CHARTING A COURSE TO RECOVERY AS THE SECOND WAVE RAGES

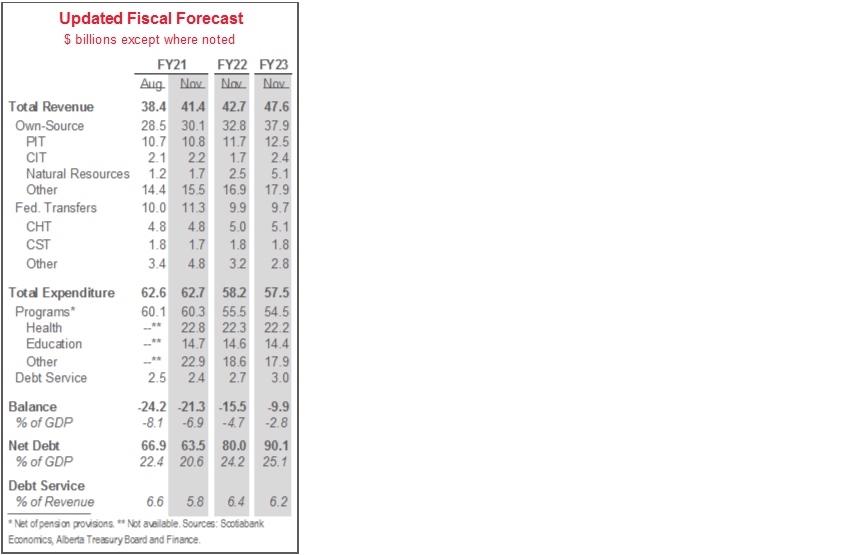

· Alberta forecasts fiscal shortfalls of $21.3 bn (6.9% of nominal GDP) in FY21, $15.5 bn (4.7%) in FY22, and $9.9 bn (2.8%) in FY23 (chart 1).

· Real GDP is expected to fall by 8.1% this year and only reach its pre-pandemic peak in 2023; adding to the oil price downturn that began in 2014, this extends Alberta’s period of convalescence to nine years.

· The government expects its net debt to climb steadily from 20.6% of provincial output this year to just over 25% by FY23.

· Borrowing requirements are set to rise to $28.5 bn this year and exceed FY21–23 targets from the February 2020 budget by almost $30 bn.

· A path to balance will be outlined once the pandemic ends; efforts to align per-capita expenditures with those of other provinces and keep the net debt-to-GDP ratio below 30% will also guide medium-term planning.

OUR TAKE

This Update clearly shows a province in the midst of significant economic and fiscal challenges. Though the record deficit and real GDP contraction this year may well represent the worst of the crisis, the recovery from the prior downturn is expected to take nearly a decade. The province’s elevated and rapidly rising COVID-19 caseload—which necessitated new restrictions as the Update was released—is another risk and adds to a still uncertain outlook.

The establishment of a 30% net debt-to-GDP anchor sends an important signal to markets that the necessary but rapidly increasing debt trajectory will be appropriately contained over the medium-term. It also leaves room to respond to any further deterioration of the economic backdrop. Alberta’s overall level of debt remains low relative to other Canadian jurisdictions. Yet, without further broadening of its revenue base away from natural resources, the government’s balance will continue to fluctuate with commodity cycles. With diversification likely to be a gradual process, this reinforces the idea that debt should increasingly be reined in as the economic recovery takes hold, though the task will be challenging given the degree of planned expenditure restraint.

ECONOMIC OUTLOOK

As in many other provinces, Alberta’s recovery from the first wave of the pandemic has surprised on the upside. The Province now expects real GDP to contract by 8.1% in 2020—still its steepest drop in recorded history, but better than the fall near 9% forecast in August. However, it notes that the torrid post-reopening expansion is cooling, with the pronounced surge in second wave COVID-19 cases (chart 2, p.2) representing a significant headwind for further growth. Alberta’s government also announced new restrictions to contain the virus’ spread on Tuesday afternoon.

