- BoC cut 50bps as expected for a cumulative 125bps of cuts…

- ...and guided more to come, while leaving the upsizing door wide open…

- ...with December’s size to be data dependent

- What to watch and when between now and December

- QT plans left unchanged

- Faster easing, same projections implies heightened concern…

- ...that may set a low bar for another outsized move

The Bank of Canada cut 50bps to take the policy rate to 3.75% and explicitly left the door open to further rate cuts with the size and pace to be determined by data and other developments. They also left balance sheet plans unchanged. Cumulative easing to date equals 125bps of cuts. Their actions met our expectations while leaving intact my views on the longer-run risks the BoC may be courting should rapid policy easing continue.

Key is that the projections left growth and inflation unchanged despite picking up the pace of easing. That may indicate a BoC bias that greater downside risk to the economy would have persisted in the absence of additional easing that would otherwise have faced slightly firmer growth on signs that monetary easing is accelerating.

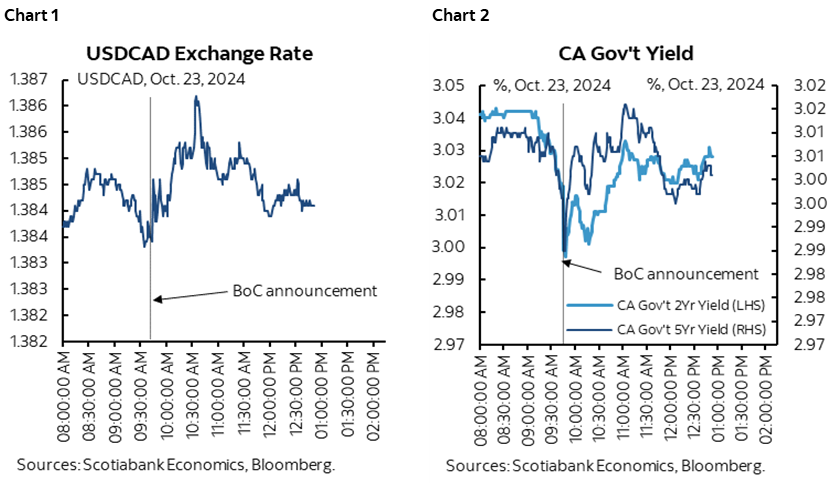

Charts 1–2 summarize market reactions into and out of today’s communications. There was little market reaction as the Canadian dollar softened only very slightly to the USD while Canada’s shorter-term bonds are mildly outperforming the US on the day. Market pricing for the next decision seven weeks away on December 11th remains on the fence between a quarter- and fifty-point cut. Terminal pricing remains at 2.75–3% by summer.

I'd say they pulled it off reasonably well today. They cut -50bps and kept everyone guessing with markets on the fence for the size of the next move with terminal still priced around 2.75–3% by next summer.

FORWARD GUIDANCE—MORE CUTS TO COME

I wouldn’t spend much time on the BoC’s forward guidance a) because it usually performs poorly, and b) because it will be driven by data. For what it’s worth, here’s what they said in the statement:

"If the economy evolves broadly in line with our latest forecast, we expect to reduce the policy rate further. However, the timing and pace of further reductions in the policy rate will be guided by incoming information and our assessment of its implications for the inflation outlook. We will take decisions one meeting at a time."

And here’s what Governor Macklem said in his opening remarks to the press conference:

"Overall, we view the risks around our inflation forecast as reasonably balanced. With inflation back to 2%, we are now equally concerned about inflation coming in higher or lower than expected."

When asked explicitly during the press conference about the potential size of the next move, Macklem said this:

“I'm not going to handicap the next move. We've been pretty clear on the direction. The timing and the pace are going to depend on the data. We're going to get a fair amount of information between now and December”

Thus, we need to monitor the large amount of data and developments between now and the next decision, but I’ll argue that their starting point may be setting a low bar for another large cut.

All that said, if the BoC wanted to say this was an unusual one-and-done upsizing, then they could have easily done so. The fact they did not, and chose instead to leave the door open, was a dovish signal that sets a low bar for data to guide another large cut.

WHAT TO WATCH AND WHEN BEFORE THE NEXT DECISION

I don’t have a view on the size of the next move in December at this point but I would not just assume that this is a one-and-done upsizing. Our published forecast implies a quarter-point move but isn’t worth much at this stage before we get a LOT of data between now and then.

GDP:

- August next Thursday with September guidance. I’ve estimated August GDP at -0.1% m/m SA. We don’t have much data for September yet but readings like the -0.4% m/m SA drop in hours worked suggest downside risk.

- September and Q3 with October guidance on November 29th. Key will be how the transition to Q4 GDP is looking. If September and tentative guidance for October are soft then it could add to the BoC’s concern that the economy is still creating more and more spare capacity into year-end.

