RECORD ECONOMIC GROWTH, TARGETED POLICY

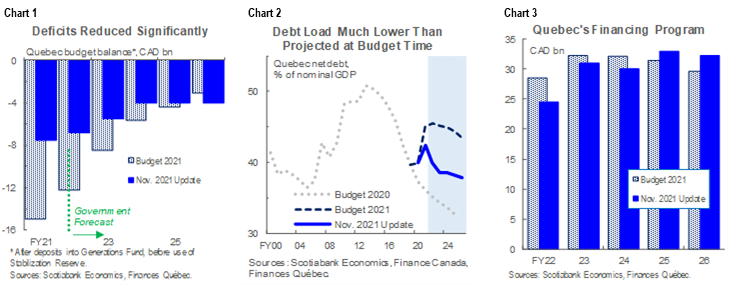

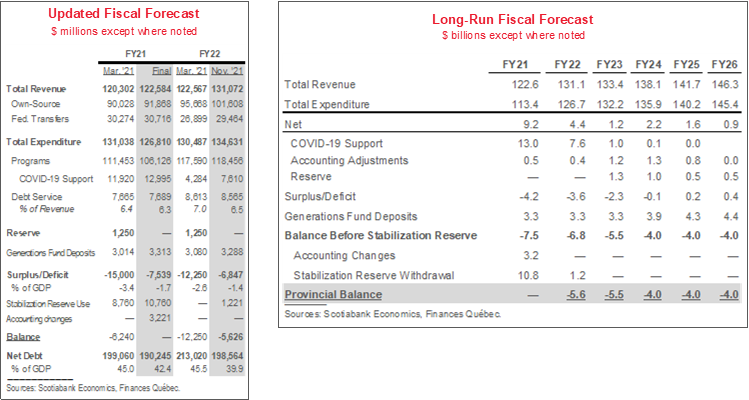

- Budget balance projections: -$6.8 bn (-1.4% of nominal GDP) in FY22 versus March 2021 Budget estimate of $12.3 bn (2.6%), -$5.5 bn (1.0%) in FY23 (all figures after deposits into Generations Fund) (chart 1).

- Net debt forecasts: expected to drop below 40% of nominal GDP in FY22 and decline steadily to 37.8% by FY26—about 5 ppts lower than anticipated in Budget 2021 (chart 2, p.2).

- GDP expectations: 6.5% real growth and 10.8% nominal growth this calendar year—both record expansions and much stronger than prior projections of 4.2% and 6%, respectively.

- Financing program: estimated at $24.5 bn in FY22, $30.9 bn in FY23, and $30 bn in FY24, all reductions from March 2021 forecasts (chart 3, p.2).

- New policy measures: aim to improve the cost of living, bolster the health care system, and address labour shortages; largely incremental but well-targeted to province-specific economic challenges.

OUR TAKE

As widely expected, Canada’s second-largest province finds itself on a much stronger fiscal path than laid out in Budget. We discussed the extent and key drivers of Quebec’s economic outperformance here; the province is following in the footsteps of all others that have released updates thus far and likely won’t be the last. Quebec’s debt as a share of output remains on a downward path and looks likely to remain well below the record levels attained in the early 2010s. This is positive from the perspective of fiscal sustainability and creditworthiness.

Changes in long-run fiscal anchors and metrics underscore the extent to which hefty economic growth alters the province’s financial landscape. Recall that in Budget, Quebec identified a $6.5 bn “shortfall” stemming from the pandemic-induced plunge in GDP and related increase in spending. It planned to eliminate that amount over the five years beginning in FY24 via expenditure adjustments or new revenues to be determined at a later date. This Update references a “structural deficit” of just $4 bn. Similarly, the province once again expects to reach a 45% gross debt-to-GDP ratio by FY26, having estimated early in the pandemic that that target was no longer attainable.

Federal transfers continue to play an important role in the fiscal plan; versus Budget, projections were revised higher by $2.6 bn in FY22, $2.4 bn in FY23 and $3.1 bn in FY24. This includes a one-time payment of $1.1 bn to support health care and vaccination and a $6 bn Childcare Agreement over the next five years. The province is also calling for an increase in the Canada Health Transfer (CHT) to 35% of provincial health spending, to support funding for long-term care.

There is less prudence built into this plan than in recent updates, which mirrors a more modest level of uncertainty with to the economic outlook than during the peak pandemic period. Update assumes nominal GDP growth of 10.8% in calendar year 2021—just a hair below the private-sector average—and FY22 no longer includes a $1.25 bn reserve. However, FY23–24 incorporate a combined forecast allowance of $2.3 bn.

New policy measures fell into four key categories: a) cost of living help, b) social policy, c) health care supports, and d) efforts to address labour shortages; all look appropriately targeted to province-specific challenges. Cost of living policies included a one-year lump sum payment to low- and medium-income households—known to be the most impacted by consumer goods inflation. That could stoke demand on the margins, but the measure is temporary, in line with expected inflation. Social policy includes cost offsets for daycare—which we’ve argued is beneficial for long-run growth. The costliest single health care measures were a one-year extension of pandemic financial incentives and further funds unlocked for broad salary cost and operating expenses related to health care workers.

Measures to address labour shortages—long identified as a significant constraint on Quebec’s growth—acknowledged both pandemic time and pre-COVID structural imbalances. Also on Thursday, Statistics Canada quietly released its Q3-2021 Job Vacancy and Wage Survey results, which showed a new record 7.3% job vacancy in Quebec in September 2021. Nearer-term measures include incentives for retirees and experienced workers to remain in the labour force, and a pledge to grant worker permits to immigrants awaiting permanent resident status. The Update also announced a suite of training and educational programs, notably in the IT sector, widely expected to experience long-run labour supply-demand imbalances even before the pandemic.

The government maintained the $4.5 bn increase to the 2021–31 Québec Infrastructure Plan (QIP) announced in the March 2021 Budget, which committed to spending a total of $135 bn over 10 years. Key policy priorities included hospitals, seniors' residences, schools, roads and public transit. Infrastructure spending plans for 2022–32 will be released in the spring budget.

Quebec’s financing program has scaled down for FY22, FY23 and FY24 relative to the March 2021 Budget, and is estimated to be $24.5 bn, $30.9 bn and $30 bn, respectively. The Update penciled in higher borrowings in FY25 and FY26, averaging $32.6 bn per year. As of November 9, 2021, 32% of FY22 borrowing had been conducted on foreign markets, with the majority of foreign currency issuance denominated in Euro. Almost all completed borrowings had a maturity of 10 years or more, higher than the mean of 70% in the decade prior. The province also issued a $498 mn Green bond under its Green Bond program in FY22, for a total of six issues totalling $3.3 billion since the program was launched.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.