LARGER DEFICITS FROM DETERIORATED ECONOMIC OUTLOOK, TAX CUTS, HIGHER SPENDING

- PEI’s deficit is projected to increase this year due to a combination of tax cuts and spending increases—including a new $32 mn tariff and trade contingency budget. Sizeable deficits are also projected in future years, as the economic outlook has been downgraded and revenue growth is slated to only slightly outpace expense increases (mainly for the health care system). As a result of the higher operational deficits and robust capital spending plans, the province’s net debt is projected to increase to 36% of GDP by FY28, which would return the province’s debt burden to its level of a decade ago. While PEI may be less exposed to trade risks than other provinces, downside economic risks remain and could put further pressure on the public purse.

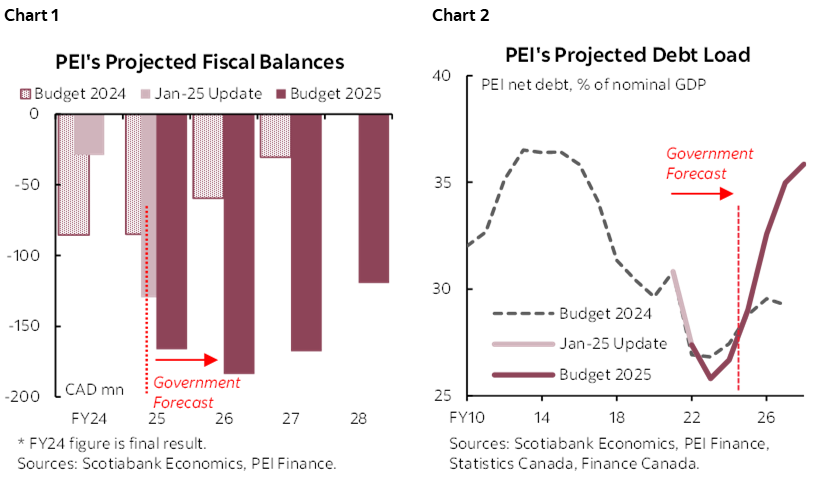

- Budget balance forecasts: the budget projects larger deficits for longer over the outlook, estimated at -$166.3 mn (-1.6% of nominal GDP) in FY25 rising to -$183.9 mn (-1.7%) in FY26, before declining to -$119.5 mn (-1.0%) by FY28 (chart 1).

- Economic assumptions: real GDP growth is estimated to be 3.8% in 2024, slowing to 2.5% in 2025 and 2.0% in 2026.

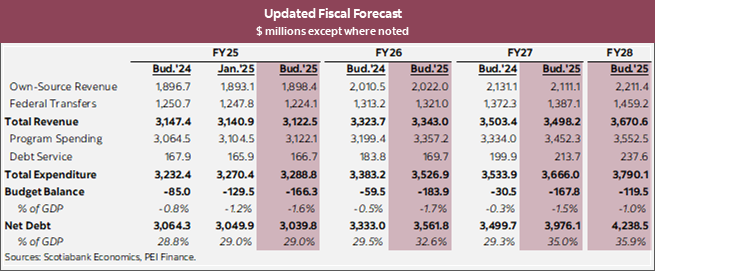

- Net debt: estimated to be $3.0 bn (29.0% of nominal GDP) in FY25, increasing each year to $4.2 bn (35.9%) by the end of FY28 (chart 2).

- Borrowing requirements: $873.5 mn in FY26, of which $800 mn is long-term borrowing and the remainder is short-term borrowing, liquidity reserves, and/or working capital.

OUR TAKE

PEI’s Budget 2025 presents larger deficits for longer over the forecast horizon compared to last year’s outlook, owing in large part due to tax cuts and additional program spending. The deficit is estimated to increase from -$166.3 mn (-1.6% of nominal GDP) in FY25 to -$183.9 mn (-1.7%) in FY26 before gradually declining to -$119.5 mn (-1.0%) in FY28, as opposed to deficits of less than 1% of GDP in FY26 and FY27 presented a year ago. Budget 2025 adds $275.8 mn in total expenditure across FY26 and FY27, and increase of 4.2%, combined with mostly unchanged (-$8.5 mn) own-source revenue over the same two-year period.

While the budget adds further expenditure across the horizon, program spending other than on health is slated to remain roughly flat in FY27 onwards. Meanwhile, tax cuts should provide support to businesses and households in the wake of an expected slowdown with tariffs clouding the horizon. Supports proposed for businesses include the small business income threshold increasing from $500,000 to $600,000 and reducing the corporate income tax rate from 16% to 15%. And supports proposed for households include raising the basic personal exemption amount from $14,250 to $14,650 in 2025 then in 2026 a 1.8% increase in all five tax brackets and the basic personal amount to $15,000, a year earlier than previously planned. The government has also set aside a good amount of funding for tariff and trade contingency in the near term, and an extra $10 mn for working capital loans to businesses and workers affected by tariffs.

Real GDP growth is estimated to be 3.8% in 2024, slowing to 2.5% in 2025 and 2.0% in 2026. The budget does not directly incorporate the potential effects of tariffs, as the proposed tariffs had been temporarily paused at the time the budget was being prepared. However, the estimated impacts of proposed tariffs would be a negative drag on PEI’s GDP growth by 2 to 3.5 per cent after one year depending on the measures and counter-measures imposed. The budget includes $32 mn tariff and trade contingency allocated in FY26 as a buffer for negative impacts from these potential headwinds.

Net debt levels are projected to increase to $4.2 bn by the end of FY28, up 39.4% in three years from the $3.0 bn end of FY25 level. As a result, net debt as a share of nominal GDP is projected to increase from 29.0% in FY25 to 35.9% at the end of FY28. Should an extended tariff and trade war drag on economic activity even more than projected in this budget, the province’s debt burden as a share of GDP could be higher in the outer years. Debt servicing costs as a share of total revenue are projected to increase from 5.3% in FY25 to nearly 6.5% in FY28, and as a share of own-source revenue rising from 8.8% in FY25 to 10.1% in FY27 and 10.7% in FY28.

Borrowing requirements are projected to be $873.5 mn in FY26, of which $800 mn is long-term borrowing, and $73.5 mn is short-term borrowing, liquidity reserves, and/or working capital. For the total long-term borrowing requirements in FY26, $555 mn is planned for government-owned capital infrastructure projects such as new schools, healthcare infrastructure, and other significant projects, $128 mn is for maturing debt, and $72 mn is borrowing on behalf of crown corporations. Long-term borrowing requirements are expected to return to $450 mn–$550 mn for FY27 and FY28.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.