TAKING STOCK OF CANADA’S PROVINCIAL FINANCES

The global pandemic has warranted unprecedented government spending at all levels of government to support households and businesses through lockdowns.

Canadian provinces are no exception where total deficit spending is approaching $100 bn (4.5% of GDP), according to their own fiscal updates released over the past several weeks.

With second waves surging across many parts of the country and still six months to go in the fiscal year, provincial budgets will continue to be under pressure but a strong federal response should provide a counterbalance.

Nevertheless, balance sheet shocks are expected to reverberate into next year even in a best-case scenario. We estimate provincial deficits could start at $60 bn before accounting for any additional temporary COVID-19 spending (or new federal transfers) next year.

Oil-producing provinces have been particularly challenged as a result of the additional shock to resource revenues, but may begin to see balance sheet improvements as oil prices gradually recover.

Debt levels will increase across the board—but for most provinces only modestly above record-levels or even below for a few. With the federal government shouldering the brunt of the fiscal response (at $380 bn or 18% of GDP and counting), provinces are in a good position to weather a relatively more modest shock to their books.

Additional borrowing by provinces has been well-received with more than two-thirds of requirements (estimated at $154 bn) already raised. After an initial short-lived spike, spreads have otherwise remained close to normal ranges, owing in part to Bank of Canada purchases, along with relatively disciplined policy approaches across provinces.

We expect this to hold over the remainder of the year and next, but note challenges ahead for provinces: namely to continue to respond nimbly to second waves, while also signaling credible fiscal discipline over the medium term.

AN UNPRECEDENTED ECONOMIC EVENT…

COVID-19 is set to result in an historic economic downturn in most of Canada’s provincial economies. Despite better-than-expected progress in re-openings this Spring, most provinces will witness record annual contractions this year even before taking into account potential second-wave impacts on activity.

Divergences in economic—and fiscal—outcomes across provinces reflect a number of factors. Success in containing the virus’ initial spread had enabled earlier re-openings in the Atlantic Provinces, BC, and the Prairies which has so far minimised the impact on output in these regions. These regions should also benefit from major project activity and renewed emphasis on infrastructure spending. Central Canada and BC have also been relatively more sheltered given higher service sector concentrations that are more conducive to telework. On the other hand, the net oil-producing regions continue to grapple with the effects of weak commodity prices, notably throttled-back natural resources production and related investment.

...SIGNIFICANTLY ALTERS THE PROVINCES’ FISCAL POSITIONS

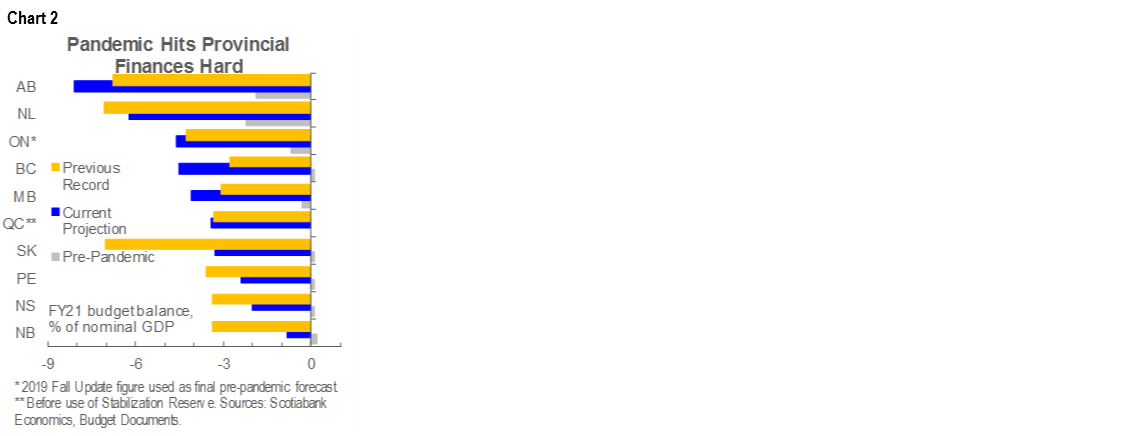

A combination of depressed revenues and significant expenditures will unsurprisingly fuel record deficits across half of provincial governments in FY21 (chart 2, p.1). Average deficit spending will be in the order of 4.5% with a few outliers related to natural resource dependency and pandemic prevalence. As steep as these balances appear, they pale in comparison to the federal government’s current projected shortfall of 18% of nominal GDP.

