BALANCE ON THE HORIZON

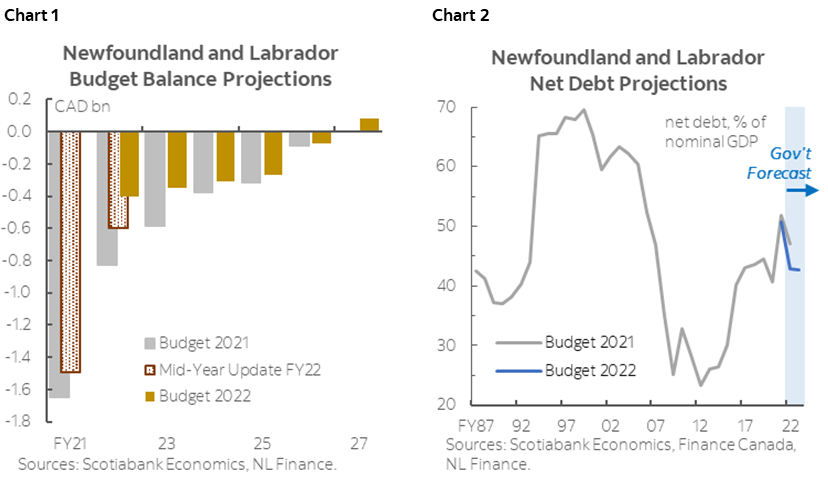

- Budget balance forecasts: -$400 mn (-1.0% of nominal GDP) in 2021–22 (FY22), -$351 mn (-0.9%) in FY23, -$309 mn (-0.8%) in FY24, -$270 mn (-0.7%) in FY25, -$74 mn (-0.2%) in FY26; surplus targeted for FY27, unchanged from last budget (chart 1).

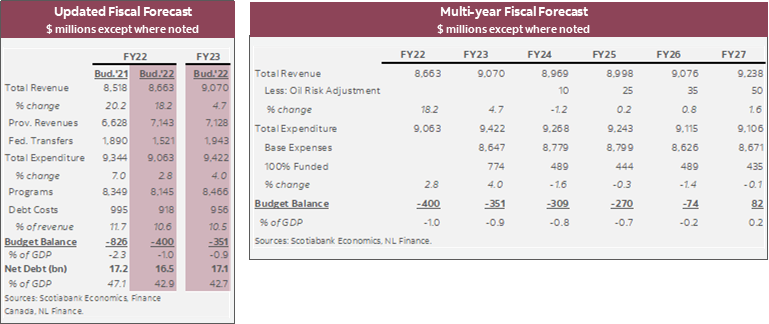

- Net debt: expected to decline to 42.9% of nominal GDP in FY22 from the pandemic high of 50.7% in FY21, then remain flat at 42.8% in FY23 (chart 2).

- Real GDP growth forecast: +3.5% in 2021, +0.5% in 2022—revised down by over 2 ppts for both years since last budget due to lower oil production. 2023 real GDP growth was raised slightly to +3.4%.

- Borrowings: $2.7 bn in FY23 (including $1.7 bn in debt maturities), following $1.6 bn total in FY22.

- Budget continues to highlight a path to balance, this time with slightly eased spending restraint and improved near-term bottom-line. Longer-term fiscal positions remain challenging in light of increasing spending needs and growth uncertainties associated with the aging demographics but this budget is a step in the right direction.

OUR TAKE

Newfoundland and Labrador’s latest budget features some near-term improvements, keeping deficits and debt burden at bay through FY23. In outer years, the plan maintained the target of returning to surpluses in FY27, pencilling in narrowing deficits of under 0.8% of GDP from FY24 to FY26—largely the same as in the last budget. While the updated fiscal trajectory reversed the aggressive spending cut that underpinned the last budget, expenses will be kept flat throughout the forecast horizon.

The province expects an improved bottom line, supported by both provincial and federal sources. Sizable windfalls from taxation and offshore royalties are behind the 1.7% upward revision in FY22 revenues versus the last budget. For FY23, with provincial revenues kept flat, the province expects total revenues to grow by 4.7% thanks to the additional $422 mn in federal transfers. In spite of favourable oil prices, offshore royalties are projected to decline by nearly 24% in FY23 due to continued falling production, contributing less than 10% of total revenue (versus 32% in 2011–12).

New policy measures focus on assisting with expected higher cost of living, eroding some own-source revenue gains in the near-term. New relief measures include 1) a one-year elimination of retail sales tax on home insurance; and 2) a 50% cost cut in vehicle registrations. These measures are broadly targeted but narrower in scale compared to other provinces that made similar announcements, and hence less likely to spur further inflation pressure.

Spending restraint is still front and centre in the medium-term. Federally funded program expenses offset the 10% spending cut initially planned in the last budget, keeping the overall level of spending flat before achieving balance in FY27. The flat level of spending is consistent with the weak population growth in the province, but combined with expected price inflation over the next few years suggests that it will be challenging to maintain the current level of public service provision.

Conservative oil price assumptions leave room for limited upside. The budget is based on a composite of price projections from 11 private-sector forecasts, which comes to a mean Brent value of 86 USD/bbl in FY23, around 15 USD/bbl below the current trending price on budget day. Offshore royalties get a $13 mn boost with each 1 USD/bbl increase in oil price, yet any potential gain could be limited by continued production decline. Budget also includes contingencies for oil price-related risks starting next fiscal year; the value of those provisions increases gradually from $10 mn in FY24 to $50 mn in FY27.

Major project timelines could be consequential to the outlook. The Muskrat Falls project—the completion of which was likely delayed for another year—secured a $5.2 bn federal funding package. The package includes $2 bn in federal financing, $3.2 bn in Hibernia revenues, and $2 bn from the conversion of GNL equity to preferred shares. This aims at staving off massive electricity rate hikes. We discussed the impact of the project on the province’s finances here. The Bay du Nord project—approved on the same day as the budget release—could provide more upside in capital investments and employment opportunities. With details of the timeline still in the making, this offshore oil project is anticipated to go into production as early as 2028.

The province expects to increase its FY23 borrowing program to $2.7 bn, of which $1.7 bn will be used to refinance maturing debt. Mirroring the smaller deficits anticipated, net debt is projected to decline sharply as a share of nominal output from 50.7% in FY21 to 42.9% in FY22, and remain at the same level in FY23.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.