- BoC holds at a 5% policy rate as expected

- BoC statement read like they’re hedging their bets until October...

- ...and had a whiff of January’s misstep

- US, Canadian data releases were more interesting, and hawkish

- Canadian politicians are playing Russian roulette

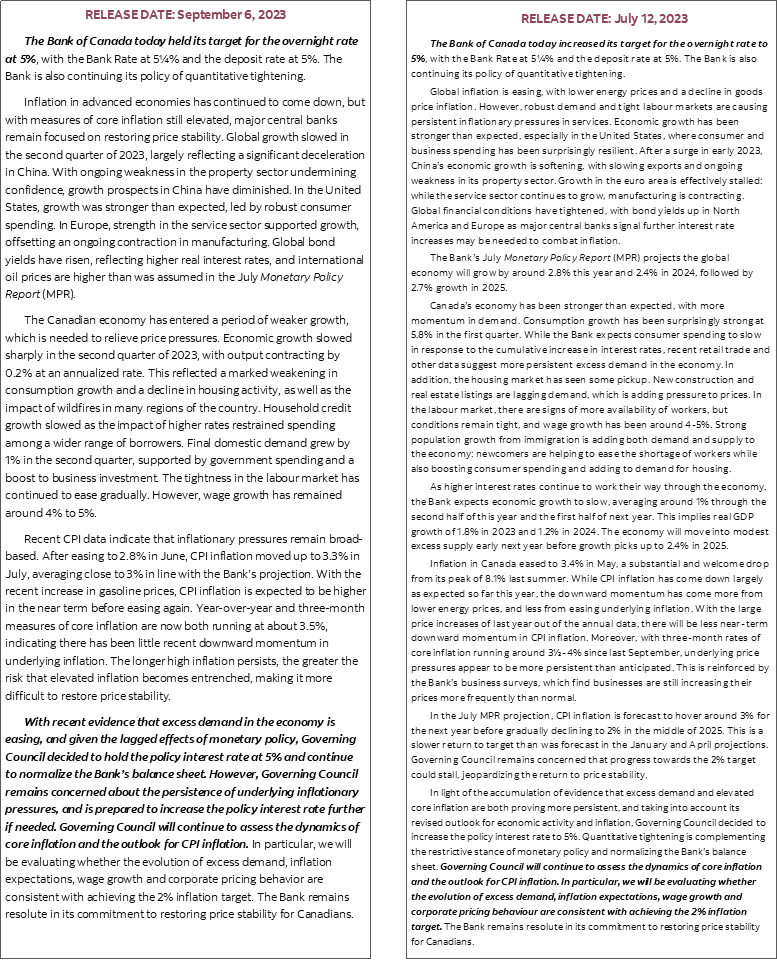

The Bank of Canada held its overnight rate unchanged at 5% as widely expected. The bias hedged the BoC’s bets in a manner that is consistent with expectations they would simply buy time ahead of the next decision with a full forecast update on October 26th.

There isn’t much to be lost to step aside now and there could be a lot to be gained in coming back with a fuller assessment next month with a lot more evidence at hand. I hope that’s how it plays out one way or the other, but I fear that the BoC is once again reacting inappropriately to what is pretty obviously a distorted soft patch in the economy that could boomerang on them. I don’t think political interference is responsible for this latest wavering stance, but I worry about the optics surrounding politicians lacking expertise in monetary policy who rather hypocritically lambaste the central bank for hiking when part of the reason it has been doing so is to offset free spending governments of all stripes.

What complicated the market reaction was the simultaneous release of bullish US ISM-services data that showcased an accelerating service sector with stronger hiring intentions and greater price pressures. As a result, the C$ weakened versus the USD that got a lift from data, and shorter-term Canadian government bond yields increased a few basis points. Frankly, the US data that points to upside risk to the most important external economy to the Bank of Canada was more interesting than their statement. So was Canadian data that arrived before the BoC statement.

THE BIAS

Please see the accompanying statement comparison at the back of this note. Key is the concluding paragraph where they hedged their bets.

That paragraph in the prior statement on July 12th said they hiked “In light of the accumulation of evidence that excess demand and elevated core inflation are both proving more persistent...” Today’s statement said they held because of “recent evidence that excess demand in the economy is easing, and given the lagged effects of monetary policy....” That’s quite the epiphany in a matter of weeks and so far that comes across as more dovish at the margin, but I hope they don’t eat their words again in future in a replay of January (more about this below).

That same paragraph went on to state that they are “prepared to increase the policy interest rate further if needed” and given that Governing Council “remains concerned about the persistence of underlying inflationary pressures.” That’s steadily hawkish at the margin. And so they should be. Nevertheless, they probably don’t have a choice but to say this because the minute they drop it is the minute market participants swing positioning, piled into the front-end and start prematurely pricing rate cuts all over again.

The final sentence of that paragraph repeated what they are following, namely “the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour.” But wait a sec here, didn’t you just say corporate pricing behaviour isn’t driving inflation (here)? Meh, I suppose they wouldn’t be the first folks to ignore their staff’s research.

