- Jobs rebounded, quirks remain

- Solid growth in hours worked favours a rebound from transitory shocks

- The BoC claimed too much credit for dampening growth vs. transitory factors

- Wage growth is off the charts…

- ...which is great in the short term...

- …but is generating unsustainable imbalances

- ...as productivity tumbles, population soars

- CDN jobs m/m 000s // unemployment rate %, August, SA:

- Actual: 39.9 / 5.5

- Scotia: 35 / 5.5

- Consensus: 20 / 5.6

- Prior: -6.6 / 5.5

While the rebound in employment matched my expectations and hours worked offer a robust signal, I’m stunned by the wage figures. The shorter-term picture for the job market and economy is pointing toward a rebound from transitory shocks, but the skies are darkening over the outlook for the job market into next year. Summary details are in the table above and chart 1.

HOURS WORKED SPELL REEEEEBOUND!

I continue to think that the BoC put too much stock in its view that GDP has been soft because higher interest rates are working and too little emphasis upon the role of transitory factors.

As evidence, I’d point to the fact that hours worked were up by 1.8% q/q at a seasonally adjusted and annualized rate (SAAR) in Q2 and are tracking another gain of 1.6% (chart 2). Since GDP is an identity defined as hours times labour productivity, this suggests there is underlying momentum in the economy excluding these shock effects. Employers are willing to pay workers for more hours and workers are willing to provide them.

A hit to productivity in Q2 dragged GDP growth down as an offset to hours, but why? At least some of that was due to disruptions to activity readings because of widespread effects of wildfires, strikes galore, abnormal weather etc. I still think that absent such shocks, GDP growth would have been in the ballpark of 2% and July would have been stronger.

Taking this one step further, it’s very debatable that the Governor should have pinned average <1% q/q SAAR GDP growth over the past three quarters on the effects of higher interest rates and done his partial victory lap yesterday. This whole period has been hit by unusual shocks. In Q4 of last year, Canada was hit by the biggest inventory drawdown in over 40 years that knocked multiple percentage points off of growth as supply chains continued to struggle. Yeah, that was rates was it. Good one. The shut down to the Keystone pipeline due to problems south of the border, a couple of train derailments, and worse than usual weather into the key holiday shopping and travel season also temporarily weighed on Q4. All of that was rates too. Q1 rebounded from these distortions, and then the aforementioned distortions in Q2 took over again with significant negative effects on consumers and housing. Isn’t it amazing that when inflation is ripping in the early stages it’s transitory, but when growth is severely disrupted by shocks and you’re trying to convince Canadians that monetary policy is working suddenly nothing’s transitory. Pfft.

In my view, the Governor should have leaned more toward transitory factors weighing on growth and stirring volatility in the numbers first, the effects of tighter monetary policy second. Instead, he did the opposite, and the BoC’s communications may be vulnerable to a potential rebound or at least a further need to control for other shocks having little to do with rates. It’s inconsistent to believe that much of the lagging effect of tighter monetary policy lies ahead, but by gosh it walloped growth over the past year.

ENJOY HIGHER PAY, FOR NOW

After a gain of 11.3% m/m at a seasonally adjusted and annualized rate of increase in July, the average hourly wage of permanent employees went up by another 10.9% in August (chart 3).

Let’s start with the positive. Good for you. And you and you and you. You too. That supports the economy in the near-term. It supports the consumer sector and housing market relative to the absence of such pay gains. A rebound in employment accompanied by solid gains in hours worked and strong pay gains supports an economic rebound narrative in the short-term.

But we also need to have a frank discussion about the risks posed by such wage gains. While it’s easy to understand why Canadians welcome such pay hikes given sundry pressures on household finances, over time, such gains need to be backed by productivity growth. When that’s not the case, imbalances arise. I’m sorry but that’s just economics 101.

