- The FOMC is more hawkish than previously, but reined in overshooting rate pricing...

- ….by hiking 50bps as expected and guiding 50bps in each of June and July…

- ...while Powell ruled out market pricing toward 75bps moves…

- ...and downplaying changes to neutral rate ranges

- The plan to shrink the balance sheet was triggered as expected

- Powell didn’t sound very convincing on recession risk

It was all going tickety boo when the FOMC statement landed and broadly met expectations. That all changed in the press conference when Chair Powell’s answers to several key questions reined in rates markets that were getting a tad aggressive and this also prompted an equity rally and dollar weakness. When the dust settled, the S&P was up by a whopping 2½% compared to just before the fun began at 2pmET, the two year Treasury yield had rallied by about 16bps, the 2s10s curve bull steepened with the 10-year yield down by 4–5bps and the USD depreciated by just under 1% on a DXY basis.

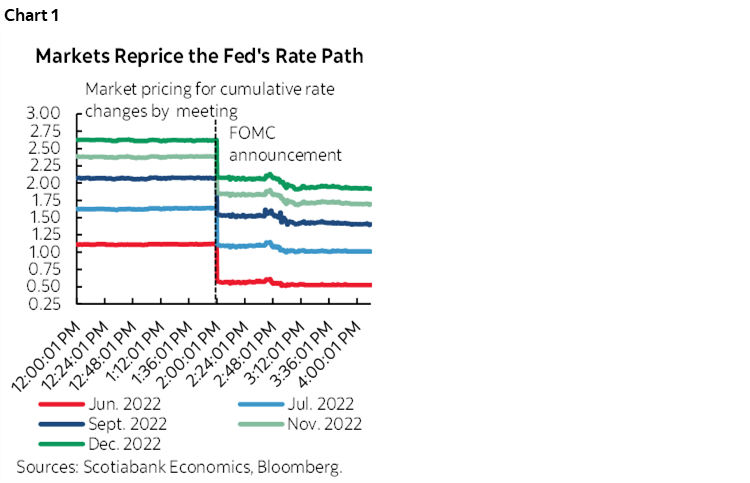

Chart 1 shows the impact of it all in terms of how markets instantly repriced the FOMC’s rate path over the rest of the year’s meetings. The chart shows the cumulative expected change in the policy rate pre– and post-2pmET by meeting through to year-end and how it dropped as communications arrived. Markets had been getting carried away with much bigger moves than 50bps at subsequent meetings and are now pricing a series of 50bps moves instead of bigger ones while shaving over a half point from cumulative rate hikes through year end. Fed fund futures markets now price the Fed ending this year at about 2¾%.

Still, the guidance on recession risk, the neutral rate range, a possible terminal rate overshoot and wage-price effects leave plenty of uncertainty hanging in the air following the suite of communications.

What follows will build up to the impactful drivers as they unfolded. It would be a gross error to portray the Fed as no longer hawkish because of today’s market moves as markets are still pricing ~175bps of hikes by year-end. Chart 2 shows the post-meeting presently priced rate path.

WHAT THE FOMC STATEMENT DID

The FOMC hiked the fed funds target range by 50bps in keeping with our expectations and Chair Powell’s guidance on April 21st when he appeared on an IMF panel. Markets had priced some chance at a larger hike and when they didn’t get that in the statement, we saw an immediate rally in shorter-term yields.

The FOMC announced it would implement its balance sheet roll-off plans starting on June 1st and as outlined in the April 6th release of minutes to the March 15th–16th meeting. Details were explained here and here in separate releases from the FOMC and the New York Federal Reserve.

The starting roll-off pace was uncertain but announced to be half of the maximum rate. Therefore, starting on June 1st, the Fed will allow a maximum of US$47.5 billion of maturing Treasuries (US$30B) and MBS (US$17.5B) to roll-off its balance sheet per month without being replaced. That pace will persist in June, July and August until the maximum previously guided pace of US$95 billion kicks in from September onward. (chart 3) That's a bit different compared to the last time they implemented roll-off caps by staggering the increases in two steps (and over twice as many months). The compressed time period, the discrete jump in September and the much higher roll-off caps upon full implementation indicate a bigger rush toward shrinking the balance sheet this time (chart 4).

Therefore, the only new information offered by the statement was relatively bland. It only told us the starting pace of roll-off and the implementation date while delivering the size of rate hike that Powell had guided in advance.

MILD STATEMENT CHANGES

Statement wording changes were fairly minor and highlighted in the statement comparison attached to this note. They could have sounded more hawkish on inflation in the statement than previously, but generally chose not to do so and retained the same unchanged language.

- The opening sentence looked through the soft Q1 GDP figure of -1.4% by flagging strength in consumer spending and business investment. That’s consistent with our take here.

