BALANCE DELAYED, BUT SOME FISCAL ADVANTAGES REMAIN INTACT

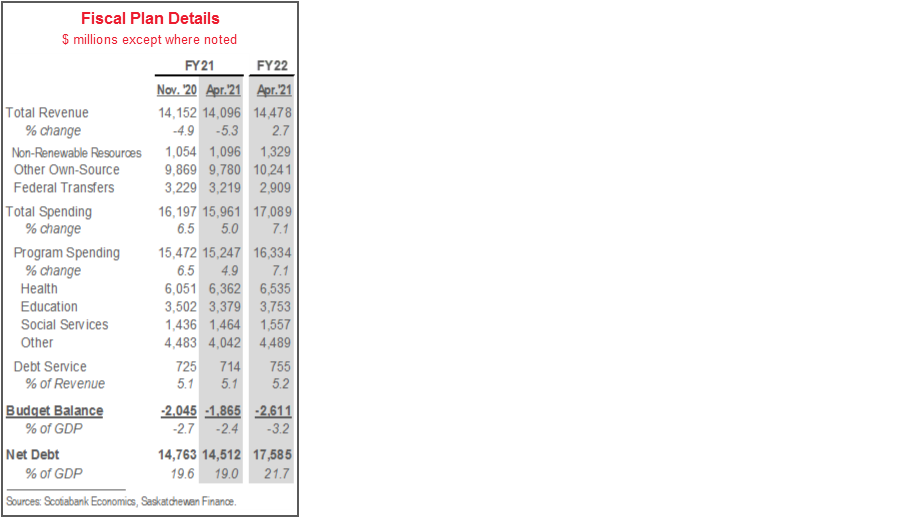

Budget balance forecasts: -$1.9 bn (-2.4% of nominal GDP) in FY2020–21 (FY21), -$2.6 bn (-3.2%) in FY22, -$1.7 bn (-2%) in FY23; return to balance targeted for FY27—two years later than last multi-year forecast (chart 1).

Net debt: expected to rise from 19% of nominal GDP in FY21 to just over 26% by FY25—higher than the prior forecast (chart 2), but still the lowest projected trajectory announced by any Canadian province thus far.

Real GDP growth forecast: -4.2% last year, +3.4% this year, +3.2% next year, which puts the provincial economy on track to reach to its pre-pandemic, 2019 annual average in 2022.

Borrowing requirements: $4.5 bn forecast for FY21, $4.7 bn in FY22.

As in other provinces, the plan builds in prudence that leaves room for upside to fiscal balances, and also maintains fiscal advantages that Saskatchewan held before COVID-19.

OUR TAKE

We begin by stating—just as we have with all other Canadian provinces—that the pandemic has upended Saskatchewan’s financial plans. In early 2020, Saskatchewan had anticipated a return to balance—hard-won after the sharp oil price correction that began in 2014—and stable surpluses through at least FY23. Now, black ink will have to wait until FY27—seven years later than expected in the last pre-COVID-19 blueprint. The fiscal shortfall of more than 3% of provincial output pencilled in for FY22 would be the largest share since the period of deep red ink experienced during the early 1990s.

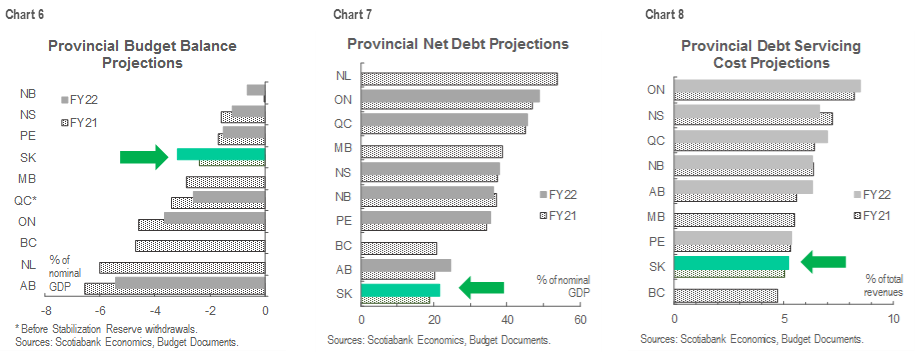

However, Saskatchewan’s balance sheet remains in relatively good shape. Though it is now forecast to climb steadily from FY21 to FY25, Saskatchewan’s net debt-to-GDP ratio is—as it stands—on track to be the lowest of any region through FY25. With the benefit of a more modest debt load than many of its peers, the province anticipates a debt service-to-revenue ratio of just 5.2% this fiscal year—the lowest announced by any jurisdiction thus far for FY22. Charts 6‒8 on page 3 summarize Saskatchewan’s key fiscal indicators relative to those in other provinces. Interest costs may rise with provincial debt beyond FY22 or if bond rates continue to climb as anticipated, but FY21‒22 indicators suggest that debt and borrowing levels remain sustainable over the medium-term.

