Next Week's Risk Dashboard

- Taiwan’s election could stoke tensions with China

- Comparing Biden to past Presidents on the economy and markets

- Trump is poised to crush the start of the US election calendar

- Why Biden’s base is deserting him

- Middle East tensions on heightened alert

- Canadian inflation expectations likely to remain too high

- Will underlying Canadian inflation come in hot again?

- US earnings season accelerates

- China’s central bank is expected to ease

- Chinese GDP, activity readings to inform momentum

- Are UK wages and CPI still trending cooler?

- Australian job market has been on fire ahead of an update

- Hoping for stability in Eurozone inflation expectations

- Bank Indonesia likely to stay on hold

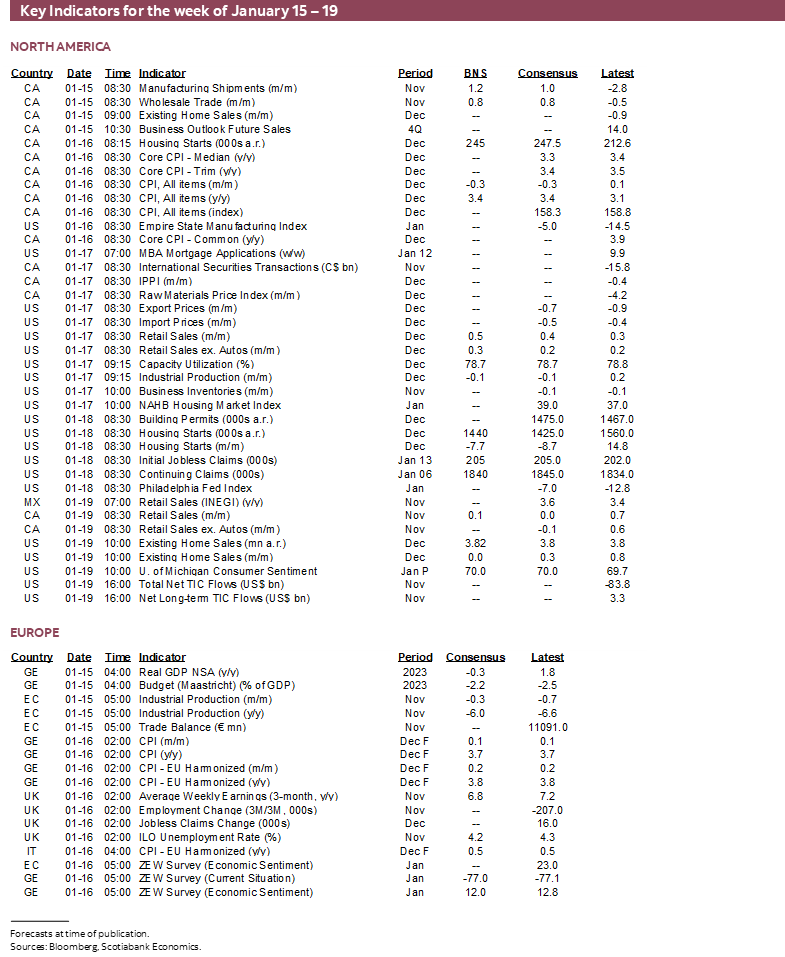

- Global macro reports

- US shut for M.L.K. Jr Day on Monday

Chart of the Week

An active year in the markets is likely to see plenty of action over the coming week. And no, I’m not speaking to the bar tab in Davos where they’ll try to solve all the world’s problems at the 54th World Economic Forum throughout the week (agenda here).

Substantive developments of relevance to markets will include the US earnings season, political events like Taiwan’s election and the first event on the US election calendar, the risk of conflict escalation in the Red Sea, the first arrival of a key central bank decision when China weighs in, plus several top-shelf macro reports that touch upon most major regions of the world economy.

TAIWAN’S ELECTION—TENSIONS WITH CHINA COULD RISE

Taiwan holds its Presidential election on Saturday January 13th and elects all 113 members of its legislature and so the result is likely to be known by the time many folks read this publication. Outgoing President Tsai Ing-wen has hit her term limit and at stake is whether her Democratic Progressive Party and its candidate Lai Ching-te can hold on.

