Next Week's Risk Dashboard

- The end of dollar dominance, or temporary volatility?

- The forces behind this week’s anomalous market moves

- Canadian CPI: are persistent core pressures continuing?

- BoC: a close call has us leaning toward a hold…

- …but here are the hold and cut cases

- ECB expected to cut, tread carefully on the bias

- Debates will spice up Canada’s election campaign…

- …with seat mapping showing it’s the Libs’ election to lose

- US earnings season intensifies

- US retailers probably partied one last time

- Chinese GDP: savour this one

- Is Australia’s job market starting to buckle under?

- UK jobs and CPI to inform the BoE’s next move

- BoK will probably cut

- Turkey’s central bank expected to hold

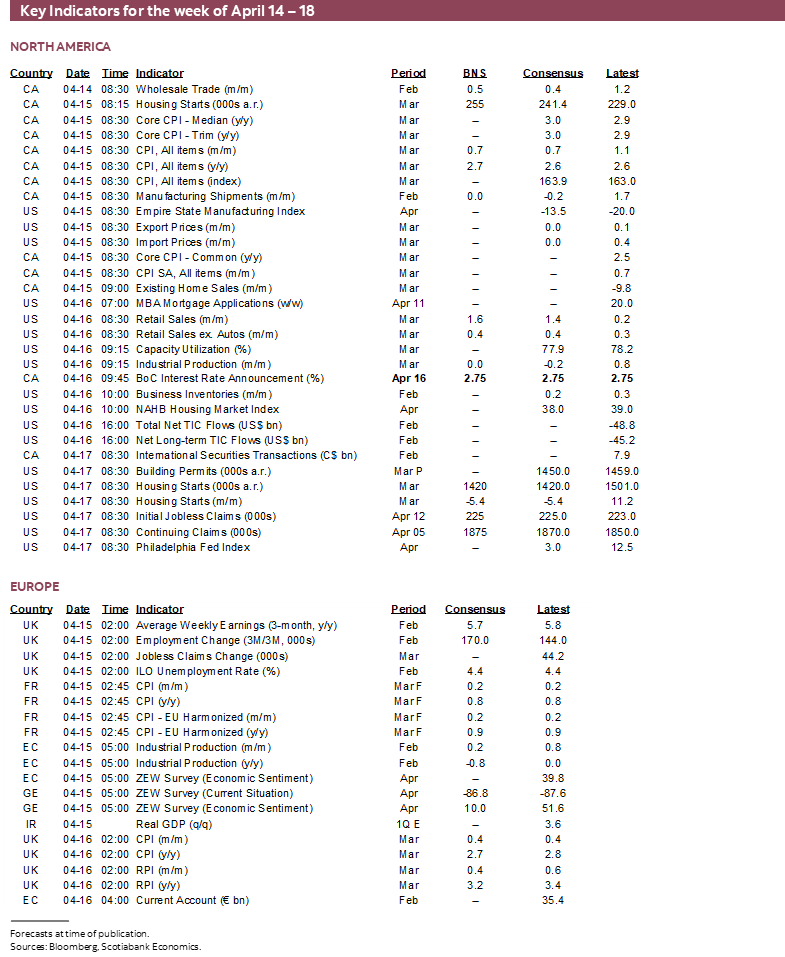

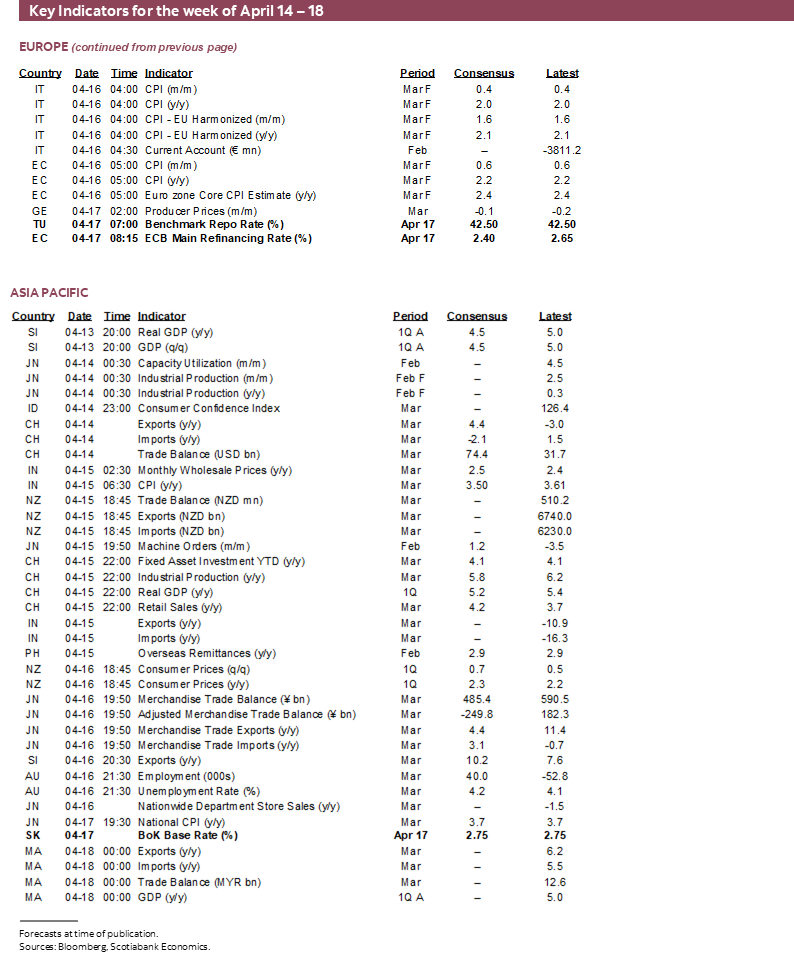

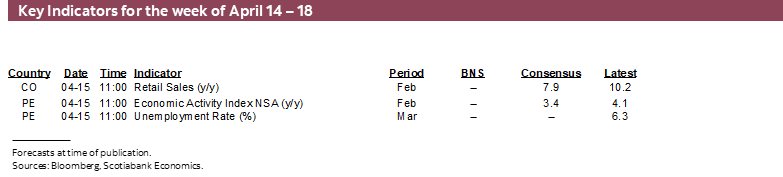

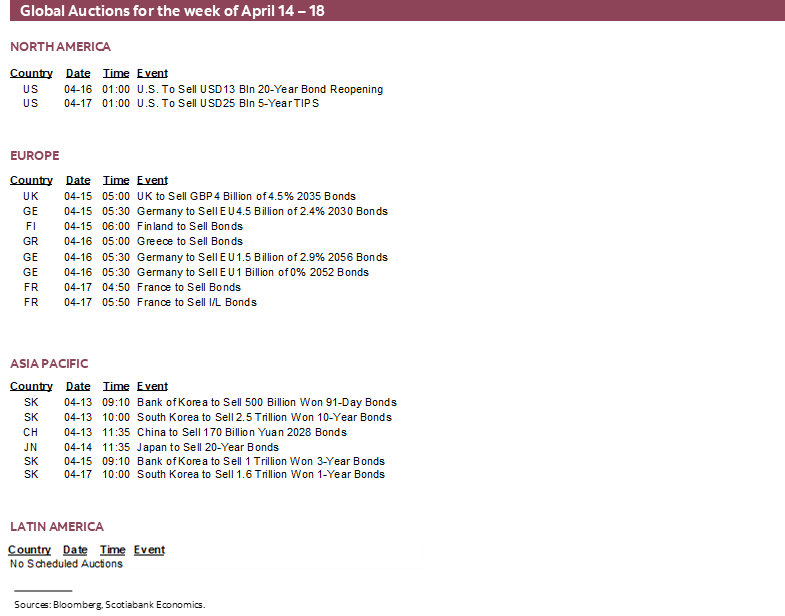

- Global macro

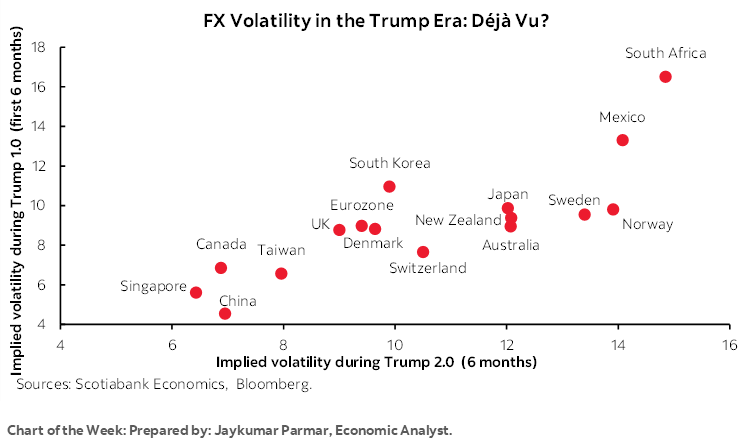

Chart of the Week

Market volatility is likely to persist into the coming week as markets grapple with whether temporary or more profound forces of change are upon financial markets due to unintended effects of Trump’s trade wars. An otherwise active calendar of developments also lies ahead. Will the BoC cut or hold? The ECB is widely expected to cut, but key is the bias. US earnings season ramps up, a pivotal moment in Canada’s election campaign arrives, and a significant line-up of global indicator releases from China, the US, UK, Canada, Australia plus a pair of regional central bank decisions will make for a spicy week ahead.

THE END OF DOLLAR DOMINANCE, OR JUST TEMPORARY VOLATILITY?

Thus far, volatility is more about price discovery in the wake of US policy shocks rather than signs of market dysfunction. Apparent anomalies in how markets are responding to rash and sudden developments may have sound explanations and could stabilize, versus extrapolating these developments with extreme and premature views such as how they finally represent the end of longstanding dollar dominance and US exceptionalism. Should developments deteriorate, the Federal Reserve is standing by the ready with a powerful suite of tools other than the policy rate that is likely to remain on hold for an extended period.

