SIGNIFICANT PRESSURES FROM COVID-19, BUT WORST AVOIDED

SUMMARY

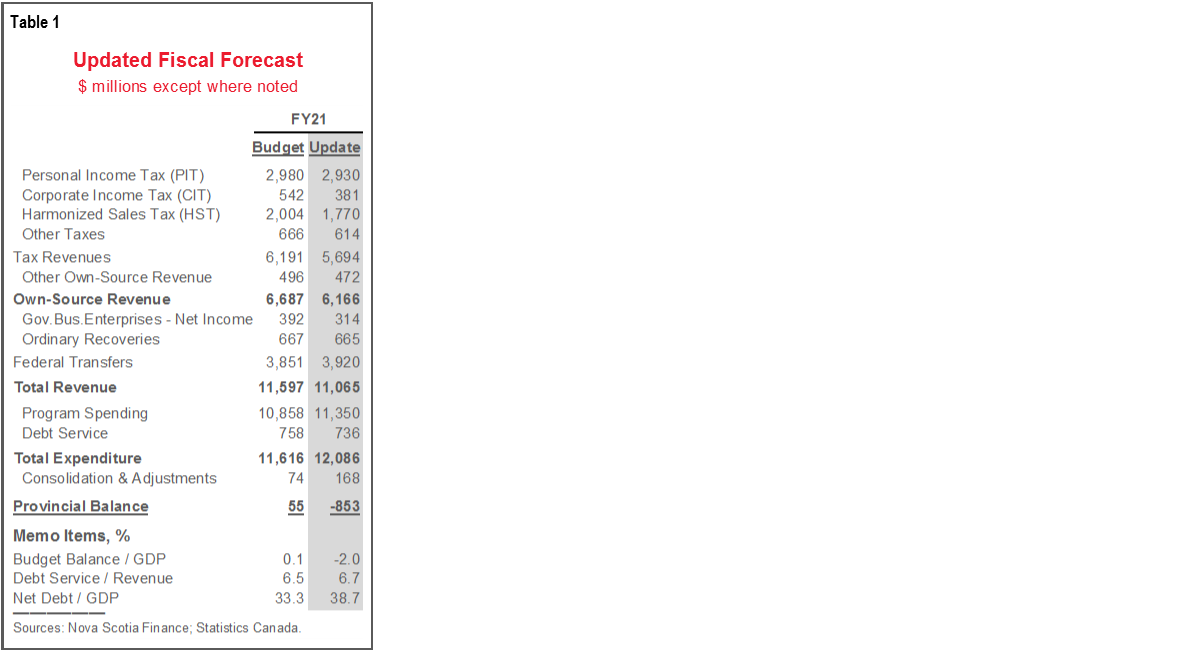

As seen across the world, Nova Scotia expects the COVID-19 pandemic to result in hefty deficit of $852.9 mn (2% of nominal GDP) in fiscal year 2020–21 (FY21), upending prior plans of surpluses through FY24.

With a record economic contraction built into the current fiscal year, the government foresees a considerably larger-than-previously outlined net debt burden equal to 38.7% of provincial output in FY21.

Risks remains and the pandemic’s impacts will likely be felt for years to come, but Nova Scotia’s relatively light caseload, diversified economy, and prudent pre-virus planning provide a basis for a solid recovery.

We expect this update to be well-received by markets: new spending is constrained to COVID-19-related shocks, while also prioritizing capital investments that should strengthen growth.

OUR TAKE

As in other provinces, this update reveals a more challenging fiscal and economic environment than before COVID-19. Rather than secure surpluses for the foreseeable future, Nova Scotia will now carry a large—albeit not historic—deficit and debt load forward. Given the prospect of a prolonged recovery and uncertain medium-term economic conditions, it, too, may have to balance long-run fiscal sustainability and support for at-risk sectors and occupations.

Still, Nova Scotia maintains a number of advantages over other jurisdictions. Its comparatively modest COVID-19 infection rates have enabled earlier easing of lockdown measures and participation in the travel bubble with neighbouring provinces, which should support its key tourism sector. Its status as a regional hub for high-value services and niche manufacturing strength should cushion it relative to less diversified local economies. Moreover, its healthy fiscal position before the pandemic appears as though it will prevent deeper red ink and heavier debt loads. Finally, funds from the Safe Restart Agreement with the federal government—not included in the plan—present upside for future balances.

Risks remain—notably around secondary waves, population, trade with China, and the virus’ course in the US—but Nova Scotia appears in position to avoid the worst of the pandemic and benefit from the eventual recovery.

