- The BoC’s key core inflation gauges were soft again…

- ...making it four in a row

- More categories are posting improvements

- Markets reacted by driving a mild rally in short-term rates

- The BoC has a stronger case for waiting in July than June

- CDN CPI, m/m %, April, NSA:

- Actual: 0.5 / 2.7

- Scotia: 0.4 / 2.6

- Consensus: 0.5 / 2.7

- Prior: 0.6 / 2.9

- Trimmed mean CPI, m/m %, SAAR: 1.75

- Weighted median CPI, m/m %, SAAR: 1.7

Make that four soft readings in a row! The key question is whether that’s enough to prompt the BoC to cut as soon as two weeks from now on June 5th or whether patience while seeking more data and other arguments to holding off will dominate. There remains a stronger case to cut in Q3/July than June in my opinion and for treading very carefully afterward.

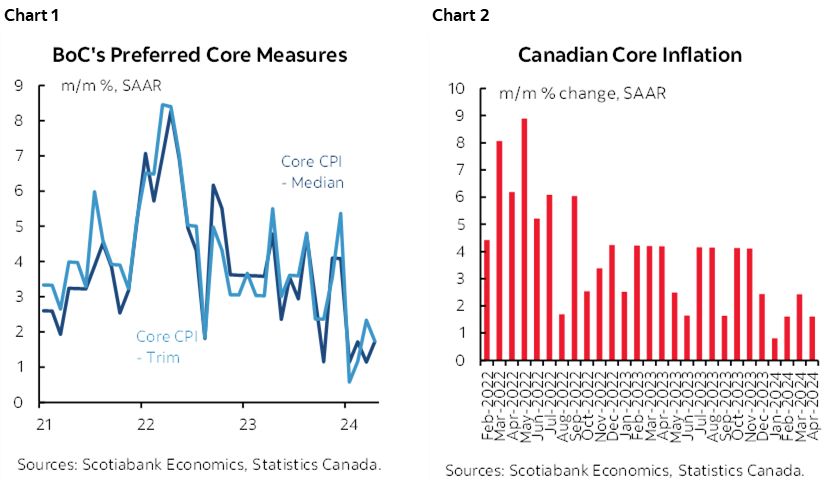

Key is that the BoC’s preferred core inflation readings put in another soft month (chart 1). Weighted median CPI was up 1.72% m/m at a seasonally adjusted and annualized rate (SAAR) while trimmed mean CPI was up by 1.75% m/m SAAR. The three-month moving averages dropped to 1.5% and 1.8% m/m SAAR for weighted median and trimmed mean respectively. Traditional core inflation (ex-food and energy) was also soft (chart 2).

Headline CPI landed at 0.5% m/m NSA which matched the consensus median and mode with 6 forecasters out of 14 expecting this reading, while 3 of us guessed 0.4%, 4 guessed 0.6% and one was at 0.7%.

MARKET REACTION

Markets added a few basis points to pricing for a June cut while retaining July as the base case. June cut pricing sits at just over 60% odds with July fully priced for a quarter point an about another 5–6bps beyond that. The Canada 2-year yield rallied by about 7bps. The Canadian dollar depreciated by about a half cent to the USD at first before pulling down to the 1.364 range on a USDCAD basis and after Fed comments.

