Next Week's Risk Dashboard

- The impressive US economy is nobody’s victim

- How to watch US inauguration unfold

- What may happen with executive orders and when

- How to time the potential Canadian response to US tariffs

- Canadian CPI — down, but up?

- BoC surveys may indicate higher inflation expectations

- How the BoC may hike in tariff wars…

- …and how its balance sheet may evolve

- The FOMC should be relieved it’s in blackout this week!

- US earnings season continues

- Global PMIs to further inform tariff front-running

- The Bank of Japan is likely to hike

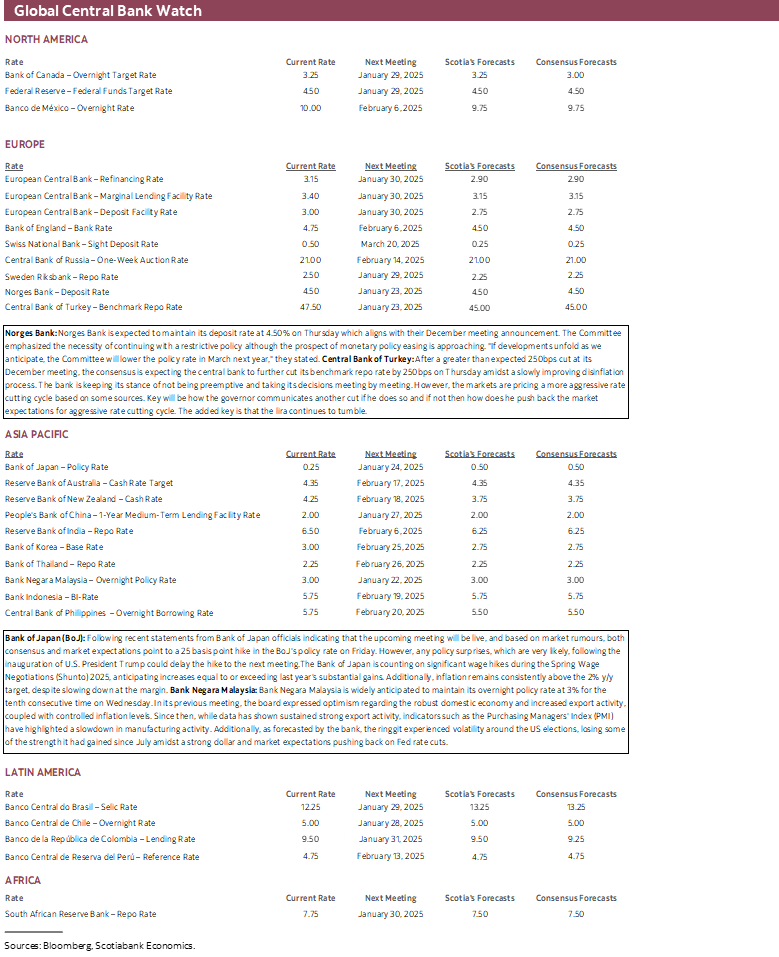

- Norges Bank expected to hold

- Turkey’s central bank may continue easing

- Negara, MAS on tap

- UK wages and jobs the last releases before the BoE

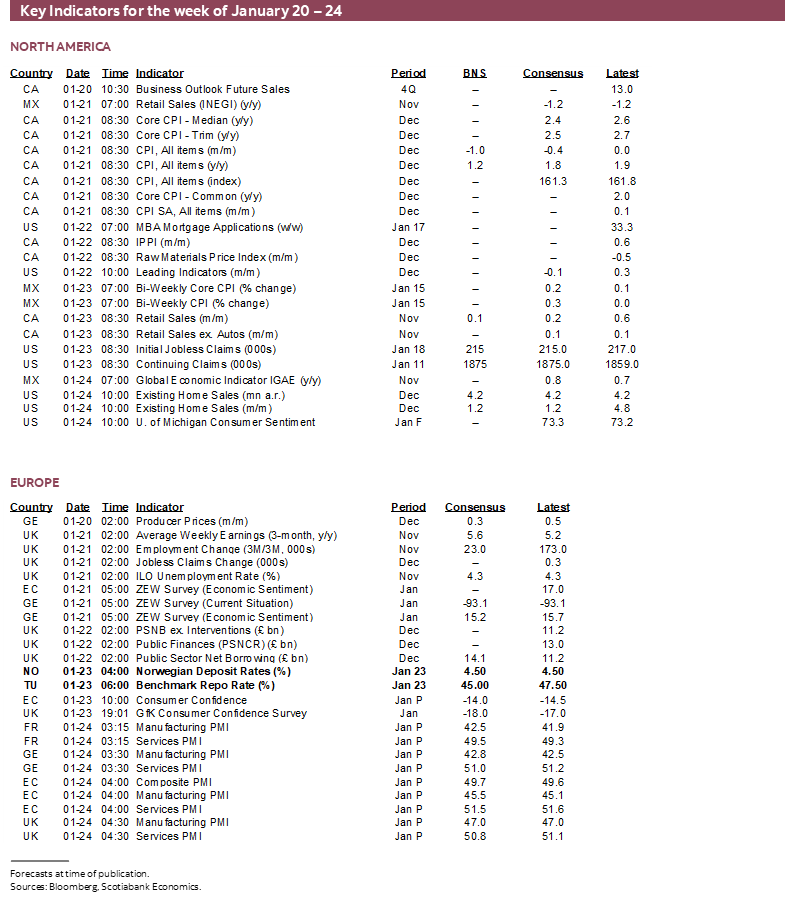

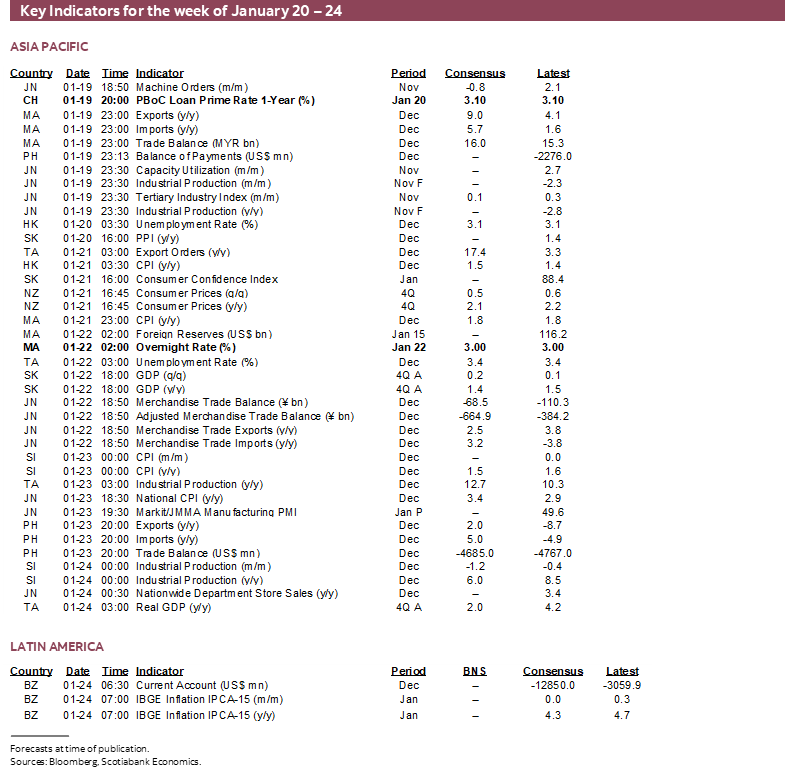

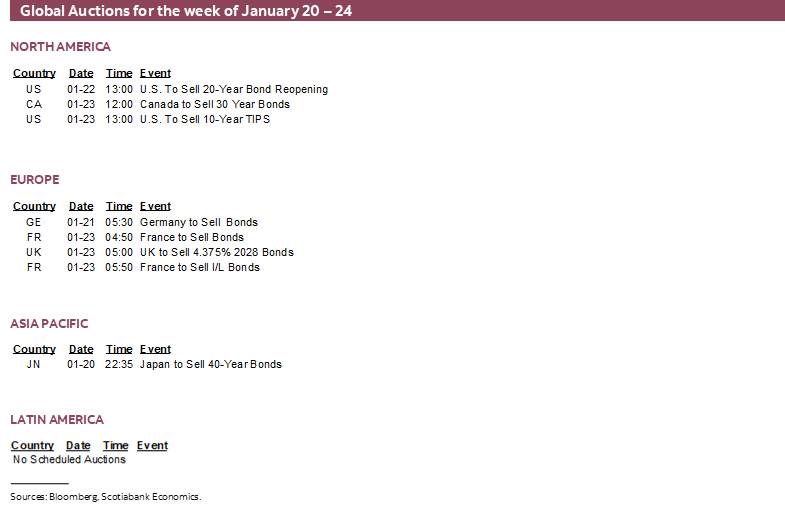

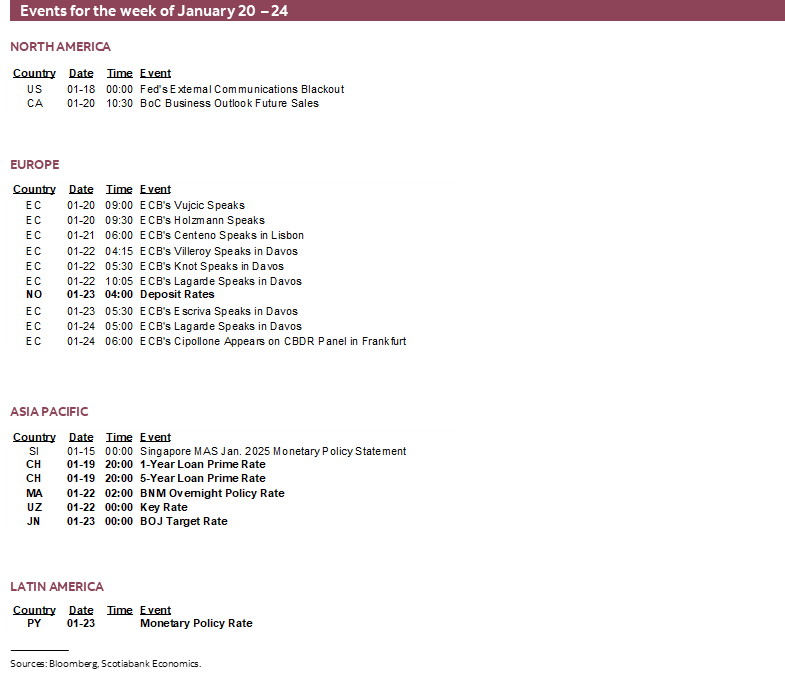

- Global macro indicators

- US markets shut for MLK day on Monday

Chart of the Week

What should the world’s strongest performing economy do at this juncture? Why, start a trade war of course! The magnitude of this risk will probably be informed by this coming week’s developments that could come fast and furiously. A playbook for watching the US Presidential Inauguration is offered along with what may happen with executive orders and responses by countries like Canada. Data risk may pale by comparison, but there are several gems on the docket along with decisions by a few central banks—most notably the Bank of Japan.

At the center of the risk of a trade war is the incoming US administration’s proclivity toward playing the victim card against all comers—allies and foes alike.

You see, the US is treated unfairly by everyone else. It does no wrong itself. I beg to differ. I simply have more admiration for the health of the US economy and the achievements of its people—Canada’s friends and neighbour—than the victim thesis merits. It’s an incredible economy run by plenty of smart minds. Minds and achievements that are degraded by baselessly trying to drag down the countries’ achievements and putting its standing in the world economy at risk along with the world economy itself.

The US economy is leading the world on growth while most other regions of the world struggle with underperformance and less growth-friendly policy frameworks. The US has among the highest per capita incomes anywhere. It is highly productive. It has deep and rich capital markets. It's an innovative and inventive economy that is usually at the vanguard of emerging technologies and their applications. The unemployment rate is low. Its universities are among the best anywhere. There are issues like income inequality and crime that are driven by domestic policy, but many other countries would kill to have such a strong economy.

