MARKET TONE

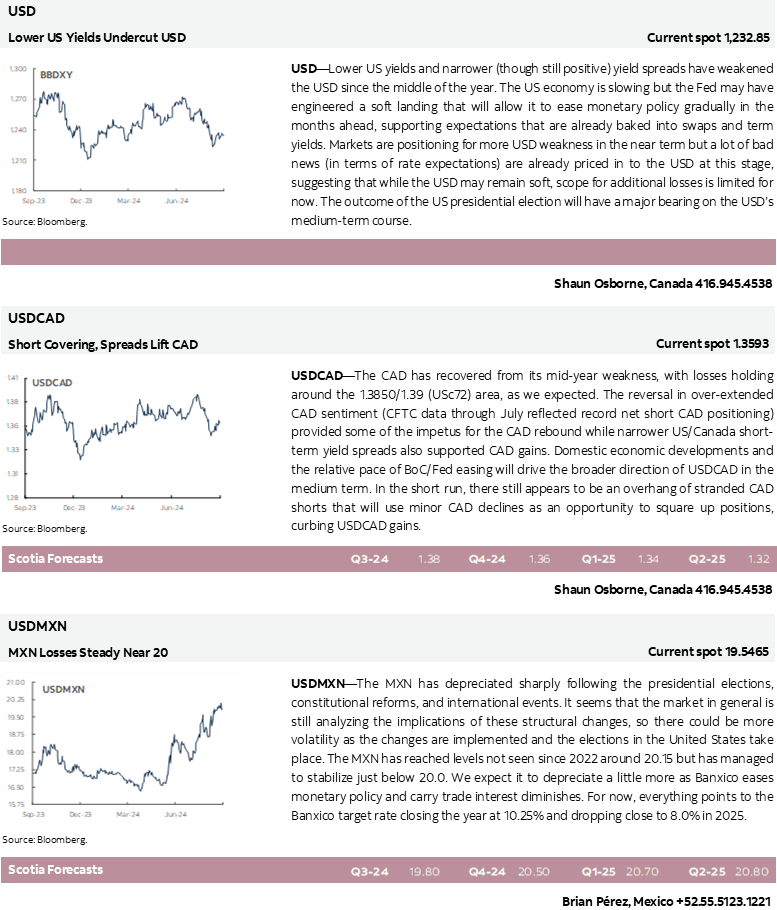

The US dollar (USD) has underperformed in the third quarter, reflecting a constellation of factors that have shaken up currency trading and injected renewed volatility into markets. We had expected the USD to ease somewhat in H2 as cyclical factors turn less supportive and while USD losses have moderated somewhat in recent trading, the net impact is still a somewhat weaker USD than we had anticipated at this stage.

USD weakness can be largely explained by the following. Firstly, US yields eased in July and fell sharply in August following the release of a weaker-than-expected US July employment report. The data boosted slowdown concerns, prompting markets to ponder whether the Federal Reserve (Fed) was “behind the curve” and would need to kick off its easing cycle with a more aggressive rate cut in September. Secondly, a Bloomberg/Businessweek interview with presidential candidate Trump revealed his concern that the strength of the USD was a “problem”, particularly against the Japanese yen (JPY) and Chinese yuan (CNY), adding to corrective pressure on the JPY but weighing on the USD tone broadly. A third, and related factor, was the extended surge in the JPY following an unexpected increase in the Bank of Japan’s (BoJ) policy rate at the end of July, with JPY gains compounded by short-covering demand as JPY-funded carry trades were unwound aggressively. A fourth factor was Vice President Harris’ elevation as the Democrats’ candidate for the presidential election. This has undermined former President Trump’s lead in opinion polls and forced markets to reconsider USD-positive “Trump reflation” trades. The outcome of the US presidential election will have a significant impact on financial markets broadly in the latter part of the year and may complicate the outlook for the USD in the medium term.

A final consideration might be weak USD seasonality in Q2 and Q3. Seasonal trends have not been especially prominent in the past couple of years, but the 2024 evolution of trading closely resembles the typical pattern of trade in the dollar index (DXY) over the past 25 years. If the pattern extends, more weakness is likely in the next month or so—possibly reflecting some further weakening in cyclical supports for the USD as the Fed starts to cut interest rates and US growth momentum slows. A moderate, late-year rebound in the USD would be a typical reflection of its average performance since the late 1990s, all else equal.

