- Canada on track to create half a million jobs in 2023...

- ...aided by another gain in September, albeit with soft details

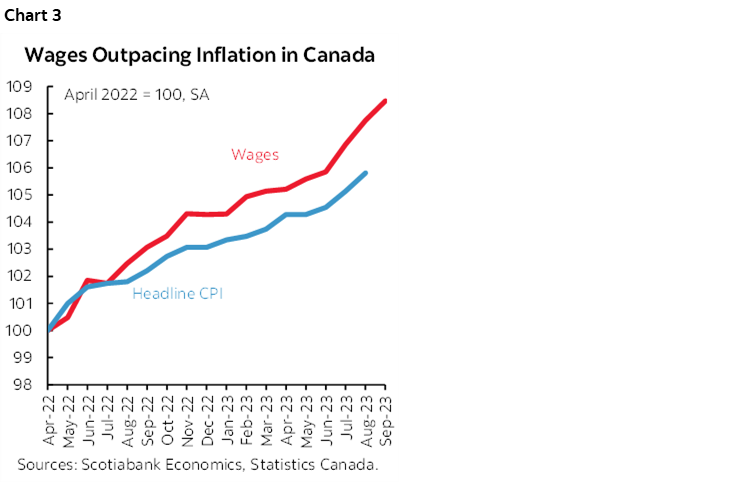

- Wage growth is far above inflation and setting records as productivity tumbles

- Hours worked support Q3 economic rebound

- The BoC is falling further behind second round effects on inflation

- CDN employment m/m 000s / UR %, September, SA:

- Actual: 63.8 / 5.5

- Scotia: 15 / 5.6

- Consensus: 20 / 5.6

- Prior: 39.9 / 5.5

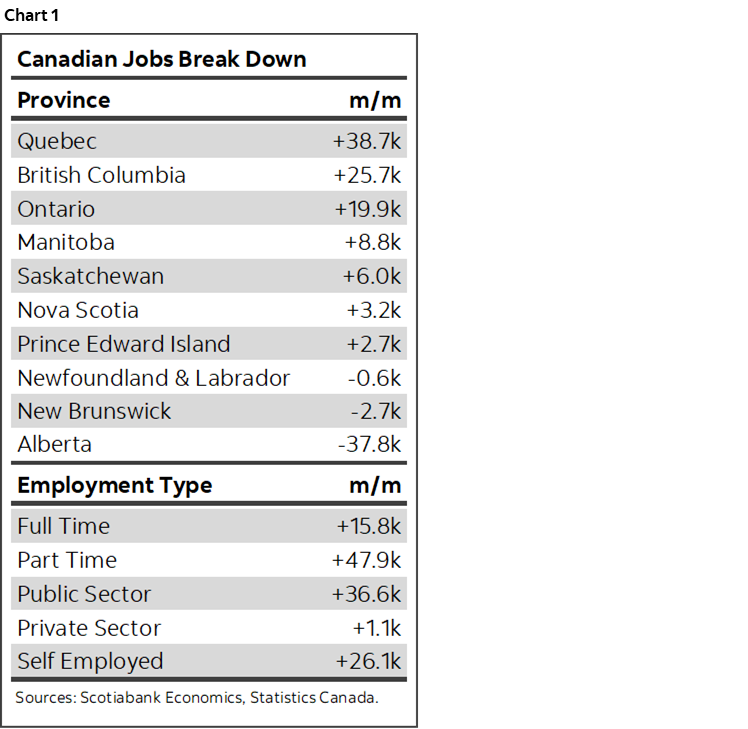

While I think the 64k rise in total employment during September had generally soft details under the hood (chart 1), the broad trend in employment gains this year remains explosive and it’s the wage figures that were the most eye popping and relevant consideration. I’ve got to tie a string to my finger to remember the next time not to say it’s unlikely to get another ripping wage gain after the latest one, because it just happened again.

As a consequence, Canada’s bond yields took flight partly on the back of the Canadian numbers but also dragged higher by the US figures. USDCAD is little changed as the effects of the numbers on both sides of the border are being treated as a wash on net.