JOB NOT YET DONE ON INFLATION

The inflation language was unambiguously hawkish. Inflationary pressures “remain broad-based.” They expect higher inflation in the near-term due to gasoline prices, but what matters is core inflation, not gas prices.

On core inflation, they flagged the three-month moving average of trimmed mean and weighted median CPI that is running at 3½% at a seasonally adjusted and annualized pace. The same measure when not smoothed was 4.2% in July and thus adding to pressures at the margin versus the smoothed measure. They also said that “There has been little recent downward momentum in underlying inflation” while warning about the dangers of persistent inflationary pressures. And no, these core measures are not being driven by mortgage interest that isn’t even included in them.

Would everyone kindly remember that the BoC’s only job is to get inflation durably to its 2% target within a reasonable medium-term horizon. It has so far failed to do so. There are many drivers of inflation beyond excess demand in a world in which structural pressures on inflation likely remain at a highly nascent stage of development.

TRANSITORY VERSUS MOMENTUM EFFECTS IN THE CANADIAN ECONOMY

The BoC hedged its bets on how to interpret recent data but on net sounded too confident that the Canadian economy has indeed “entered a period of weaker growth.” Here we go again?

On the proverbial one hand, they said Q2 GDP reflected “a marked weakening in consumption growth and a decline in housing activity.” What’s unclear is what they think drove this and how sustainable this softening may be. I think some of what drove it was pulled forward into Q1 and therefore we should smooth volatile growth that would be above trend, plus transitory shocks like impaired product availability during Q2, wildfires, weather during a historically wet month of July, and strikes. Q1 consumption was up by 4.7% q/q SAAR and so flatness in Q2 shouldn’t really surprise the BoC. The BoC should not be swinging from bust to boom to bust all in one year and versus having a steadier hand on the tiller. The hike bias reflects a steadier hand now but the test will come in the data and how they react again.

On the proverbial other hand they tossed in reference to weak growth being driven by “the impact of wildfires in many regions of the country.” They failed to reference any other shocks, like the disruptive effects of strikes and weather. Nope, didn’t happen. Didn’t see that. Maybe that was to stay politically neutral to the labour unions and thus avoid pointing a finger at striking workers, but if the omission is really how the BoC thinks then it’s not good economics.

A vulnerability to the BoC’s outlook may take the form of a rebound in activity as transitory shocks dissipate and set against all signs that the US economy continues to put in a strong performance and as I’ve previously argued.

A MIXED INTERNATIONAL ASSESSMENT

The statement acknowledged China’s weakness and said “growth prospects in China have diminished.” Ok, probably, but we’re monitoring stimulus efforts in real time and in a market where a lot of bad news is discounted in China’s financial markets. Of greater importance to Canada, however, is the US economy where “growth was stronger than expected, led by robust consumer spending.” No prizes for guessing which economy matters more to Canada.

Note the irony here in that at the same time as the BoC statement landed, US service sector data that accounts for dominant shares of US consumer spending and over half of GDP unexpectedly ripped higher. ISM-services increased by 1.8 points to 54.5 and thus further above the 50 dividing line between contraction and expansion. Prices paid jumped 2.1 points to 58.9 and employment jumped by 4 points to 54.7. ISM-services conflicted with the deterioration in the S&P Global services PMI that slipped to 50.2 on a slight negative revision for the same month of August. Recall that ISM captures domestic services whereas the S&P gauges reflect global operations of US services firms.

ONTO MACKLEM

Bank of Canada Governor Macklem will speak before the Calgary Chamber of Commerce tomorrow at 2:10pmET to deliver the customary Economic Progress Report that follows non-MPR decisions. The speech will be available at 1:55pmET. He will then host a press conference at 3:30pmET.

I would expect him to rattle off the list of readings from inflation to wages, productivity and inflation expectations that indicate they are not done yet. Another miserable productivity report for Q2 landed just before the decision (more below), extending the long string of such reports. I would also expect him to repeat that they are making progress toward their inflation target but that they still think that durably achieving 2% lies well off into 2025.

Key, however, may be how he expands upon his interpretation of the soft patch for Canadian GDP growth over the summer. How much was transitory and how much signalled durably weakening momentum effects? How much was temporarily pulled forward? He might sound circumspect by hedging his bets and simply saying that they’ll be watching the data carefully and still have a hike bias. That would be an improvement over January, as long as he doesn’t commit to a multi-meeting holding period that prices out the still prevalent market bias toward pricing a hike.

I think the risk at the margin here is that the BoC repeats what it did in January by lowering its guard after a weak Q4 and embracing a multi-meeting pause only to see growth and inflation risk rebound. He also has to be prepared to lean against any of the Federal government’s and the provinces’ free spending ways if they should be resurrected once more in another upcoming round of Fall statements or Winter/Spring budgets. If they do, then expect a nastier bun fight with the politicians across all stripes who have been driving some of the inflation that has harmed living standards particularly for the lower- and middle-class income cohorts.

