- Nonfarm payrolls met expectations…

- ...as wage growth accelerated

- This could be the last month for weak seasonal adjustment factors to hold back jobs…

- ...as SA factors will probably turn more favourable going forward

- Governor Waller’s ensuing speech prompted wild volatility in fed funds pricing…

- ...but is much more careful and balanced than selective media headlines

- The FOMC should stick to a measured, gradual pace

- US nonfarm payrolls m/m 000s / UR %, SA, August:

- Actual: 142 / 4.2

- Scotia: 140 / 4.2

- Consensus: 165 / 4.2

- Prior: 89 / 4.3 (revised from 114 / 4.3)

US nonfarm payrolls met my expectations—and basically consensus expectations after taking account of high statistical noise. Notwithstanding modest revisions, headlines about how they disappointed are a bit absurd in recognition of the 90% +/-130k confidence interval around the estimates.

Payrolls were up by 142k alongside negative revisions of 86k over the prior two months with –29k of that affecting July’s initial estimate. Such a small revision to July has little effect on August’s jumping off point.

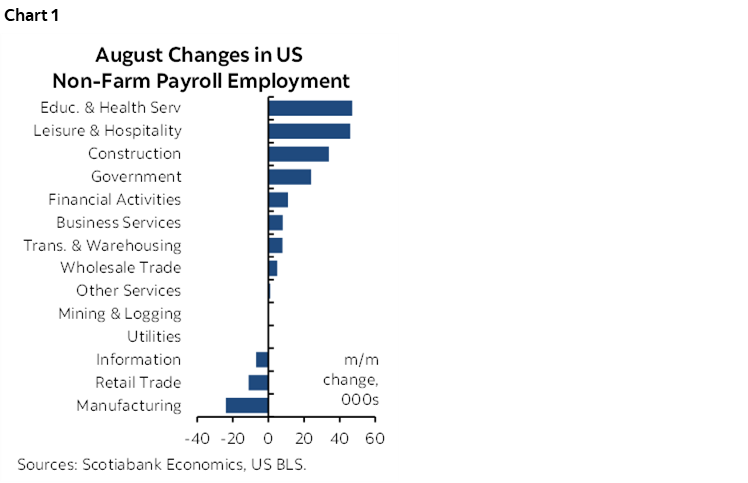

Payrolls were up modestly because of three main sectors (chart 1): US health/social assistance was up another 44k, leisure hospitality was up another 46k, and government added another 24k. There was not much breadth beyond that.

The companion household survey saw a job gain of 168k that exceeded the 120k rise in the size of the labour force that was slower than the reported 420k rise in the LF during July. This met expectations for how the unemployment rate would dip as job gains exceeded new entrants.

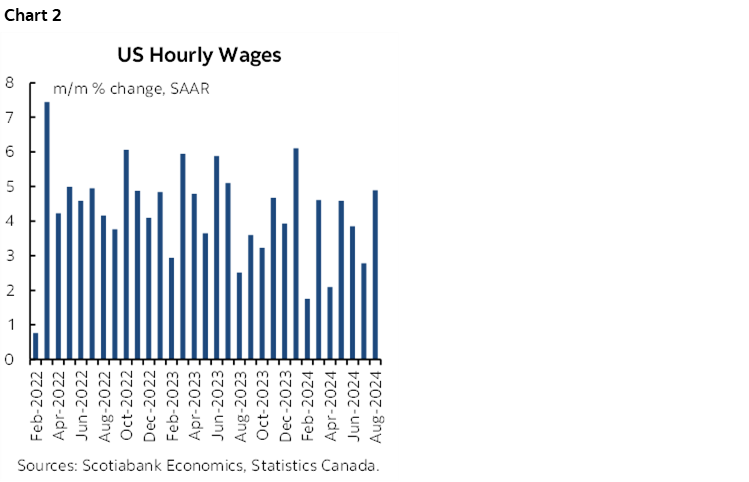

Wage growth was stronger than expected (chart 2). Wages were up by 0.4% m/m SA in the US which was higher than all estimates. That works out to 4.9% m/m at a seasonally adjusted and annualized rate. The three-month moving average now sits at 3.8% m/m SAAR.

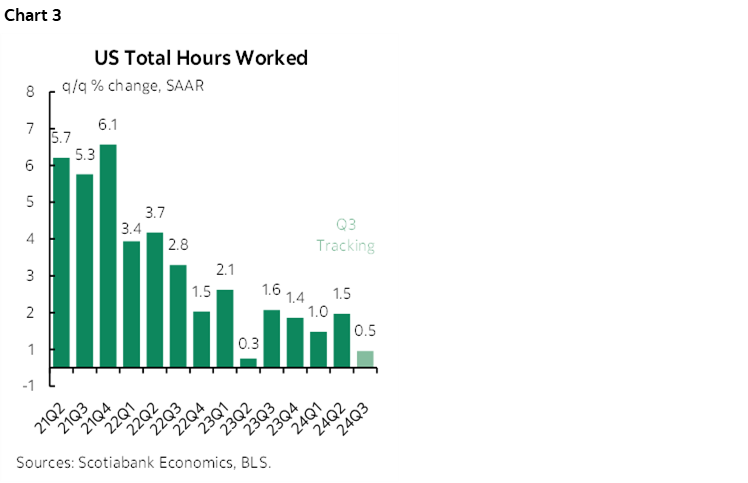

Hours worked were up by 0.3% m/m SA which reverses the prior month’s similarly sized drop. That gives Q3 hours working tracking a modest rise of 0.5% q/q SAAR (chart 3) which leaves Q3 GDP growth more dependent upon productivity gains since GDP is an identity defined as hours worked in aggregate times labour productivity with the latter defined as real GDP divided by hours.

