SEEING RED, SIGNALLING MORE

- Canada’s federal Finance Minister tabled her Fall Economic Statement on November 21st.

- The update paints a picture of waning economic activity and with it, dwindling revenue expectations over the horizon. Economic and fiscal developments since last March’s budget are expected to drive a further deterioration of $19 bn in budget needs between FY24 and FY28.

- The government meanwhile folds in an additional $21 bn in net new measures (FY24–29) broadly in line with expectations. The bulk of this reflects previously announced industrial supports ($8.5 bn) and the GST waiver for rental housing ($4.6 bn).

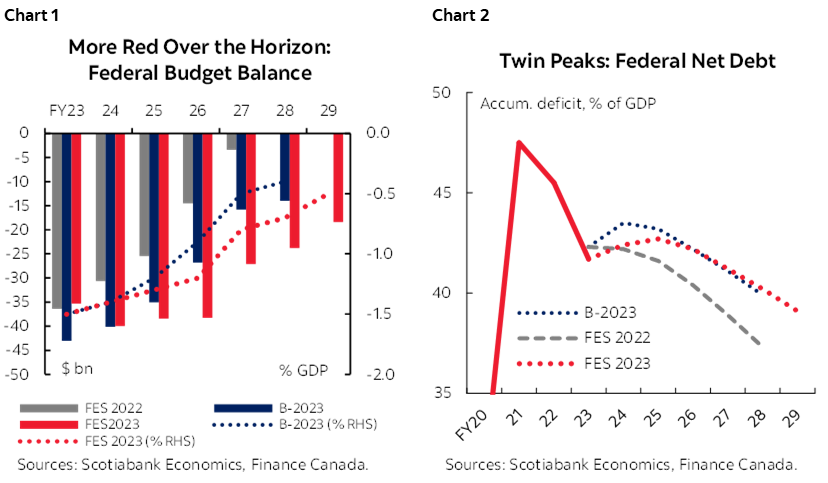

- The net impact sees deficit spending largely moving sideways over the next couple of years before resuming its downward descent in the latter part of the decade (chart 1).

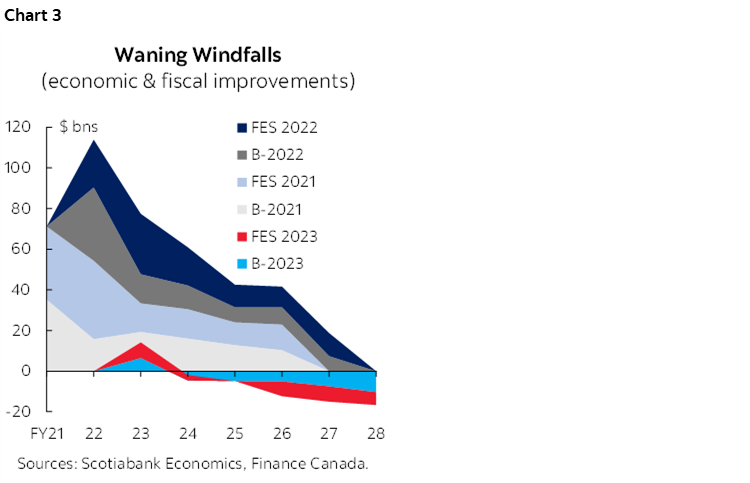

- The starting point for net debt looks better—about a percentage point lower in FY24 at 42.4% of GDP—but its peak has been pushed out one more year to FY25 before pivoting back down (chart 2).

- The government has added a few new ‘anchors’ over the horizon—including keeping deficits below 1% beyond FY26—but fade anything beyond this as Canada would have a new mandate or new government by then. If anything, the update signals a comfort with persistent modest deficit spending (if there was any lingering doubt).

- New near-term demand measures are limited and shouldn’t change the incremental outlook for inflation, interest rates, and the economy. Government spending still in the pipeline compounds an uncertain—but certainly bumpy—path ahead for inflation.

- Markets may have breathed a sigh of relief with a softer inflation print released earlier in the day, but the Governor is likely still holding his breath for a few more data points to confirm the trend—and for households and businesses to believe it.

- He’s now got one more data point on government spending. It shouldn’t surprise him, but it likely unsettles him.

