- Fed hiked 75bps as expected, downplayed a bigger move...

- ...but a policy rate peak of 5% is in sight by early next year…

- ...followed by a prolonged pause with minimal and pushed out cut guidance

- If Powell’s 3 pause criteria don’t unfold, then >5% cannot be ruled out

- Equities didn’t like starker warnings on the economy

- Balance sheet plans remain on auto-pilot

- Forecasts revised growth down, unemployment and inflation up

- A possible rate path: November +75, Dec +50, Jan +50/25, pause

- The statement was a carbon copy of July’s

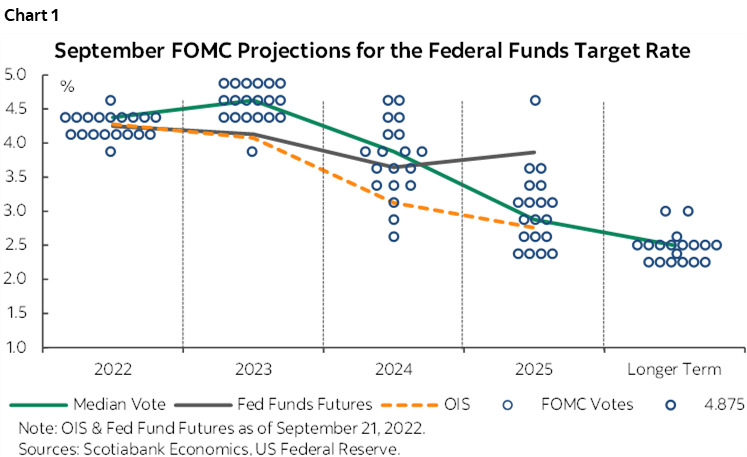

The FOMC’s signals that a policy rate peak toward 5% lies in store amid a worsened set of forecasts for the economy drove a hawkish market reaction to the full suite of communications. The US 2 year yield increased by about 6bps, the 10 year yield fell 3bps, the USD firmed and the S&P 500 sank by 2½% compared to just before the communications began to roll out at 2pmET. Please see the statement here and the Summary of Economic Projections including the ‘dot plot’ here. Chart 1 shows the updated policy rate guidance across individual voters, the median vote, and market-based expectations for the future policy rate.

In my opinion, a reasonable forecast for where the Fed funds upper limit is going based upon today’s guidance and nearer term expectations for inflation would be to assume a 75bps hike in November, another 50 in December, and then either 25 or 50 in February with a pause signal conditional upon data and developments which would have the policy rate at 4.75–5% by 2023Q1. This is a little higher than markets are pricing even in the aftermath of the communications.

POLICY RATE HIKED BY 75BPS

The FOMC hiked the fed funds upper limit by 75bps to 3.25% as expected. Chair Powell appeared to downplay any reference to discussion of a larger 100+ move by referencing uncertainty toward the volatility in recent inflation readings that may have held them back. He noted that “We got a surprisingly low inflation reading in July and a surprisingly high reading in August. We don't want to overreact. The trend shows it's too high compared to where we want it.”

With this move, Chair Powell said in his press conference that "We've moved into the very lowest level of what may be restrictive." Neutral is a difficult concept to nail and can vary over time but 3¼% being the ‘very lowest level’ of restrictive is a hawkish signal.

