- Canadian inflation exceeded expectations again…

- ...and the myths keep piling up

Canadian CPI, m/m / y/y %, September:

Actual: 0.2 / 4.4

Scotia: 0.3 / 4.4

Consensus: 0.1 / 4.3

Prior: 0.2 / 4.1

Canadian core CPI, y/y % change, September:

Average: 2.7 (prior 2.6)

Weighted median: 2.8 (prior 2.7)

Common component: 1.8 (prior 1.8%)

Trimmed mean: 3.4 (prior 3.3%)

Canadian inflation climbed by more than consensus estimated again. The reaction in CAD and short-rates was fairly muted either because it wasn’t a wild break from where markets were leaning and/or because it’s likely best treated as a placeholder with most of the BoC’s projections and decision making process at an advanced stage ahead of next Wednesday’s communications.

Readings like these nevertheless marginally reinforce expectations for a shift to the reinvestment phase of the QE program on October 27th, while still indicating that rate hikes lie some time further away than markets are pricing around March/April and closer toward when the BoC thinks spare capacity shuts. To that effect, we foresee the Bank of Canada transitioning toward four rate hikes over 2022H2 starting in July and then four more in 2023.

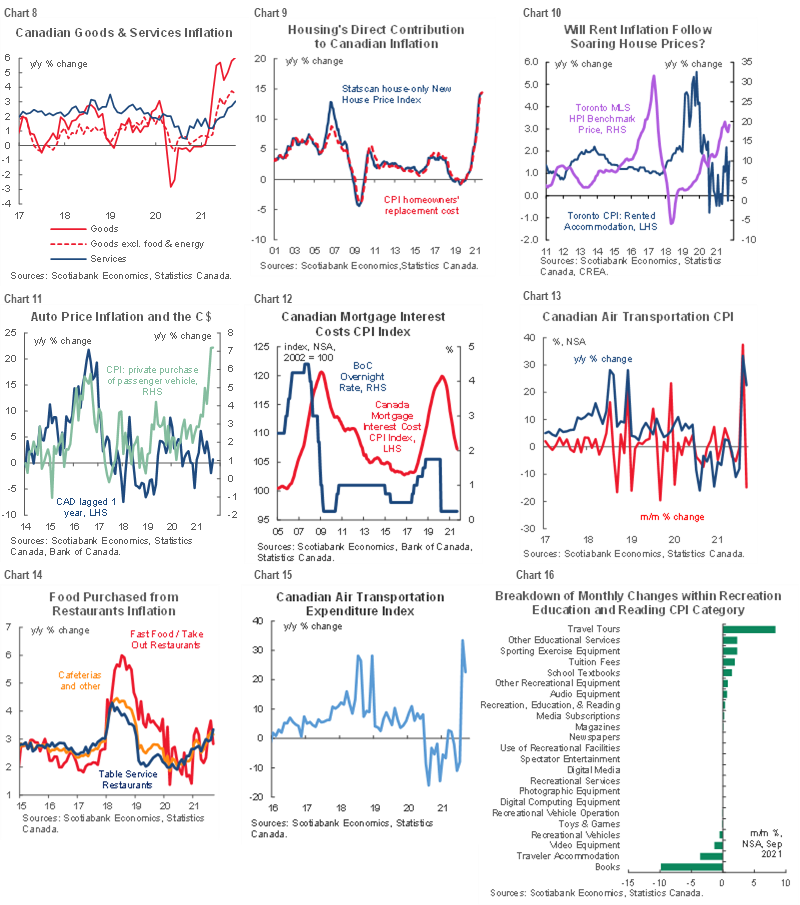

It’s still the case that inflation is high for reasons other than year-ago base effects. The seasonally adjusted and annualized pace of inflation was 5.2% in September. Chart 1 shows the trend. We’ve been getting very elevated readings for six months now and starting back in April when lockdowns were in place into late Spring/early Summer. That is one bit of information that indicates that the price pressures we are seeing are not just a reopening spurt.