Jobs/wages:

- October data arrives on November 8th

- November data arrives on December 6th

CPI:

- October prices will be released on November 19th and it will be the only inflation reading between now and the December decision.

The next BoC surveys including measures of inflation expectations won't arrive until January.

There will be one FOMC decision (Nov 7th). Plus the US election of course, on Nov 5th.

FORECAST CHANGES

Charts 3–4 show the changes in the Bank of Canada’s forecasts. Despite picking up the size and pace of policy easing, the BoC left its forecasts for growth and inflation unchanged compared to the prior round. That could imply they are incrementally concerned about downside risk to their projections as an offset to easier monetary policy.

They took Q3 GDP growth down to 1.5% q/q SAAR from 2.8% in the July MPR. They could have gone even lower, as 1% tracking is within the realm of reasonable estimates, but it’s still a marked downgrade. They only (explicitly) publish two quarters out at a time, and so we now have their first estimate for Q4 GDP growth which stands at 2% q/q SAAR.

They left next year’s GDP growth unchanged at 2.1% Q4/Q4, and took 2026 down a tick to 2.3% Q4/Q4.

CPI was left unchanged at 2% Q4/Q4 in both 2025 and 2026.

How much attention should we pay to the BoC’s inflation forecasts? None. The BoC cannot forecast inflation. Chart 5 is updated to include today’s projections. Each dashed line is what past quarterly MPRs expected for inflation versus the red line that is actual inflation. They miss the turning points, undershoot, overshoot, and sound too confident in their projections every step of the way. So, when the BoC sounds confident about hitting 2% inflation sustainably in its forecasts, it’s best to ignore.

STATEMENT CHANGES

The statement also flagged $10 lower oil prices than assumed in the July MPR which matters to Canada via a less supportive terms of trade. They always turn incrementally dovish when the ToT softens materially.

The BoC is doubling down on concerns toward per capita consumption and an expected rebound. I think they’re dead wrong to be so obsessed with per capita consumption. Take temps (int'l students, temp foreign workers, asylum seekers) out and it's not falling (chart 6). Temps innately don't spend like others; students are building human capital, while temporary foreign workers spend a little here but send or take back the rest when they leave. Plus temps are a transient population that could be here one minute, gone the next, while Canada tightens their numbers. The BoC shouldn't be chasing them.

PRESS CONFERENCE TRANSCRIPT

What follows is an attempt at provided a rough transcript of what I think were pertinent Qs &As during the press conference.

Q1. How fast do you think the policy rate should move back to a place where it is no longer restrictive?

A1. Macklem: We've been clear about the direction and that we will take our decisions one meeting at a time. Today we decided to take a bigger step because of recent information. First is headline inflation that has come down significantly. Core inflation has continued to gradually ease. Shelter price inflation has started to come off and increased our confidence it will continue to ease. We still have excess supply in the economy. Expected inflation has come down and are now nearing normal. The economy is growing but continues to be in excess supply. The labour market is soft. We have revised down near-term growth. To us that suggests it was appropriate to take a bigger step today. We also guided we anticipate further cuts one at a time. Our focus now is very much on keeping inflation close to the middle of the 1–3% range. As the upward forces on inflation ease we need growth to pick up. We'll be watching growth and inflation between now and December.

Q2. How much discussion was there about a 25 or 50 move or even larger?

A2. Macklem: There was a clear consensus that it was appropriate to take a larger step today. You'll get the summary of deliberations in a couple of weeks that will give more colour.

Q3. Does the acceleration of rate cuts suggest you will bring forward the timing of when you will end QT?

A3. Rogers: We haven't really changed our position on QT. They are both parts of the normalization process.

Q4. Do you have greater concern about undershooting the inflation target?

A4. Macklem: Our forecast has inflation staying close to the middle of the range. With lower rates the stage is set for growth to pick up. It's a pretty good looking story with growth picking up and lower inflation.

Q5. How are you weighing concerns in housing?

A5. Rogers. We do have a forecast pick up in housing. There are bidirectional risks to the timing and magnitude.

Q6. How likely is it that you may have to cut another 50bps in December?

A6. Macklem: I'm not going to handicap the next move. We've been pretty clear on the direction. The timing and the pace are going to depend on the data. We're going to get a fair amount of information between now and December

Q7. How much does the Bank factor in bond market expectations. If yields were to start marching higher, how much would that market outlook affect your expectation of how much more easing we need in Canada?

A7. Macklem: Rambling answer saying they look at broad conditions and basically will do what they must.

Q8. What would be the impact of possible tariffs imposed by the US on Canada? On monetary policy?

A8. Macklem: We'll take risks and changes in policy into account but at this stage the policies have not yet been announced.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.