5% IN SIGHT

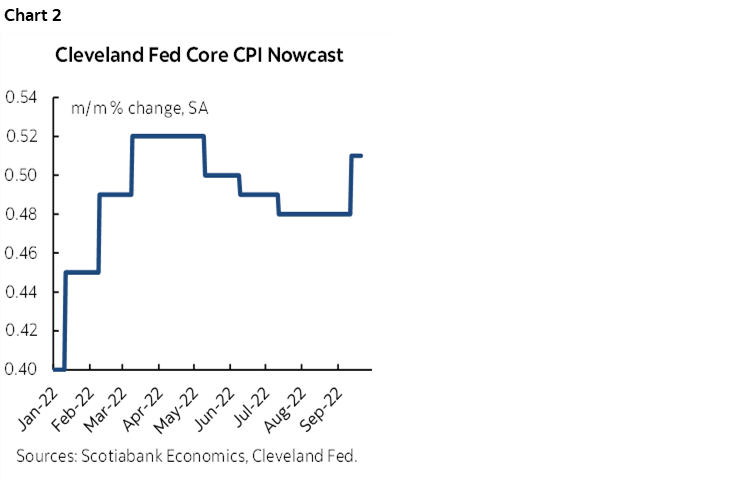

The surprise came in the dot plot. The FOMC signalled a policy rate ending 2022 at 4½% which is 100bps higher than in the June dot plot. There is a razor thin divide in the dots with one more participant expecting a year-end target of 4½% than 4¼% and that could mean between 100–125bps of hikes over the November and December meetings. If the Cleveland Fed’s ‘nowcast’ for September core CPI inflation is on the mark (chart 2) then when that hits before the November meeting it’s likely to result in another 75bps hike. That could leave another 50bps in December to hit the year-end range in their forecasts.

Next year shows an evenly divided FOMC between a policy rate peak of 4.5%, 4.75% or 5% with a median in the middle. If they are going to such a peak then it makes sense to assume they won’t hesitate only to come back with a little more later. These are year-end forecast points in their tables but I think that year-end masks a 4.75–5% peak into 2023Q1.

If so, then markets continue to be slightly haircutting such a path and arriving there a little later than would appear to be a likely baseline view to get there by the February or March FOMC.

WHY THE CHANGES?

When asked point blank why they are expediting the pace of hikes, Powell admitted that “Our expectation was that by now we would have seen inflation start to come down as the supply side has started to heal. We haven't seen that. 3, 6 and 12 month trailing basis inflation is not where we expected or wanted to be. That tells us we need to keep doing these large increases as we approach the level we think we need to get to and we're still discovering that level.” This leaves open considerable room for debate around guiding policy rate moves and their future effects based upon what has already happened to inflation.

In plain language, the August CPI print spooked them and so did the smoothed trend that is proving to be more persistent than they had anticipated.

Powell also explained how “this era has been known for long periods of expansions” and if they don't front-load now they may never get control of inflation.

On guiding expectations for the Fed’s ultimate destination, Powell stated they believe they need a restrictive policy stance with meaningful downward pressure upon inflation and concluded “We want real rates that are positive across the yield curve.”

PAUSE CRITERIA

When asked what will inform the FOMC’s possible shift toward slowing down the pace of rate hikes and stopping, Powell pointed to three main criteria:

- they want a sustained period of below-potential growth. He did not define a period but the forecast peak in the policy rate is conditioned upon achieving below potential growth for at least 2022–23;

- that includes evidence of cooling labour markets toward a better supply and demand balance which in their forecasts appears to require a sustained unemployment rate toward 4½%.;

- and hard evidence that inflation is moving back down to 2% which in their forecasts happens gradually over 2023–24 and takes until 2025 to realize 2% inflation.

By extension, if they don’t see these signs, is the FOMC open to a higher peak than 5%?

HIGHER FOR LONGER!

The FOMC has clearly pivoted toward the higher for longer narrative on the view that inflation’s drivers are longer lived than previously judged. It’s probably going to be longer-lived than what they’ve shown here.

In any event, not only do the dots show no one anticipating rate cuts in 2023 they also set a high bar against material cuts in 2024. The revised projection shows the median forecaster at 3.9% (so 4%) in 2024 which is up a half percentage point from the last forecasts in June. That’s a very modest signal that far out.

THE ‘R’ WORD: LESS DENIAL, MORE ACCEPTANCE

What equities probably disliked the most were the starker warnings on the economic outlook.

When it was pointed out in the press conference that the forecast increase in the unemployment rate could be associated with an outright recession and whether that’s necessary in order to bring down inflation, Powell took another step away from earlier optimism. He said rather frankly that "the chances of a soft landing diminish as policy becomes more restrictive or restrictive for longer."

When asked for the odds of recession, he said somewhat tersely “I don't know what the odds are. There is a very high likelihood of below-trend growth for a while. It could give rise to higher unemployment and I think we need to have that and softer labour market conditions. We're never going to say we have too many people working" but he just basically said that.