The US has an opportunity to show the world how to achieve similar success by leading it. By being a magnet for talent. By setting an example. Not by dividing it.

Yet the finger-wagging is rather rich. Nah, no subsidies here. Further, US southern states siphoned off industry from northern states and Canada for decades by giving subsidies to auto firms and others, and now they're complaining that Mexico is doing it to them. That's a tad rich. Canada lost a lot of business to states like Kentucky that doled out cheque after cheque in subsidies.

Fast forward and Biden's Inflation Reduction Act doled out more subsidies galore, forcing countries like Canada to be dragged further down the subsidy path in response or else lose more of their industry.

Nowadays Canada runs a modest trade surplus with the US but take oil out and it's a deficit. Yes a deficit. And a longstanding critique of Trump's stance on trade is that trying to force the current account deficit smaller through tariffs or other measures that raise complicated risks—not least of which full on retaliation that damages global supply chains and global trade—would shrink the capital account surplus and with it foreign buying of US debt. Last I checked, the balance of payments needs to balance! If the US wants a smaller current account deficit, then spend less! Rack up less debt! While the part of the current account deficit that is because of attractive investment opportunities in the US shouldn't be viewed as a problem. The other part of the twin deficits is an own goal.

And give me a break on US agricultural policy relative to Canada or basically anywhere not named Europe as the two most highly distorting agricultural markets in the world that cause endless headaches for countries caught in between their policies. The US Farm Bill spends hundreds of billions per year in subsidies to corporate farms. These are not the ones of the 1930s.

Further on subsidies, the US set the conditions for the Global Financial Crisis and then bailed everyone out, cementing moral hazard problems for a generation. The Federal Reserve led central banks to buy up enormous shares of the global bond market by becoming addicted to QE as a policy tool, and then wondered why the US government has such a big deficit as the other half of the twin deficits.

Canada has a AAA rated sovereign one notch above America’s rating because its deficit to GDP ratio is a fraction of the US ratio and because it made difficult decisions like revamping the Canada Pension Plan in the 1990s to put it on sound footings. The US will pay a steep long run price if it doesn’t address its own fiscal and social security challenges rather than sparking trade wars and driving deficits and debt higher yet.

That would be a shame. The world needs an engaged America. One that makes the decisions today to remain a global powerhouse tomorrow. One that strikes a balance with efficient regulation that considers longer-run risks to the economy, society and environment. One that leads. One that counters foes and doesn’t lose friends.

HOW TO WATCH THE INAUGURAL ADDRESS AND POLICY RISKS

Pomp and ceremony will mix with serious policy actions starting this weekend through to Monday and the full week ahead. There may well be policy statements at any time, either through the press or social media by Trump or his advisors, and perhaps including any of this weekend’s events before launch day on Monday.

The President’s reception and fireworks (real ones) are on Saturday evening along with a Cabinet reception and VP Vance’s dinner. Sunday brings on a “Make America Great Again Victory Rally” at which Trump will deliver remarks that could broach any topic whatsoever given his style.

Markets, banks, the post office, some couriers, and most schools will be shut Monday for Martin Luther King Jr Day which is likely to give a ratings boost to watching the 2025 Presidential Inauguration. The National Park Service has this schedule of events at the Capitol and you can get your tickets there if so inclined! I’m convinced my front row invitation got lost in the mail. First up is the 60th (accounting for multiple terms) Presidential swearing-in ceremony that begins at 12pmET. It’s all apparently moving indoors this time to the Capitol Rotunda because the sunny forecast is for “brutal cold” of 24’F (-4’C to billions of others around the world); clearly despite the talk they’re not tough Canadians! Snowflakes; come try out that tough talk in Regina in January. Then there will be the inaugural address and inaugural luncheon following the ceremony. Then it’s parade time, starting around 2:30pmET; we’ll see if Trump walks up Pennsylvania Avenue again. The inaugural ball follows in the evening.

The inaugural speech by President Trump follows the ceremony when he puts his hand on the bible and promises this time to uphold his duties to the office and the Constitution. I have low expectations that we’ll get any policy meat out of it. These things are usually like SOTU speeches; written by a committee of career speech writers and party hacks with loose guidance and sign-off. They’re political, full up chest-thumping hubris and strident rhetoric. There will be sparks, but no fire. Or at least that’s likely to be the case if past inauguration speeches offer any guide. They’re all here if you’ve got serious time to kill, including Biden’s from 2020 here, and Trump’s from 2016 here.

TIMING EXECUTIVE ORDERS

The executive orders could then start flying at any moment once Trump takes his oath and becomes the 47th President of the United States. President Biden in 2020 began issuing executive orders within hours of taking the oath and issued this fact sheet at the time. Watch for something similar.

Reports indicate that over 100 executive orders being delivered commencing on Monday with many of them released before going to the inaugural ball. Border security, immigration enforcement, pardons, energy development, vaccine mandates, TikTok’s fate, and social policy priorities are among the orders that are expected to kick it all off.

Key to many, including our clients in Canada and Mexico will be executive orders on tariffs and trade. Trump announced this past week that a new External Revenue Service will be created to “collect our tariffs, duties and all revenue that come from foreign sources. We will begin charging those that make money off of us with trade, and they will start paying, finally, their fair share. January 20, 2025, will be the birth of the date of the External Revenue Service.” Tariffs are normally collected by the Customs and Border Protection folks and many have noted this would require Congressional approval.

At issue is whether a threatened additional 10% tariff on China and 25% tariffs on CUSMA/NAFTA/USMCA partners will be imposed. Of interest is that when advisors planted a story in the press about the possibility of gradually stepping up tariffs at a rate of 2–5% per month, Trump did not refute it immediately thereafter as he is prone to do in such circumstances. Smaller increments may introduce optionality along the way to assess the effects and responses, but the notion it would avoid a surge in inflation is silly. Such a path would merely be a water torture approach to tariffs that ends at the same point a few months down the road for tariff pass through effects on inflation. A series of increases could make it more difficult for central banks to look through a one-off tariff change and be more damaging over time by way of unmooring inflation expectations.

