- The Fed hiked 75bps with ongoing hike guidance…

- ...and markets initially reacted dovishly to the statement...

- ..only to reverse that reaction in the press conference…

- ...as Powell said the terminal rate would move higher than previously thought…

- ...and that it is “very” premature to expect a pause

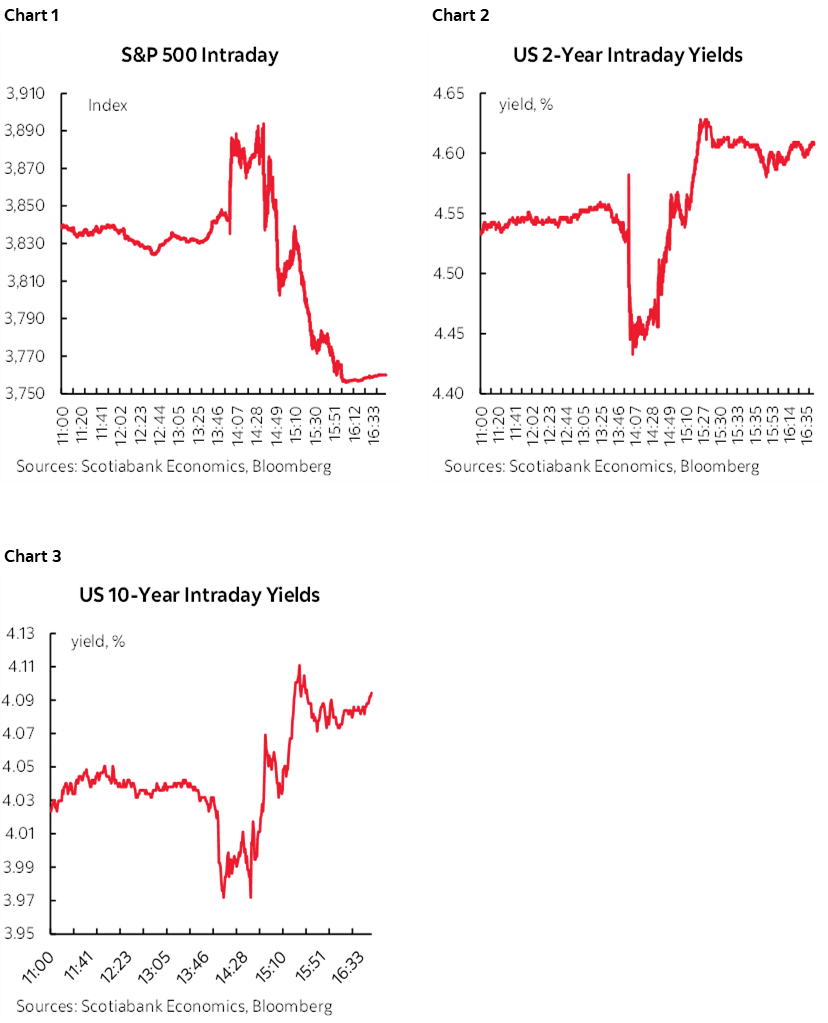

Markets took down two different sets of messages from the FOMC this afternoon. The statement reeled in the doves by largely stating the obvious to which they initially overreacted in my opinion, only to clip their wings in the press conference with two powerful comments. Markets were whipsawed by the overall communications by at first pushing yields and the dollar lower and stocks higher post-statement and then reversing those moves and then some during and after the press conference to end up with an overall hawkish interpretation. Charts 1–3 shows some of the movements in markets.

I’ll review the statement changes first and then what was said during the press conference.