SEASONALS ABOUT TO TURN HIGHER?

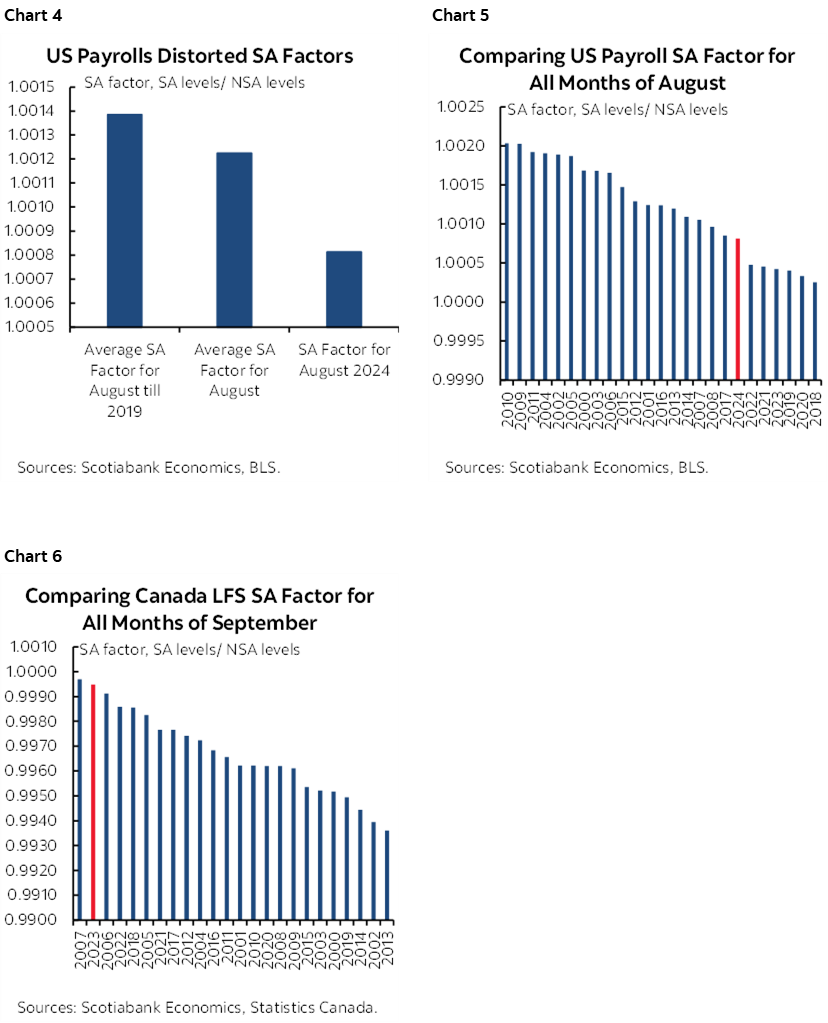

Be careful here. This August’s seasonal adjustment factor was also lower than past like months of August which extends the multi-month pattern (charts 4, 5). Chart 6 shows that the past couple of years have seen the September SA factor become among the strongest compared to like months in history; if that repeats next month, then altered seasonal adjustments compared to pre-pandemic adjustments could buoy payrolls by tamping down the NSA gain to a lesser extent than over recent months.

IMPLICATIONS FOR THE FEDERAL RESERVE

In my opinion, nothing screams out from the overall set of numbers that the Fed should be in panic mode and feeling a rush to upsize. The first cut shouldn’t be the deepest in this case. The US economy remains in excess demand. Wage pressures remain significant. Tariffs—if employed—risk first-round inflationary effects and we’ll be in a better position to judge this risk after the November 5th Presidential election. Ditto for high risks to US immigration policy that is tightening in the waning days of the Biden administration, and could massively tighten if Trump wins. Supply chains remain fragile. I think all of that says be careful in the opening salvos; the minute you cut –50bps once, you’ll be pushed much faster.

This is why I’m skeptical toward what Chicago Fed President Goolsbee says in reference to how policy tightens with each month of passive Fed policy and low inflation. He should craft his arguments in a forward-looking sense by invoking inflation expectations rather than using last month’s data. Doing so should give at best very modest confidence—if any– in the ability to forecast inflation in future especially in light of the fact that the Fed simply isn’t credible in its attempts at doing just that.

Enter Governor Waller’s remarks (here). Selective interpretations of his remarks sparked high volatility in fed funds futures when the headlines landed. Those headlines made it sound like Waller is leaning toward upsizing cuts at the September meeting which drove pricing for this month’s decision close to a full –50bps in their immediate aftermath before swinging around in the other direction toward –31bps or so and hence closer to a quarter point cut. I would strongly recommend reading his full speech. It is much more balanced and careful than the headlines.

The tricky thing for the FOMC is that they go into communications blackout tomorrow ahead of the September 18th communications and we’re only hearing snippets from a small minority of officials in the aftermath of the report who may not be representative.

We get CPI next Tuesday with widespread expectations it will land at 0.2% m/m SA on core and with nowcasts around the same. If it surprises and/or if Chair Powell and the FOMC have a problem with where markets are pricing, then that could resurrect the possibility of using clandestine ways of communicating with markets through story plants. Powell never wanted to surprise markets on game day on the way up or the shift sideways, but is he still of that mindset? He has said a couple of times that the path going forward would involve less hand holding.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.