DETAILS

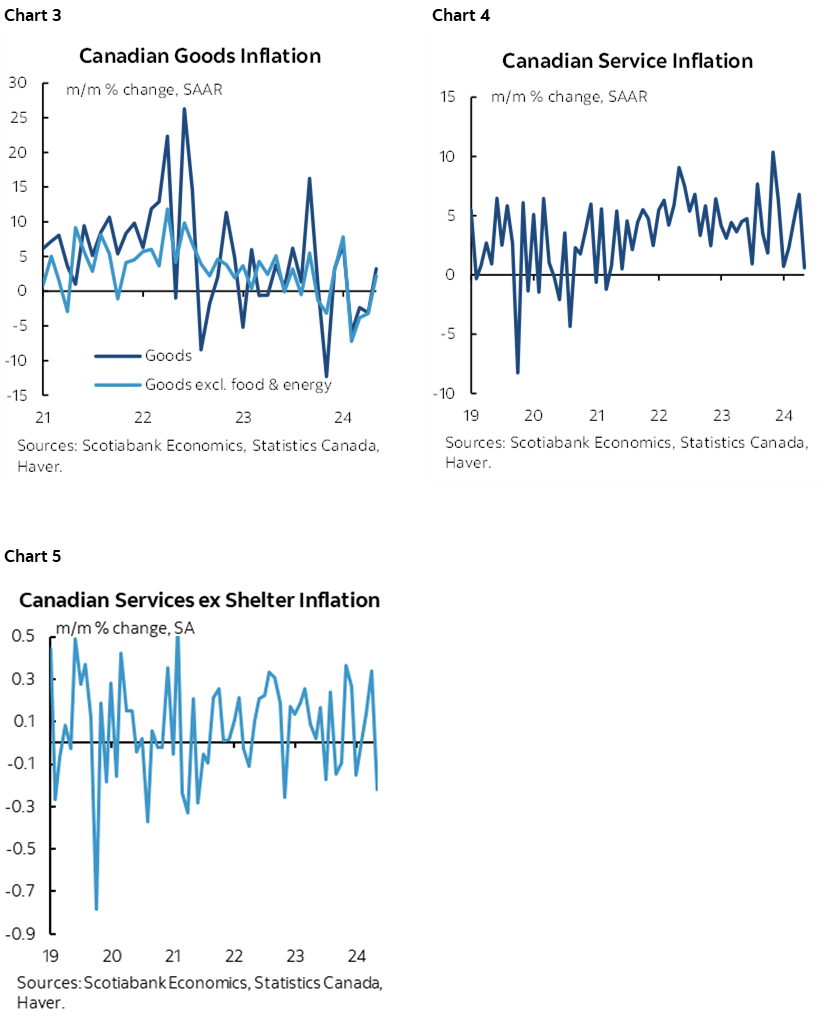

The goods side of the picture picked up which isn't surprising (chart 3), but this time the services side eased off (chart 4). Services ex-shelter inflation was particularly weak but is also very volatile (chart 5). The trend in goods inflation has been pointed higher and services inflation has been very volatile and so a risk is that if the former continues and the volatile latter picks up again then next time they could reinforce one another.

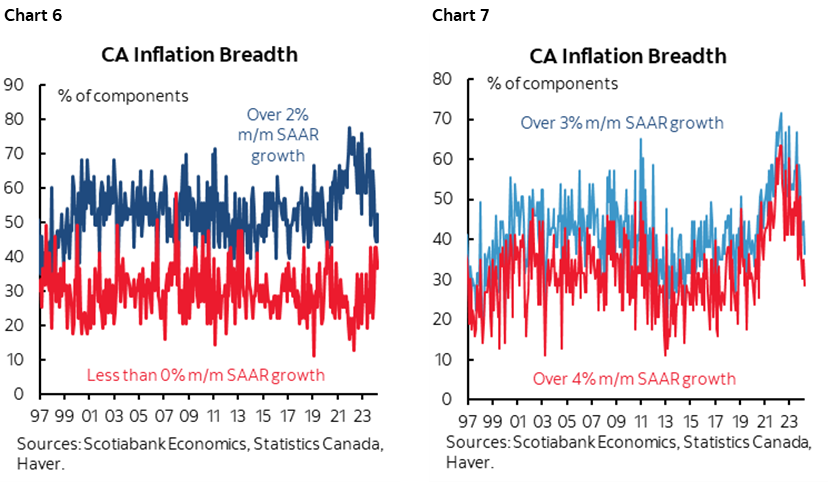

Breadth continues to improve (charts 6–7). The share of the basket that is posting high inflation readings of over 2%, 3% or 4% m/m SAAR is dwindling while the share of the basket that is registered less than 0% is rising.