STATEMENT CHANGES

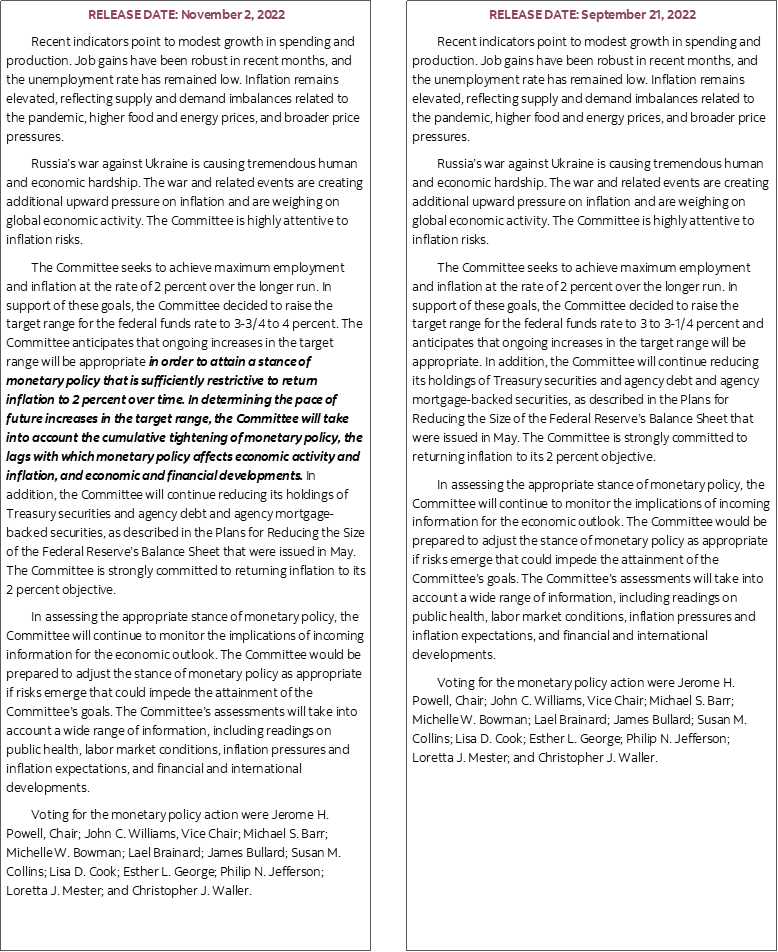

The statement was largely a carbon copy of the September statement as shown in the accompanying statement comparison, except for the insertion of the following part with emphasis added upon the new text:

“The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Yields and the dollar sank and stocks rallied when they saw reference to taking lags into account. That gave me a sense of unease in that there is nothing about this paragraph that should be particularly surprising. As the Fed approaches its terminal rate it was thought to shift toward a protracted pause in order to assess the lagging effects of policy tightening.

Furthermore, against the very small tail of dovish voices, they did not hike by less than 75bps and they did not drop rate hike guidance or aggressively signal a coming end to hikes. Why markets reacted to the statement the way they did at first is something I can’t fully comprehend.

Otherwise, there were no changes to balance sheet guidance or the description of current conditions which was expected and the statement was unanimous.

THE PRESS CONFERENCE

The press conference started off reinforcing this market reaction when Chair Powell said that they will continue to tighten “purposefully” versus “expeditiously” as previously guided. That sounded a little less aggressive.

All that changed as Powell said two key things. One flagged that the terminal rate is likely higher than judged in the September dot plot. The other is that it is very premature to be thinking about or talking about pausing the Fed's rate hikes.

When asked whether the bias is against another 75bps increase in December in favour of slowing the pace, Powell didn’t exactly shut the door on another mega move in December:

“That time is coming and it may come as soon as the next meeting or the one after it.”

When asked about how high they may go before pausing this is where things really began to change in markets:

“On how high to raise the policy rate we are saying sufficiently restrictive in order to achieve our 2% inflation target over time. We think there is some ground to cover before we meet that test. We may ultimately move to higher levels than we thought at the time of the September meeting. That level is uncertain and we will find it over time.”

This was explicitly reinforced with the comment that "the ultimate level of interest rates will be higher than previously expected" and then repeating that the next dot plot will move higher than the September one. Recall that the September dot plot had equal numbers of dots by FOMC participants at 4.5%, 4.75% and 5% policy rate peaks with a median projection of 4¾% and so Powell is guiding that the median is likely to hit 5% or higher which implies there may be several participants above such a level.

Powell upped the ante even further when he said that:

“it is very premature to be thinking about or talking about pausing our rate hikes. We have a ways to go. We need ongoing rate hikes to get to that level of sufficiently restrictive.”

And so “very premature” indicates that they are likely several meetings away from tossing in the towel on rate hikes at a minimum. This probably further slants the risks to our 5% terminal rate forecast higher rather than lower.

He also rejected the notion that they have overtightened by pointing to where inflation is.

OTHER TOPICS

There were a few other more tangential matters that were touched upon.