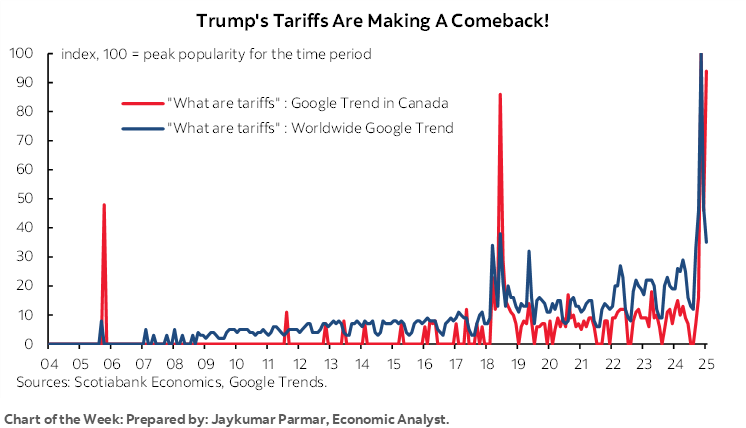

I’ve replicated a useful table from Oxford Economics with full credit but with our addition of the IEEPA tool (chart 1). It shows the range of options for using pieces of US legislation to introduce tariffs, along with whether Congress has to be involved.

One tool most likely to be employed is Section 338 of the Tariff Act of 1930 that followed the Smoot-Hawley Tariff Act and preceded such a grand time for the US economy. Section 338 can be used via executive order with no involvement from Congress. This note from before the 2016 election by a former Deputy USTR offers some background. It gives the President power to impose “new or additional duties” on any country or countries that are deemed by him to have discriminated against US commercial interests. I’m no trade lawyer, but the wording of that piece of legislation seems to give nearly omnipotent power to the President to impose tariffs for virtually any reason.

Tariffs of up to 50% are allowed under this Act upon finding that a foreign country has an “unreasonable charge, exaction, regulation, or limitation” that discriminates against the US “in respect to customs, tonnage, or port duty, fee, charge, exaction, classification, regulation, condition, restriction or prohibition” at the expense of US commercial interests. Right. So, if a Canadian team wins the Stanley Cup this year, then would that meet the Act’s criteria for something that worked against US commercial interests? He says sort of in jest.

Another possibly more probable tool that may be used is the International Emergency Economic Powers Act (IEEPA) that the late Jimmy Carter enacted in 1977 under vastly different auspices. It gives the President broad powers to regulate trade and other transactions when a national emergency is declared. Trump has been playing that card with endless woven tales of being ripped off and border security concerns. The IEEPA allows for a broad toolkit of measures to be employed from tariffs to sanctions to embargoes and other tactics. The President has the unilateral power to declare an emergency, to define its nature and scope, and to enact punitive measures in response.

TIMING THE CANADIAN RESPONSE

On the heels of the surprising degree of unity on the need to respond to potential US tariffs across thirteen of Canada’s fourteen First Ministers (recap here), the Federal Cabinet will convene a retreat in Quebec on Monday and Tuesday (here). It is understood that the prime purpose is to craft a response to potential US tariffs amid reports that a target list of C$150 billion of US imports is in circulation. See last week’s Global Week Ahead — Play the Long Game on Tariffs (here) for an explanation of the case for retaliating.

Pending the exact timing of any executive order signed by Trump that raises tariffs or possibly other restrictions, the Canadian response is likely to quickly follow. There are also likely to be communications on a support package of measures for the Canadian economy. Individual provinces may also enact their own measures, likely led by Ontario where the industrial base may be the most vulnerable to US protectionism.

As for the Bank of Canada’s possible reaction, it depends critically upon several assumptions. If the US imposes major tariffs in broadly based fashion for a meaningful period of time and Canada does not retaliate, then the BoC will be cutting aggressively. If those same assumptions hold but Canada does retaliate through its own significant tariffs in a broadly based manner for a meaningful period of time, then the BoC is more likely to be tightening monetary policy. The inflation impulses from damaged supply chains all over again plus CAD depreciation and pass through of tariffs on imports would pose upside risk to the 2% inflation target. The supply chain experiences of the pandemic plus anyone who is listening carefully to what the BoC is saying on that matter should have markets careful with their positioning.

For more on the policy rate risks and a discussion on the projected evolution of the Bank of Canada’s balance sheet see this note.

CANADIAN CPI—DOWN, BUT UP?

If tariffs start flying, then whatever else happens this week is bound to take on vastly less importance. On that list will be the Bank of Canada’s twin surveys of consumers and businesses on Monday and the next day’s CPI report.