The signs of strains were evident in market moves this past week. The 10-year Treasury yield backed up by about a half percentage point to about 4½% and the two-year yield increased by about 30bps. The dollar on a DXY basis has been steadily tumbling this year and is about 9% weaker to where it was in January. The euro and related crosses are about 10% firmer to the dollar over this period during which all major crosses have appreciated and so have many emerging market currencies.

On the face of it, these are curious developments. Instead of benefiting as a safe haven during times of stress in the markets and a shock to the outlook like this past week’s fumbled US trade policy moves, the dollar has weakened, and US government bond yields have risen. Before the US S&P 500 rallied from Thursday afternoon into Friday, the simultaneous cheapening of Treasury bonds and stocks was unusual.

What’s going on? Are these signs of severe strains emerging in markets? Or evidence of healthy price discovery in the wake of the US government’s erratic moves? Either way, the market reactions were a major reason why the Trump administration postponed its worst tariffs on trading partners other than China by 90 days and there are still risks ahead. The other reason for postponing some of the tariff moves was perhaps to focus more upon pushing off tariff plans in an attempt to get the GOP moving toward a Budget reconciliation bill.

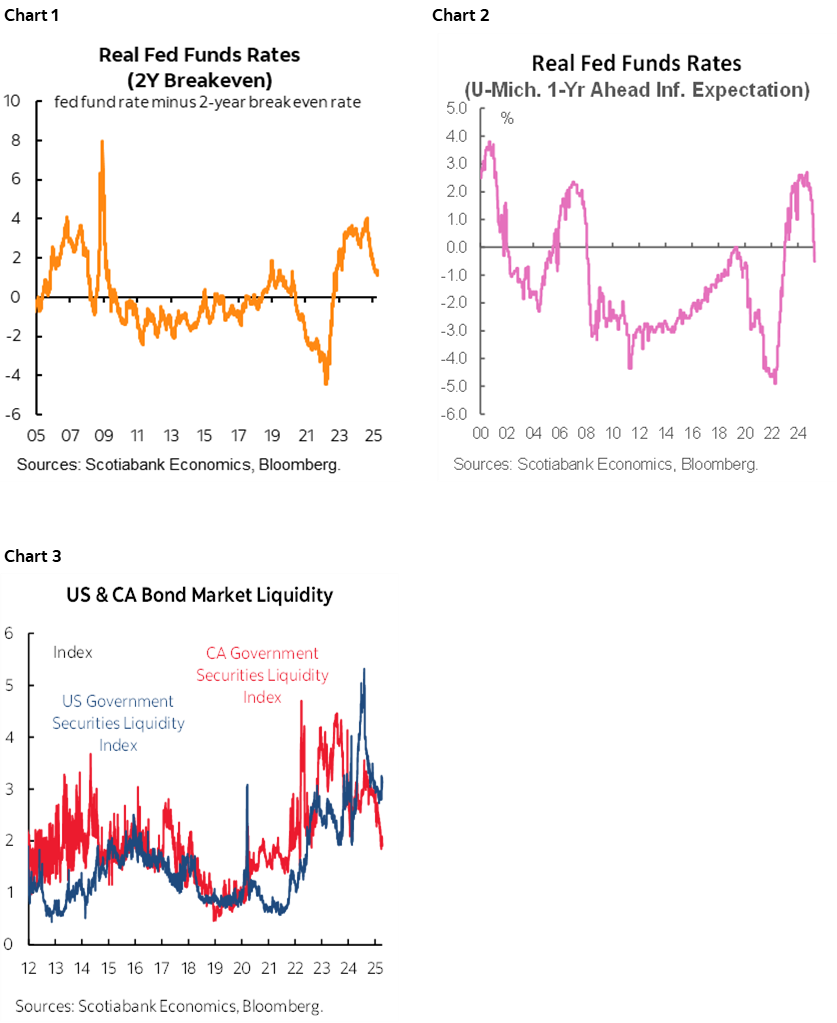

What I think explains these apparently unusual market moves is that markets are struggling with a fundamental and sudden reassessment of US inflation-adjusted policy yields that have abruptly fallen (charts 1, 2). This occurred against the backdrop of already impaired Treasury liquidity that worsened (chart 3). These developments were disruptive to the highly leveraged market that specializes in aligning relative interest rate and exchange rate differentials across markets. The developments were a shock to contracts and transactions that were priced with collateral terms based upon a less unstable policy backdrop. Perhaps once markets reassert a new equilibrium for real yields and how related financial markets should adjust there may be renewed calm.