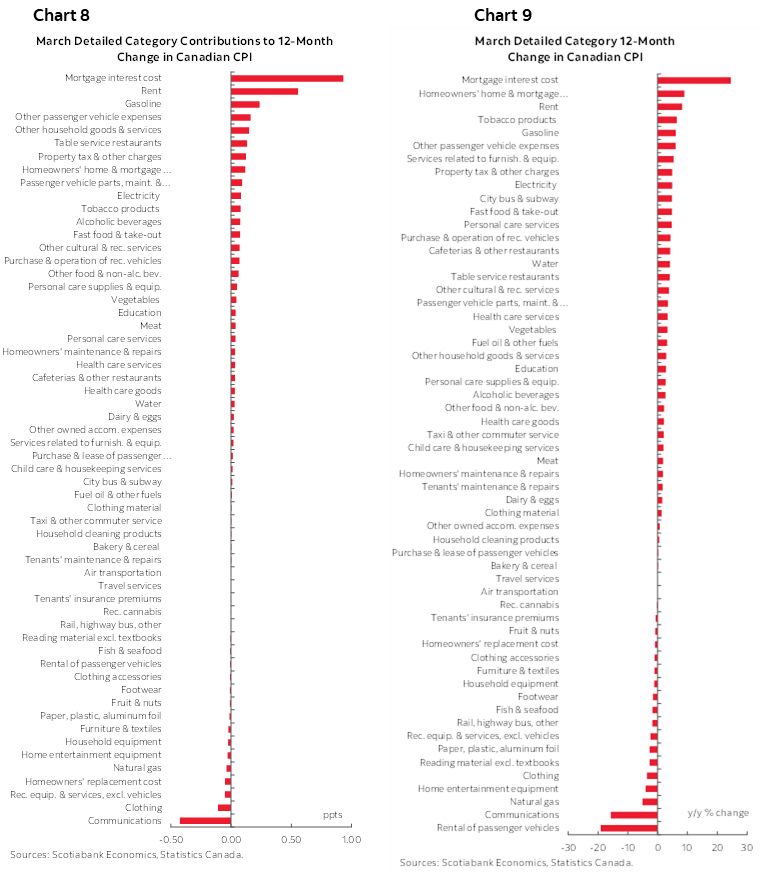

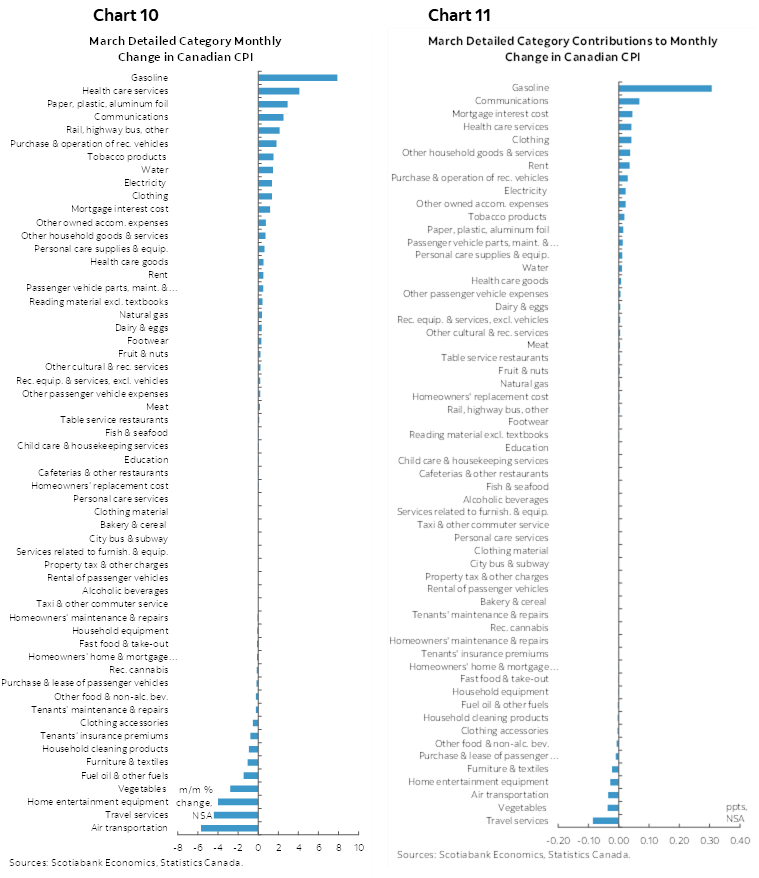

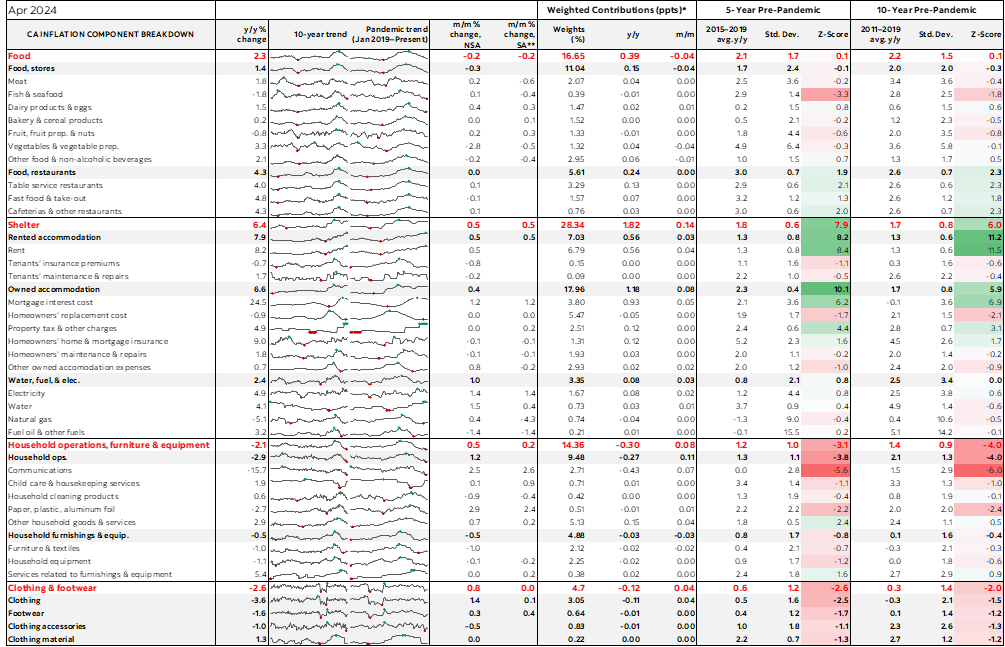

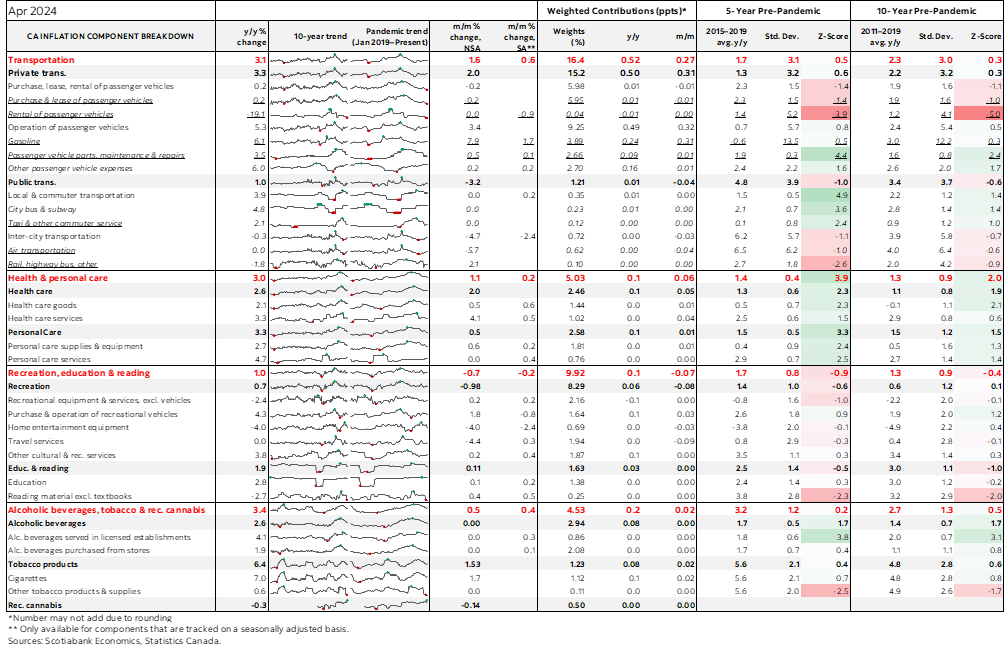

Charts 8–9 on the following page provide a breakdown of the basket in y/y terms and weighted contributions to y/y inflation. Charts 10–11 on the page after that one do likewise for month-over-month pressures.

