- US jobs accelerated in line with our expectations

- Positive revisions made the prior soft patch a little stronger

- Composition was solid

- Wage growth is definitely accelerating beyond productivity gains

- Fed Chair Powell is probably overstating job slack…

- ...given the different demographics around the pandemic shock

US nonfarm payrolls, m/m 000s // UR (%), SA, October:

Actual: 531 / 4.6

Scotia: 675 / 4.6

Consensus: 450 / 4.7

Prior: 312 / 4.8 (revised from 194 / 4.8)

US employment growth sharply accelerated and the prior soft patch wasn’t quite as soft as previously indicated. A net 766k jobs were created including positive revisions, of which 531k were created in October. That’s broadly in line with our expectations in terms of how it all nets out with revisions that had pointed toward an acceleration based upon surveys indicating increased labour force attachment in October and it signals that the job market is doing well.

Stocks got a mild boost from the release while Treasuries were little impacted at the front-end and the long-end rallied by ~3bps.

Revisions added 235k jobs to the two prior months and were evenly split between September that was revised up 118k to a gain of 312k, and August that was revised up by 117k.

Quality was high partly due to substantial breadth (chart 1). The private sector added 604k jobs last month while government shed 73k almost entirely at the state and local levels.

By sector, every major category was up. Services added 496k jobs while goods added 108k. Jobs were up the most in leisure and hospitality (+164k). Next up was trade and transport (+104k) of which retail accounted for 35k. Business services added 100k jobs including 41k in temp help. Manufacturing added 60k and construction 44k.

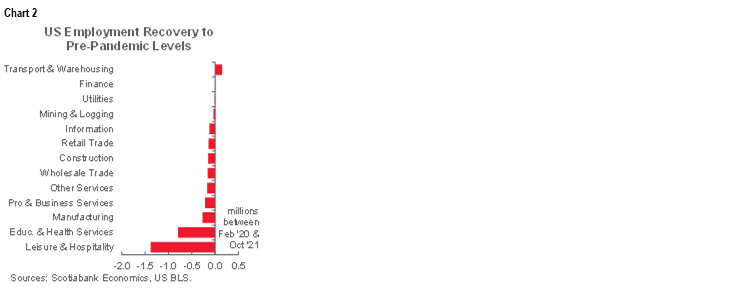

On net to date, the US is 4.2 million jobs shy of the February 2020 level. My opinion remains unchanged in that job markets are tighter than Fed Chair Powell thinks. Chart 2 shows that almost all of the still lost jobs remain concentrated in two sectors: leisure and hospitality plus education and health services.

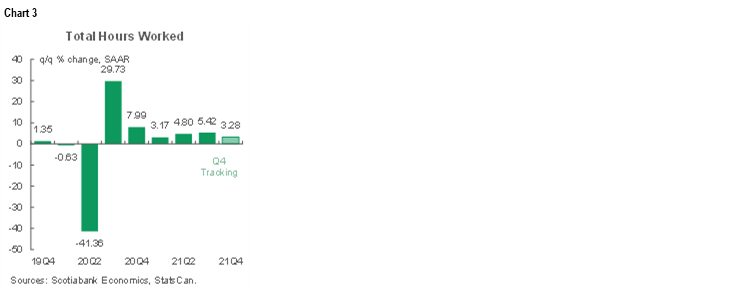

US hours worked were up by 0.2% m/m in October. They are tracking a 3.3% q/q SAAR gain in Q4 based upon the Q3 average and October while assuming flat readings in November and December just to focus upon the effects of what we know so far. Hours were up by 5.4% q/q SAAR in Q3. See chart 3. Since GDP is an identity defined as hours worked times labour productivity this points to strong momentum in the US economy.

Wages are revealing in that regard. Average hourly wages were up another 0.5% m/m in October, or 5.6% at a m/m annualized rate. Chart 4. That continues to drive the wages trend higher into Q4. We want to see if that has legs beyond recent effects. That’s likely why Chair Powell emphasized monitoring this carefully over 2022H1.

The split between full-time (+188k) and part-time (+171k) job creation was roughly even. Since February 2020, full-time jobs are down by 3.1 million and part-time jobs are down by 1.6 million which indicates there isn’t much difference between full- and part-time employment in the recovery to date.

The unemployment rate fell to 4.6% from 4.8% because it is derived from the sister household survey that registered a gain of 359k jobs that more than tripled labour force re-entry (+104k). Chart 5. The U6 measure of unemployment and underemployment fell to 8.3% and is 1.3 ppts above pre-pandemic levels that were close to the historic low set in 2000.

The participation rate held unchanged at 61.6% and remains 2.8 ppts below the pre-pandemic level.

It’s still hugely unclear to me whether the part rate will return to pre-pandemic levels. It had been declining for two decades prior to the pandemic. The pandemic hit boomers when many more of them were entering or close to retirement, unlike the aftermath of the GFC. The nature of work has changed and will continue change, but the demographics around this shock perhaps make it unwise to assume it will be like the aftermath to all prior shocks in terms of recapturing those who have exited. Added to this is whether it is wise to target pre-pandemic gauges of full employment that may have been overshooting.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.