Growth estimates for the ensuing three years range from 3.6% to 4.4%—a partial rebound that will keep provincial output below 2019 levels until 2023. According to that forecast trajectory, Alberta would also recoup the losses it incurred following the commodity price plunge that began in 2014 by 2023 (chart 3, p.2). Anchoring those projected gains are expectations of gradually rising oil prices—in line with our own projections—crude production, energy investment, and exports as the global backdrop improves. Non-energy outlays are also expected to rise, supplemented this year by provincial infrastructure spending and eventually complemented by the province’s transition to renewable energy, with help from the sped-up Job Creation Tax Cut for corporations.

FISCAL PLAN DETAILS

The nearly $3 bn improvement in the current fiscal year’s projected deficit is sourced almost entirely from stronger revenues. Nearly half of that expected revenue outperformance stems from stepped-up federal transfers—a large share of which relate to the Safe Restart Agreement payments—while the rest mirrors modest improvements in oil prices and economic activity.

Beyond this year, government receipts are forecast to rise as economic growth resumes. The Province expects personal income taxes—the largest single line item on the revenue side of the ledger—to reach FY20 levels in FY22. However, material declines in federal transfers and corporate income taxes next year—the former due to easing pandemic support and the latter as a result of the accelerated Job Creation Tax Cut—will delay the total revenue recovery until FY23.

The fiscal plan continues to include expenditure restraint. Before COVID-19, black ink by FY23 incorporated mean annual program spending contractions of 0.2% during FY20–23. This Update increases program expenses by more than 7% in FY21—reflecting a range of pandemic supports plus $1.25 bn to divest from the prior administration’s crude-by-rail program contracts. As pandemic-related policies are unwound, program spending is expected to fall by 8% in FY22 and nearly 2% in FY23—resulting in a two-year pace not far off the rate during the historic, albeit longer consolidation period in the 1990s (chart 4). Projected cuts are more modest for the key health and education categories, but will likely be challenging if the population and CPI growth forecast for each of the next two years materializes.

Following the 51% surge to $8.4 bn penciled in for this year’s Alberta Capital Plan, the Province will ease infrastructure outlays. However, it intends to boost FY22–23 capital spending by about $900 mn versus the schedule outlined in this February’s budget (chart 5, p.3), expenditure increases that it attributes to strategic ventures that will assist the economic recovery.

On the back of these plans, Alberta forecasts fiscal shortfalls of $21.3 bn (6.9% of nominal GDP) in FY21, $15.5 bn (4.7%) in FY22, and $9.9 bn (2.8%) in FY23. The FY21 figure, if it comes to fruition, would narrowly eclipse the previous 6.8% record deficit share of GDP set in FY87.

Future planning will incorporate three fiscal anchors. First, consistent with last year’s MacKinnon Panel report on Alberta’s finances, an effort to align per-capita government expenditures with those of other provinces. Pre-pandemic targets will be adjusted as the ongoing fiscal impacts of the virus and its economic fallout become clearer. Second, a net debt-to-GDP ratio well below 30%. Third, concrete timelines for balancing the budget and debt repayment, to be determined once the pandemic has passed.

DEBT AND BORROWING

In line with the moderately lower shortfall projected in FY21, Alberta lowered its current-year net debt forecast to $63.5 bn (20.6% of GDP); that indicator is expected to rise steadily to 25.1% of output by FY23 (chart 6). While those figures represent the most significant burdens for the Province since at least FY86, Saskatchewan—for now—is the only Canadian jurisdiction on pace to register lower rates in the coming years. Alberta anticipates that the cost of servicing its debts will hover near 6% for the next three fiscal years—again, among the lowest rates currently forecast in any Province.

Mirroring deficit forecasts, the Province anticipates that its borrowing requirements will surge to $28.5 bn in FY21, before easing to $20.9 bn in FY22 and $19.2 bn in FY23. The projected FY21–23 total is almost $30 bn more than outlined in the February 2020 budget.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.