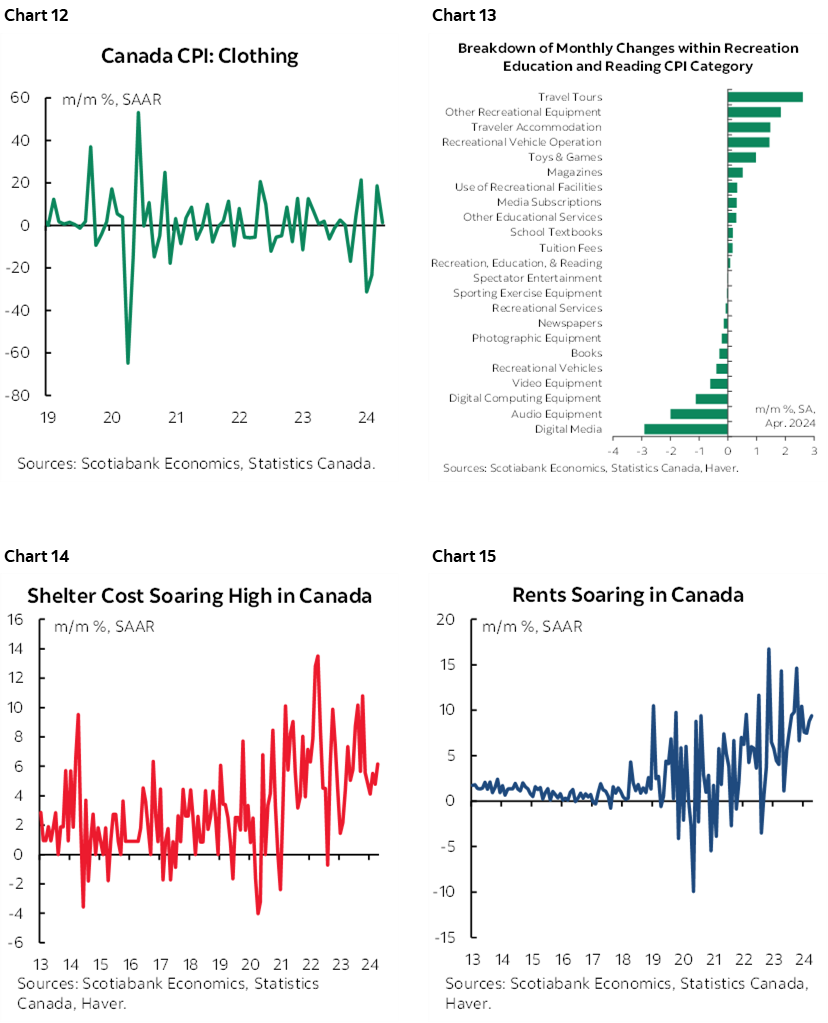

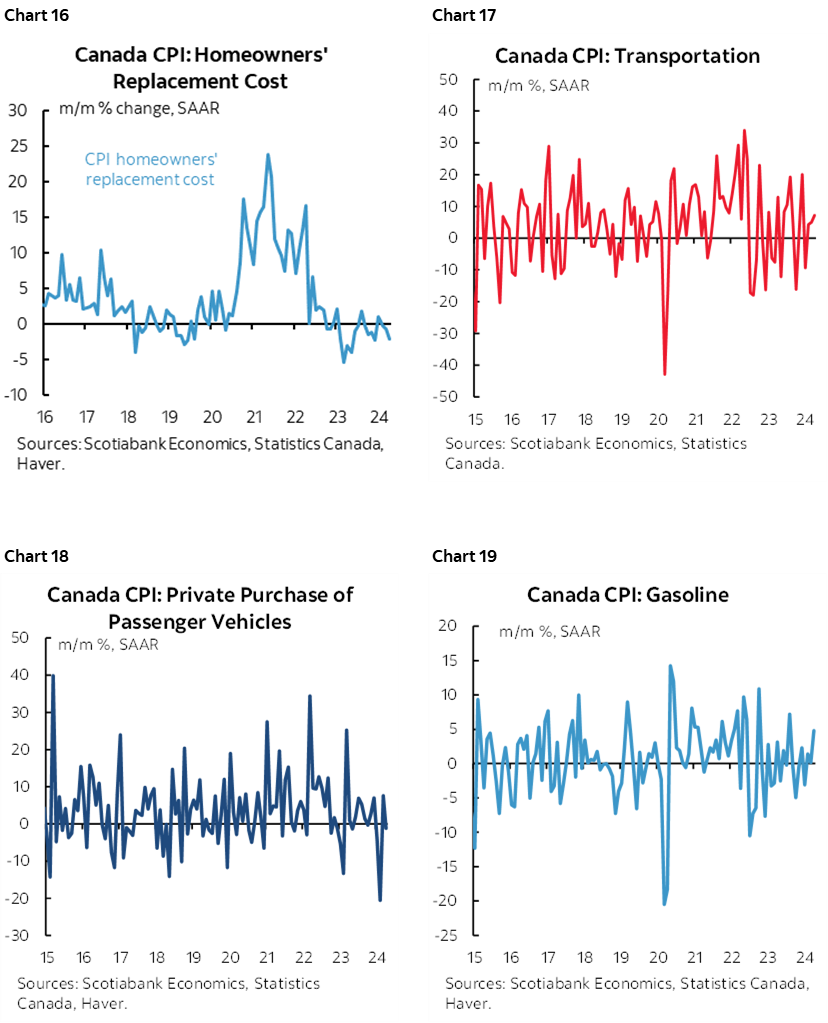

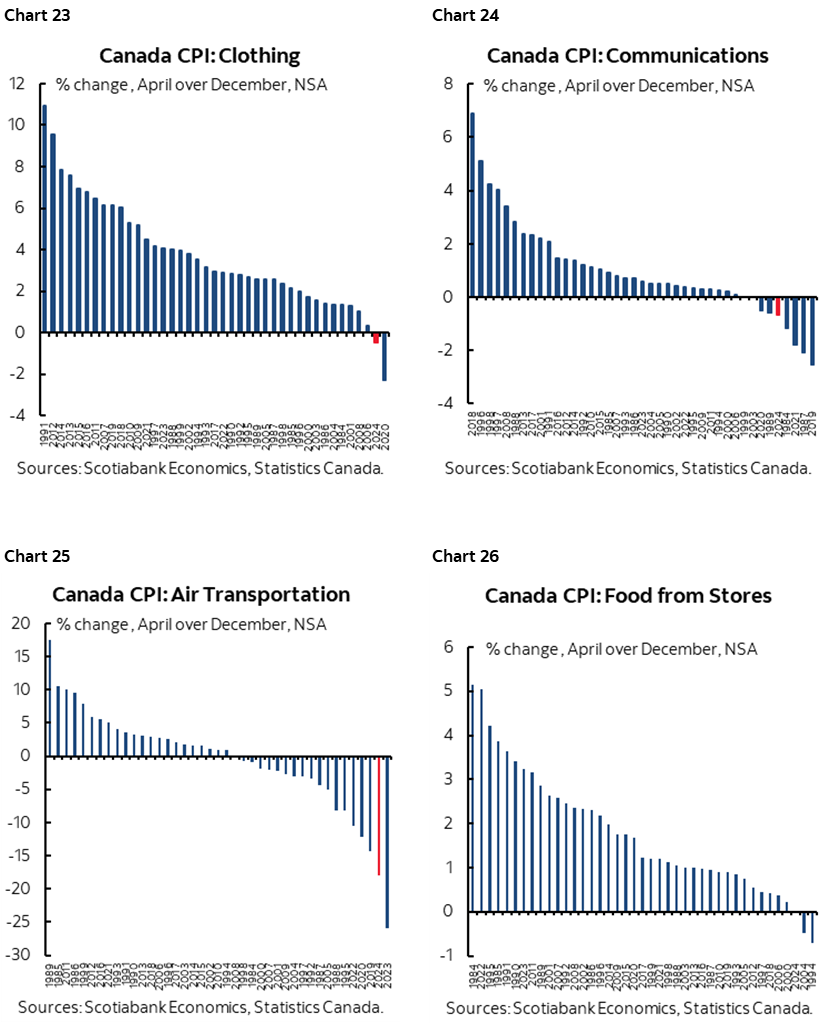

Charts 12–22 highlight several CPI components. Clothing and footwear prices remain soft. So did the recreation, education and reading category that captures most leisure activities.

Shelter cost inflation remains high. That is being driven by rent, while homeowners’ replacement cost that is driven by builder prices remains soft.