Enter covered interest parity. Theory posits that the interest rate differential between two currencies in cash markets should equal the difference between spot and forward market exchange rates between the same two currencies and across the same time horizons. When that’s not the case, arbitrage ensues in whatever combination is necessarily to align the current rate spread with the market’s assessment of the reward or penalty to holding a currency relative to another in two different time periods.

That’s the theory. Reality is that there is a complex error term on this relationship called the cross-currency basis. A popular theory is that the covered parity relationship became impaired when regulations changed to make the core financial system—banks in particular—safer after the Global Financial Crisis. The added regulatory restrictions that were placed upon them restrained their ability to deploy as much balance sheet in search of arbitrage opportunities. This can be particularly problematic when there are sudden shocks to the system, like the late 2019 repo funding market crisis or the early stages of the pandemic.

Enter nontraditional financial market players led by hedge funds. Through a complex array of transactions, they can move in where banks have become more restrained and seek to realign markets and restore covered interest parity. They do this through cash transactions in the Treasury market, operations in the Treasury futures market, and funding their moves by adjusting Treasury securities as collateral in the repo market. Very high amounts of leverage are involved which amplifies profits if the correct bets are placed but amplify losses and trigger margin calls on hedge funds and potentially forced selling of safe and riskier assets if unanticipated developments shock the system.

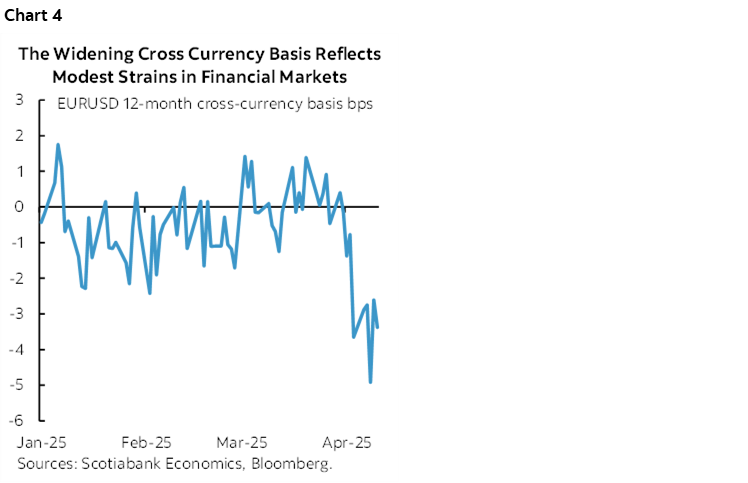

And so problems arise when there are sudden unexpected shocks to their complex web of transactions. Like Trump’s massive retaliatory tariffs that sparked a total re-evaluation of risks to growth, jobs, inflation and what the Federal Reserve may do about it all. Cross currency basis widened (chart 4) and this widening has persisted but is nowhere close to crisis levels that signal widespread dysfunction. It widened because increased uncertainty and violent repricing of expectations for inflation, growth and what the Fed might do was a sudden shock to a very highly leveraged market.

It is encouraging that—despite the unusual moves across connected markets—measures like the basis are not signalling a crisis, but this requires further monitoring this week. Further abrupt moves could slam already shaken confidence and faith in the Trump administration’s handle on policy measures.

There are important backstops to consider. For one, the Federal Reserve is already using its communication tools to lend support such as this FT piece that captured remarks from Boston Fed President Susan Collins who said “we’re not seeing liquidity concerns overall” but the Fed “does have tools to address concerns about market functioning or liquidity should they arise.”

These tools take varied forms including liquidity injections through routine repo operations, deployment of existing facilities, relative rate adjustments such as at the discount window if needed, the creation of new measures and facilities if needed, and possibly tweaks to quantitative tightening after having just tapered the pace at which it is allowing its Treasury holdings to roll off the balance sheet as they mature. Monitoring, communicating support, and if needed, jumping in the markets to restore confidence are powerful ways in which the Fed can support market functioning without abandoning its patience mantra as it too evaluates where inflation and job markets are going in future and what to do about it.

Further developments lie ahead. Governor Bowman’s recent confirmation hearing before the Senate Banking Committee for the role of Vice Chair for Supervision is important. She—and Chair Powell—support exempting banks’ holdings of Treasury securities from the supplementary leverage ratio (SLR). If her nomination flies—and it is expected to whenever the vote is held—then this would free up more capital to improve liquidity and functioning in the Treasury market. The longstanding deterioration of liquidity in the Treasury market could use the help.

To sum up, keep calm, and trade on. With information known to date, I wouldn’t look at these recent moves as clear evidence that the almighty greenback is baked for good. Moves in the basis and Treasury liquidity reflect rational moves by market participants including banks when they get concerned about dollar liquidity and converting into other currencies. As markets reprice expectations and settle down at a new equilibrium and with the FOMC standing at the ready, recently anomalous developments in financial markets could well be temporary. That could reopen markets that have seen suspended issuance and lending activity.

As for what lies beyond for the US dollar? I’ve said all along that the Trump administration needs to tread extremely carefully with respect to fiddling with the overall position of the US balance of payments accounts. Measures to abruptly shock the trade and broader current account deficits must be considered in light of the flip side to these effects on the capital account. Abruptly narrower trade deficits mean abruptly narrower capital account surpluses, as in less foreign appetite for US paper. Presumably the two hedge fund managers in Trump’s cabinet are sharing this caution. Still, it’s too early to tell if the US administration will succeed in durable narrowing the trade deficit through blunt tools and how both global trade and the global financial system may evolve from here.

BANK OF CANADA—IT’S A CLOSE CALL

The Bank of Canada delivers its next policy decision on Wednesday. As if US policy uncertainty isn’t enough of a challenge for them to navigate, there is also domestic policy uncertainty in the midst of an election campaign.

