- As Canadian provinces unveil their mid-year economic and fiscal updates, we will get a peek at their fiscal positions amid stalling growth, persistent inflation and rapid population growth.

- The macro backdrop is challenging but remains constructive. Some provinces could expect limited revenue upside from resilient labour markets, surging population and well-supported energy prices.

- Though likely modest, it is inevitable that expenditures will rise in response to escalating concerns such as housing affordability, wage negotiations and natural disasters, as confirmed by the first-quarter updates.

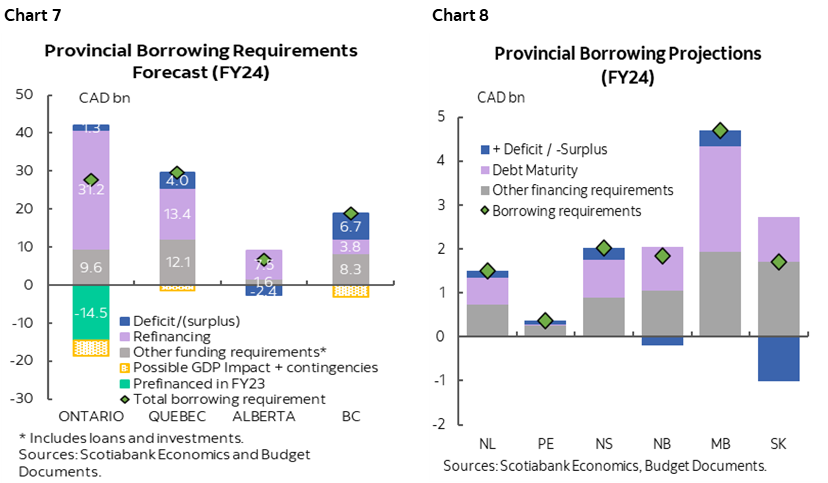

- Current-year (FY24) borrowing should remain stable relative to previous forecasts, given that changes in fiscal positions are anticipated to be modest and unlikely to lead to a material increase in financing needs, the bulk of which come from repaying maturing debt and capital spending.

- With a dimmer outlook in the following fiscal year, mounting spending pressures, and an uncertain interest rate environment, provinces should prioritize preserving fiscal room in light of heightened uncertainty. We will be looking for signs of fiscal prudence in the upcoming fall updates. This is likely the best course of action provinces can take on their parts to reduce uncertainty.

FY23 PUBLIC ACCOUNTS BRING MIXED RESULTS

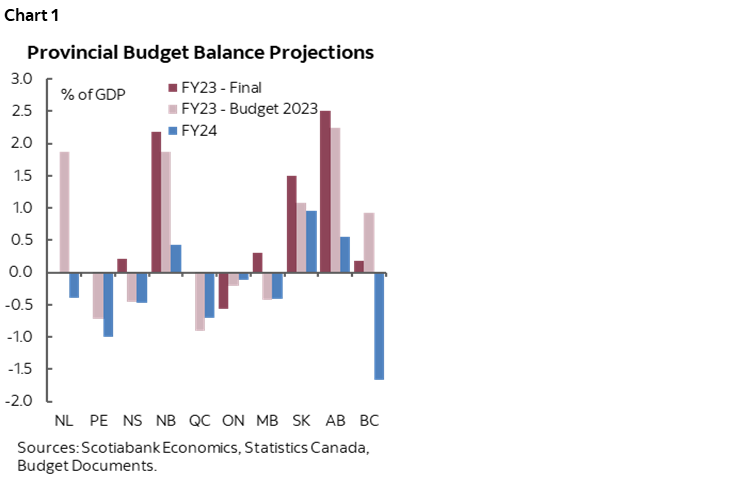

Provincial governments have embarked on a collective path of consolidation, but mounting fiscal pressures loom on the horizon—a trend that is expected to become more evident with the release of their mid-year updates this month. The FY23 public accounts revealed large downward revisions in Ontario and BC’s bottom lines as a result of lower tax reassessments relating to prior years, which further weigh on revenue outlook given softer starting points (chart 1). Other provinces benefited from better-than-expected economic growth and prudent fiscal planning, reporting stronger results than previously estimated. Saskatchewan, Alberta and New Brunswick ended the fiscal year with larger surpluses, while Nova Scotia and Manitoba surprised with a return to a balanced book in FY23.