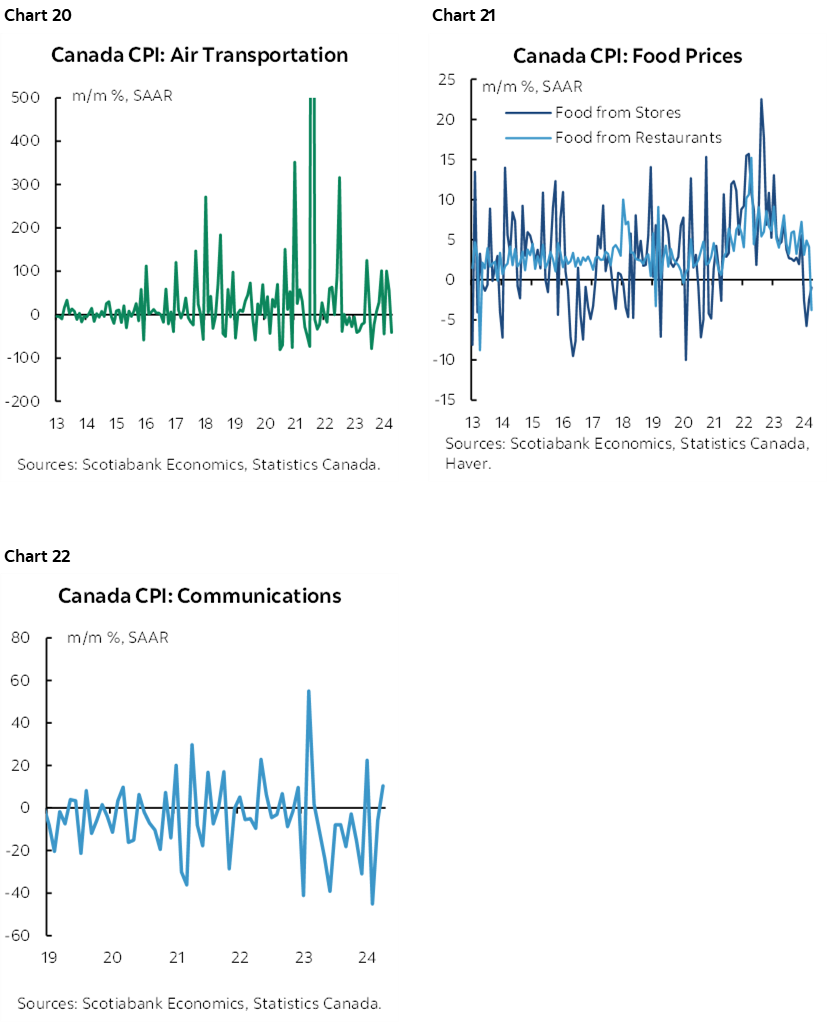

Transportation CPI picked up again and that was driven by higher gasoline prices while vehicle prices and airfare remain soft.

Food prices fell again and in terms of both groceries and at restaurants.

Communications prices that include things like cell phone service and internet service picked up.

JUNE, JULY, SEPTEMBER, OR LATER?

I still think the BoC should wait past June. Our best odds remain on a Q3 cut with July the most probable and 75bps of cuts this year. July pricing is worth paying on the belief that it’s unlikely that the BoC would cut back-to-back in both June and July and yet July OIS has about 30bps priced.

Why wait? For one, Governor Macklem said in carefully developed written testimony just on May 2nd that they would be evaluating developments over coming “months” of additional evidence. Note the plural form of his reference. June 5th was only one month ahead of his comment and one month of additional evidence on inflation and some other metrics like GDP. To cut in June would be a communications misstep that would add to the BoC’s hall of fame of communications missteps.

If Macklem cuts on June 5th after saying he wished to wait “months” then the rates complex would probably pile into more cuts for the year as a whole. With the Fed signalling it’s in no rush and the BoC already 50bps below with a weaker currency than the Fed is facing, the BoC would risk unmooring CAD and offering a little more upside to what I view as ongoing arguments for viewing full cycle inflation risk as being higher in Canada than the US.

Furthermore, the BoC will have much moreevidence by the July 24th decision and not much more by the June 5th meeting other than GDP. The list of what they’ll get by July and not June includes:

- another batch of consumer and business surveys including inflation expectations that Macklem emphasizes as one of the key readings;

- the BoC will have the opportunity to update their forecasts at the July meeting and provide a full suite of communications;

- They'll know what the Fed does on June 12th including its dot plot after the BoC's June meeting but before the July one;

- the BoC will have more evidence on H1 growth including not only the Q1 figures at the end of this month, but more evidence on Q2 amid very tentative indications it's holding up

- They'll have another two rounds of figures for jobs and wages after 90k jobs were created in April;

Overall, however, I'm not budging from my narrative that we need a lot more inflation data to test potentially temporary influences. As argued in meetings last week, there was a chance that April could see firmer TM and WM figures today, but that timing it is impossible and I'd want to see overall Q2 data to have more confidence that what is driving core inflation lower isn’t just a confluence of temporary factors. Charts 23–26 continue to highlight how exceptionally unusual some of the price softness is to start 2024 and drivers could well include weather and regulatory pressure on sectors like telecoms and grocers. If so, then these nonfundamental factors could mean revert higher.