Budget builds in prudence with revenue projections based on economic growth below the private-sector mean; this opens the door for near-term upside to fiscal balances. Both Saskatchewan and Canada are assumed to grow by less than 4% in real terms this year, in contrast to the rates nearer to 6% pencilled in for both in our latest forecast update—published after the passage of the US stimulus package. Meanwhile, WTI is assumed to average 55 USD/bbl in calendar year 2021—about 3 USD/bbl below the year-to-date mean—and rise only gradually to 59 USD/bbl by 2025 (chart 3). Prudent planning is wise given uncertainty about COVID-19 and lingering weakness in oil production and investment, though future use of any windfalls should be deliberately and methodically considered.

New policy consisted largely of COVID-19 assistance and previously announced election campaign pledges. The former category encompasses funds for safe return to schools as well as testing and personal protective equipment. The latter includes the promised 10% rebate on SaskPower electricity rates, temporary small business tax rate reduction, and tax credit for eligible home renovations completed by end-2022. Funds were also earmarked for workforce training, improving newcomer admissions integration amid border closures, and supports for hard-hit tourism operators.

Increased infrastructure outlays should help support the province’s recovery. Relative to the 2019 fiscal plan—the one to detail investment intentions beyond FY22—FY21‒23 capital expenditures related to government ministries and agencies have been increased by $1.4 bn (chart 4). Another $3.2 bn is expected to be provided over FY22‒23 through Saskatchewan’s commercial Crown sector. Ventures targeted under the province’s Capital Plan include highway projects, health care facility improvements, broadband network upgrades, and various construction activities deemed likely to stimulate economic growth and local job creation.

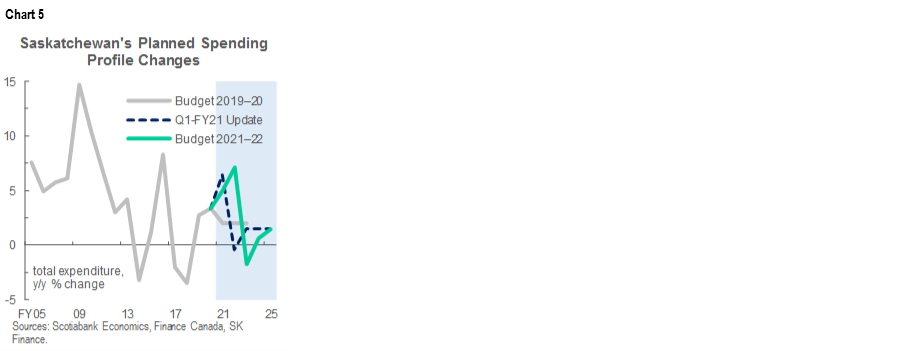

The fiscal plan continues to include spending restraint. Recall that expenditure control anchored provincial consolidation plans following the last commodity price downturn. In FY22, the province projects that total expenditures will advance by a solid 7.1%, an increase that largely reflects the new policies outlined above. In FY23, it has built in a 1.7% reduction in total spending—presumably related to a drawdown in pandemic assistance—and average annual growth of just 1% during FY24‒25 (chart 5). The latter rate compares with outer-year CPI growth forecasts in the 1.6‒1.7% range—suggesting that spending control may prove challenging—though stronger-than-anticipated economic growth may leave room to relax the degree of planned spending restraint.

Saskatchewan anticipates borrowing requirements—which it conducts entirely via the General Revenue Fund—of $4.657 bn in FY22. That follows a forecast of $4.456 bn in FY21, just completed. In FY22, nearly $300 mn of the total is allocated to refinancing maturing debt, with the rest expected to finance the provincial deficit and infrastructure plans.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.