When asked whether he has changed his assessment of whether the risk of under doing it exceeds the risks of over doing it, Chair Powell said no and because it’s easier to reverse tightening later than it is to deal with the consequences of failing to get inflation under control.

Asked whether he sees evidence that inflation is at risk of becoming entrenched, Powell hedged his arguments by saying that “Longer-term inflation expectations have moved down. We don't have a scientific way of saying at what point inflation has become entrenched. We have to use our tools to get inflation down.”

Powell repeated that the window for a soft landing has narrowed but is still possible while sounding as skeptical as he did during the September press conference.

On whether owners’ equivalent rent will start to put downward pressure upon inflation into 2023, Powell reminded listens that CPI captures OER and general housing measures for everyone, whereas it’s important to remember that private rent measures indicate that marginal pressures may be ebbing. He noted that there is still pipeline pressure moving through rent increases.

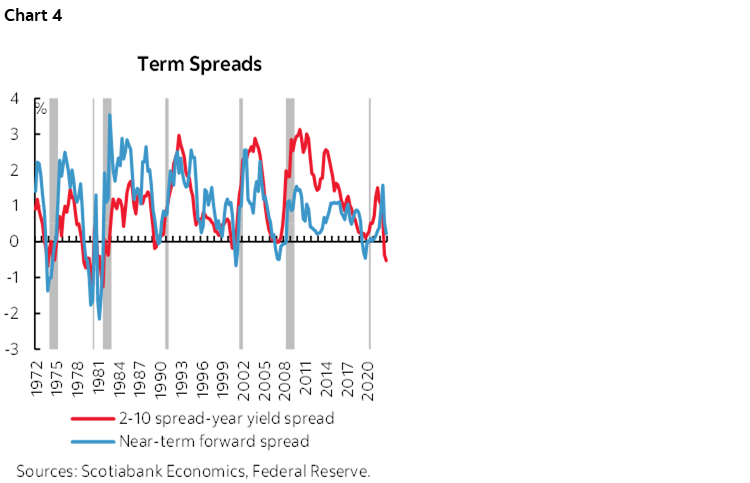

Powell was asked whether inversion of the Fed’s preferred measure of the yield curve that has turned very flat (chart 4) would still be interpreted by him as signalling a likely rate cut. His answer was that they continue to monitor this measure but that it also matters why it is inverting and emphasized its inflation signals which seemed to be an attempt to distance himself from his earlier comments.

Powell was asked to revisit past comments about an overheated labour market and concluded by saying “It’s not obvious there is a gradual softening” and repeating that the job market is in a state of excess demand and is “very, very strong.”

He was also then asked about wage-price spiral concerns and said he doesn’t see that yet but that this can tend to be recognized when it is too late.

BANK OF CANADA IMPLICATIONS

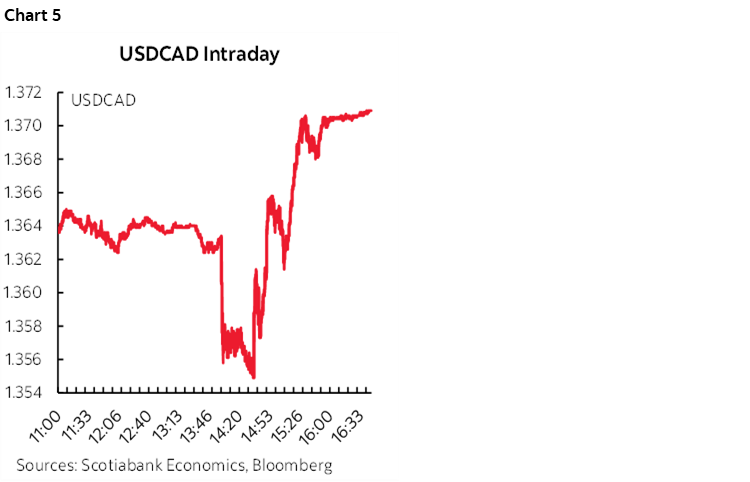

With the Fed saying it is “very premature” to think about pausing and that they will raise the estimates for the terminal rate that were provided only last month, it has the feel of positioning the Bank of Canada as having prematurely opened up a negative rate differential to the Federal Reserve if they are truly focused upon the effects on the Canadian dollar and import price pass through effects. CAD depreciated by about three-quarters of a cent to the USD by the conclusion of the communications (chart 5).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.