BoC Surveys—Watch Inflation Expectations

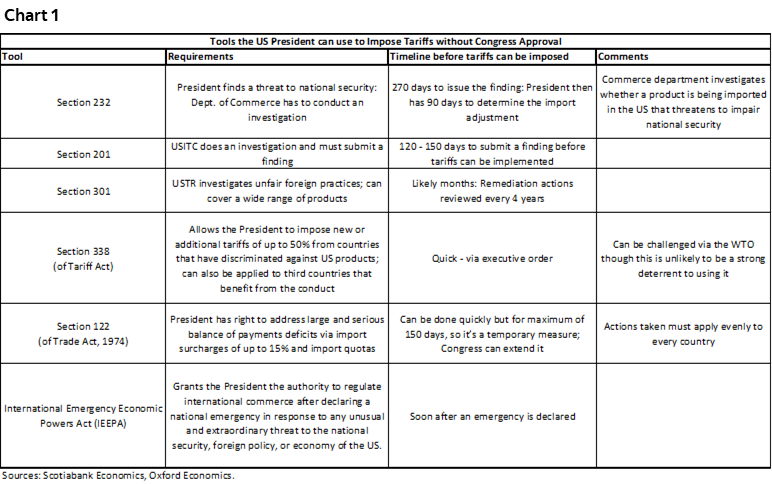

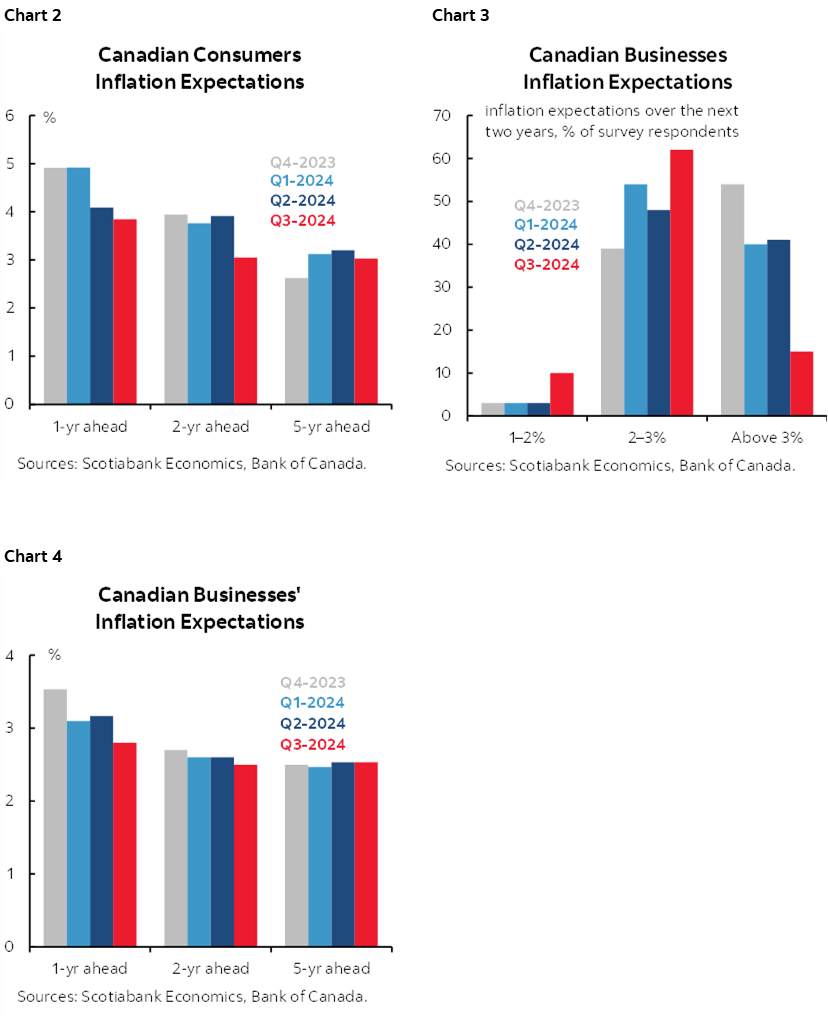

Monday’s release of the Business Outlook Survey and the Canadian Survey of Consumer Expectations will be of interest in terms of their broad array of measures on expected growth, hiring—and particularly inflation.

As charts 2–4 show, the last survey for 2024Q3 still showed consumers expected inflation roughly at or above the upper limit of the BoC’s 1–3% inflation target range across all time horizons while businesses were in the middle of the upper part of the band. The BoC needs to see further progress, but survey freshness is going to be a big challenge. The BOS survey would have been sampled from mid-November to the very start of December. The fresher accompanying Business Leaders’ Pulse has an online sample bias and was likely sampled throughout Q4. The consumer survey would have been sampled or the first half of November. Therefore, while each survey will have the benefited of being conducted in the ensuing aftermath of the November 5th US election, they are bound to offer a stale assessment especially if tariffs start flying.

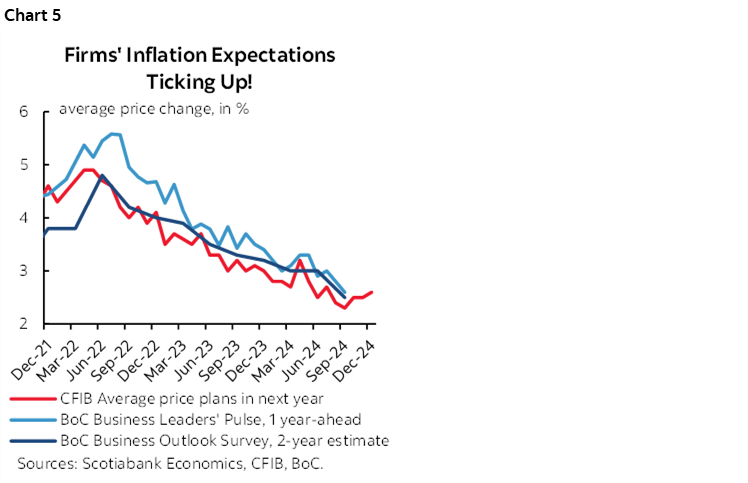

A timelier measure is from the CFIB. Its small business inflation survey shows that inflation expectations are starting to creep higher again. This measure is often a timely, accurate indicator of what to expect for the BoC’s survey measures of inflation expectations (chart 5).

Canadian CPI—Headline Softness, Core Strength?

While the same stale concern will apply here, Canada refreshes CPI figures for the month of December on Tuesday. Headline CPI is likely to be quite soft, but the Bank of Canada’s preferred measures for core inflation are likely to be firm. The BoC would clearly look through a weak headline figure driven by reasons discussed below, but what happens to underlying inflation makes their read more uncertain. It’s more likely than not that this will be a sustained one-off to the level of prices that is permanently ratcheted lower rather than setting the stage for a bounce back later.

