- The Delta variant of COVID-19 is unlikely to prompt a return to widespread mobility restrictions.

- Economic data continue to come in on the stronger side of expectations globally, and we are revising our forecasts up accordingly.

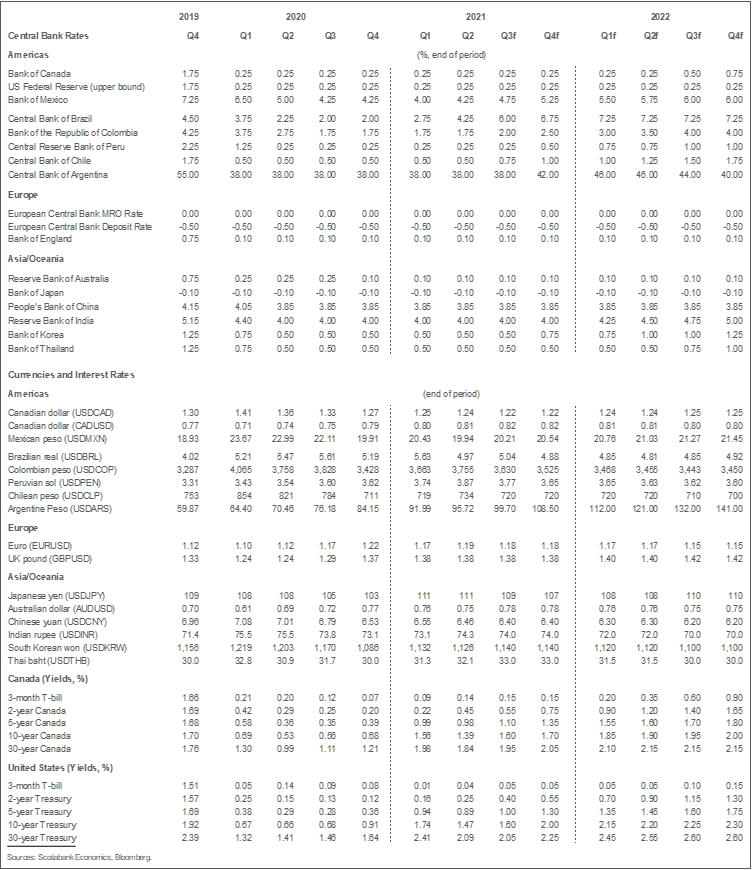

- While some emerging market central banks have begun raising interest rates, policymakers in advanced economies are some distance from doing so. The Bank of Canada should be the first to move, but only in July 2022.