Lai has advocated stronger ties with the US and agitated the relationship with China while seeking to build up Taiwan’s military defences. It is widely believed that China could respond with aggression either through economic policy tools or militarily if Lai wins.

It’s Lai’s election to lose according to the final polls that were published before the pre-election blackout (chart 1).

As for market reactions, it’s likely to be tricky to navigate between potential PBOC easing on the one hand, versus potentially intensified geopolitical risk into the Monday Asian market open.

US ELECTION SEASON COMMENCES

The candidates have been in election mode for quite a while now, but the US election season begins in earnest on Monday with the Iowa Caucus. The full timeline of primaries and caucuses is here including Super Tuesday on March 5th and the Republican and Democratic conventions.

Trump is running away with it to this point. He is predicted to win the Iowa Caucus in a landslide that begs asking why the other candidates would even still be bothering at this stage for any reason other than to possibly get a role in cabinet or some cushy post abroad (chart 2).

Chart 3 shows that Trump is polling the biggest margin of support over his Republican rivals in the suite of GOP Caucuses of any Republican presidential candidate in decades. He owns the Republican party.

It’s safe to say that Trump will be the nominee, barring the probably small risk that the Supreme Court and his litany of legal challenges changes his prospects.

On the flip side, Biden has lost the support of his own base. Chart 4 shows that Biden’s approval rating among Democrats and Democrat-leaning voters has gone from over 90% in early 2021 to about 60% now. That’s a spectacular collapse in support among voters who are naturally inclined to vote for a Democratic candidate.

I maintain that while both candidates pose their own mixture of risks and opportunities to the economic and market outlook, economics can explain these developments without getting into character issues howsoever entertaining or distressing it may be to do so. Charts 5–13 compare Biden’s performance compared to all other past Presidents in reasonably modern times in terms of GDP growth, job growth, the unemployment rate, wage gains, inflation, fiscal deficit changes, Treasury yields, corporate bond yields, and the stock market. By some of these measures, Biden has done well. By others, well, not so much. Some need to be interpreted carefully; for instance, Biden may not have changed the deficit much, but he has maintained it at a high level throughout his term.

But the distributional considerations are another matter. Where Bidenomics failed was in its promise to deliver the gains to lower- and middle-income Americans. Some of that is due to unfortunate circumstances derived from the pandemic and the initial responses he inherited, but that’s not a complete excuse by any means. Some of it is due to ongoing fiscal stimulus that far outstayed its welcome and that buoyed inflation and with it, higher borrowing costs through a massive ongoing surge in spending (chart 14) and indebtedness (chart 15), both of which involve regressive effects. A surging inflation-tax with its demand- and supply-side drivers coupled with higher borrowing costs serve to harm lower income households disproportionately compared to upper income households.

That’s the record to date, but what about the future? Biden’s tax proposals would impose trillions of dollars worth of added tax hikes summarized here. Many Americans are naturally predisposed to viewing tax hikes as anathema, even when most of the hikes don’t necessarily directly affect them on an individual basis! One reason for this is because of trickle down effects of tax hikes on corporations and wealth that raise the after-tax cost of capital and disincentivize investment and hiring. Another is perhaps best simply explained as a cultural bias with the benefit of Uncle Sam’s reserve currency status.

The roles of the USD and Treasuries in global leveraged financing vehicles connote advantages that paper over US fiscal largesse—to a point. With among the highest public debt to GDP ratios among peer group economies, the US is getting closer toward pushing its luck with the bond market (chart 16). The bond market is grappling with bigger and more frequent debt auctions that are showing signs of presenting funding strains in the US economy including via repo market gauges that put the Federal Reserve in the awkward position of potentially re-evaluating its Quantitative Tightening stance earlier than it judged to be likely even a relatively short time ago.

CANADIAN INFLATION—SURVEYS AND HARD DATA

Canadian inflation and Bank of Canada watchers will see things spice up a bit at the start of the week. Survey measures and hard data will combine to incrementally inform progress on the BoC’s inflation goals.