REVENUE: LIMITED UPSIDE, PLENTY OF DOWNSIDE

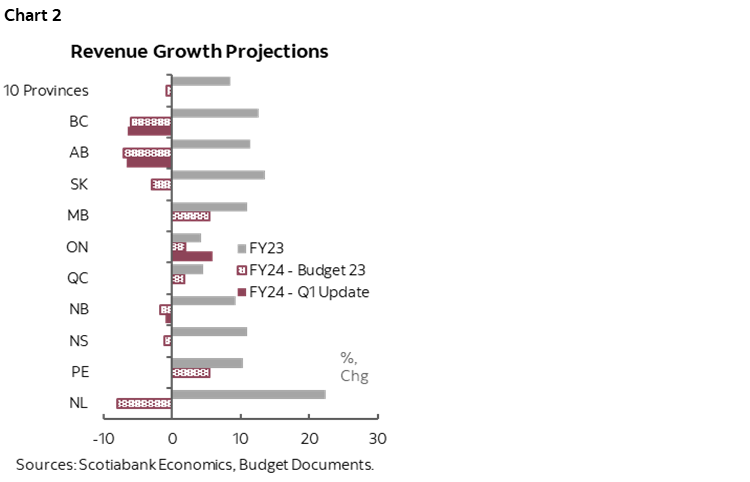

In FY24, strong headwinds on revenue drive a deterioration in provinces’ finances (chart 2), but certain provinces can still find some potential upside thanks to resilient labour markets, surging population and well-supported energy prices. Budget 2023 foresaw a slight dip in aggregated revenue for FY24, following an impressive 8.5% growth in the previous fiscal year. While we anticipate some revisions in revenue projections in the upcoming mid-year updates, the overall impact could be fairly neutral. The first-quarter updates released to date have modestly improved revenue forecasts for New Brunswick and Alberta but BC’s revenue projection has seen significant downward revision, primarily due to reduced natural gas royalties.

