- Key—but not all— measures of core inflation are in a two-month soft patch...

- ...that the BoC will flag as progress, but still a long way from end goals

- Trimmed mean and weighted median CPI are ebbing, traditional core accelerated

- Breadth of large price increases remains too high

- Core goods inflation ebbed and drove the softer reading...

- ...which requires monitoring this category into the holiday shopping period...

- ...but services inflation is off the charts and more connected to rapid wage gains

- Shelter costs—especially rent—are exploding

- BoC rate cut bets are highly premature

- Canadian CPI, y/y // m/m %, October, NSA:

- Actual: 3.1 / 0.1

- Scotia: 3.1 / 0.0

- Consensus: 3.1 / 0.1

- Prior: 3.8 / -0.1

- Canadian trimmed mean CPI, y/y // m/m % SAAR, Oct: 3.5 / 2.4 (prior 3.7 / 1.8 revised from 3.7 / 2.4)

- Canadian weighted median CPI, y/y // m/m % SAAR, Oct: 3.6 / 1.74 (prior 3.9 / 1.75 revised from 3.8 / 1.75)

Canada is in a soft patch for inflation but let’s not get carried away. Markets largely shook it all off as CAD strengthened a touch versus the USD and the 2-year yield climbed 2–3bps partly in sync with the US front-end at the same time.

We have two months of evidence across two of the three main core inflation measures and there are still worrisome underlying details to emphasize. For now, it’s encouraging, but we’re a long, long way from the BoC pulling out the pom-poms. To do so would be like the Blue Bombers declaring victory in the Grey Cup twelve seconds before the end of the Grey Cup. There is still of game left here folks.

Headline inflation was on consensus at 0.1% m/m NSA and 3.1% y/y. I had estimated 0% m/m NSA and 3.1% y/y. That said, the m/m SA headline gauge slipped by -0.1% m/m in line with my estimates with the help of somewhat generous rounding up. Who cares.

Key, however, are the core gauges and the evidence in a high frequency sense. On that there are a few observations:

- Trimmed mean: The measure of CPI that lops off the top and bottom 20% of weighted contributions to the overall change in prices was up by 2.4% m/m SAAR which was slightly firmer than the 1.8% pace the prior month (chart 1). On a smoothed 3-month moving average basis, this measure is now tracking 3.2% m/m SAAR (chart 2).

- Weighted median: The measure of CPI that takes the 50th percentile price after ranking weighted contributions to overall CPI was up by 1.74% m/m SAAR for the second month in a row (chart 1). That takes the 3-month moving average measure down to 2.74% from 3.5% (chart 2).

- CPI ex-f&e: The traditional measure of core inflation that simply excludes food and energy prices got a little spicier last month. It was up 4.1% m/m SAAR from 2.5% the prior month (chart 3). The 3-month MA measure slowed to 3.3% from 3.6%.

- We don’t hear much about them any longer, but for kicks, CPIX was up 3.2% m/m SAAR from -0.8% the prior month. The 3-month moving average moved lower to 2.1% from 2.4%. CPI excluding the eight most volatile items that the BoC used to emphasize was up 2.4% m/m SAAR from 0.8% prior and the 3-month MA measure ebbed to 2.1% from 2.7%.

So far we can say that while the various measures somewhat conflict with one another, on balance Canada continues to make progress toward lower inflation. We’re not there yet. It’s two months of a soft patch using the measures that look at higher frequency estimates of underlying price pressures at the margin, but we’re closer. The suite of these measures continues to trend somewhat above the 2% gauge and we need to see further evidence of disinflationary pressures.

I think the BoC will continue to require much more evidence that this soft patch has more legs to it than just a couple of months. They will also focus upon the underlying details and the risks going forward.

DETAILS—GOODS DISINFLATION, SOARING SERVICES

First off, there is still a high breadth to the large price changes. It’s well down from the peak, but as chart 4 demonstrates, the share of the CPI basket that is up by over 3% m/m SAAR or 4% m/m SAAR remains elevated and generally above pre-pandemic levels.

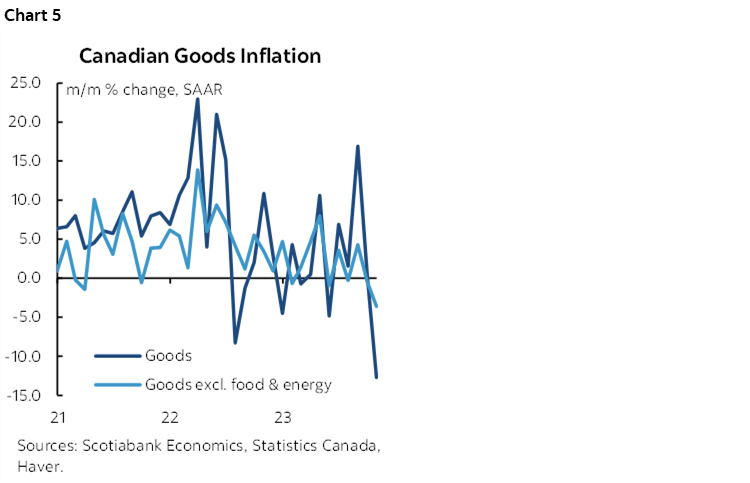

Second, core goods price inflation ebbed again and that explained all of the disinflationary pressure last month. Chart 5 shows what happened to all goods inflation in m/m SAAR terms and that was heavily driven by lower gasoline prices. The same chart shows that core goods CPI inflation ebbed but not as much as total goods price inflation.

Key to goods inflation will be what happens through the holiday shopping season. Will discounting be more/less/same as prior seasons? How will holiday shopping perform after an extended period of flat trending retail sales that are entirely skewed toward goods?

Third, service price inflation accelerated (chart 6). It landed at 10.1% m/m SAAR in October which was the hottest reading since July 2018 when it was 10.9%. That’s likely to be a major concern to the BoC. It’s probably a little more closely tied to wage pressures that are skyrocketing while productivity tumbles.

In short, at this rate of service inflation and its persistence, we’d better hope goods inflation never gets reignited. I’m skeptical and think this is a temporary soft patch on the latter.

What’s behind services inflation? Rent for one thing (chart 7). It’s absolutely exploding. That’s significantly driving overall shelter cost inflation (chart 8). Chart 9 shows that travel and recreation related prices also played a role.

The last thing in the world that the BoC would wish to do would be to add even further and more sustained upward pressure upon shelter-related inflation and its potential spillover effects by easing prematurely. They may not target housing explicitly, but hot housing and service price inflation will keep them very guarded for a long while yet.

Charts 10–15 provide additional detail by component.

Charts 16–17 show the y/y breakdown of the basket and the same thing on a weighted contribution basis.

Charts 18–19 show the m/m breakdown of the basket and the same thing on a weighted contribution basis.

The accompanying table shows a further detailed breakdown of the CPI basket including weighted contributions by component and z-score measures of deviations from trends.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.