The Bank of Canada updates its Business Outlook Survey and Consumer Expectations Survey plus the timelier Business Leaders’ Pulse survey on Monday. While numerous soft-data sentiment readings will be updated, key will be the measures of inflation expectations since they are among the relatively few things that Governor Macklem has said he is closely following. Others include momentum in core inflation, the demand-supply balance, company price-setting behaviour, wages and productivity.

Chart 17 provides a sense of what may be revealed. The line for the CFIB’s small business survey shows that members plan to raise prices by 3.1% over 2024 based on a survey conducted between December 5th to 8th. That’s still a month old by now, but the BoC’s surveys will also lag as they were conducted between mid-November to early December. Given the correlation between the CFIB and BoC 1- year ahead measures it is reasonable to expect that the BoC’s surveys will indicate that inflation expectations will remain at or above the upper end of the BoC’s 1–3% inflation target range. That could be especially true since the BoC measures that are skewed more toward larger businesses have tended to land a little higher than the CFIB measures.

Next up will be CPI for December on Tuesday. I have estimated that CPI will dip by -0.3% m/m in seasonally unadjusted terms as per the consensus polling convention that is similar to Europe (US polling is for seasonally adjusted estimates). Since December is normally a seasonal down-month for the overall CPI index, we need to apply standard seasonal adjustments to this estimate. Upon doing so, CPI is expected to rise by 0.3% m/m SA.

Far trickier is the task of estimating the BoC’s preferred core gauges of underlying inflation pressures. They are Trimmed Mean and Weighted Median CPI. Trimmed mean lops off the top and bottom 20% of the basket while weighted median is the weighted 50th percentile price. Neither includes measures like mortgage interest costs or other outliers to the upside or down and the BoC relies on these gauges to reflect central tendency price pressures. Don’t look at the year-over-year readings so much as the month-over-month seasonally adjusted changes at annualized rates and on a spot and trend basis.

When these measures came in fairly hot in December for November, they started the market’s re-evaluation of rate cut pricing by the March and April BoC meetings. They are very difficult to estimate on a short-term basis because of the inherent volatility to the 55 CPI components as small changes within their distribution can drive significant swings in the overall readings.

EARNINGS—STILL FOCUSED UPON BANKS

US earnings season accelerates somewhat with twenty-three companies listed on the S&P500 set to release Q4 results. Among the key names will be Goldman Sachs and Morgan Stanley that arrive at the same time into Tuesday morning’s pre-market.

Earnings breadth picks up the week after next week when 75 S&P500 firms release across more sectors. It’s very, very early in the season thus far, but the kick-off has been unfavourable (chart 18).

CENTRAL BANKS—EYES ON CHINA

Big names in central banking begin to weigh in again this week but the real deluge beings to arrive the following week. In fact, we’ll only hear from two central banks, one with potential global effects and one that is more impactful to regional markets.

PBOC—What to Cut?

Consensus expects the People’s Bank of China to reduce the One-year Medium-Term Lending Facility Rate by 10bps to 2.4% on Monday. At the time of writing, four expected a hold, thirteen forecast a 10bps reduction and one thinks a 15bps cut could be offered.

If they cut, then it would be the first reduction since last August. The PBOC has cut this key policy reference rate by a cumulative 80bps since late 2019 of which 45bps have been delivered since the end of 2021. Forecasters are keying off of comments by central bank officials that have intimated openness toward easing.

They could instead opt for another reduction in the required reserve ratio—the share of bank capital set aside as a contingency instead of supporting lending (chart 19). Recently softer than expected growth in new yuan loans suggests that softness in China’s economy could require a lending boost (chart 20) as long as borrowers show a willingness to respond.

So why the change in sentiment when there has been discussion in the markets about potential further easing for some time now? It could be that the central bank has more confidence that the Federal Reserve is done hiking and will at some uncertain point shift toward easing which takes some of the pressure off of the yuan. China’s currency has appreciated along with many others relative to the dollar since the USD began to soften after early October.

Bank Indonesia—Inflation Ok, Rupiah Less So

Bank Indonesia is widely expected to stay on hold at a policy rate of 6% on Wednesday.