Own-source revenues are expected to fall by about 11%* across provinces in FY21, in line with severe jobs losses and declines in employment earnings (chart 3). Corporate income tax receipts are widely expected to plunge as business profits nosedive. Mirroring the economic growth outlook, the net oil-producing provinces will take a further hit as natural resources revenues plummet. Again, this compares favourably to the federal situation where the Parliamentary Budget Office (PBO) estimates revenue declines will exceed 15% y/y at the federal level.

Extraordinary policy supports should partially offset revenue declines. Second quarter transfers to Canadian households from government, at nearly $55 bn, eclipsed household income losses of about $21 bn. The bulk of these transfers are taxable, namely the Canada Emergency Response Benefit. In fact, Quebec has forecast that personal income tax receipts will largely be flat this year after accounting for these transfers, whereas other provinces for the most part have adopted a more cautious forecasting approach to revenues which could serve as an upside.

Total expenditures across provinces are expected to rise by about $51 bn (2.4% of GDP, for an 11.3% y/y increase), of which about 90% is attributable to pandemic-related policies and cost pressures. This is after accounting for offsetting direct transfers to provinces from the federal government. The bulk of these expenditures are temporary, with spending set to pull back rapidly next year. In addition to program spending increases, Canada’s ten provinces have allocated more than $6 bn in pandemic contingencies and forecast allowances in FY21, the largest of which is Quebec’s $4 bn provision, which provide an additional cushion to second waves.

...AND DEBT LEVELS TO INCREASE

There will be step-changes in debt levels across all provinces as a result. The expansion of balance sheets across all provinces is expected to exceed the change in debt at the onset of the 2008–09 Global Financial Crisis (chart 4). Most provinces had embarked on debt consolidation paths prior to the pandemic—some further advanced than others—given elevated levels for some (chart 5; chart 6, p.3).

PRESSURES TO PERSIST BEYOND THIS YEAR

A rebound in government coffers is expected in FY22. Scotiabank Economics has penciled in economic rebounds next year, along with a modest rally in oil prices, leaving the door open for revenue gains next year. However, we still expect economic activity—and hence government revenue receipts—to remain below pre-pandemic levels until 2022. The prospect of a gradual oil price recovery likely means only modest gains in government resource income, continuing the general downward trend that began during the GFC (chart 7).

A step-down in expenditures should also underpin faster consolidation. For illustrative purposes, we assume that expenditures unrelated to COVID-19 will expand at the rate of inflation plus population growth next year, while some pandemic-oriented spending pressures persist, particularly those related to health, education, and long-term care. This will likely put upward pressure on next year’s balances which we have ballparked at a third of current year COVID-19 related expenses.

On the basis of these assumptions, we estimate that deficit spending across Canada’s 10 provinces would start at $60 bn next year. As the most populous provinces, Ontario, Quebec, Alberta, and BC account for more than 90% of the aggregate fiscal shortfall. The $60 bn figure is more than $30 bn narrower than the current projection of about $96 bn for the provinces in FY21. With an increasing likelihood of further increases to spending pressures related to second waves, the total could reasonably be expected to be higher, though further federal transfers—actively being sought by a number of provinces—could provide an offset.

MARKETS TAKING IT IN STRIDE

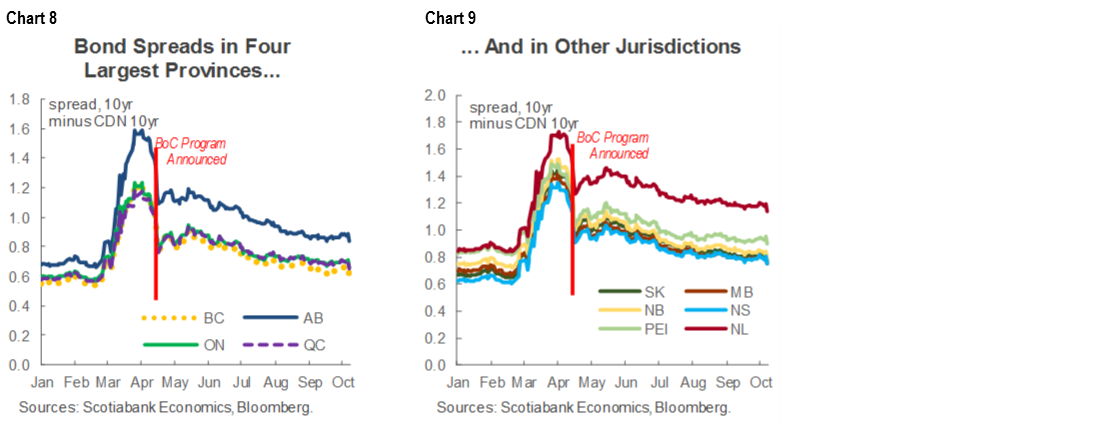

Provincial debt issuance has been relatively well-received so far. There was a brief spike in spreads at the onset of the pandemic which has largely subsided as the Bank of Canada purchase facilities came on line, though oil-producing provinces still face a risk premium consistent with past recessionary periods (chart 8; chart 9, p.4). With spreads durably back in normal ranges, the Bank of Canada has recently scaled down its purchase programs while continuing to signal it stands ready to scale up liquidity support if needed.