ECONOMIC OUTLOOK

As most elsewhere in the world, Nova Scotia expects the COVID-19 pandemic to result in a severe economic contraction—in both real and nominal terms—in 2020. Province-wide lockdowns and a worldwide drop in economic activity are forecast to result a 6% plunge in real output this year—far worse than the post-1982 record drop of just 1.2% witnessed during the Canada-wide early 1990s recession (chart 1, p.1). As in New Brunswick, Quebec, and Manitoba, Nova Scotia anticipates a less pronounced contraction in nominal GDP than it does for real GDP. Presumably, this reflects expectations that imported inflation will dominate output gap effects. Even after a strong rebound next year, the Province expects nominal GDP to sit 4.3% below levels anticipated in Budget 2020.

Diversified trading relationships—a strength for Nova Scotia—unfortunately will not cushion against the impacts of a global economic downturn. Nominal export values to the US, China, and Europe are all down by more than 15% to date in 2020. This exacerbates the weakness in external shipments of staple pulp products and tires anticipated irrespective of the pandemic. Going forward, necessary adjustments to new health and safety practices are expected to challenge export-oriented firms.

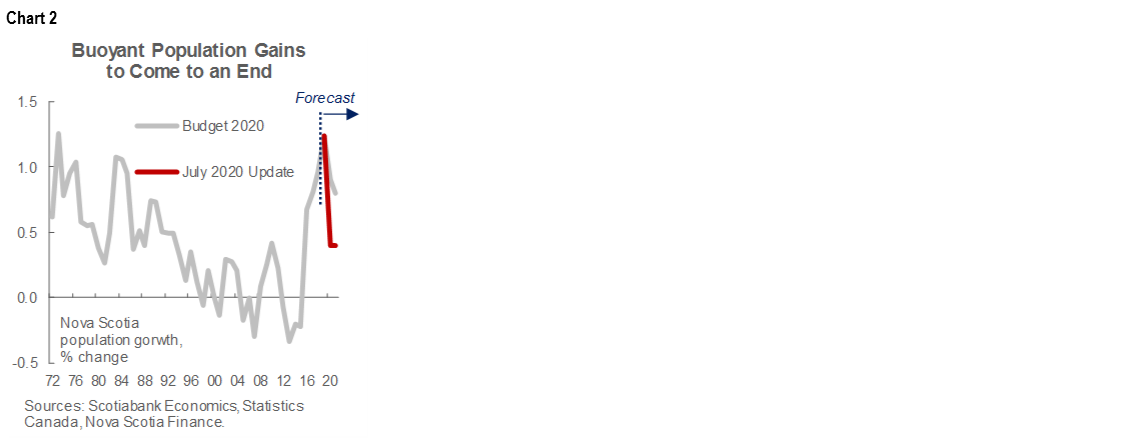

Population growth, an important driver of Nova Scotia’s recent expansion, is forecast to slow considerably versus its pre-virus trajectory. Immigration, interprovincial migration, and net non-permanent resident attraction all contributed to the 1.2% headcount expansion in Nova Scotia last year—the steepest climb since the 1970s (chart 2). Going forward, travel restrictions will likely weigh on all these flows, limiting population gains to an annual average of just 0.4% in the next two years, in contrast to the mean nearer 1% anticipated at budget time.

FISCAL DETAILS

Weaker revenues are a natural consequence of the more downcast economic outlook. Total government receipts are expected to come in more than $500 mn lower than anticipated as of just five months ago. Versus the Budget 2020 projection for FY20, the 3% drop that would represent the sharpest annual revenue decline since at least FY87. Some $234 mn of the downward revision is attributable to softer harmonized sales tax revenues, with a further $161 mn from the projected plunge in corporate tax receipts. These changes reflect broad-based expectations of hard-hit consumption and investment.

On the expenditure side of the ledger, the Department of Health and Wellness is forecast to contribute to almost 80% of the $492 mn cost overshoot relative to Budget, again reflecting the nature of this downturn. The implied 5.3% annual increase in total expenditures is, historically speaking, modest—spending growth exceeded that rate in every year from FY05–08, in FY12, and in FY18.

At $1.29 bn, projected FY21 capital spending is almost $250 mn higher than budgeted in February (chart 3). The boost—to an already hefty bump announced in the last fiscal blueprint—is expected to support the provincial economy’s near-term recovery and enhance its long-run productive capacity.

As a result of spending increases and the softer revenue outlook, the Province has penciled in a budget deficit of $852.9 mn (2% of nominal GDP) for the current fiscal year. That ends a run of four consecutive annual surpluses. It would be the largest nominal shortfall since at least FY87, but fall short of the GDP share over 3% set in FY2000, which followed a period of soft economic growth and major accounting changes. The 2% output share is also among the smallest reported by any province post-pandemic.

For provincial debt, the story is similar to that of the budget balance: higher, but for now, not historically so. At 38.7%, net debt’s projected share of GDP falls well short of loads near 50% seen in the late 1990s and early 2000s (chart 4).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.