A fresh statement and Monetary Policy Report will come first (9:45amET). A press conference hosted by Governor Macklem and Senior Deputy Governor Rogers follows forty-five minutes later. Also watch for complementary research notes on topics such as revised neutral rate estimates and perhaps other matters.

Our (nervous) call is a hold. I'll lay out cases below for both a hold and a cut at this meeting. No further balance sheet changes are expected since the BoC is on autopilot in terms of having ended quantitative tightening back at the January meeting. The BoC's action to bring market pricing in line with its policy rate has been successful.

The Hold Case—Inflation!

Governor Macklem has been clear that monetary policy has its limits in a trade war and that at the end of the day it will focus upon price stability including the achievement of its 2% inflation target. How to interpret risks to that target is uncertain, but I’ll start with the case for upside concerns that would dominate a potential hold decision.

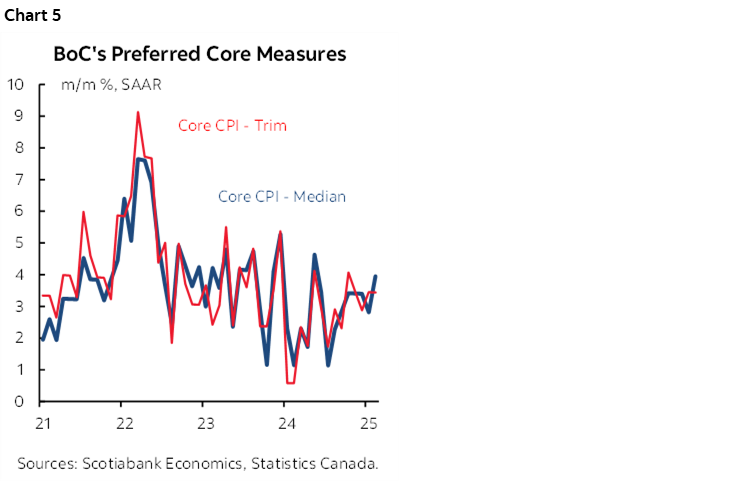

First, inflation has not been licked to date. The best way of depicting this is the ongoing upward pressure on the BoC’s preferred measures of core inflation-trimmed mean CPI and weighted median CPI. These measures seek to track central tendencies within the CPI basket. We’ll get fresh figures for March on Tuesday, but the last report showed then running at 3½% to 4% on a month-over-month basis at a seasonally adjusted and annualized rate. These core measures have been persistently too hot straight back to last May (chart 5). Their persistence has tended to suggest that the BoC shouldn’t have been easing as much as it has to date, so it’s time to call time out. Factors like ongoing supply chain challenges, housing shortages, weak productivity, real wage gains, and persistent cost pressures are among possible explanations.

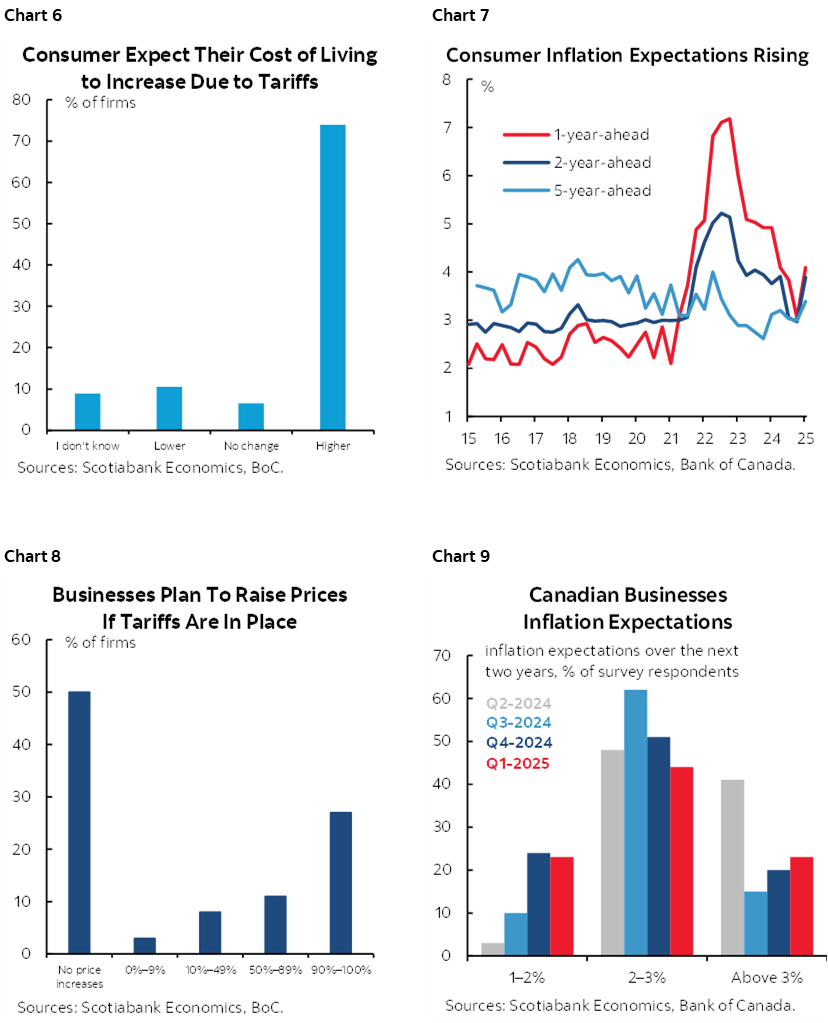

Second, enough of the folks who are making decisions on main street seem to believe that inflation risk remains skewed higher. While stale on impact, the BoC’s surveys show consumers expect higher inflation to result from trade tensions (chart 6) with inflation expected to be above 3% across all horizons (chart 7). Many businesses are signalling willingness to pass on tariffs through higher prices (chart 8). Furthermore, two-thirds of businesses say they expect inflation to be above the 2% inflation target with 44% expecting it to be between 2–3% and about one-quarter expecting inflation to be above 3% (chart 9).

Third, retaliatory tariffs add some upside risk to inflation which is behind the measures of inflation expectations. Canada has imposed 25% tariffs on $60 billion of US imports plus a 25% tariff on the share of US assembled vehicle imports that is non-CUSMA/USMCA compliant. These higher prices will begin showing up in prices paid very shortly.

Fourth, how supply chains evolve from here is a risk facing central banks the world over. A potentially severe crippling of supply chains is at a nascent stage of development. The trade war started by the US and the crippling bilateral tariffs with China essentially mean trade stops between the two countries given that producers would be supplying each other’s market at a loss. Some of that will trickle into Canada through US routes.

