- BoC cut –25bps, left QT intact as expected

- Macklem signals no appetite for upsizing cuts

- Canadian markets ignored the BoC…

- ...moving in sympathy to US markets that reacted to US JOLTS data

- Full press conference transcript

- Bank of Canada overnight rate, %:

- Actual: 4.25

- Scotia: 4.25

- Consensus: 4.25

- Prior: 4.5

The Bank of Canada met expectations by cutting its policy rate by 25bps to 4.25%, leaving balance sheet plans unchanged and signalling nothing more than a drip pace of data-dependent future cuts that offered no hint toward upsizing cuts. And markets couldn’t have cared less about any of it as the focus was on US data which ironically points out limits to the BoC’s standard line that what matters is what happens in Canada independent of the US.

Please see the accompanying statement comparison. The original link to the statement is here and Governor Macklem’s opening remarks to his press conference are here. I’ll explain the BoC’s communications without repeating my views on what they may be underestimating that were explained in this morning’s note here.

NO DISCERNIBLE MARKET REACTION

The most interesting thing about the BoC is that what mattered to markets was JOLTS data out of the US.

US JOLTS job vacancies fell to 7.673 million in July from a downwardly revised 7.91 million in June that was previously estimated at 8.184 million. The problems with JOLTS, however, include that it is a) lagging to July, b) a poor guide to the more important payrolls report on Friday, and c) you can't entirely tell why openings fell in terms of whether it was cooler demand or more success filling the spots. We can see that JOLTS reported a 273k increase in hires during July, however, while 202k more folks were fired or laid off than the prior month and another 381k left their jobs due to retirements, transfers or other reasons.

The simultaneous release of JOLTS data drove US 2s to richen and the yield to drop by several basis points with Canada 2s following the US. The USD broadly weakened post-data which drove about a quarter cent appreciation in CAD relative to the USD. The USD started to move before JOLTS and so did US 2s a touch. In the end, there was no discernible reaction to the BoC independent of the effects of US data.

STATEMENT NITPICKING

At 357 words, this was a very short and sweet statement with no surprises.

The final paragraph's guidance is very similar to the prior statement by way of signalling that “monetary policy decisions will be guided by incoming information” in a data dependent fashion.

Minor tweaks included:

1. Compared to July, shelter price inflation "is starting to slow". Macklem's opening statement somewhat reined in this reference by saying "the upward forces coming from prices for shelter and some other services have eased slightly." ie: "slightly." The BoC needs to think of the long game on housing scarcity, not the short term data.

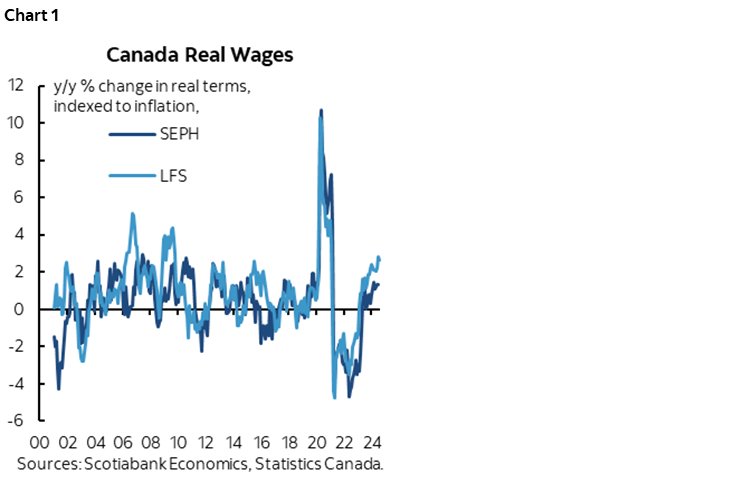

2. Compared to July when they said "wage growth is showing some signs of moderating" they strike that out now and say "Wage growth, however, remains elevated relative to productivity." Why? Because it’s not slowing (chart 1).

3. This might really be nitpicking but the ending paragraph now says "Excess supply in the economy" as opposed to "ongoing excess supply" which is probably not meaningful, but why change it if not.

GOVERNOR MACKLEM’S OPENING STATEMENT SIGNALS SLOW AND STEADY PACE

Key in the accompanying release of Governor Macklem’s opening comments to his press conference is that forward guidance was unchanged in signalling a measured pace with no hints at altering size/pace. He said: "If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further cuts in our policy rate."