Inflation is running at 2.6% y/y with core at 1.8% which is within the target range of 2% +/-1.5%. The central bank is likely to continue to be sensitive to doing anything that could destabilize the rupiah. It has underperformed other Asian crosses since the USD began looking toppish after early October and may be perceived to be vulnerable to unwanted instability should BI cut prematurely.

GLOBAL MACRO—TOUCHING ALL THE BASES

There will be numerous key macroeconomic reports due out from across multiple major markets over the coming week.

China’s Economy—Barely Holding it Together

China’s economy just might be holding it together. Barely. We’ll find out Tuesday night (eastern time) when it releases Q4 GDP plus higher frequency activity readings for December. Growth is expected to be about 1% q/q SA at a nonannualized pace (chart 21). At 4% annualized and probably just over 5% y/y, that’s barely adequate by China’s standards.

Also key will be how the year ended because that will inform the hand-off effects into 2024Q1 and full year growth. Industrial production, retail sales, the jobless rate and fixed investment will all be updated with December readings at the same time as GDP.

UK Wages and CPI—Still Disinflationary?

The main risk in European markets will be UK CPI on Wednesday as well as UK jobs the day before and then UK retail sales to end the week. All job market readings will be updated including jobless claims, payroll employees and wages. Wage growth has been very slightly cooling in year-over-year terms to 7.3% in October but key will be whether the sudden weakness in October’s m/m figures was the start of a more troublesome trend (chart 22). That could nevertheless assuage the Bank of England’s concerns about bringing inflation down as core CPI is expected to dip to just under 5% y/y with the key there being whether November’s much lighter than normal month-over-month reading was the start of more intense downward pressure (chart 23).

Eurozone Inflation Expectations

The ECB’s 1- and 3-year measures of inflation expectations picked up over the course of 2023 and that puts some interest behind what happens in November’s reading on Tuesday (chart 24). It’s stale, however, and so ECB officials are likely to rely upon other fresher gauges in market expectations and developments such as rising shipping costs. Also watch for any further insights when the ECB releases minutes to the meeting leading up to the December 14th decision on Thursday.

Canada Mainly Focused Upon Inflation

Canada will mainly focus upon inflation as outlined above, but there will be other releases on the docket. Monday’s manufacturing sales are expected to rebound and also watch Monday’s existing home sales tally for December. December’s housing starts could rise on Tuesday in keeping with the trend in residential building permits and seasonally warmer and drier weather in parts of the country. Advance guidance points to a gain in Canadian retail sales during November on Friday, but more important may be advance guidance for December.

US Calendar Also Highlighted by Retail Sales

US releases are also expected to be constructive on balance. It mostly comes down to the state of the consumer when retail sales get updated for December on Wednesday. A rise in auto sales offers a running head start alongside expectations for a modest increase in sales ex-autos and gas as the holiday shopping season concluded. Industrial production is expected to be soft that same day and ahead of the Fed’s Beige Book that will offer regional anecdotes on the state of the US Economy later in the afternoon. Thursday’s housing starts are expected to give back some of the large 15% m/m surge during the prior month. On Friday, existing home sales are likely to be little changed given advance pending home sales data, but the week will end with reliance upon the University of Michigan’s consumer sentiment reading including measures of confidence and inflation expectations.

Asia-Pacific—Aussie Jobs and Japanese CPI

Australia’s job market has been on fire but will it continue? An uninterrupted string of job gains dating back to May has driven almost 300k more jobs. The effect has driven the labour force participation rate to a record high of 67.2% while keeping the unemployment rate around the record low range of 3.5–3.9%. Wednesday’s tally for December is forecast to keep the momentum going with a mild gain in employment.

Japan’s national CPI reading will probably just follow the already known Tokyo gauge that was soft for the month of December. The bias behind the Bank of Japan’s latest decision the following week is therefore likely to remain on the cautious side.

Light LatAm Developments

LatAm markets face light calendar-based risks. Brazilian (Wednesday) and Mexican (Friday) retail sales numbers for November are on tap.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.