Fifth, it’s reasonable to expect further fiscal stimulus to be rolled out. Provinces have done this to an extent in the annual budget parade. The Federal government has done a little via measures such as enhanced access to expanded employment insurance benefits and supportive financing measures by Crown corporations. But key will be future measures that are likely to be introduced by the Federal government once the April 28th election determines a victor and the composition of Parliament, once Parliament returns and a fresh Cabinet is appointed, and once priorities are established on the path toward a budget that may take weeks to deliver, perhaps by June. Assumptions on the amount of fiscal stimulus that is forthcoming are largely arbitrary in magnitude and composition, but if the past pattern is any indication, then the same mistake of overdoing it on short-term transfers to households may be likely.

Sixth, at 2.75%, the BoC’s policy rate is already within the neutral rate range that the BoC estimates to be between 2.25% and 3.25% pending a possible refresh this week. Policy is already much easier in Canada than in the US where the Federal Reserve’s policy rate of 4½% sits well above 3% longer-run estimate of the neutral policy rate.

Seventh, the currency has done some of the heavy lifting for the BoC, although be careful with this argument. It’s true that CAD has depreciated to the USD since before the US election, but recent moves that have shown disfavour toward the USD have reversed much of this; USDCAD at about 1.39 at the time of writing is about six cents firmer than the peak weakness in February and only about 4–5 cents weaker than early last October. The BoC will have a mindful eye toward what is going on with the USD which I’ve written about in a separate section, and also the chicken-and-egg aspect to currency movements and volatility toward pricing future BoC rate moves; some of the remaining currency weakness reflects market pricing for 25–50bps of easing over the course of this year.

Eighth, there are other developments going on in the economy beyond the tariff obsessions. The fuller integration of the wave of immigration into the economy represents lagging stimulus to the housing and consumer markets; I’ll give opposing arguments on this in the cut section. Prior monetary easing has not yet fully worked through the economy in lagging fashion. Canadian households have a high saving rate and hoarded savings with pent-up demand for housing and related consumption.

The Cut Case—Disinflation!

And here is the opposing list of reasons for the Bank of Canada to cut this week. Key is that Canada is a modestly sized, open economy that trades a lot especially with the US and is significantly dependent on commodities.

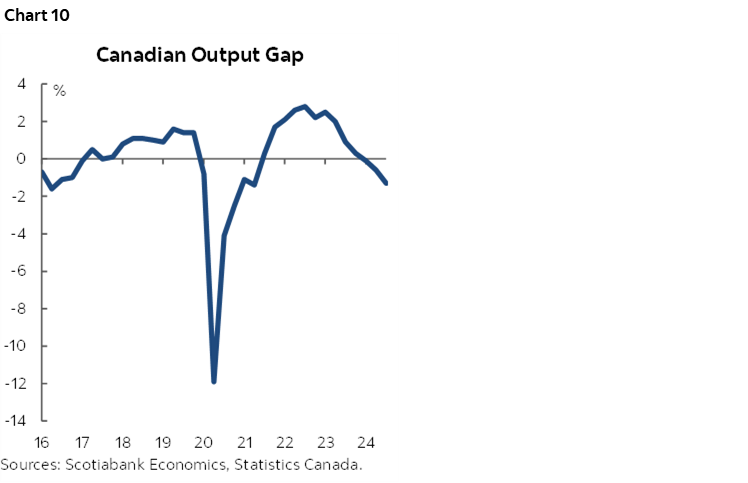

First, Canada is starting with ongoing slack in its economy even before the effects of the trade shock hit. The output gap remains in net slack territory (chart 10).

Second, as the international backdrop sharply deteriorates, Canada could import considerable economic weakness, more slack in its economy, and disinflationary effects. The BoC must revise global and US growth sharply lower this week; they previously had the US pegged to grow by 2.6% this year and 2.3% next year whereas recession talk is now in the air. This means there will be less foreign demand for Canadian exports and hence a bigger drag on Canadian economic growth. That, in turn, could add more slack to the economy depending in part upon how the BoC refreshes its estimate of the supply side and its projected rate of growth, a.k.a. potential GDP.

Third, commodity prices matter a lot to Canada and key measures are falling. Western Canada Select—a proxy for heavy oilsands in Alberta and Saskatchewan—has plunged by almost 20% in just the past couple of weeks as trade tensions became massively escalated. The BoC tends to look upon lower commodity prices as a case for a dovish pivot. That’s because lower commodity prices represent a negative terms of trade shock as export prices fall more than import prices which means the country is importing a downward shock to imported incomes. This effect trickles throughout the economy and shows up in upward pressure on fiscal deficits, and downward pressure on overall corporate profits and household incomes. Because of these effects, it tends to mean less spending by households and businesses.

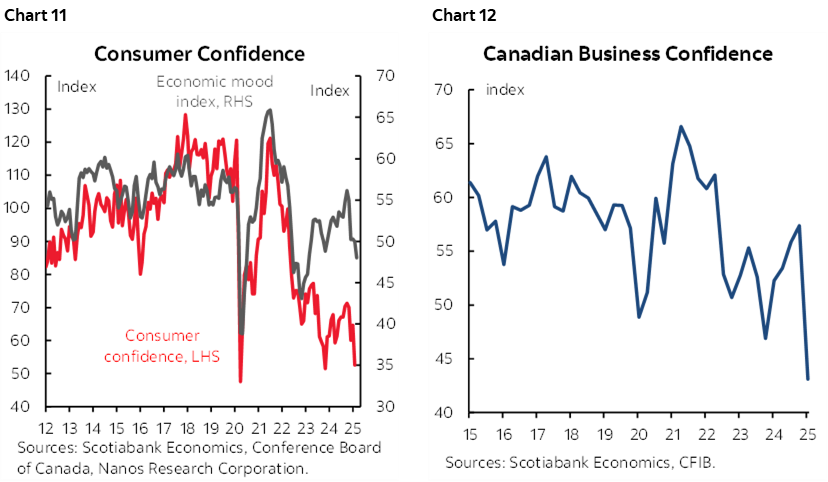

Fourth, it’s not just about concern toward exports and commodity income effects. The damage being done to consumer confidence (chart 11) and business confidence (chart 12) is likely to drive much more caution toward spending and investment. We are already seeing some tentative signs of this in weak home sales and the pull back in auto sales. The loss of over 30,000 jobs in March is just one reading after a strong wave of hiring, but it may also be a warning sign of what’s to come (recap here).