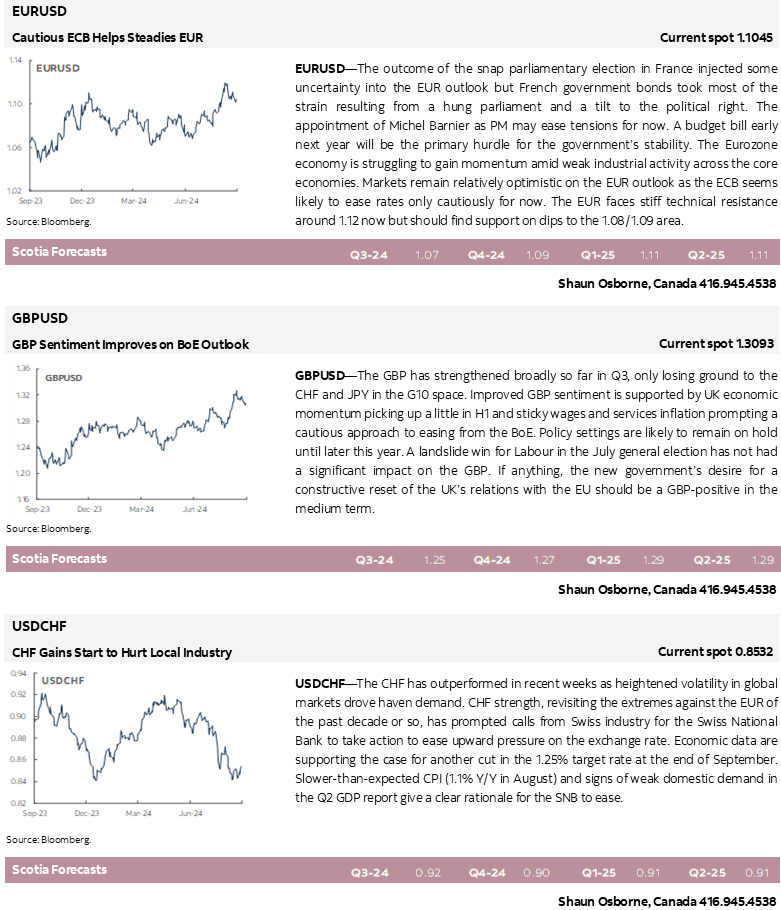

The Canadian dollar (CAD) has recovered from weakness seen through late July and early August that saw the USD retest the 1.39 area (close to the 2022 and 2023 USD highs). Slowing inflation and rising unemployment prompted the Bank of Canada (BoC) to cut interest rates three times since June, stealing a lead over its many of its central bank peers. Weak cyclical drivers intensified bearish sentiment in the CAD through mid-year but negative sentiment appears to have peaked just as the CAD troughed. The broader slide in the USD through August squeezed out a significant proportion of CAD short positions, with lower US yields (and narrower US/Canada spreads) helping pin back the USD.