Pricing for the BoC’s October 25th decision jumped by 4–5bps post-data and is now baking in about half of a quarter-point hike. The BoC’s twin business and consumer surveys including measures of inflation expectations on the 16th, CPI on the 17th, and external developments could still be impactful to the decision.

I’ve continued to guide in client meetings and presentations that the Canadian front-end remains overvalued and that one last reach into the chip bag probably won’t be enough here. Hikes have to be treated in the plural sense as broad inflation risk remains higher in Canada than the US and the whole curve should be at or above the US.

WAGES ON FIRE

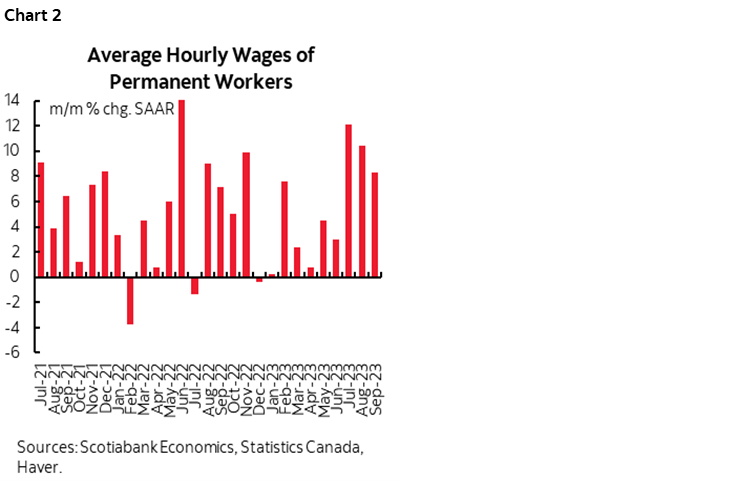

Average hourly earnings of permanent employees jumped by another 8.3% m/m SAAR in September (chart 2). This follows a rise of 10.5% in August that was revised up a bit from the previously reported 10¼%. The month before that (July) posted a gain of 12.1% m/m SAAR that was also revised up from the previously reported estimate of 11.6%.

That positions the three-month moving average at 10.3%. Other than the wonky period at the start of the pandemic, we’ve never had a trend gain like that. The effect lifted the y/y rate to 5.3%, but the m/m SAAR figure best captures an inflection point. Chart 3 shows that strong real wage gains being booked despite productivity that is in a tailspin.

ON TRACK FOR HALF A MILLION JOBS CREATED IN 2023

63,800 jobs created in September after 39,900 were created in August is certainly nothing to spit at. The 104,000 jobs in the past two months lifts the year-to-date employment gain to 387,800. There isn’t much one can say that would reject the significance of creating ~400k jobs ytd, or over half a million at an annualized rate.

FADE THE JOBS NUMBERS THEMSELVES

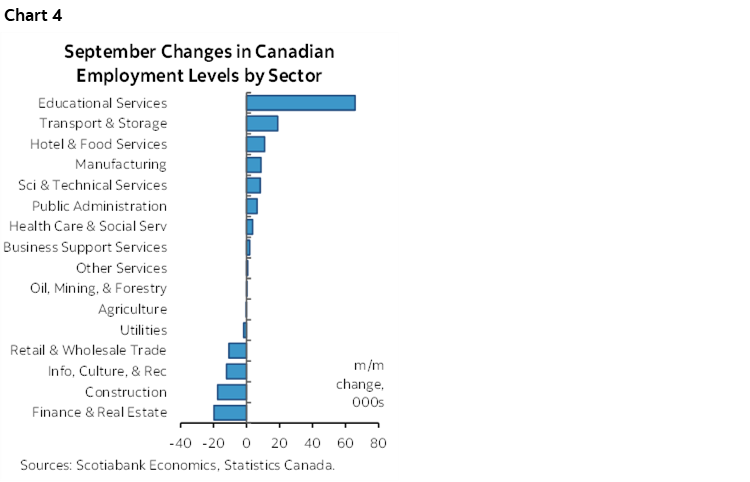

But let’s try dampening some of the enthusiasm anyway. All of the gain in September was traceable to two things that are to be treated skeptically in my opinion. Education sector employment was up by 66k after it fell by 44k in August. Teacher jobs are apparently the riskiest and most volatile on the planet. Who knew??! What I think is happening here is that Statcan is having a lot of difficulty with its seasonal adjustments around the start of the school year given the changed timing of education sector contracts now versus history. Ergo, fade the numbers, their bosses are not so volatile as to fire and rehire them all at the start of each school year.