WHAT CANADIAN DATA SAID

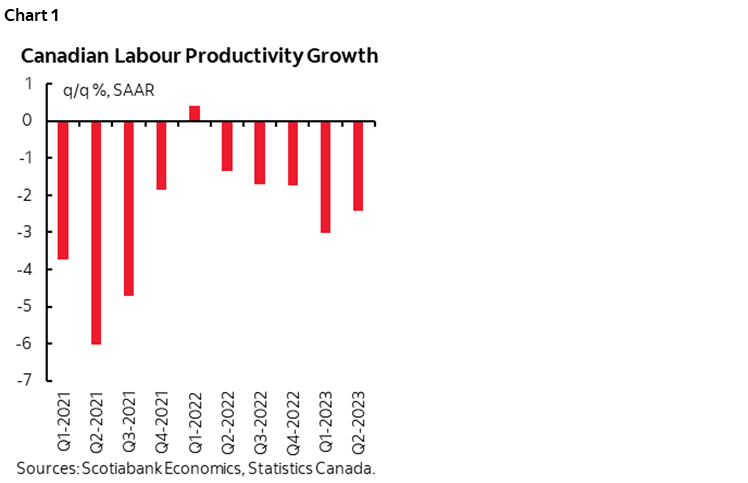

Canadian labour productivity blows again. Q2 output per hour worked fell by another 0.6% q/q SA non-annualized. That’s a tenth worse than I had estimated. It’s the fifth straight quarterly decline in a measure that has been down every quarter since 2020Q3 except for one in 2022Q1 when it was flat (chart 1). Canadians are getting paid more to produce less which is a bad combination for inflation risk.

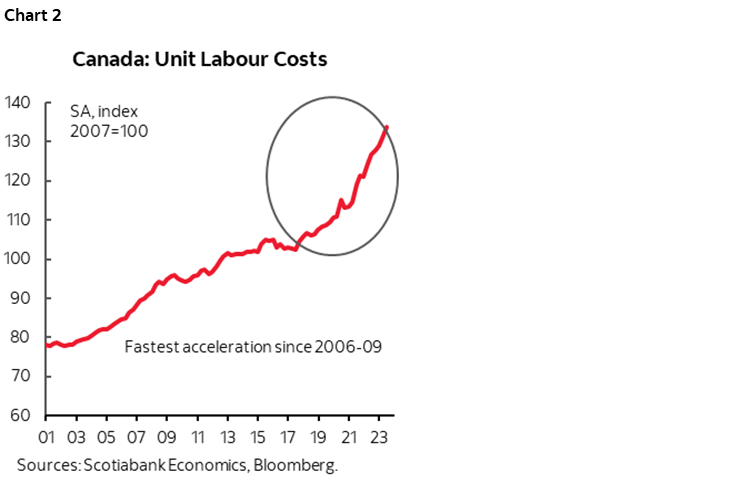

An extension of this point is that Canada posted the biggest gain in unit labour costs since 2022Q1. They were up by 2.1% q/q at a seasonally adjusted by nonannualized rate. That’s another blow to Canadian competitiveness that measures productivity-adjusted employment costs. Unit labour costs started to accelerate after 2017 but the biggest acceleration has been throughout the pandemic and it's getting worse (chart 2). ULCs have increased by over 30% since 2017 with about two-thirds of that deterioration occurring in the pandemic. This is going to hurt Canada especially relative to near-shoring winners like Mexico that have managed ULCs much more effectively.

Canada also updated trade figures for July that spoke directly to transitory effects as an added caution to the BoC not to get too fussed about the summertime soft patch. What the trade figures reinforce is that the summertime soft patch in Canada's economy was driven by big transitory distortions like wildfire and strike effects. Statcan flagged that imports that cleared BC's marine ports fell 18.5% m/m NSA for the biggest June to July drop since 2005. Exports going through BC's marine ports fell 23% m/m for the lowest since Feb 2020. Both of these effects reflect the BC port strike’s influences.

There were other influences as well. The result is that import volumes fell 4.3% m/m SA and export volumes were down 0.2% m/m. The BC port strike was likely behind the effects and hence we should look through it. Here is what Statcan said about exports:

"Although the impacts of the British Columbia marine port strike were evident in the exports of some products, declines attributable to strike activity were more than offset by increases in products less affected by this event."

Lumpy data on aircraft exports were up sharply and agricultural products were also up sharply.

On the import side the added distortion came through metals and nonmetallic minerals that was down 25.3% m/m SA. Statcan traced that primarily to lower gold transfers between financial institutions which has nothing to do with the economy.

YOUR GUARD SHOULD BE UP ON POLITICAL INTERFERENCE

Canadian Finance Minister Freeland inexplicably issued this statement after the decision, throwing her voice behind provincial premiers who have spoken out against the BoC of late. This is unhelpful and with rare precedence. I have confidence that the BoC’s Governing Council will do what’s necessary, but the optics—especially before an international audience that funds much of Canada’s open capital markets and that is on heightened alert toward global political interference in central banks—create the impression that political interference risks influencing the BoC’s decisions. If one knows one’s history on the BoC such as the Crow era, then one would unwisely assume that politicians will hold sway over the BoC. Nevertheless, the concluding line about working “to ensure that interest rates can come down as soon as possible” is not the domain of a Finance Minister. Cutting spending to drive less inflation than Federal and Provincial governments have been partly responsible for driving would be!

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.