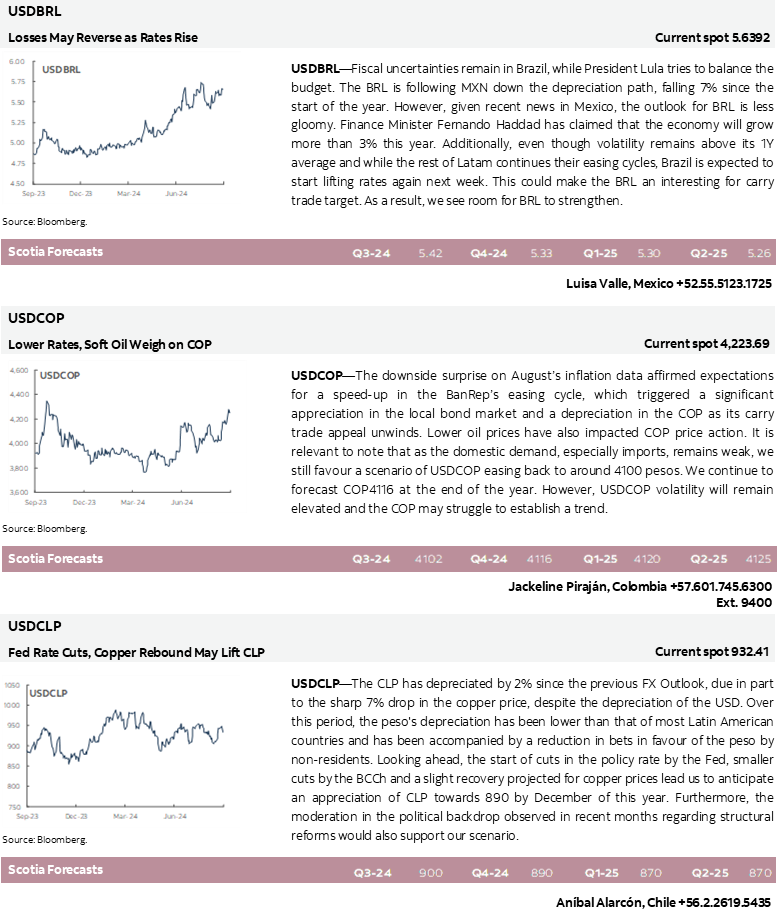

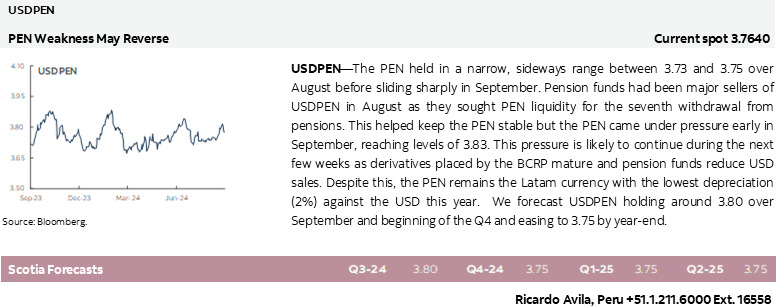

Pressure on the Mexican peso (MXN) has intensified in the past few months. Political concerns remain a drag on the MXN amid speculation that President Lopez Obrador will push ahead with judicial reforms before he steps down. MXN losses have extended to the 20 zone, with weakness amplified by the unwind of JPY-funded carry trades in the MXN following the BoJ rate hike. Heightened volatility across markets generally will likely preclude any significant revival in carry trade demand for the MXN for now. Other Pacific Alliance currencies have outperformed the MXN so far in Q3 but are trading off their best levels. Softer copper prices and lower rates have undercut the Chilean peso (CLP) while weak crude oil prices have weighed on the Colombian peso (COP). The Peruvian sol (PEN) is the top regional performer so far over the quarter.

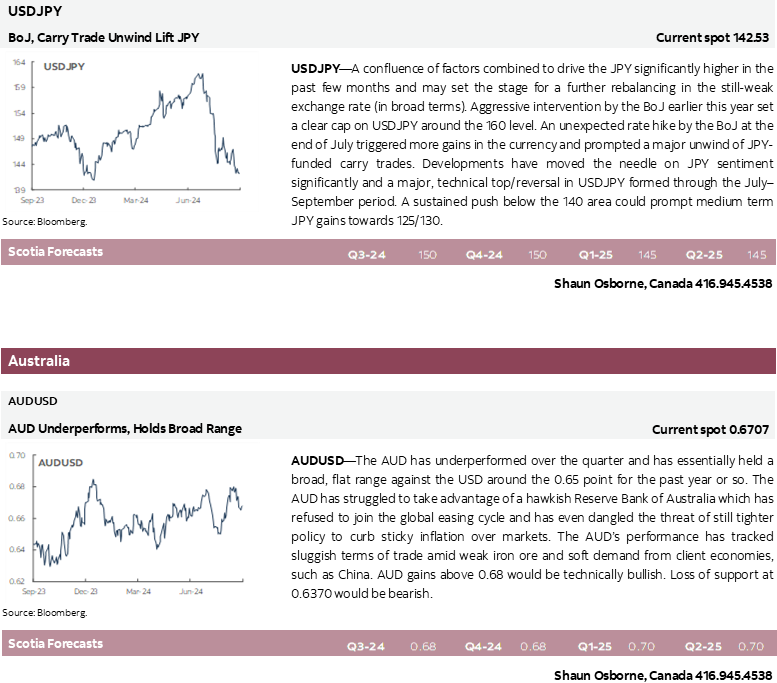

Most core G10 currencies have benefitted from lower US yields and somewhat narrower short-term interest rate differentials to post gains against the USD over Q3. The Japanese yen JPY is the top-performing major currency, reflecting some of the factors noted above (BoJ tightening and the washout in carry trades prompting significant JPY short covering). In addition, the central bank intervened again in support of the currency in July and BoJ officials appear confident that monetary policy is on the right course, leaving the door open to additional, if modest, rate increases in the coming months. A firm ceiling on USDJPY has been established around the 160 point now but the JPY remains weak in real effective terms, implying that the sharp appreciation seen in the currency in Q3 has room to extend in the medium term as US/Japan interest rate differentials continue to narrow.