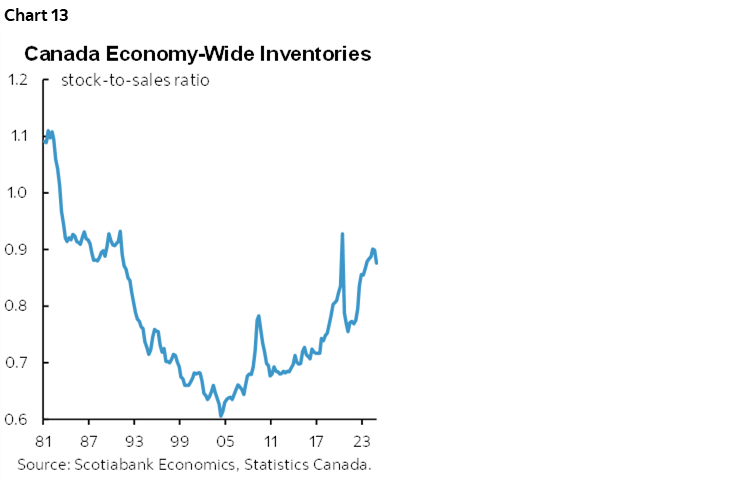

Fifth, inventories are rising (chart 13). Some of that is rational after the experience of the pandemic and other supply chain shocks over recent years. Companies chose to hold higher inventories because they were burned by the inability to get product when they needed it. This may remain true for the longer-term but could be a headwind to the economy in the nearer term. Inventories are expensive to finance and store, so as they balloon, production and hiring are likely to weaken in order to contain inventory costs.

Sixth, because of these developments, the BoC is very likely to revise Canadian growth projections sharply lower. They previously had 1.8% growth this year and next. We are leaning toward average quarterly annualized GDP growth of under 1% this year and it could easily be weaker. We cannot rule out recession risk in Canada.

Seventh, as growth is revised lower, the BoC could widen its estimated amount of slack in the economy. Key will be how they adjust their estimates for the supply side’s ability to grow. They might adopt a more negative view in the shorter-term which could be partly offsetting to their projected amount of slack in the economy.

Eighth, remember flexible inflation targeting? Governor Macklem was the #2 at the BoC when Mark Carney was Governor and emphasized a flexible approach to inflation risk when dealing with the aftermath of the Global Financial Crisis. The BoC targets 2% as the midpoint of a 1–3% inflation target range and could conceivably say that the uncertainty toward how bad things may get merits relaxing a little in favour of allowing nearer term inflation to stray somewhat above 2%. Whether Macklem would do that now is uncertain. He has said he is focused on 2%, but then again, it’s our perception that when given half an excuse to turn dovish he tends to seize the moment.

Ninth, Canada is not retaliating against US tariffs in dollar for dollar fashion and so on net the tariffs are a mild disinflationary shock to demand; they hit Canada’s exports harder than Canada’s imports and so the overall trade surplus may narrow and the trade deficit after excluding energy may widen.

Tenth, an added risk possible downside risk to the inflation outlook is trade diversion by countries facing high tariffs in the US toward dumping surplus product in Canada. China is the main conduit through which this may happen.

Eleventh, while the BoC has often gone against markets, if they were to hold at this meeting then they would slightly tighten monetary policy conditions given the one-in-three odds of a 25bps cut that is priced for this meeting at the time of writing. This isn’t likely to be a big consideration to the bank and the market is only pricing between 25–50bps of easing in total this year.

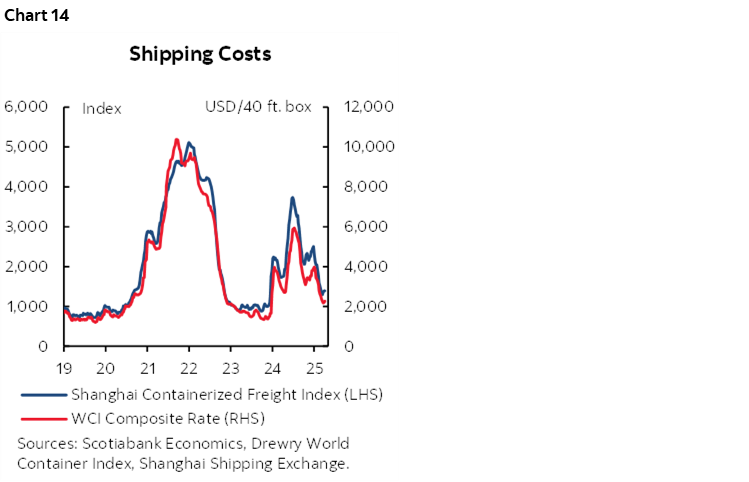

Lastly, while supply chains are at risk of driving higher inflation, a partial offset is that transportation costs will probably fall and perhaps by quite a lot. For example, global container prices are presently soft (chart 14) and as global trade deteriorates, there is likely to be less demand for containers and modes of transportation across air, rail and shipping. This effect is likely to be disinflationary because the limited amount of trade that survives will be incurring lower transportation costs.

CANADIAN INFLATION—UNLIKELY TO AFFECT THE BOC’S NARRATIVE

Canada updates CPI for the month of March on Tuesday and hence one day before the BoC’s decision. Could it sway the call either way? That’s highly doubtful and so I’ll keep this section relatively brief. The BoC’s forecasts and Monetary Policy Report will be set before the CPI release and they are unlikely to be overly reactionary to just one set of numbers.

I’ve estimated a rise of 0.7% m/m on a seasonally unadjusted basis as per the polling convention, and 2.7% y/y from 2.6% the prior month.

Because March is normally an up-month for prices as new Spring and Summer lines get rolled out for seasonal merchandise, the 0.7% m/m NSA rise is estimated to mean at 0.3% m/m seasonally adjusted gain.

The rest of the pressure comes significantly from the expiration of the GST/HST cut on a modest portion of the CPI basket in mid-February. The way Statcan captures this effect entails including half of it in February and the other 0.4% m/m half of the rise in total CPI the next month.

Gasoline prices were slightly weaker in March over February in seasonally unadjusted terms and this could be about a -0.1% m/m NSA weighted drag on total CPI.

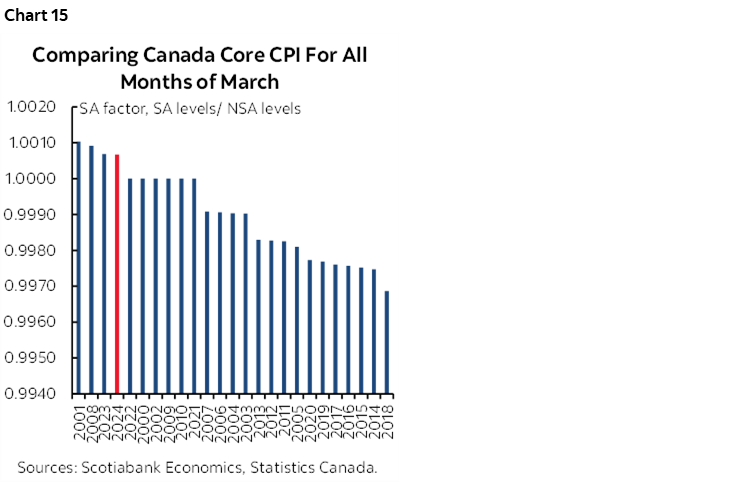

A further upside risk is what happens to seasonal adjustment factors. They may overstate the rise of seasonally adjusted prices because of the recency bias in how SA factors are calculated. By emphasizing seasonal patterns in more recent years more heavily than history, recent months of March have seen relatively high SA factors (chart 15).

