MORE SURPLUSES AHEAD

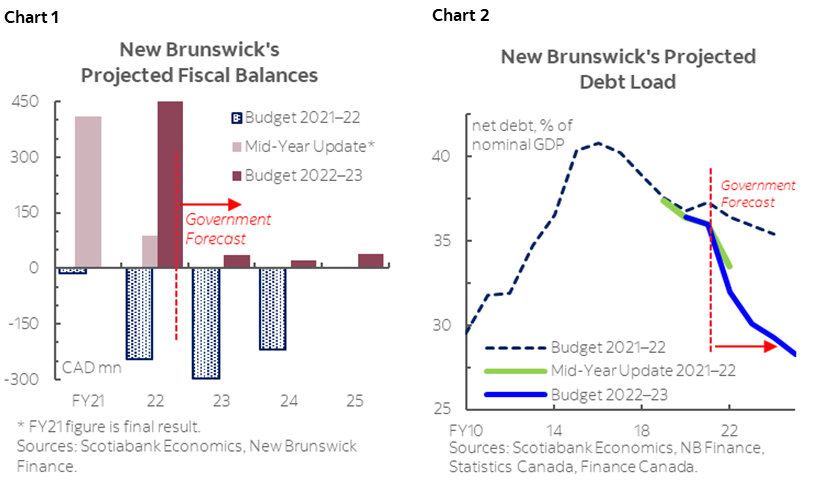

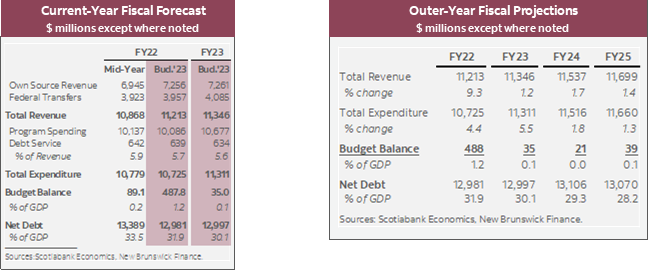

- Budget balance forecasts: +$488 mn (1.2% of nominal GDP) in FY22, +$35 mn (0.1%) in FY23, +$21 mn (0.05%) in FY24, and +$39 mn (0.1%) in FY25 (chart 1).

- Net debt: expected to decline steadily from 31.9% of GDP in FY22 to 28.2% by end-FY25 (chart 2).

- Real GDP growth forecast: +3.4% in 2021, +2.2% in 2022 and +1.6% in 2023 — slightly lower than Scotiabank’s projections for the outer years.

- Borrowing program: $1.9 bn in FY23, of which $1.6 bn is allotted to long-term borrowing, and $150 mn is associated with the New Brunswick Municipal Finance Corporation.

- After projecting sizable surpluses at the height of the pandemic, New Brunswick’s government shifts to focus on long-run economic growth. The budget outlines a concrete plan to cautiously boost key spending coming out of the pandemic era while maintaining a balanced budget.

OUR TAKE

New Brunswick is set to continue its streak of black ink, pencilling in stable surpluses of under 0.1% of GDP from FY23 to FY25. This builds on the sizable surplus anticipated in FY22 ($488 mn, 1.2% of nominal GDP)—underpinned by the province’s strong own-source revenue gains—providing a solid starting point for the new multi-year plan. Total revenue growth is expected to moderate in the medium-term at an annual average of 1.6% from FY23 to FY25, reflecting easing economic growth as activities normalize. Federal transfers will continue to play an important role and are projected to grow by 3.2% in FY23, contributing to almost all of the revenue gains that year. Debt levels are expected to be on a steady downward trend as a share of output throughout the planned horizon.

In addition, the tax relief measures confirmed in this budget will weigh on revenue growth, but also provide some offset to near-term inflationary pressures. These mainly include the increased basic personal amount and the low-income tax reduction threshold, as well as a come-back of the property tax cuts proposed in their last budget before the pandemic (-50% for rental properties and -15% for other).

The multi-year spending plan is also lifted since last year’s budget. Total spending is expected to rise by 5.5% in FY23, before growing at an average of 1.5% from FY23 to FY25. This is in contrast to the spending restraint planned through FY24 in the last fiscal blueprint. Big-ticket spending measures include education (10.3% increase in FY23), long-term care (10.3%) and health (6.4%)—all key areas of spending in light of Brunswick’s aging demographics and stronger population growth projections supported by recent migration trends. The province also tabled a capital plan in December last year, which raised its FY23–FY24 infrastructure spending by $250 mn (19% increase) versus the last plan to address priorities in transportation and infrastructure. This level of investment could boost GDP by an estimated $550 mn (1.5% of 2020 nominal GDP).

New Brunswick’s FY23 borrowing program is estimated at $1.9 bn, up from the $1.25 bn funding requirements projected for FY22. The FY23 figure includes $1.6 bn related to long-term borrowings, and $150 mn for the New Brunswick Municipal Finance Corporation.

Overall, while risks to economic prospects continue to linger, the province outlined a plan that largely contains new spending to revenue windfalls and gradually reduces debt burden.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.