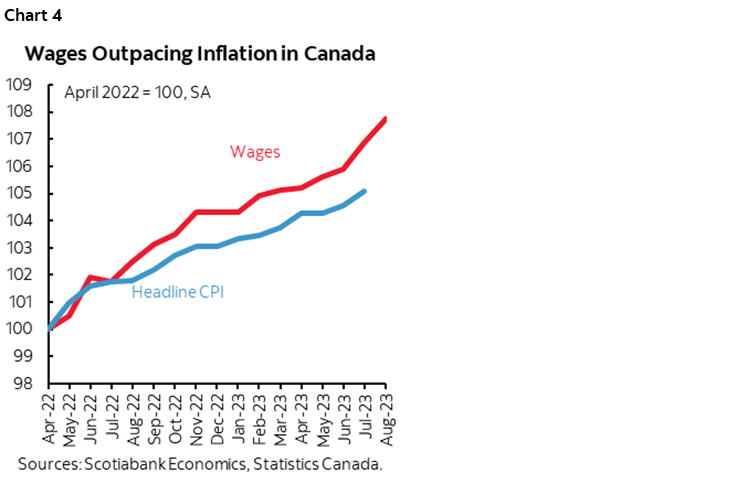

Enter chart 4. Wage gains have been about much more than just keeping up with inflation over the past year, a period of time over which wages have been significantly outpacing inflation and at a recently escalating rate of divergence. True, this is reversing the prior drop in real wages as nominal wage growth was outpaced in inflation. But Canadians cannot sustainably get paid more for years to come just because inflation was nasty to them in the past. There has to be a sounder motive.

That sounder motive has to be productivity. Chart 5 shows that rapid wage gains are not occurring because folks are more productive. Output per hour worked has been in freefall.

Furthermore, unit labour costs (productivity-adjusted employment costs) are skyrocketing in Canada (chart 6). That’s not just occurring during the era of high and volatile inflation. Pay has been outpacing productivity in Canada for years. ULCs started to rise after 2017 and have gone practically vertical in the pandemic.

So what? Well, the so what factor is that at some point we face one or both of two choices. One choice is that monetary policy needs to tighten further to counter escalating risk of second-round pressures on inflation emanating from labour markets. This is one reason why I don’t think one should be so confident that hikes are over.

Another choice is that even with a solid starting point for corporate finances, c-suites are going to be forced to address this. More pay for less work is a dent to profit margins and c-suites have a fiduciary duty to their shareholders to do something about it. Given that the outlook for revenues in an economy facing lagging effects of rate hikes is probably not great, there is likely to be rising pressure upon companies to reduce head counts. That may be an unwelcome message, but there is a job to be gone here in cautioning about what may lie ahead if these developments don’t improve very soon.

What complicates the picture is surging immigration. The 15+ population was up by another astounding 103k in August over July. Labour market risks into Canada need to be monitored very carefully given the interactions between wages, productivity and surging population.

DETAILS

What’s under the hood in the job details offers up further perspectives. Two big effects of questionable quality probably cancelled each other out. They were a surge in self-employed versus a plunge in education sector employment.

First up is that after a -6.6k flea bite in July, employment roared back with a gain of about 40k in August. Details were mixed in terms of what drove this gain.

By province, the gain was led by Alberta, Quebec and BC as Ontario slipped a touch and all others were little changed.

Almost all of the gain was in full-time jobs (+32k) as part-time jobs were up by a milder 8k.

The self-employed category drove most of the gain with about a 50k rise. Self-employed jobs are valuable in many respects especially in a country like Canada given the composition of its labour market and business community. But this is the softest of the soft data that relies fully upon self-disclosure and no cross checks. When so much of a report is driven by this component it raises justified skepticism.

Private payroll jobs fell by 23k. That concerns me more. Public sector jobs were up 13k but the public administration component was flat (-3k) after a 17k drop the prior month if we believe the LFS.

Chart 7 shows the change by sector. Service sector jobs were up 42k as goods employment was little changed (-2.5k). Within goods, a large rebound in construction employment (+34k) reversed the prior month’s loss and I still think this reflects weather distortions from July’s record wetness in key parts of the economy toward a rebound in August. Offsetting this, however, was a 30k drop in manufacturing jobs and a milder 11k decline in employment in the agricultural sector with a small rise in natural resources (5k).

The large gain in service sector employment was driven by 52k more jobs in the professional/scientific/technical services category that includes everything from tech workers to accountants, lawyers and other professions. A 21k gain in ‘other’ services added to the headline job tally. Milder gains were booked in transportation and warehousing (13k), wholesale and retail trade (8k) and business building and support services (8k).

There were two main offsets in services, however, and I don’t trust one of them. Educational services shed 44k jobs. Be careful with this figure when transitioning toward a new school year. Here’s what Statcan had to say:

“During the summer months, changes in seasonally adjusted employment estimates for this industry can be affected by slight variations in the timing of when school-year contracts for temporary employees end and begin.”

In other words, ignore it. Probably didn’t happen.

But there was also a 16k drop in employment within the Finance, Insurance, real estate, rental and leasing category.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.