This issue was further addressed in the Q&A with reporters as captured below. Macklem still downplayed any serious consideration being given to upsizing and made it clear that slow and steady is the base case while alternative scenarios include both pausing and upsizing along the way.

Macklem’s reference to being more concerned about downside risks itself risks being misinterpreted again. They are not signalling greater unease. Macklem explained himself in the last presser in July and largely repeated that explanation in today’s presser. His explanation then and now was that when inflation is way above target you are naturally more worried about upside risks to inflation. When inflation is coming in line with target you shift to being more balanced between upside and downside risks to inflation which by definition means you become more focused upon downside risks to inflation than previously (while also monitoring upside risks). In other words, the BoC becomes more symmetrical in looking at risks to the 2% inflation target

On the labour market, Macklem said:

"The unemployment rate has risen over the last year to 6.4% in June and July. The rise is concentrated in youth and newcomers to Canada, who are finding it more difficult to get a job. Business layoffs remain moderate, but hiring has been weak. The slack in the labour market is expected to slow wage growth, which remains elevated relative to productivity."

Note two things here. One is I agree that the bulk of the labour market remains sound as weakness is focused upon excess numbers of temps messing up the job market for youths. This will reverse into 2025. Two is they still cling to how "slack" in the labour market will slow wage growth. I disagree with that partly on the first point I made (temps being curtailed will tighten the market again and breathe new life into the job market for youths) and partly because collective bargaining gains remain in progress and yet to be factored into hard wage data.

And on how much excess supply you see in the Canadian economy, that is significantly dependent upon how much you believe their fudged potential growth assumptions as input into output gap calcs. I don't, for reasons again outlined in my morning note.

PRESS CONFERENCE TRANSCRIPT

What follows is my attempt at providing a full transcript of the Q&A between Governor Macklem, Senior Deputy Governor Rogers, and journalists. When capturing it on the fly I paraphrase remarks to get the broad thrust of the points.

Q1. Did you discuss a half point rate cut?

A1. There was a strong consensus for a 25bps reduction. The Council also agreed that if inflation continues to ease broadly in line with our forecast it is reasonable to expect further reductions. We also agreed we're not on a predetermined path. We did discuss some different scenarios. We discussed scenarios where it would be appropriate to slow the pace and scenarios where we could cut more including 50bps. He’s giving examples of both scenarios. We're going to be taking decisions one at a time.

Q2. Why 25 and why not 50? What is stopping you from being aggressive?

A2. We started cutting in June, this is our third decrease, inflation is still above our target, we do expect it will ease further. We do expect some pick up in growth. There is some downside risk to that pick up. If we need to take a bigger step, we're prepared to take a bigger step but at this point 25bps was appropriate.

Q3. Do you think monetary policy should remain restrictive after cuts relative to neutral rate estimates?

A3. He's explaining that the neutral rate speaks to a scenario that never happens with full equilibrium and no shocks. The neutral rate is not something that affects our decisions from one meeting to the next. When we say it's reasonable to expect further cuts it does not mean we are on a path to the neutral rate. It is meant to refer to the short-erm.

Q4. What do you think will be the impact of the planned reduction in temp resident immigration?

A4. SDG Rogers saying that the surge took some pressure off the labour market. Now the economy is having difficulty absorbing new entrants. It will be important that the influx of labour supply matches our ability to absorb it. We expect the government will announce a few more measures to tighten immigration and are watching closely. [ed. I continue to believe the BoC is misreading the labour market as temps did not create meaningful slack outside of the youth market which is likely to tighten into 2025 as the temps population is curtailed . It’s unrealistic to see temps meaningfully impacting wages.]

Q5. How does the Fed's move toward easing affect you?

A5. We take monetary policy in the best interests of Canadians. Interest rates between Canada and the US can diverge. There are limits but those limits have not become a constrain on Canadian monetary policy. Our policy rate did not go as high as the US. We have cut 75bps and the US has not cut. We're not seeing a big impact on our exchange rate. The divergence has not run up against any limits to this point. With markets expecting easing by the Federal Reserve I don't expect limits to come into play. [ed. That clearly all depends upon uncertainties facing the Fed’s rate outlook itself.]