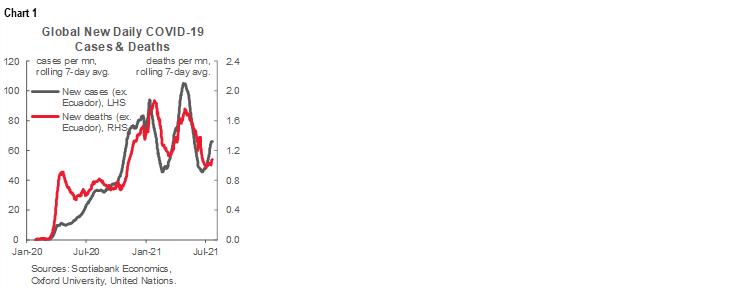

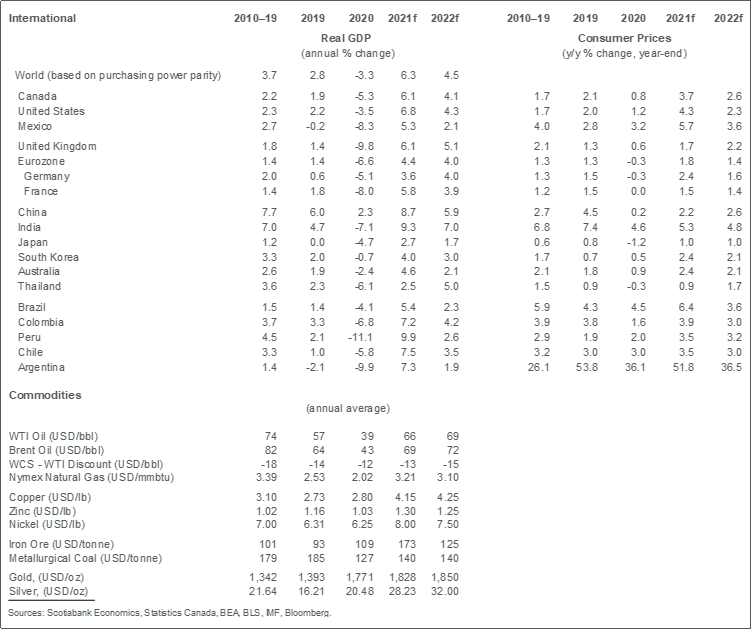

The Delta variant makes clear that we are not yet done with COVID. Financial markets have been spooked by the potential economic and financial impacts of the surge in cases being observed globally, sparking risk-off moves affecting currency, credit, and foreign exchange markets since our forecasts were last updated. However, we consider the Delta variant to be much less troubling from an economic perspective than the previous waves and we are, in fact, raising our forecast for global growth this month. We now expect the global economy to advance by 6.3% this year rather than the 6.2% we last predicted, followed by growth of 4.5% next year, unchanged from our previous forecast.

The experience resulting from the Delta variant thus far makes clear the benefits of aggressive vaccination campaigns. Even though the virus appears to be ripping through unvaccinated populations in various countries, the medical consequences for vaccinated individuals infected with the virus are greatly attenuated, such that hospitalization rates are climbing only very gradually among those individuals. Moreover, relative to the last two waves, global deaths remain low and stable in many countries. As a result of these outcomes, we consider the odds of a return to aggressive lockdown measures to be quite remote. In the United States, for instance, infections are rising most rapidly in states that have generally been hesitant to restrict movement and economic activity. In other countries, like Canada, very high rates of vaccination are likely to inoculate against a return to widespread mobility restrictions. And, in many other countries where vaccination rates lag those of Canada and other highly vaccinated nations, economic data remain robust and leave those countries in better shape to deal with mobility restrictions than earlier in the pandemic.