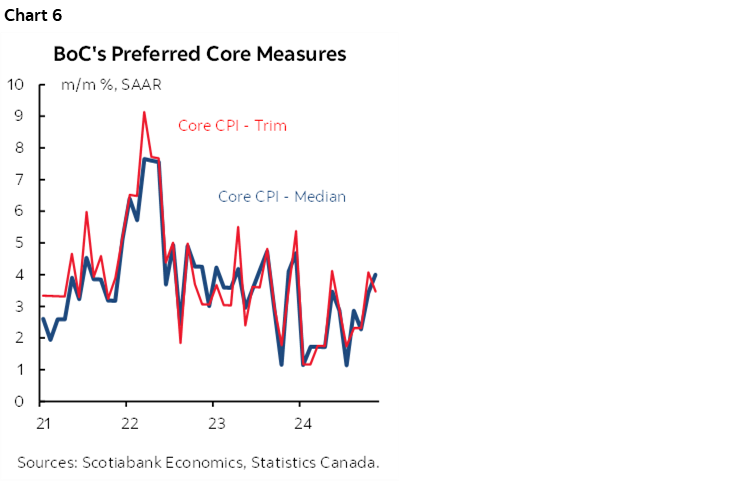

I’ve estimated a headline CPI drop of 1% m/m NSA that would drag the year-over-year rate down to 1.2% from 1.9% the prior month. I would not be the least bit surprised to see another warm reading for the trimmed mean and weighted median measures of underlying ‘core’ inflation in keeping with the recent acceleration (chart 6).

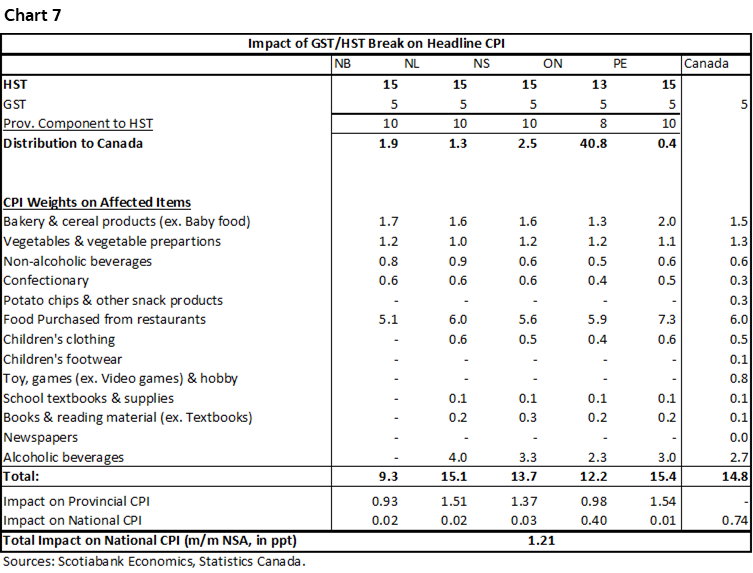

First is the headline estimate. The Federal government announced that effective December 14th until February 15th there would be no Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in provinces with an HST (Ontario, NB, NS, NF&L, PEI) collected on a list of items ranging from essentials like certain groceries not already exempt, to video game consoles.

The impact of this tax cut will drag CPI lower. Chart 7 shows the calculations. The maximum impact of the 5% GST cut on the relevant 15% of the national CPI basket that was targeted for relief is to shave -0.7% off m/m CPI. Then we consider the impact across the five provinces with HSTs by calculating their shares of the national basket times their incremental HSTs over the GST times their own uniquely affected CPI basket weights. The provincial impact subtracts about another 0.5 ppts from m/m CPI. In total, the maximum drag effect on CPI from the tax change is about -1¼% m/m NSA.

One immediate issue is how much of the tax cut will be passed onto consumers versus captured by companies. They may have been less aggressive with seasonal discounting or even raised some prices to ‘crowd in’ room vacated by the tax cut.

There is limited precedence for the size of this cut. In July 2006, the GST was cut by a full percentage point to 6%. Then in January 2008 the GST was cut by another one percentage point to 5%. In both of those cases, Statistics Canada offered an advance estimate of the possible change in CPI solely traced to the tax changes at -0.6% m/m NSA and did so as a preview in the prior month’s CPI reports (here, here). This time we have no such Statcan preview to go by despite the fact that they had time to offer one; the stimulus announcement was on November 21st, well before the next CPI report on December 17th.

The effects of the tax cut on CPI may be temporary and revert higher if the expiration stays on track for mid-February. That may not be true, however, if being that much closer to an election likely in May makes it less likely that the government wishes to see prices spike again in February and in the CPI report for the month weeks later.

An added effect is that December CPI is normally a down month in seasonally unadjusted terms. A 1 ¼% hit to m/m CPI from tax changes would be lifted by a typical seasonal effect of a few tenths of a percentage point to somewhere around -1.6% m/m NSA.

An effort to draw upon other components analysis and tax incidence effects is why the overall call was shaved to be a -1.0% m/m NSA reduction in total CPI.

Which brings up the issue of the core measures. The BoC's preferred measures exclude the effects of changes in indirect taxes, like the GST/HST. There will be no direct effect of the tax cuts on them. But if there is crowding in behaviour by retailers, then that effect would not be removed and it would be impossible to attempt to do so. Should retailers have captured some of the tax cut for themselves one way or another, then that could exert upward pressure upon trimmed mean and weighted median CPI in m/m SAAR terms. That could be more likely for weighted median—that measures the change in the weighted 50th percentile price within the overall basket—than trimmed mean that removes the top and bottom 20% of the weighted distribution of contributions to price changes. Given that the GST/HST cut applies to about 15% of the national CPI basket, trimmed mean could weed out the influence in the upper 20% of the tail—while nevertheless bumping other warmer items back into the middle 60%.

And who cares. Which is why I put CPI after all the content on what may happen in terms of policy risk next week.

CENTRAL BANKS—THE BOJ’S HIKE WILL STICK OUT

I’ll bet that FOMC officials are thankful they’ll be in blackout starting this Saturday and through to the day after the January 29th decision. Given how sensitive folks can be, they’ll cherish the free pass not to have to say anything over Inauguration Week barring something really calamitous happening. Serendipity strikes again!

Other central banks won’t be as lucky. Here’s the line-up.

Bank of Japan—Hike!