Both the euro (EUR) and pound (GBP) have appreciated a little more rapidly than we had expected against the soft USD since the middle of the year. While both the European Central Bank (ECB) and Bank of England (BoE) are poised to cut interest rates in the coming months, economic conditions (sticky service inflation in the Eurozone and still-elevated wages in the UK) suggest rates may fall relatively more slowly in the Eurozone and UK than in North America. But term yield spreads appear fairly priced to reflect these developments, suggesting that the USD may remain soft but might not weaken that much more unless rate expectations adjust significantly from current levels.

Shaun Osborne, Canada 416.945.4538

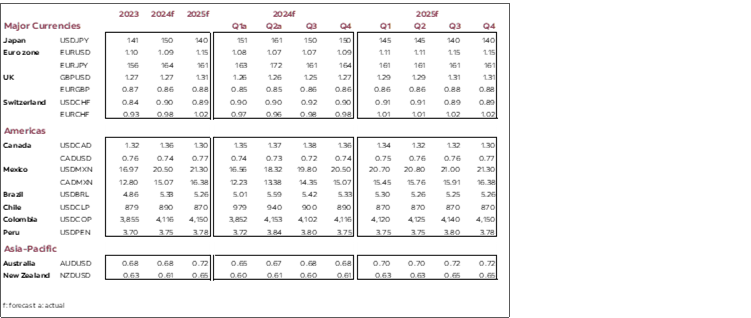

FX FORECASTS

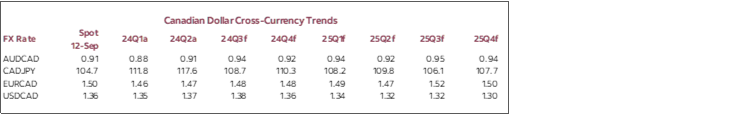

CAD FX FORECASTS

FEDERAL RESERVE & BANK OF CANADA MONETARY POLICY OUTLOOK

FEDERAL RESERVE—GRADUAL REMAINS THE PLAYBOOK

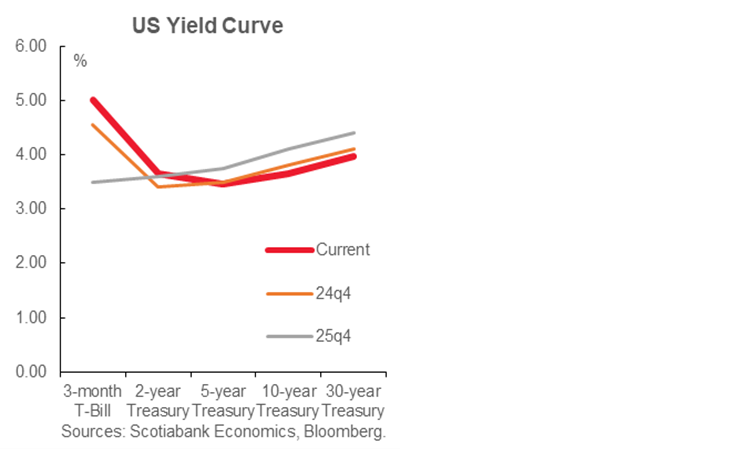

Scotiabank Economics expects the FOMC to cut in three consecutive quarter point moves over the remaining meetings of 2024 followed by another 125bps of cuts next year. That should put the upper limit of the fed funds target range at 3.5% by the end of 2025 and hence still restrictive. We also expect QT (quantitative tightening) to end by late Winter or early Spring next year.

The US economy remains in excess aggregate demand with a labour market that is still tight. It’s too soon to declare inflation risk as having gone away especially in light of potential ongoing challenges with seasonal adjustments to inflation and jobs data.