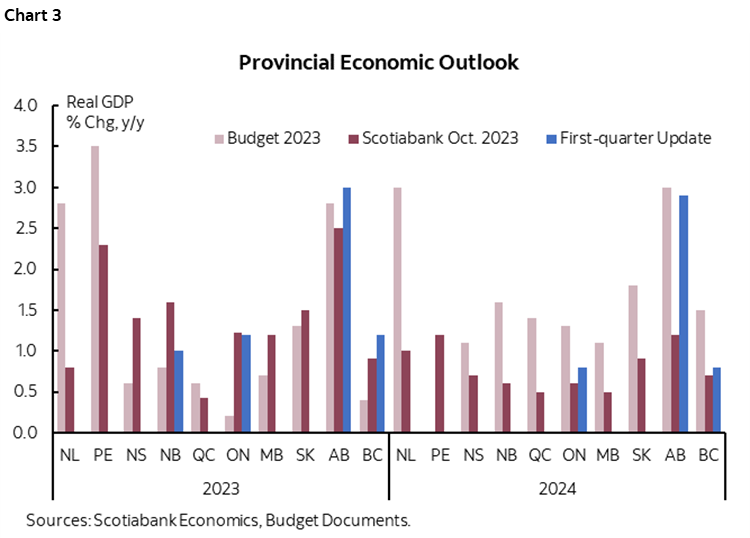

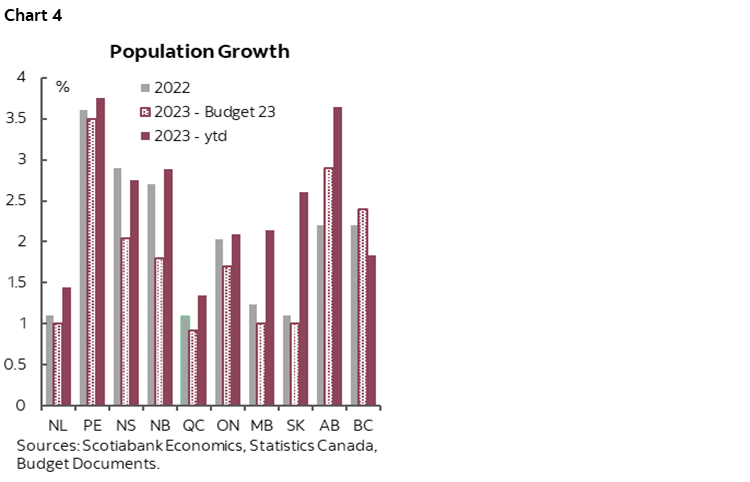

Heightened uncertainty underscores the importance of prudent growth assumptions. A stronger start to the year, combined with a delayed slowdown implies a slightly stronger growth profile in 2023 and a weaker outlook for 2024 than assumed at budget time (chart 3). As a result, the growth assumptions underpinning the latest forecast lean towards the conservative side for 2023 and may warrant further upgrades, but a downward revision in 2024 growth is inevitable and will offset some potential revenue gains. While labour markets have displayed remarkable resilience, bolstering government revenues thus far, income growth is anticipated to decelerate as labour market conditions soften, weighing on tax revenues. Population growth is set to exceed last year’s record high and contribute positively to provinces’ finances this year (chart 4). Provinces that largely underestimated 2023 population growth could expect some upside in the tax base. However, on a per capita basis, revenue is projected to contract by -2% in FY24 according to the latest estimates as economic activity slows.

Oil-producing provinces will likely face weaker-than-anticipated resource revenue at mid-year given the optimistic oil price assumptions that underpinned the budgets, but the recent rally in crude values and a narrower light-heavy differential suggest potential revenue upside. Oil prices have been facing headwinds for the most part of the year from a bleaker global outlook that could dent fuel demand. WTI price was trending around US$75/bbl before starting to move higher following Saudi Arabia and Russia’s effort to support oil prices through voluntary production cuts. As supply-side politics remain in the driver’s seat for the rest of the year, combined with a potential escalation of conflict in the Middle East, firmer oil prices leave room for upside but with high volatility. Alberta revised its WTI price assumption down from US$79/bbl to US$75/bbl for FY24, slightly below the current market pricing and Scotiabank GBM’s forecast for the fiscal year, signalling prudent planning given the high sensitivity to oil prices. As a rule of thumb, 1 USD/bbl is linked with a net fiscal impact of $630mn for Alberta. A similar downward revision could lead to a reduction of -$60mn (-1.8%) in royalties for Saskatchewan. Despite crude prices being a wildcard, the completion of the Trans Mountain Pipeline Expansion (TMX) in early 2024 will boost egress for Alberta, keeping light-heavy differentials tight, which bodes well for industry profitability and government revenues. BC’s resource revenue forecast saw a $1.2bn drop due to a downward revision in natural gas price assumptions, accounting for half of the additional deficit projected in FY24. The current price forecast errs on the side of caution and leaves from for improvement.

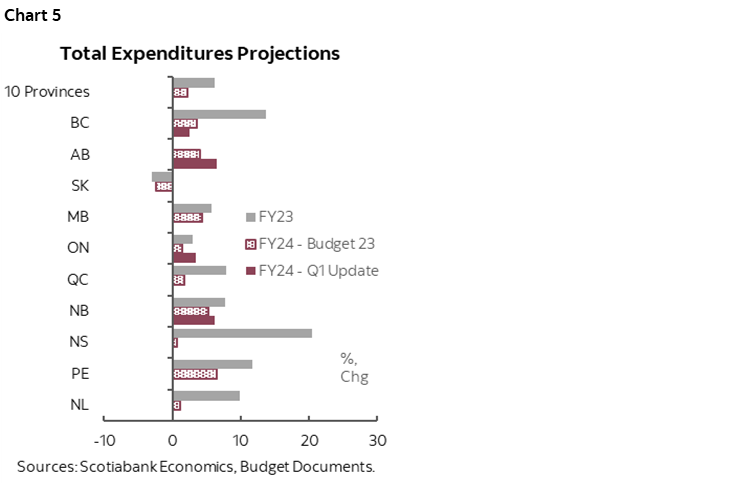

EXPENDITURES: CONTINUED RESTRAINT WITH UPWARD PRESSURE

Provinces will find it increasingly difficult to rein in spending. While spending growth is expected to taper off in FY24 and restraint should continue in the upcoming fall updates, heightened expenditures could be expected in response to worsening housing affordability, wage negotiations and wildfires, as confirmed by the first-quarter updates (chart 5). Notably, wildfire costs in Alberta amounted to an estimated $980mn in Alberta and $762mn in BC, with the potential for even higher costs in Quebec due to a more extensive impact area. BC has seen large spending increases due to wage settlements, surpassing budgeted levels by +4.5%, offering a glimpse into the trends expected in the fall updates. Provinces have all bolstered healthcare spending in their 2023 budgets, partly offset by additional funding from federal-provincial healthcare agreements, and will likely continue adjusting healthcare spending upwards to address the current challenges, with additional pressure stemming from the population surge. Furthermore, some provinces are expected to follow the federal government’s lead in announcing tax changes aimed at spurring rental construction.