Bank of Canada purchases have played a role in restoring function initially, but relative attractiveness of offerings has also been a driving factor in market liquidity. The central bank has purchased around $10 bn in provincial bonds—of the $107 bn in total provincial bond issuance as of end-September—which is well-shy of the Bank’s $50 bn cap for its Provincial Bond Purchasing Program as market liquidity has been resilient.

Overall, provincial debt markets should remain stable, if not favourable, over the course of the recovery (and second-waves). Even with second waves imposing a potential setback on economic recoveries in some provinces, the federal government’s more expansionary fiscal policy should help minimize (substantial) additional hits to provincial budgets while the Bank of Canada backstop should contain credit spreads. Yield pick-up in global bond markets increasingly dominated by negative-yielding products and an opportunity for diversification will continue to be relative advantages for Canadian provinces.

LONGER TERM

A real challenge for provincial governments at this juncture will be to simultaneously demonstrate short term fiscal flexibility in the face of a rapidly evolving crisis, while also credibly signaling discipline over the medium term.

While it would clearly be premature to embark on fiscal consolidation efforts at present, it is not too early for provinces to set out policy frameworks for medium term consolidation. This could serve to further strengthen confidence in provincial finances following a period of rapidly elevating debt levels and—importantly—when additional spending could still be warranted in some cases either on a temporary pandemic-basis, to support structural adjustments, or to opportunistically invest in longer term productivity-enhancing measures.

Longer term concerns around provincial fiscal sustainability pre-date the pandemic. The pandemic has temporarily pushed up provincial financing needs with consequent step-changes in debt levels that should not meaningfully impact long-term fiscal sustainability on aggregate. However, the PBO has been flagging longer term fiscal sustainability challenges for provincial governments for several years now, as aging demographics in particular weigh on expenditures. The recent Fitch rating action at the federal level also signaled concern in this regard. Both point to structural factors that existed prior to the pandemic that will need to be tackled over the medium term.

The crisis has magnified the strengths (and some weaknesses) of Canada’s federation to rise to such challenges. Despite highly decentralized policy autonomy and fiscal capacity, an implicit federal guarantee of sub-national debt means market observers often consider general government debt levels in their assessment. In the near term, favourable (relative) federal debt levels—along with substantial central bank interventions—have underpinned confidence in provincial borrowing activity. This is particularly true for smaller provinces that may not fully benefit from scale advantages even if they adopt ‘gold standard’ fiscal policies. This implicit backing allows provinces to punch above their individual weights provided policies are coherent.

The loose coordination of fiscal policy across levels of government has been another Team Canadian advantage during the pandemic. A collaborative approach between federal and provincial governments has enabled a more efficient allocation of emergency support at the height of the pandemic. Notably, the federal government was in the best position fiscally to shoulder the brunt of the impact with lower net debt levels and fewer longer term sustainability pressures relative to provinces. As the crisis matures, a more targeted approach is likely needed, but this will still hinge on the ability to collaborate effectively across layers of government.

Continued—but responsible—goodwill is needed in the next phase of the recovery. Some of the biggest provinces are calling for substantial and sustained increases to transfers. For example, Alberta, Manitoba, Ontario and Quebec have called for an increase in the federal share of health care costs with what would amount to a structural shift of about 2.5% of GDP onto the federal balance sheet. However, history has shown that simply ramping up transfers to provinces has not necessarily led to better outcomes for Canadians in areas such as health, education, long-term care, and childcare where there are benefits—both fiscally and in the quality of the outcomes—than a national vision that supersedes provincial borders.

All levels of government will have their work cut out for them in delivering on all-encompassing promises in the recent Speech from the Thone. Some provide a real opportunity to either strengthen growth (for example childcare or retraining) or bend cost-curves by designing better delivery modalities (for example, long-term care, healthcare, education) that could have a substantial impact on the general government balance sheet. This would benefit all levels of government over the medium term.

* For Provinces that have provided a breakdown of revenues since the beginning of the pandemic.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.