The Bank of Japan is likely to hike on Friday as it delivers fresh forecasts and policy guidance. Twenty-six within Bloomberg consensus expect a 25bps hike, one expects 10bps, and thirteen expect a hold. Markets are roughly 80% priced for a quarter point hike. If they go with a quarter point hike then the BoJ will have raised its policy rate by 60bps in total since March of last year when it started off at -0.1%. The initial quest to steer away from negative rates is well underway by now.

Why such a forecast? Largely because BoJ officials have pretty much said they’ll hike.

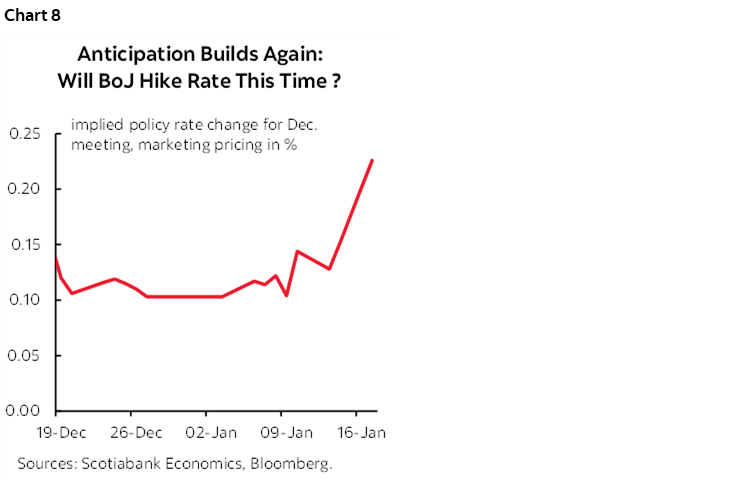

‘People familiar with the matter indicated to journalists in clandestine fashion this past week that there is a likelihood that the BoJ hikes by 25bps barring any disruptive effects around whatever Trump may do. The latter seems likely, so perhaps take it with a grain of salt. While the rumour mill isn’t always accurate, there was already a decent chance priced just before they indicated as much. Hike pricing doubled this past week in the wake of comments by Governor Ueda and DepGov Himino that formally declared this one to be a live meeting at which they would decide whether to hike or not (chart 8). That’s Japanese for ‘we’re gonna hike’ barring something really big happening.

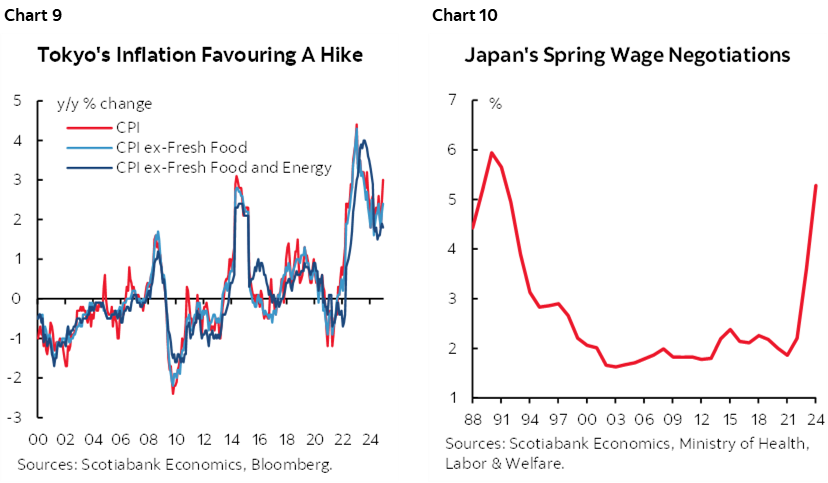

What has a bounce in their step? The prospect they may be achieving their inflation goals as core inflation shows continued progress (chart 9) and expectations point to adding a third strong yearly gain to the Spring Shunto round of wage negotiations (chart 10).

Should the US impose global tariffs including on Japan and the Japanese government retaliates, then it may further reinforce imported price pressures and hence further tightening.

Bank Negara Malaysia—Watching, Waiting

Negara is widely expected to stay on hold at an overnight policy rate of 3% on Wednesday. It has been on hold since May 2023 when it last hiked. The ringgit has been depreciating by nearly 10% to the dollar since October as EM risk around US trade policy increases.

Monetary Authority of Singapore

MAS recently announced that it will deliver a Monetary Policy Statement on Friday morning (ET) with the next one due no later than April 14th. The Singapore dollar is pegged within a controlled range to a basket of trade-weighted currencies known as the TWI index that includes Singapore’s main trading partners.

Norges Bank—Because They Said So!

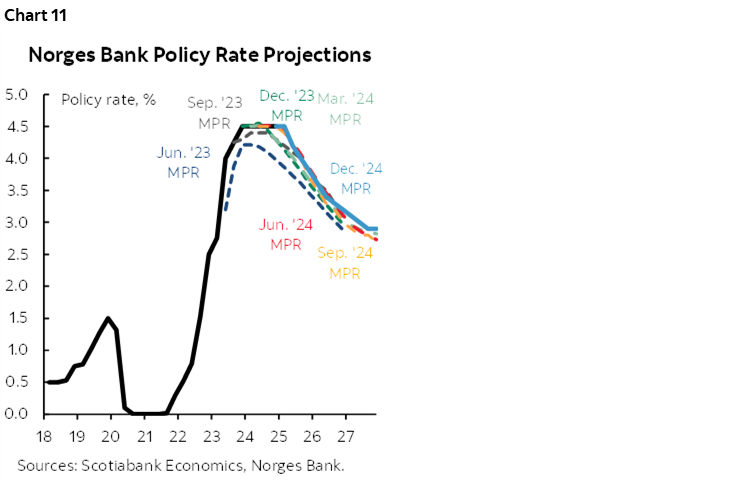

Norges Bank is expected to leave its deposit rate unchanged at 4.5% on Thursday. Consensus is unanimous and markets have nothing priced for this meeting but expect a quarter-point cut at the next meeting on March 27th.

Why? Because this central bank provides explicit guidance. Provided at the time of their last decision to hold on December 19th said “the policy rate will most likely be reduced in March 2025” which means skipping again on January 23rd. The cumulative pace of easing in the freshened guidance was lowered from previously (chart 11).