Note the progression of thinking from how there is a path to a soft landing to then saying there is a narrow path to a soft landing, to then saying the path was narrower and now sounding even less convinced by abandoning any reference whatsoever to a path!

Instead, Powell said three things still give some possible cause for optimism but I’m skeptical toward the quality of his points.

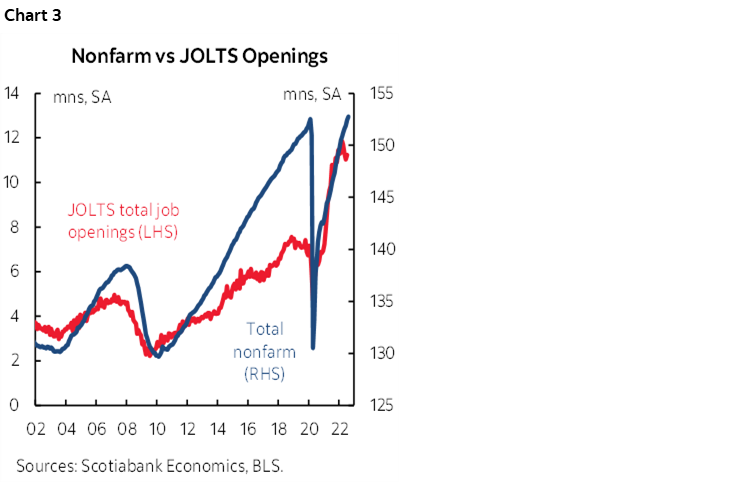

1. He said that it's possible that job openings come down without hitting jobs which is probably still wrong as previously pointed out given that JOLTS job openings are weakening and when that happened last time it presaged an outright decline in nonfarm payrolls (chart 3).

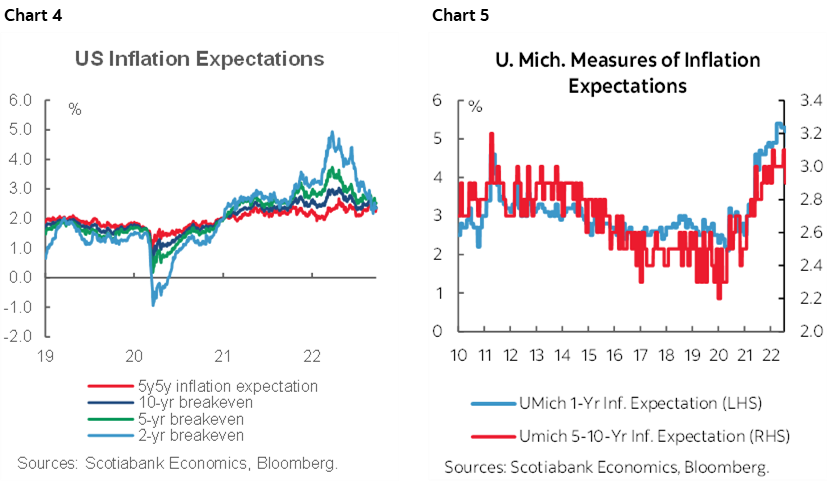

2. He also emphasized how the fact that inflation expectations are reasonably anchored should make it possible to bring inflation lower without as much pain as could be the case if they were fighting higher and unmoored expectations. The strength of his argument depends critically upon which measure of inflation expectations we use. The Fed’s preferred market gauge for the 5y5y metric is reasonably well anchored (chart 4), but they also like UofM sentiment that shows consumers’ 5–10 year inflation expectations closer to 3% that far out (chart 5). #cherrypicking.

3. Finally Powell noted that supply shocks are contributing to the increase in inflation and there is evidence this is improving. He’s right, but some may be stalling and it’s possible that further supply disruptions lie ahead. I hope not, but it’s not hard to imagine Europe’s industrial heartland shutting down because it can’t get gas at any price this winter.

Powell also observed that while interest-sensitive sectors are showing the effects of policy tightening and USD strength is having its effects on exports and imports, “This is a strong, robust economy. Job markets are strong. People are still spending with stockpiled savings. States are flush with cash. Data is showing below-trend growth (below 1.8%) this year but there is a possibility that growth can be stronger than that. We are focused on inflation and can't fail.”