WANING TAILWINDS

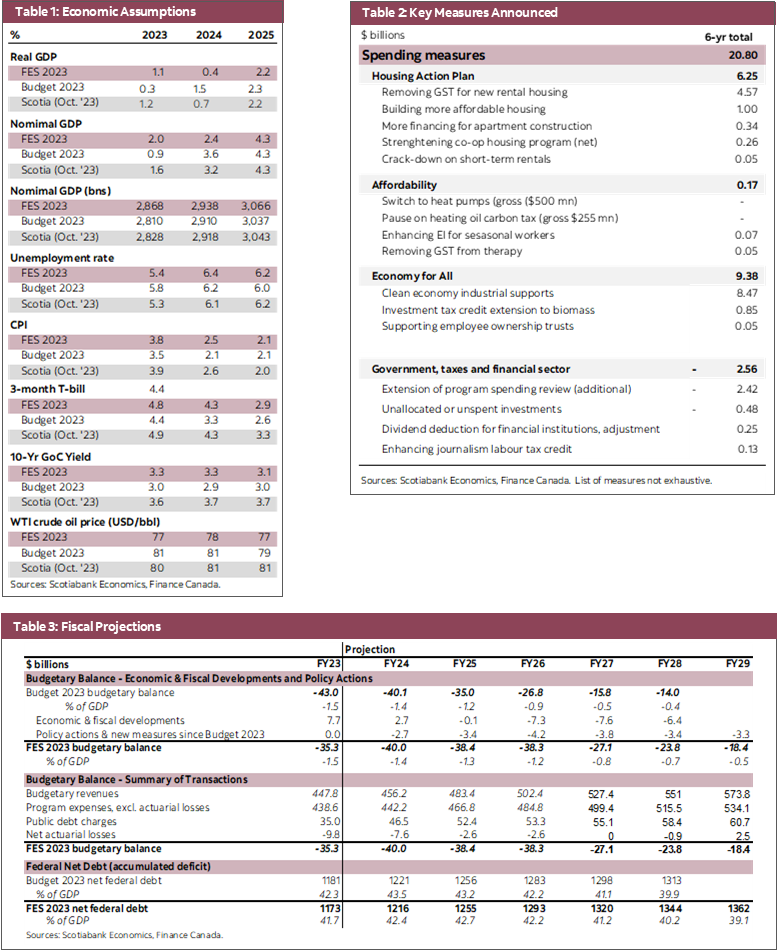

Canada’s federal Finance Minister delivered another economic and fiscal update amidst heightened uncertainty. The narrative points to persistent inflation and elevated interest rates exacerbating affordability challenges for Canadians, while geopolitical tensions endure. Despite private sector forecasters—whose collective outlook establishes the baseline—materially revising up their outlook for interest rates since the winter budget, the expected path for nominal output remains largely in tact as businesses and households have so far withstood multiple headwinds in this slowdown (table 1, back).

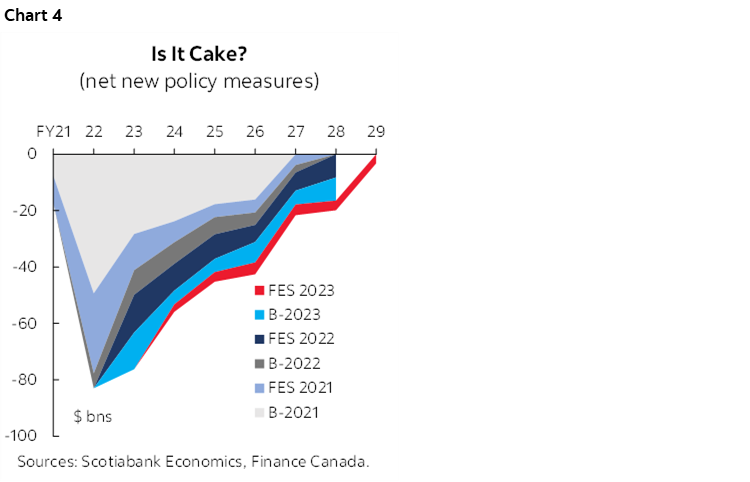

Fiscal windfalls are increasingly a relic of the early pandemic days. Last year (FY23) yielded an $8 bn improvement to the bottom line relative to expectations at budget time, owing in part to decent labour market strength and robust corporate income tax revenue. Looking ahead, the sharper-than-anticipated slowdown underway this year weighs on the near-term fiscal outlook, reflected in sideways revenue collection in the early months of the year. Gains from the stronger FY23 handoff are mostly eroded over the medium term with a $18.7 bn net deterioration in economic and fiscal developments between FY24–28 (chart 3).

JUST ONE MORE BITE

The update folds in another $20.8 bn (0.75% of GDP) in net new spending over the planning horizon. Most of this had been signaled in the months, weeks, and days ahead of the update so there were few surprises by the time the actual document landed. More generally, fiscal activism at the federal level is nothing new (chart 4).

The lions’ share of new spending comes from industrials supports for EV and battery chain production. These earlier-announced intentions amount to $8.5 bn over the horizon. The update also extends (eventual) investment tax credits to cover biomass projects ($850 mn). The update announces that the Canada Growth Fund will be the principle entity issuing carbon contracts for difference and will allocate up to $7 bn (of its $15 bn capital) to this end. While details on the CCUS tax credit had been anticipated in this update, these will only come later. A timeline for execution for a host of transition-related legislation is provided.