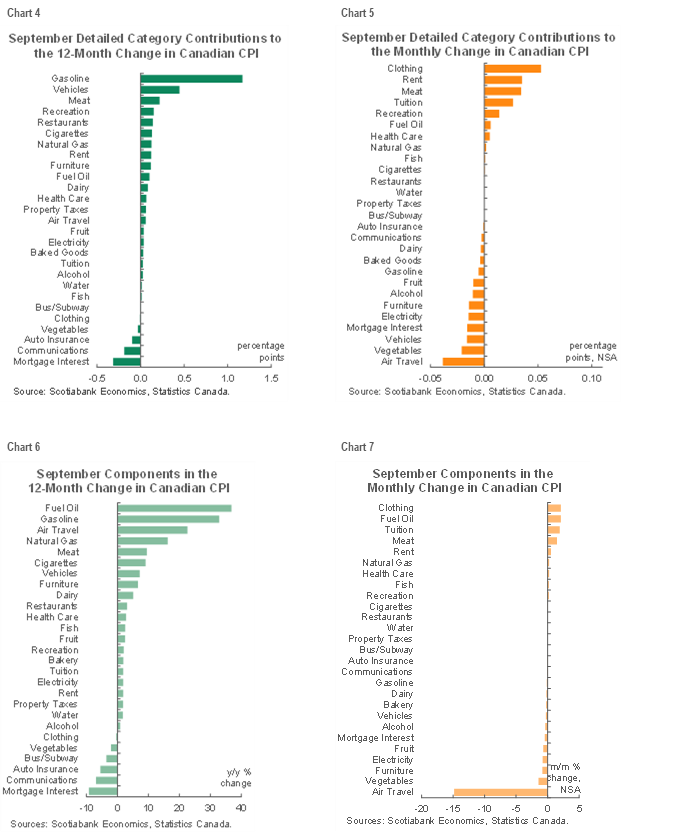

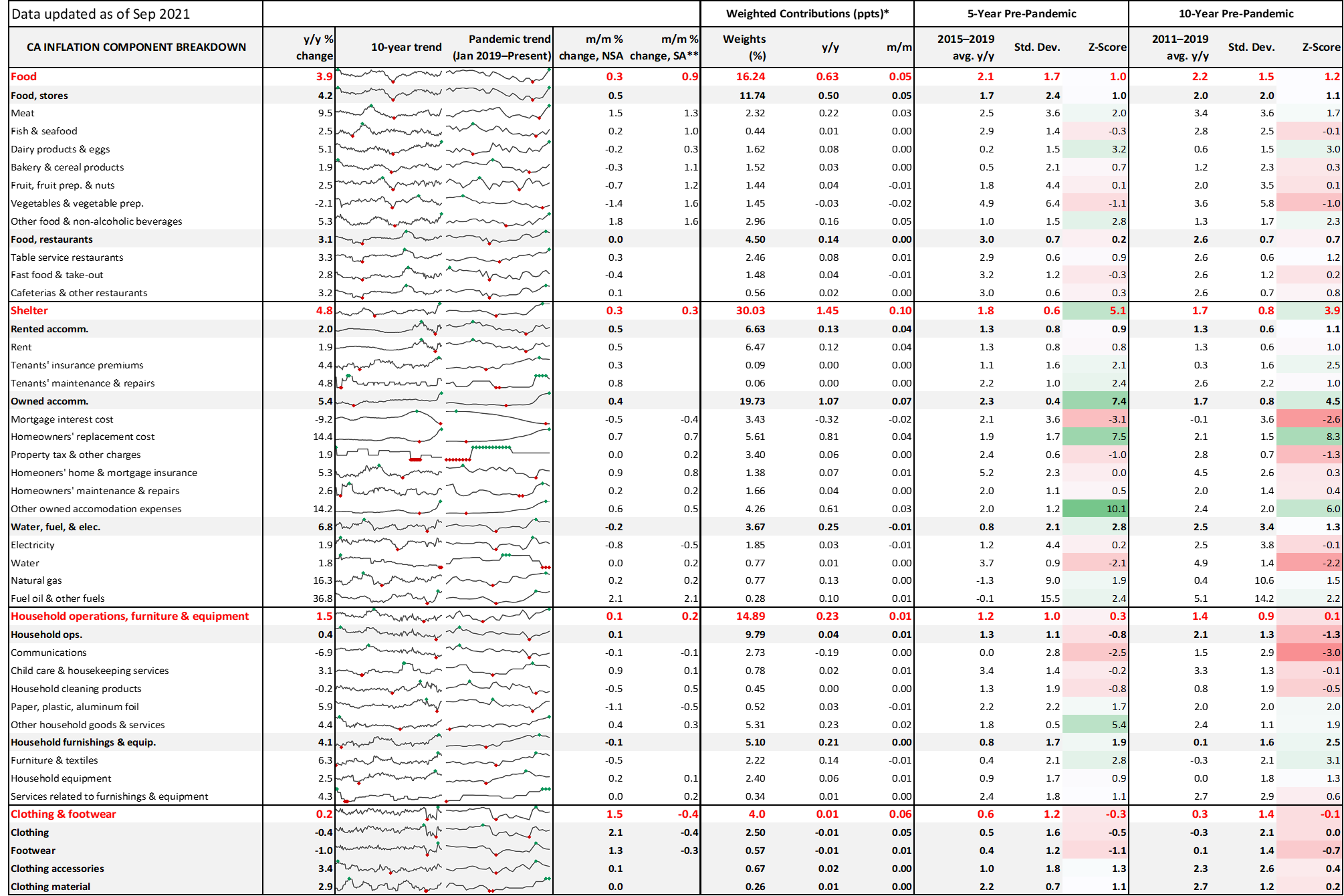

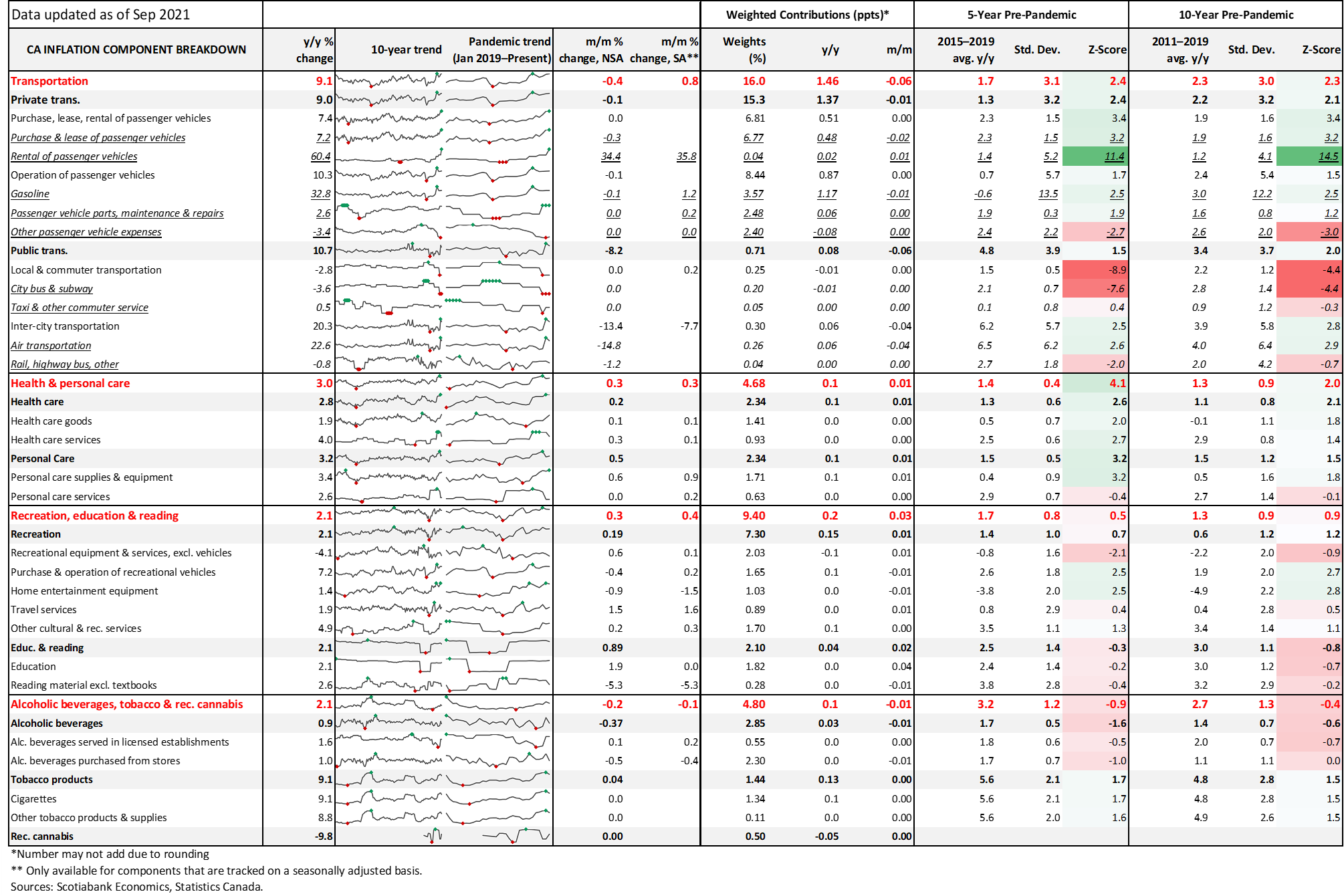

It’s also the case that this is not really a narrowly-driven phenomenon. Central tendency measures of inflation are meant to weed out some narrow drivers, and they too have escalated and not off particularly soft levels of a year-ago either (chart 2). Further, when it’s your home, your car and fuelling it, your grocery bill and your utilities that are driving the biggest weighted contributions to inflation, then clearly we’re looking at something impacting a rather large chunk of a typical household’s budget (chart 3).

We’ll have more to say on inflation including a sustained overshoot of the 2% target and the BoC outlook in our pending forecast release and accompanying materials. For now, the remaining charts offer a broader perspective on the underlying details.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.