LEWIS CARROLL WROTE THE REST

As for the dots with the addition of 2025, let’s just say that they look like something Lewis Carroll might have penned. A nice neat landing on at-potential GDP growth with inflation remarkably on target at 2% and the policy rate back in the upper end of what the FOMC judges to be the 2–3% neutral rate range. How quaint. When given a choice, the FOMC took the red pill.

NO STATEMENT CHANGES

There were literally no changes to the statement other than to alter the reference to the target rate range to reflect today’s hike. They retained reference to how “ongoing increases in the target range will be appropriate” and the decision was unanimous.

Please see the accompanying statement comparison that almost literally copies and pastes what they wrote in July.

NOTHING NEW ON BALANCE SHEET PLANS

Roll off plans remain intact at a $95 billion per month and there was no reference to discussion over whether to adjust RRP counter-party limits as some in the markets have been intimating to occur at some point. That might more suitably follow in the minutes or at subsequent meetings.

Powell was also asked whether the slowing housing market would affect the Fed’s plans to run off MBS or possibly sell and he flatly stated that this was “not something we're considering right now or that I expect to consider in the near-term.”

FORECAST REVISIONS

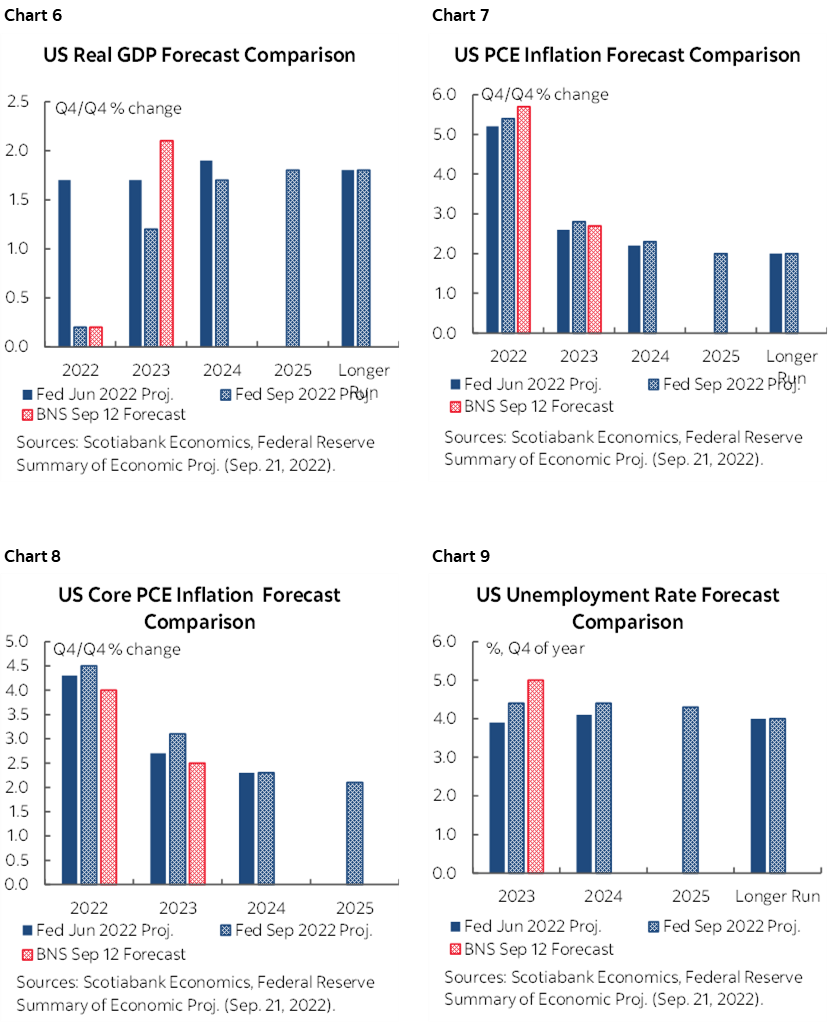

As shown in charts 6–9, the FOMC projections downgraded economic growth, increased the projected unemployment rate and raised inflation forecasts compared to the prior round of projections in June.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.