Housing featured also prominently with another $6.2 bn over the horizon. The earlier-announced GST waiver on rental housing was costed at $4.6 bn, while another $1 bn was allocated towards social housing. The government elaborated on plans to raise low-cost rental financing with a $20 bn increase in Canada Mortgage Bond (CMB) issuance, indicating the government will purchase up to $30 bn annually in CMBs (walking back from earlier intentions to possibly fold the program into regular Government of Canada bond issuance). It also plans to develop a Canadian Mortgage Charter to support Canadian homeowners renewing into higher interest rate environments (even as the biggest vulnerabilities are felt among non-home owners).

There is little else (from an immediate fiscal perspective) in the update. Earlier-announced heat pump incentives are sourced from existing resources. The update expands the government program spending review to yield an additional $2.4 bn over six years. See table 2, back for a detailed list of measures.

LETTING THE GUARD(RAILS) DOWN...AND PUTTING MORE UP

The slope and shape of the deficit path change modestly. Little change is expected this year (-$40 bn, 1.4% of GDP in FY24) but shortfalls largely move sideways through FY26, declining modestly only as a share of GDP (table 3, back). About 0.3 ppts are added to deficit projections over the medium term relative to budget forecasts, landing at -0.5% of GDP by FY29 (table 3, back).

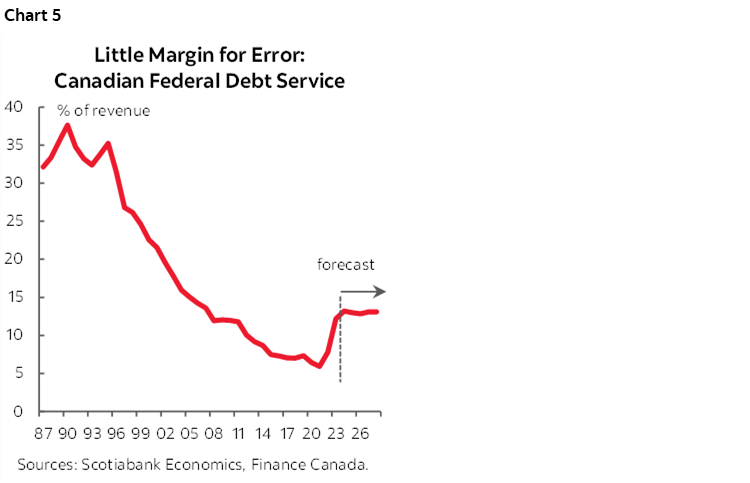

The trajectory for net debt benefits from a lower starting point but it is now on a two-year ascent before it is expected to reverse course. Net debt in FY24 is expected to land a full percentage point lower than budget forecasts (at 42.4% of GDP) but above last year’s 41.7%. The expected peak is now FY25 (at 42.7%) before climbing back down to 39.1% by FY29. Elevated debt charges against higher-than-anticipated rates across all maturities should knock some complacency out of running persistent deficits, with the best-guess base case seeing debt charges leveling off over the medium term (chart 5). This leaves little margin for error especially as private sector forecasts for the 10 year GoC may be sanguine.

While again breaching its earlier fiscal anchor—loosely interpreted to mean declining debt as a share of GDP—this update introduces some new ones. The new guiding posts are four-fold: maintain FY24 deficit spending inline with the Budget 2023 outlook; lower the FY25 debt ratio relative to this update and keep it declining thereafter; maintain declining deficits (as a share of GDP) in FY25 and beyond; and keep deficits below 1% of GDP in FY27 and beyond. First, fade anything beyond next year as election risk is high. And if downside scenarios materialise, assume all anchors are abandoned. Finally, if anything, these reaffirm the government’s comfort with running modest deficits into perpetuity.

The government has adjusted its borrowing plan to reflect recent developments. Planned bond issuance has been revised up by $32 bn in FY24 (to $204 bn). While no details are provided, non-budgetary items drive the uptick. New issuance focuses on both short (2-year) and long bond (10 year+) sectors. The update announces $4 bn in green bond issuance.