Some provinces might adjust their debt service cost projections upward due to a higher-than-anticipated interest rate trajectory, but the scale should be limited due to the longer-term nature of their debt structures. The rise in debt servicing costs does not currently pose a significant risk to provincial finances. In their latest projections, provinces anticipate the debt service ratio to peak at around 6% in FY24, which remains below the 7–8% range observed in the decade preceding the pandemic.

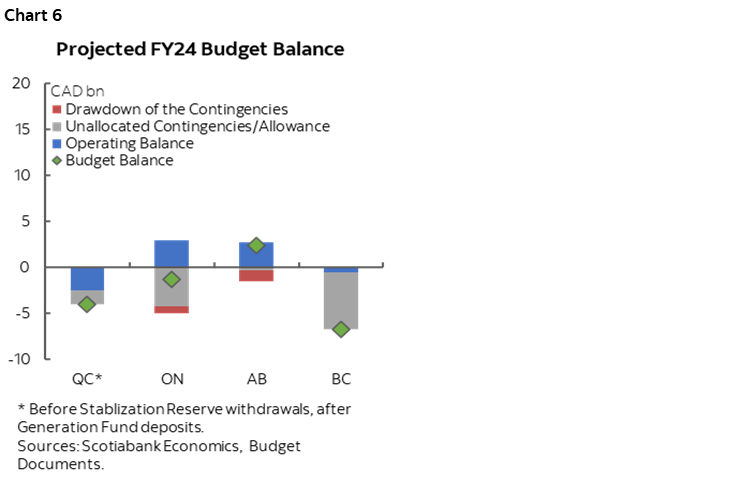

The largest four provinces, along with Manitoba have planned ample contingencies at the time of budget, a prudent move that has proven prescient in light of unforeseen natural disasters and factors menacing revenue sources. Provinces have largely drawn upon these financial buffers at mid-year (chart 6). Ontario, for example, depleted 20% of its contingency fund, primarily to cover increased outlays in manufacturing land development. Wildfire-related expenses drained over three-quarters of Alberta’s contingency fund by the first quarter. Quebec will likely see its contingency fund entirely consumed by wildfire costs. BC earmarked the most substantial financial buffer, including $1.0bn in the Pandemic Recovery, $2.2bn in Shared Recovery Mandate, and $2.3bn allocated to General Programs, CleanBC and Climate & Emergency Response, which should help absorb the mounting costs of government services and offer potential upside.

STABLE SUPPLY ANTICIPATED

Updates in fiscal position may result in minor adjustments to provinces’ borrowing requirements, but current-year borrowing should remain relatively stable as the bulk of financing needs come from maturing debt and investments. In the largest four provinces, unallocated contingencies and revenue upside could reduce supply (chart 7). However, as previously noted, the potential upside is limited and unlikely to lead to a material increase in financing needs. Beyond the largest four provinces, nearly half of the financing needs are attributed to refinancing, with the operating balance accounting for a small portion of the rest (chart 8). While a potential increase in program spending could drive higher borrowing needs, the overall impact should be modest. Additionally, as in previous years, construction delays in capital projects could lead to a reduction in financing requirements.

Provinces would be best to ride-out renewed uncertainty. Slim economic updates that avoid—or at least minimise—major new spending would be consistent with economies operating more or less at capacity and inflation still uncomfortably persistent. Long-dated debt structures, tight provincial spreads, and generally improving fiscal books should put provinces in good stead to weather any turbulence. There is also uncertainty around the future of Canadian Mortgage Bonds (CMBs)—considered a proxy for provincial bonds—that could impact the market. There are also ample other sources of potential exogenous shocks to global bond markets that would feed through to provinces anyway. Why risk adding another by layering on more spending at this time?

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.