And yet we have more confidence now compared to earlier that the US economy is rebalancing the forces of supply and demand in order to enable an easing cycle. Trend gains in productivity and population including undocumented workers have expanded the potential supply of the US economy. Demand is expected to cool with further lagging effects of credit tightening and prior policy tightening. Fiscal policy has been dragging against US GDP growth for some time. The broad dollar has recently softened but there could still be lagging negative effects on net trade stemming from appreciation over prior years. Housing affordability remains pressured.

As excess demand wanes so should pressures on the Fed’s dual mandate and aided by an expected lessening of housing’s influences on inflation into 2025.

A key risk, however, remains the US election and the likelihood that whoever wins there may be further upward pressure on term premia shown in our yield curve forecasts. Trade policy and fiscal policy are difficult to assess until we get past the US election.

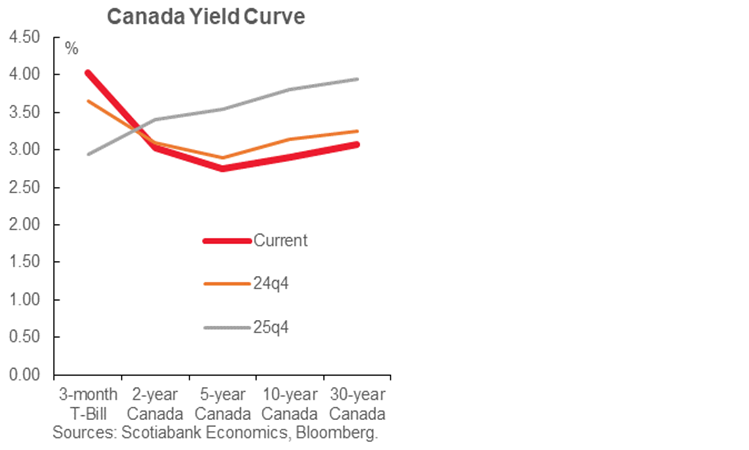

BANK OF CANADA—THE LEVERAGE ADVANTAGE RETURNS TO CANADA

Scotiabank Economics expects two more quarter point rate cuts this year in October and December followed by a cumulative 75bps reduction spread over early next year. That should put the overnight rate at 3% by the second quarter of next year which would remain substantially higher than pre-pandemic levels. This forecast is little changed from previous expectations.

There are many uncertainties overhanging this forecast. One is geopolitical developments including the US election and its potential impact upon fiscal and trade policies. Other risks are domestic in nature. Mild excess capacity is expected to persist even as the supply side is expected to grow more slowly due to ongoing productivity challenges and curtailed population growth, but demand pressures could face greater strength than we forecast and close spare capacity faster and thus limit rate cuts.

One such channel is fiscal policy being more stimulative than we have incorporated. A federal election year beckons, and governments of any stripe that are down in the polls like the current one tend to engage in fiscal pump priming. Greater than expected fiscal easing could complicate monetary easing.

More important could be views on the consumer and housing markets. To say there is upside is a tough sell at present due to the recency bias; many households have been pressured by developments to date. But as forecasters looking to the future, upside risk could come from a combination of pent-up demand, excess saving in narrow and broad forms, and the lagging effects of a population surge. The catalyst to this happening is that whereas high debt was a disadvantage in a rising rate environment, high debt confers more rewards to the Canadian economy relative to others as rates normalize.

The accompanying chart shows how this is expected to unfold as the rates curve normalizes into 2025 with potentially higher inflation and issuance risk as term premia rise.

Derek Holt, Canada 416.863.7707

NORTH AMERICA

MAJOR CURRENCIES

MAJOR CURRENCIES (continued...)

LATIN AMERICA

LATIN AMERICA (continued...)

DISCLAIMERS

FOREIGN EXCHANGE STRATEGY

This publication has been prepared by The Bank of Nova Scotia (Scotiabank) for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Scotiabank, its affiliates or any of their employees incur any responsibility. Neither Scotiabank nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. Scotiabank, its affiliates and/or their respective officers, directors or employees may from time to time take positions in the currencies mentioned herein as principal or agent, and may have received remuneration as financial advisor and/or underwriter for certain of the corporations mentioned herein. Directors, officers or employees of Scotiabank and its affiliates may serve as directors of corporations referred to herein. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable. Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, all members of the Scotiabank group and authorized users of the mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia and Scotiabank Europe plc are authorised by the UK Prudential Regulation Authority. The Bank of Nova Scotia is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available on request. Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities. Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.

SCOTIABANK ECONOMICS

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.