PUTTING OFF THE TOUGHER QUESTIONS

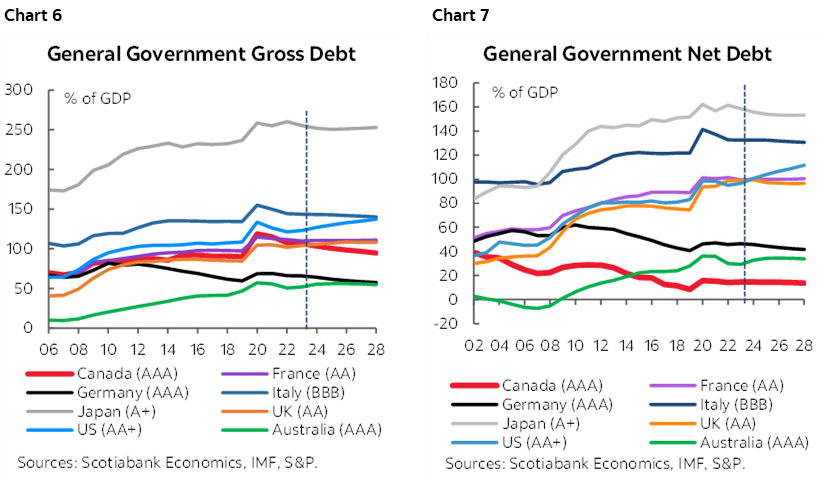

Canada needs a more fulsome and informed debate on its fiscal future. While Canada’s government debt—general or federal, net or gross—is pretty good and its deficits relatively small plotted against peers (charts 6 & 7), it risks complacency that could harbour vulnerabilities over time. Global interest rate uncertainty aside, Canada doesn’t have the buffer and higher market risk tolerance of reserve-currency countries. Assessments of Canada’s long run fiscal sustainability are also predicated on a cooperative fiscal arrangement in a system where subnational debt levels (unequally) rival federal liabilities, but revenue levers dwindle with each level down. Once seemingly-untouchable public pension assets offset about a fifth of general government gross debt. These assumptions are showing signs of strain.

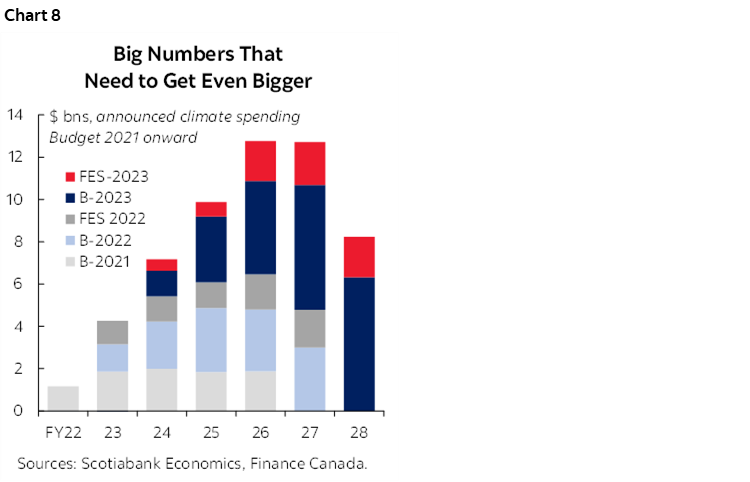

Superficial discourse on Canada’s fiscal position also puts the green transition at risk. Canada has made substantial downpayments on the green transition, including ones enumerated in this update, but it still has a long way to go. A framework that makes little distinction between spending that fuels today’s consumption versus investments that drive higher productivity and more sustainable growth tomorrow risks undermining the latter if the former is proliferate. We estimate about a tenth of incremental pandemic-era investments in FY24, for example, targets the transition (chart 8).

The good news is that these pledges in isolation put the federal government broadly in line with projected needs under its net zero commitments. Less reassuring, it still has to get this money out the door in a manner that delivers results and crowds in provinces and the private sector (and this update mostly stalled on implementation details). The government then not only has to replenish these financing commitments, but likely has to treble them by mid-century to be consistent with its transition ambitions.

This means there will need to be a societal consensus, if not resignation, that multibillion dollar climate announcements become the norm. Fiscal restraint in other areas increases those odds. Delivery of results, even more so. Transparency should be a given.

THE HORSE HAS ALREADY LEFT THE BARN

Near-term demand-inducing measures are limited in the update, but the system is already well-primed. Fiscal layering has added on about $60 bn in new federal measures in FY24 alone. Direct to households, grocery rebates and prepayments of the Canada Worker Benefit injected more than $3 bn into the Canadian economy this summer, while central Canada stands to see another billion before the (fiscal) year-end between the extension of the gas and fuel tax cuts in Ontario and the benefits indexation in Quebec. More than half the provinces have yet to weigh in this Fall.

The update shouldn’t incrementally change the outlook, but government spending represents a fat tail risk to inflation projections. The Bank of Canada has been increasingly vocal in its unease with government spending projected to average 2.5% through 2024, above the economy’s speed limit. Lagged effects of interest rates—including further real-term tightening—should otherwise bring the economy closer to balance over this horizon (and even open a bit of slack), but confidence levels around the many moving pieces are wide.

Markets may have breathed a sigh of relief with a softer inflation print released earlier in the day, but the Governor is likely still holding his breath for a few more data points to confirm the trend—and for households and businesses to believe it. He’s now got one more data point on government spending. It shouldn’t surprise him, but it likely unsettles him.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.