What ‘s the argument for rushing in June, on the other hand? Macklem. Period. He's a dove at heart and communicates in ways that make it dicey to rely too heavily upon what he says. That’s been true every step of the way. Take, for instance, speeches when he was SDG under Carney about pushing the frontiers of maximum employment that he then repeated upon becoming Governor while ignoring all of inflation’s warning signs and hiking too late. Then playing catch-up at a frantic pace. Or pausing prematurely. Or resuming hikes. Then celebrating a few lousy months of soft inflation readings after one of modern history’s worst inflationary episodes. Everyone’s confidence in exactly what the BoC will do should be tempered by this consideration.

WHEN TO START MATTERS MUCH LESS THAN THE PATH THEREAFTER

Nevertheless, the greater vulnerability in rates pricing remains not around the exact starting point to cutting, but around the path thereafter and how restrictive the BoC wishes to be and for how long. I would tread very, very carefully. The BoC’s output gap framework is not performing as they anticipated coming into the start of the year. Aggregate demand and aggregate supply are on the list of things Macklem says he is watching. Q1 growth is reasonably somewhere between 2–3% with high uncertainty in areas like inventories, but considerably stronger than 0.5% in their January MPR forecast before they reset higher in the April MPR. That was after Q4 surprised them a percentage point higher. Very tentative evidence for Q2 is looking like another decent quarter but loosely based on tracking of hours and alt-data with not much hard data yet.

This is key because the BoC had been saying at the start of the year that 2024H1 would be the worst period for the economy and it’s certainly not looking like that given tracking of growth and employment conditions. With the Fed in no rush and the economy outperforming their earlier expectations, the risk of reigniting inflationary pressures by cutting too soon and too fast is very high. As argued in publications and umpteen client meetings, I still think inflation risk is higher in Canada than the US going forward.

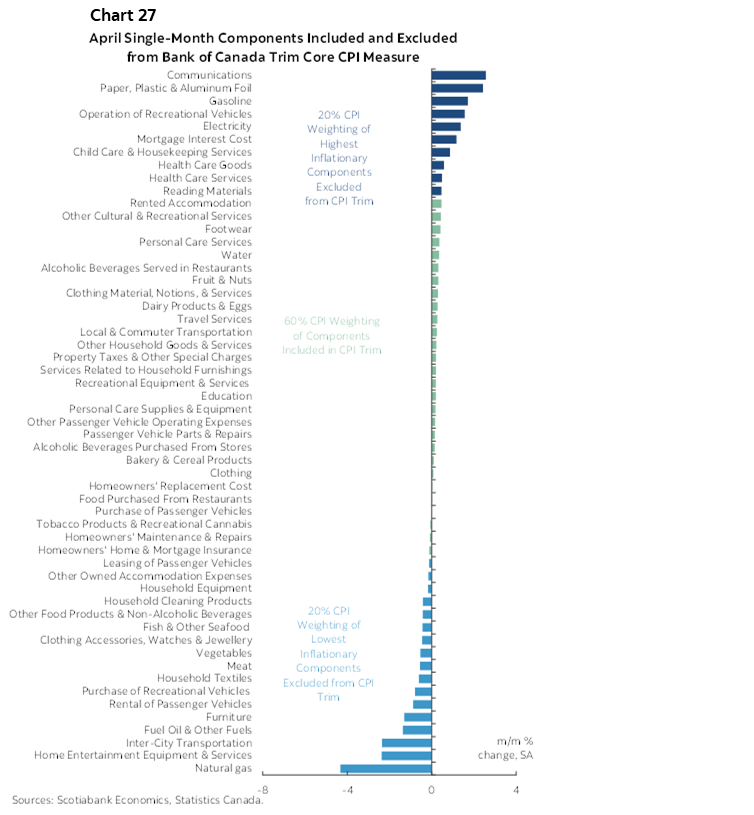

Please also see chart 27 for a breakdown of what was in and out of the trimmed mean basket this time. The appendix includes a more detailed table including subcomponents and micro charts.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.