Secondly, self-employed was up by another 26k. These are important jobs in Canada, but this is the softest of the soft data. It’s self disclosed, and always to be treated carefully.

There isn’t much left after taking away those two categories as the rest of the breakdown was a series of milder ups and downs that cancelled each other out (chart 4). Overall, the goods producing sector lost 10,500 jobs mostly due to construction that fell 17,500 with a partial offset provided by an 8,800 increase in manufacturing employment.

Service sectors added 74k jobs mostly due to the 65,800 rise in education sector employment, but transportation and warehousing also posted a strong 19k rise while professional and scientific registered a gain of 8,400 and accommodation and food services hired 11k while there were also 6,400 more civil servants hired. Offsets included a 20k drop in the F.I.R.E. sector and about 11k fewer wholesale and retail sector jobs.

Most of the gain in employment was in part-time jobs which also dents quality. Part-timers increased by 48k, but a 16k rise in full-time employment isn’t too shabby either.

There was decent breadth to the gains across provinces.

HOURS WORKED SPELL ECONOMIC REBOUND

Hours worked slipped 0.2% m/m in September after a 0.5% jump the prior month. They are tracking a gain of 1.4% q/q SAAR in Q3 after a 1.8% increase in Q2 (chart 5). Since GDP is an identity defined as hours worked times labour productivity with the latter defined as output per hour worked, the rise in hours is a supportive factor for broad GDP growth. Since we can observe rebounding activity readings, it’s likely that output per hour worked could be supported as well. If so, then Q3 GDP is accelerating over the stall we saw in Q2 that I still view as being heavily driven by transitory factors.

The hand-off on hours worked, however, bakes in no growth for Q4. That’s obviously to be treated a very tentative since we don’t have any Q4 data yet and hence what’s shown for Q4 in chart 5 is based solely upon the way Q3 ended and Q3 averaged.

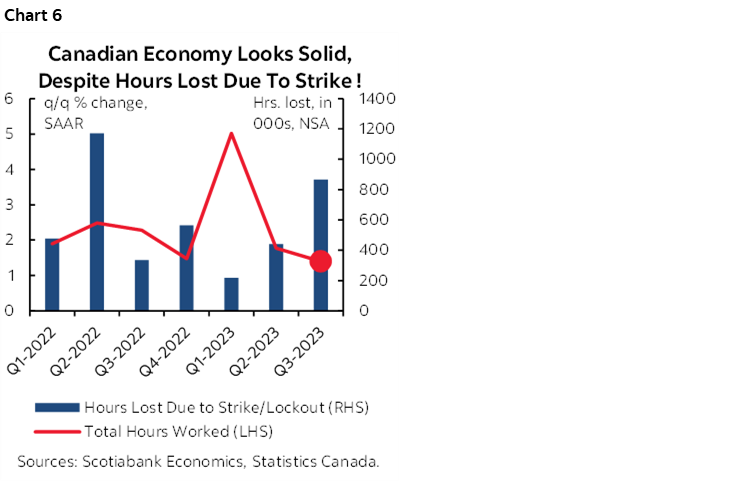

All that said, Canada is losing a considerable number of hours worked to strikes. Chart 6 shows lost hours due to both strikes and lockouts that in our times also includes pandemic disruptions. The lost hours in Q3 was due to strikes as opposed to earlier spikes that were also driven by pandemic policies. The point here is to view the well over 800k lost hours worked in Q3 as something that is transitory, or at least transitory as some strikes eventually settle and are possibly replaced by others! Add them back, and hours would be up by closer to 2% q/q SAAR. Nevertheless, it’s a component of hours worked that is lost not due to economic activity but due to labour strife.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.