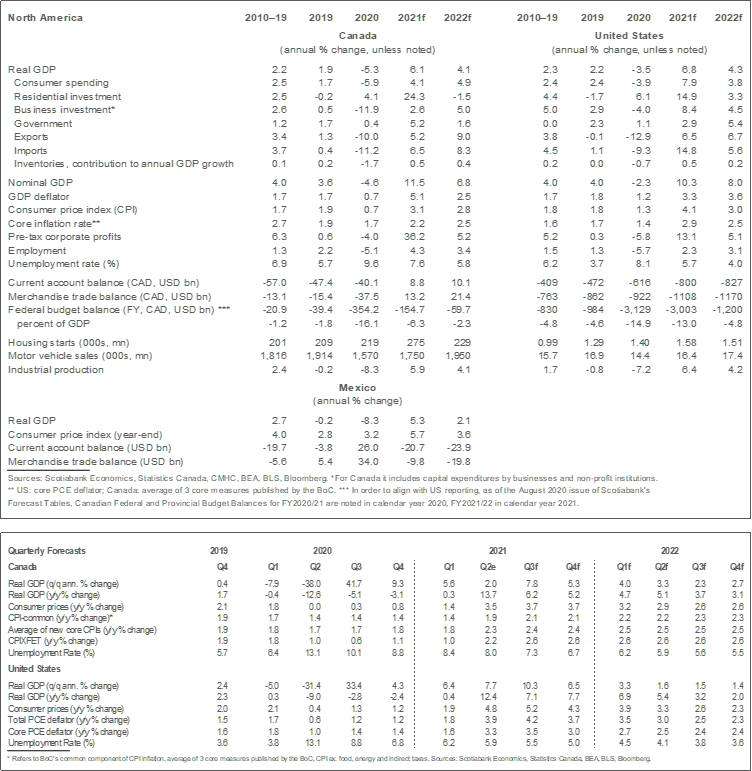

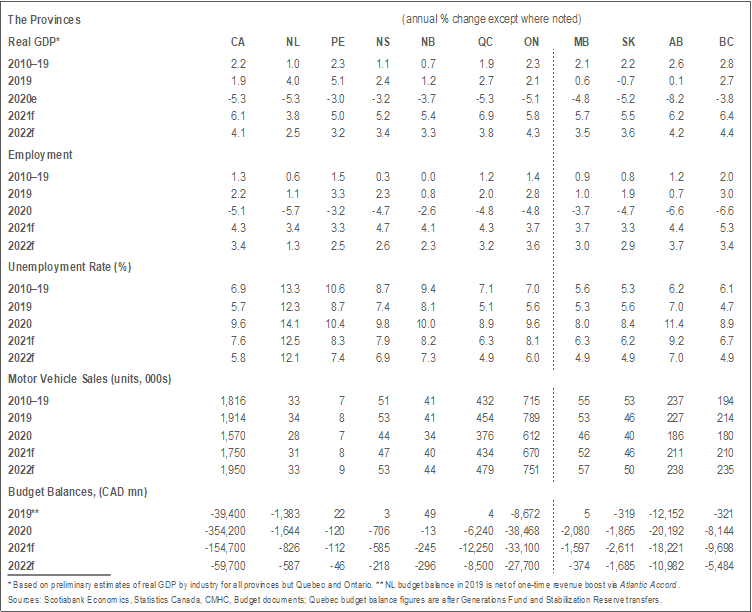

Our forecasts this month thus, by and large, represent tweaks to our earlier views, largely reflecting the incorporation of incoming economic data which have generally, but not uniformly, been on the stronger side of expectations. In Canada, for example, we kept our forecast at 6.1% in 2021 but raised it a touch to 4.1% in 2022. This captures slightly less robust growth at the tail-end of Q3 and early in Q4 as we incorporate a very small impact of the Delta variant in the fall, but that is offset by stronger growth before and after that. Even developments in credit markets are broadly supportive: the decline in longer-term interest rates observed in many countries represents a loosening in financing conditions which are likely to add somewhat to growth despite the fact that some view the drivers of these moves as capturing fears about the outlook. Outside the US, the risk-off appreciation of the US dollar is pushing currencies below their fundamental values, adding to the growth impulse coming from lower interest rates.

In the Pacific Alliance Countries, the impacts of the virus and political/social developments are largely offset by the strength of the domestic economy which has benefitted from re-openings, much stronger-than-anticipated commodity prices, and the associated robust global recovery. In some countries, like Chile and Mexico, the rebound and the inflationary consequences of higher commodity prices and exchange rate movements have led central banks to tighten policy well ahead of other countries.

Our view on rates in the US and Canada remains largely unchanged. We continue to expect that the Federal Reserve will raise its policy rate in the first half of 2023 and are heartened to see that the Fed shifted its dot plots in that direction since our last forecast was published. In Canada, we still forecast that Governor Macklem will raise interest rates in July 2022, and his recent decision to taper asset purchases provides greater confidence on that front. In both countries, as is the case in many other nations, the key challenge for policymakers beyond the immediate impacts of COVID remains the lack of certainty regarding the future path of inflation. Though inflation remains well above target in Canada and the US—reflecting a combination of base effects and a large number of supply chain challenges—it still appears to be more likely that the current surge in inflation reflects temporary rather than more persistent factors. The recent declines in the price of key commodities is a significant data point in that assessment, but there is no question that uncertainty around the inflation outlook is historically high.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.