Q6. Are you concerned about the composition of Q2 GDP growth that was driven by government spending versus a drop off in household consumption?

A6. In any one quarter the composition of growth shifts around. In the first two quarters of the year growth averaged around 2% compared to around 0% over 2023H2. Consumption picked up in Q1 and then slowed but the two quarters as a whole saw a pick-up in consumption and investment and some government spending. Going forward we expect population growth to come down given policy changes. We are expecting some pick-up in per capita consumption as population growth ebbs and interest rate cuts take effect. Growth has picked up in H1 and we want to see it pick up further. We need it to be above potential growth, above 2%.

Q7. Where do you see the steady state level of settlement balances? Have you changed your views on the level of reserves given CORRA spreads over o/n?

A7. We don't see much change. We're over $100B and still see a need to go toward $80B. [ed: No, Gravelle said that was the ceiling, not the target. Not sure if that was a Rogers slip up or a new signal and I continue to think the BoC is too dismissive toward whether QT is contributing to funding market pressures].

Q8. Do you still see the risks to the inflation outlook as balanced?

A8. Core inflation has come down broadly in line with forecast. Shelter inflation is still much too high but it looks like it is starting to come down. To get back to the target we need to see further weakening of shelter inflation. There may be downside risk to our July projection for the near-term. We'll have a new forecast in October.

Q9. How could upward pressures on inflation be stronger than expected as you referenced?

A9. In the months ahead, we do expect inflation continue to ease. As we get into next year it could back up due to base effects. We need to see further easing of shelter that is 25% of the CPI basket ([ed. ex-mortgage interest which adds 3% to the weight] that is running over 8%. Shelter could be a risk holding inflation up. There is always some uncertainty about how much slack there is in the economy. We think there is slack in the economy but it is possible there is less slack than we think. On the downside, as inflation gets closer to the target, we have to guard increasingly against the risk that inflation undershoots. We don't want to go right through it so that when we get to 2% inflation we stay there. Rogers chipping in now, flagging wage growth higher than productivity as another upside risk

Q10. Regarding downside risks to inflation, can you overlook small deviations from 2% or is that something you have to be concerned about.

A10. If we're a little over or a little under we're going to be trying to get it back to 2% and we are symmetric in that respect.

Q11. You say you are taking decisions one at a time but you also say it is reasonable to expect further cuts. How worried are you that you are saying to Canadians to take on more debt?

A11. Household debt is quite high. High interest rates have taken the steam out of consumption. That is why we can reduce now. [ed. dodged the question].

Q12. Where do trade issues rank in terms of risks to your outlook given recent protectionist measures?

A12. There is no question the global trade landscape is changing. I'll have a lot more to say about this in my London speech next Tuesday. We are assessing the impact of these changes. The pandemic has highlighted the need to invest in supply chains which carries costs. Geopolitical tensions have increased and that is changing trade relationships. Businesses need to consider economic security and not just cost of production.

Q13. Over what time do you not expect shelter inflation to accelerate? How much of a pick-up would it take to worry you?

A13. Shelter inflation is a combination of rent, mortgage interest cost, house maintenance, user cost, price of new homes through the cost of fixing your house. With mortgage rates coming down and more supply coming into the rental market and population growth coming down we could see house prices pick up with overall shelter inflation still coming down.

Q14. Do you still expect a soft landing scenario?

A14. We're much closer to landing than we were. Inflation is closer to target and while the economy has slowed it hasn't weakened sharply. We have not landed it yet. As we are getting closer to the 2% inflation target we do have to guard more against the risk the economy is getting too weak.

Q15. How will the Fall fiscal update impact your outlook for rate cuts by the end of the year?

A15. Well, I don't know what's in the statement so it's pretty hard to answer. We don't comment on fiscal policy [ed. yes you do!!]. Our mandate is 2% inflation and fiscal policy is the mandate of parliamentarians. Whenever they announce in their budgets and statements we build them into our projections. When I do from time to time comment on fiscal policy I do in terms of the impact on inflation and monetary policy. When the economy is overheating, further fiscal stimulus is more worrisome. Today we are getting back to target and so I do not feel the need to comment on fiscal policy. [ed. The BoC always reacts to fiscal policy developments after the fact. Keep eyes on the Fall statement and Winter Budget].

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.