- Job gains are now described as “robust” instead of “strong.” Stay tuned for Friday’s payrolls…

- The war’s effects on inflation shifted to the present tense through “are creating additional pressures” rather than “likely to create.”

- The war’s effects on growth shifted from “likely to weigh” to something more affirmative in saying “and weigh” on economic activity.

- The reference to the balance sheet roll-off plans was changed as appropriate.

CHAIR POWELL’S PRESS CONFERENCE REALLY LIT UP EQUITIES

Chair Powell’s remarks prompted a lot of volatility and eventually a bigger rally in shorter-term yields and it only took a few minutes into the press conference before equities started to shoot higher. The keys were guidance against out-sized hikes, against changing neutral rate estimates and no strengthening of pre-existing forecasts/dots to target a terminal rate overshoot.

His first remarks actually pushed shorter-term rates higher when Powell started by saying “Inflation is much too high,” and “the labour market is extremely tight, and inflation is much too high,” and repeated “extremely tight” and “very strong.” That sounded like a Fed Chair who was coming out swinging.

Powell went on to provide explicit guidance by saying “additional 50 point rate increases should be on the table at the next couple of meetings” and that there was “widespread” support for this on the FOMC. Bingo, the FOMC will be sitting at 2% by July, or double today’s 1% upper limit.

But rates rallied when Powell was asked if bigger moves than 50bps at a time were a consideration. He ruled out the risk of a 75bps hike. Markets had been leaning in that direction, but when asked if it was a consideration, Powell said “75 bps is not something the committee is actively considering."

Further, when given the opportunity to reassess the FOMC’s estimate of the neutral rate range and whether the committee could move above it, Powell said “We can't identify neutral with any precision. The current estimates are 2–3%. We will be looking at financial conditions and how they affect the economy” while assessing the path for the policy rate. This guidance and further comments around it rejected any appetite for revisiting the neutral policy rate at this point. That’s important because it says the Fed does not think an equilibrium policy rate is higher than 2–3%, or is not ready to communicate such a shift at this point.

Also, when asked about the possibility that the policy rate may have to overshoot this neutral policy rate range and whether the FOMC is prepared to court a recession if needed, Powell said “It's certainly possible we'll need to move above neutral. We can't say that today. We do see restoring price stability as absolutely essential to the economy in coming years." That’s a hint that recession or not the Fed is determined to bring down inflation after having totally blown it to date.

I find Powell's guidance on hitting neutral is the same as the BoC's. They'll further evaluate once they get toward neutral and then assess whether they need to go higher without pausing along the way.

POWELL’S LUKEWARM CONFIDENCE IN AVOIDING A RECESSION

When probed about recession risk, equities covered their ears and went to a happier place. Powell said there's a "good chance" to have a "soft or softish" landing and “We have a good chance to restore price stability without a recession" and concluded that “It won't be easy and it could be subject to events outside of our control.”

When I hear central bankers saying words like this it sounds to me like they’re worried about an elevated risk of recession. That’s likely fairly prudent in this environment, while stopping short of making it a base case.

That said, Powell’s explanations for how a recession might be avoided were somewhat wanting. He referenced a low unemployment rate as one reason for avoiding recession, yet the unemployment rate lags and tends to soar as the proverbial fan is getting hit so that’s not terribly comforting. I agree, however, with his references to strong household and business balance sheets.

Still, markets may have heard what they wanted here, at least to a degree. Powell’s adulation for Paul Volcker shone through when he spoke with praise and said in response to whether they’d keep hiking if supply side pressures keep worsening. He said “I'll say for now we'll do the job we need to do in focusing upon demand. We have to make sure that our inflation expectations are well anchored and this puts central bankers in a very difficult position.”

WAGE-PRICE SPIRAL EFFECTS WILL BE KEY

Key to watch going forward will be what happens to the risk of a wage-price spiral. Markets also sought some comfort in the fact that Powell rejected talk of a wage-price spiral that could reinforce inflationary pressures. When asked is inflationary psychology changing, he said “We don't really see strong evidence of that yet but that does not in any way make us comfortable.” Perhaps he should read the BIS note that went out earlier today (here).

In all, the FOMC managed to deliver a broadly hawkish set of messages that will take the fed funds target rate up to 2% by July whereas the March dot plot had signalled this to be the end point for the year. Clearly the Fed is more hawkish than they were sounding in March, but markets had gotten ahead of the extent to which the Fed was turning more hawkish. For now, they reined that in while assuming the Fed’s right on a goldilocks outcome marked by a soft landing. The script is set for the near-term, but highly uncertain thereafter especially once we may court the prospect of a terminal rate overshoot and the impact of an extended period of SOMA portfolio shrinkage upon reserves.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.