Key, however, will be whether the aforementioned trend persistence in the Bank of Canada’s preferred core gauges continues. It’s virtually impossible to forecast these measures that are so sensitive to small movements in the dozens of price subcomponents that are included in the basket absent credible price information before hand. However, as the GST/HST cut fully shook out of prices, it’s possible that some relief in core prices could arise if retailers seek to offset some of the tax-induced price spike. These core measures exclude the direct effects of tax changes but it’s the indirect effects that may be uncertain.

ECB—CUT BUT TREAD CAREFULLY

The European Central Bank is widely expected to cut by 25bps to 2.25% on Thursday. Almost all of consensus is in that camp and it’s about 95% priced. Key will be forward guidance that is expected to be guarded relative to another 50bps that is priced over the remainder of the year after this week.

Unlike, say, the Bank of Canada’s handling of the trade war, the ECB’s policy rate remains above estimates of the neutral rate that is estimated to be around 2%.

Core inflation has continued to ebb toward 2.4% y/y in March as the month-over-month seasonally unadjusted reading was among the lowest over recent years compared to like months of March. Forward looking downside risks to growth may be emphasized more than inflation uncertainty for now, but President Lagarde is expected to tread carefully in terms of future risks.

CANADIAN ELECTION WATCH—IT’S THE LIBS’ ELECTION TO LOSE

It’s fish or cut bait time in Canada’s election campaign. The election is on April 28th, but two key leaders’ debates will be held this week. They are PM Carney’s to lose, given his massive polling advantage.

The French language debate will be held first at 8pmET on Wednesday evening on CBC. The English language debate follows the next evening at 7pmET. Leaders of the five main political parties will participate including Liberal leader and PM Carney, Conservative leader Pierre Poilievre, Bloc Québécois leader Yves-François Blanchet, NDFP leader Jagmeet Singh and Green Party Co-Leader Jonathan Pedneault.

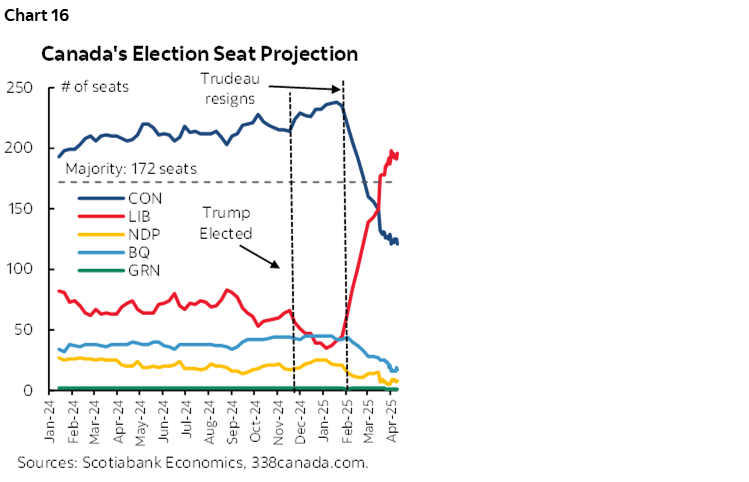

The Liberals are strongly in the lead. Various polls indicate more modest support differentials than shown in attempts to translate the polls into seat projections in the first-past-the-post system. Chart 16 shows the Liberals strongly in the lead. Some of this reflects how badly the NDP is doing such that the Liberals have consolidated the center-left vote to their favour. Much of it reflects the abrupt deterioration of support for the Conservatives since about early- to mid-March.

Watch polls conducted in the immediate aftermath of the two debates.

EARNINGS—MORE US BANKS ON TAP

US earnings season is kicking into higher gear. We saw some decent numbers out of US financials to end this past week. Of the less than thirty S&P500 firms that have released thus far, about three-quarters have been consensus EPS expectations and just over half have beaten on revenues. Thirty-two more S&P500 companies will report this week including more of the US banks. Key will be Goldman on Monday, and then Bank of America and Citigroup on Tuesday. Their remarks on market functioning may be insightful.

