ARE WE IN A WAGE-PRICE SPIRAL?

Powell said that wage increases are running well above the Fed’s 2% inflation goal over time but that “We don't know how persistent this effect will be or how entrenched it will become. We don't see that [ed. a wage price spiral], some sectors may be slowing, but it comes back to misaligned supply and demand in the labour market.” I think a better answer would have been to note that in the longer run it’s productivity growth that needs to support sustainable real wage gains and the US has room to improve on trend productivity growth.

WILL THIS TIGHTEN FINANCIAL CONDITIONS?

When asked whether the Fed’s monetary policy tightening will drive tightened financial conditions including possibly softer equities he bluntly said that’s the point. Tighter monetary policy is designed by nature to tighten financial conditions. The implication is that there is a fairly high bar set for a Powell put to be triggered.

STALLED NOMINATIONS

I wouldn’t say this was unexpected, but Powell dismissed a question on whether stalled nominations are impairing the Fed’s ability to function. He noted that the regs committee is not active and so the affected issues are coming straight to the full board and being dealt with at that level. He stated “We are continuing to make do with the situation we have.”

HOW THE FED BLEW IT

Powell got a little testy when he was asked if the Fed should have moved earlier. He said that with the benefit of hindsight they did act too late, but implied that with the information they had at the time he feels they did the right thing.

I strongly disagree with him here. Powell was far too stridently dismissive of inflation risk for too long. Rather than sounding like a circumspect central banker open to bidirectional risks, Powell spent almost all of last year until December sounding extremely dismissive toward any risk of inflation while emphasizing the role of base effects and narrow drivers of a transitory burst. For that, the Fed needs to take some accountability for setting the conditions for the inflation we are now seeing.

When he was asked whether the change in the policy framework that was made before the pandemic may have played a role in slowing the Fed’s response, Powell said “No, it was an unexpected burst of inflation that did it.” Here too I don’t buy it. I think the revised policy framework slower the Fed’s response by clouding its judgement and allowed inflation to run hotter than would have been the case in past cycles before drawing a Fed response.

QUESTIONS LEFT UNANSWERED

My wish list of potential discussion points was mostly met, except for silence on the following issues:

- Asset sales: there was no reference whatsoever to this important issue. At the January press conference, Powell was asked whether outright sales are possible and all that he said was that “those are all great questions but the committee is just turning to them now.” Watch the minutes in three weeks time for this one.

- I was expecting Powell to be asked about Fed preparedness for a liquidity shock like a Lehman-style event given the war’s uncertain effects, but he was not. He probably would have said that they are better prepared this time as argued in the Global Week Ahead.

- Powell could have been asked about the very wide dispersion of forecasts into 2023 including expectations for the Fed policy rate to be anywhere between 2.25–3.75%. We’ll have to wait until the minutes for further colour on the range of opinions.

Please also see the accompanying statement comparison.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.