Norges noted that “Higher tariffs will likely dampen global growth, but the implications for price prospects in Norway are uncertain.” Hence the dilemma facing many central banks.

Central Bank of Turkey—Another Cut Coming

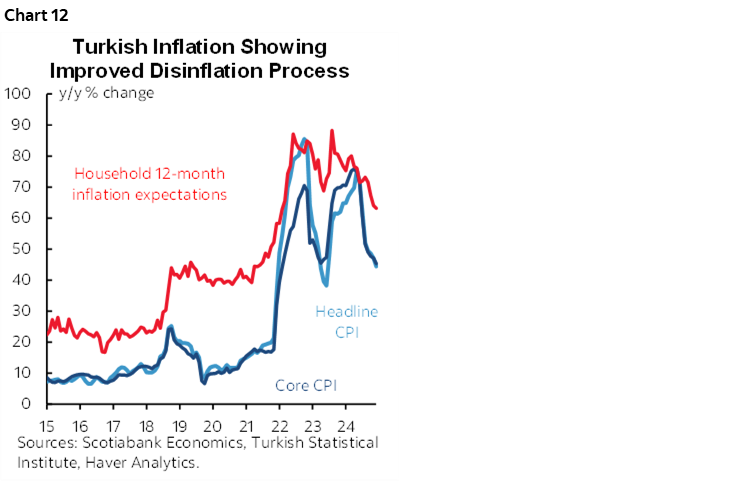

Rate cuts are in motion. Turkey’s central bank cut by 250bps in late December from an eye-watering 50% repo rate. It’s expected to cut again on Thursday with consensus unanimously expecting another 250bps cut down to a positively paltry 45%! Sarcasm intended. Inflation is starting to roll with core CPI down from a peak of 75% y/y to 45% recently and inflation expectations are improving (chart 12). That’s hardly mission accomplished especially since the lira continues to depreciate to the dollar which raises import price pressures, but maybe the central bank feels it can turn less restrictive.

GLOBAL MACRO—IF DATA MATTERS, THEN THESE NUGGETS ARE THE ONES TO WATCH

What has been covered so far will dominate the week’s market attention, but there will be a few other nuggets to consider. Major economies update purchasing managers’ indices for the month of January toward the end of the week. First up are Japan and Australia on Thursday (ET) followed by the Eurozone, US, UK, and India on Friday. Watch for further indications that global purchasing managers are trying to get ahead of tariffs imposed by the US and retaliatory measures by several economies. Inventory stockpiling through accelerated ordering and also a greater rush to get exports to market may aid near-term growth but harm growth later.

Whatever juice is left in the tank after what the incoming US administration has planned has been digested will mostly have to consider earnings risk. Thirty-seven names on the S&P are poised to release earnings including names like 3M, Netflix, Capital One, J&J, and GE. Names that are more impactful on the broad S&P index will follow in subsequent weeks.

Canada reports retail sales for November on Thursday along with a flash estimate for December’s sales in nominal terms. Statcan previously guided on December 20th that November’s sales were tracking no growth but with only a 50.6% survey response rate. Including the flash for December should give us a better understanding of the overall quarter.

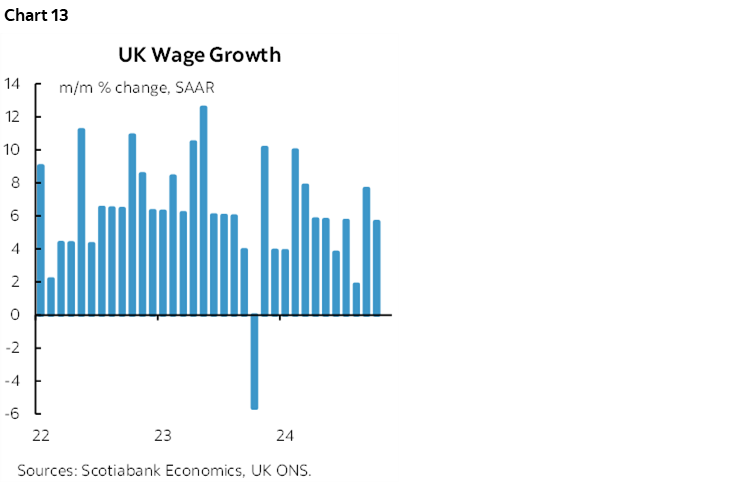

The UK updates a series of measures for jobs and wages for the months of December and January on Tuesday. It’s the last batch of meaningful data before the February 6th BoE decision at which point markets expect a 25bps cut. Job growth has slowed but wage growth remains sticky (chart 13).

CPI reports will also come from New Zealand for Q4 (Tuesday), Japan for December (Thursday) that is likely to reinforce what is already understood from the Tokyo gauge, Singapore (Thursday) when MAS issues its statement, and Brazil for January (Friday). Mexico reports its bi-weekly CPI measure on Thursday.

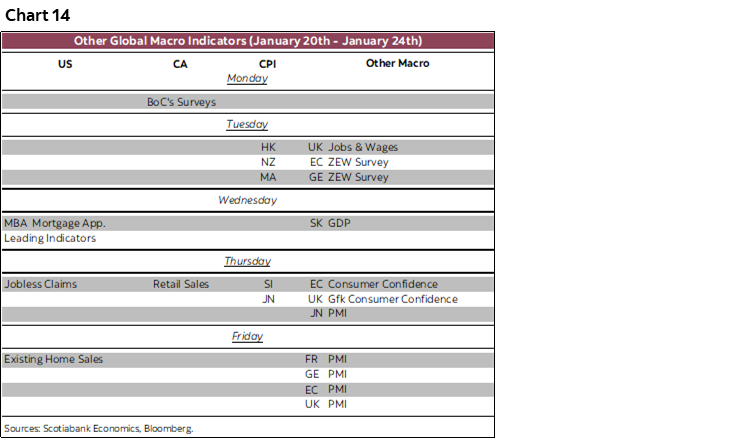

See chart 14 for a summary of the indicators.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.