GLOBAL MACRO—WALKING BACKWARDS

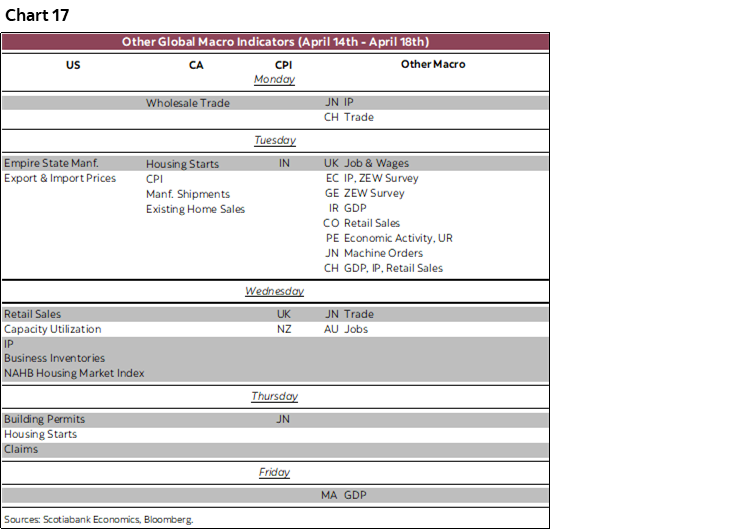

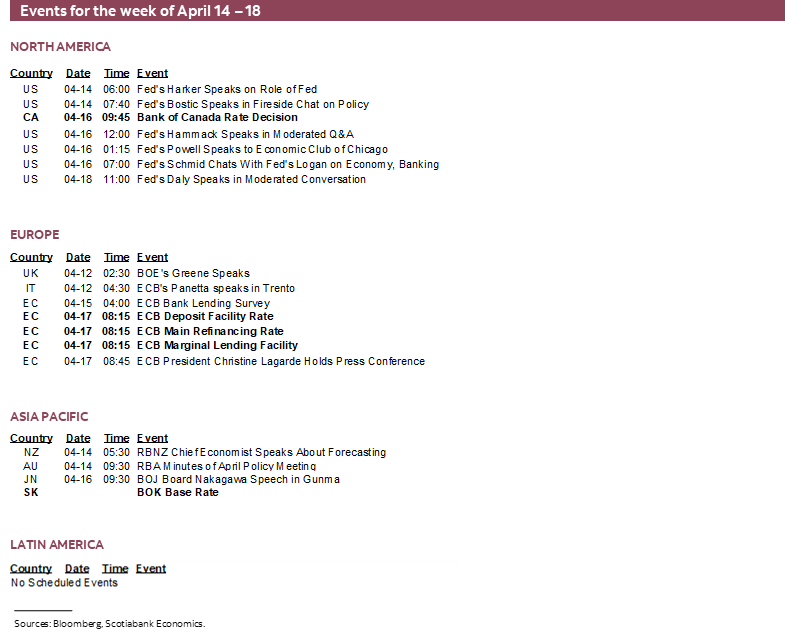

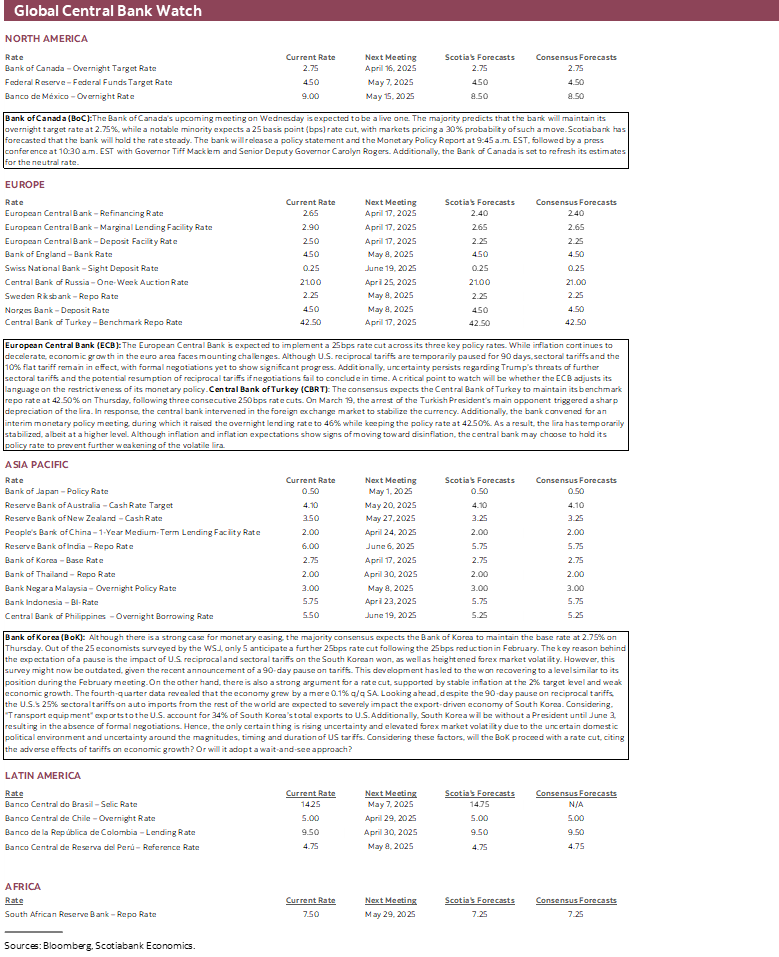

Chart 17 summarizes other global indicators that are due out this week. They are briefly discussed below, but backward-looking data hardly matters under current circumstances. The key ones will be US retail sales, Chinese Q1 GDP, Australian jobs, UK jobs and UK CPI. The Bank of Korea and Turkey’s central bank will weigh in.

United States—A Last Gasp for Retail Sales?

In the US the focus will be upon the ongoing US-motivated tariff wars and market functioning. The indicator docket will mainly focus upon Wednesday’s US retail sales that are expected to be quite strong in part because of the 11% m/m SA jump in auto sales last month that reflected a rush of buying to get ahead of Trump’s auto tariffs and retaliatory moves abroad. I’ve estimated a 1.6% m/m SA jump in retail sales largely because of this factor.

Import prices will take on more than usual importance but perhaps just quite yet when the figures for March land on Tuesday. It may be too soon to expect a significant tariff-induced jump, but they’ll be the first quantifiable signs of inflationary pressures to help further inform potential pass through into producer and consumer prices. Also watch several industrial gauges like output (Wednesday) and the start of the regional manufacturing surveys when the Empire gauge is released on Tuesday.

Business inventories in February (Wednesday) will be watched for input into Q1 GDP tracking. Inventory contributions to growth have been waning compared to earlier last year.

Asia-Pacific—China’s Best Quarter of the Year?

Quite a lot of data is due out with the focus on China, Australia, CPI readings and also the Bank of Korea’s decision.

China conducts its monthly data dump at the start of the week. Key will be the Q1 GDP figures alongside March readings for retail sales and industrial output that will help inform hand-off math into Q2 GDP tracking. China’s economy is thought to have grown by about 1½% q/q SA nonannualized, but clearly greater downside lies ahead. Monday brings export figures that are rather topical these days, but only for March and so expect expedited front-running of tariffs. Also due out by that day or the next will be aggregate credit and monetary supply figures. Falling home prices will get a March refresh (Tuesday).

Australia reports jobs for the month of March on Wednesday eastern time. The 53k loss in February was the first drop since last March and the biggest since December 2023. Another one could prompt greater concern about the economy and reinforce market pricing for the RBA to cut again on May 20th.

Markets and economists are somewhat divided on what the Bank of Korea may do next Thursday. Some expect a hold at a 2.75% base rate, others expect another 25bps cut. Governor Rhee Chang-yong signalled on February 25th when he cut that further cuts were likely forthcoming this year. He remarked that market pricing at the time seemed reasonable in terms of 2–3 cuts this year. That implies frequent skips given that there are six meetings left. Clearly a lot has changed since then both externally with US trade actions and given the move toward an election on June 3rd following protracted political uncertainty.

CPI figures will be released for March by Japan (Thursday) and India (Tuesday), plus Q1 CPI will be updated by New Zealand (Wednesday).

Europe—The UK Job Market in Focus

Europe’s ongoing response to Trump’s trade war will dominate the agenda. The UK will be the main focus as far as indicators go. Tuesday’s payroll employment figures for March, wage figures for February, and total employment tallies for February will then be followed by CPI for March the next day. Total employment has picked up over the two prior months while CPI is expected to remain elevated around 3½% y/y with still hot services inflation just under 5% y/y.

Turkey’s central bank is widely expected to hold its one-week repo rate unchanged at 42.5% on Thursday.

Canada—Side Shows

In Canada, the BoC, CPI and election debates will dominate. Minor indicators will include wholesale trade that may post modest growth (Monday), housing starts that are likely to rise on Tuesday, manufacturing shipments that are expected to be little changed on Tuesday, and that same day’s existing home sales during March as a barometer of homebuyer confidence.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.