Next Week's Risk Dashboard

• Corporate balance sheet strengths

• US nonfarm payrolls to cool?

• Canadian jobs aided by massive easing of restrictions

• BoC surveys likely to show higher inflation expectations

• Minutes to the anticlimactic FOMC meeting

• Analysts to firm up earnings estimates

• Inflation: China, , Chile, Colombia, Mexico, SZ, SK, Thailand, Philippines

• CBs: RBA, Peru, Negara

Chart of the Week

THE OTHER BALANCE SHEETS

As Americans and Canadians go into their long Canada Day and Independence Day weekends, I know that many of you are thinking what better way to pass the time could there possibly be than to read an economics publication rather than golf, tennis, dining, bbq’ing, fishing, sleeping, or just plain frolicking about. If you’re actually reading this, then you agree. For the teeny tiny minority who might need a little more coaxing but still have some interest, this issue will err on the somewhat lighter side of normal.

Before turning to the expected developments over the coming week, I’ll start with another entry in the evolving series of notes on risk mitigants into a downside scenario for the economy. As monetary policy tightens financial conditions, it will continue to ding the interest sensitive sectors the most, lessen excess aggregate demand and perhaps reopen some slack while probably raising unemployment rates as the Phillips curve channel through which softer inflation is delivered. These effects may be more powerful than the Fed ‘put’ arguments that markets had become accustomed to before the pandemic since the magnitude of the inflationary challenge is far greater today. In fact, if a Fed put is triggered too soon then it may complicate the inflation fight for a much longer period of time.

The state of corporate balance sheets prominently figures among the varied concerns about the state of the Canadian and US economies and their ability to handle tighter monetary policy. Broad metrics are very sound and indicating high resilience and this should enable the corporate landscape to continue to drive an economic expansion. Much of the focus is upon household balance sheets that I view as stronger than much of the popular commentary suggest, but nonfinancial and financial corporate strengths don’t receive enough attention.

For one, interest coverage across the whole nonfinancial corporate landscape is running at a record high in both the US and Canada (charts 1, 2). Q1 is the latest available as Q2 continues to unfold. This measure is highly correlated with charge-off rates especially during abrupt recessionary periods in the past.

A deterioration in interest coverage likely lies ahead and should be driven by higher financing costs, cooler growth in profits to be further informed by the upcoming earnings season, and a shift in management and financing of net working capital requirements. Gross charge-off rates tend to rise fairly quickly when interest coverage begins to deteriorate but are likely to do so relatively modestly into 2023.

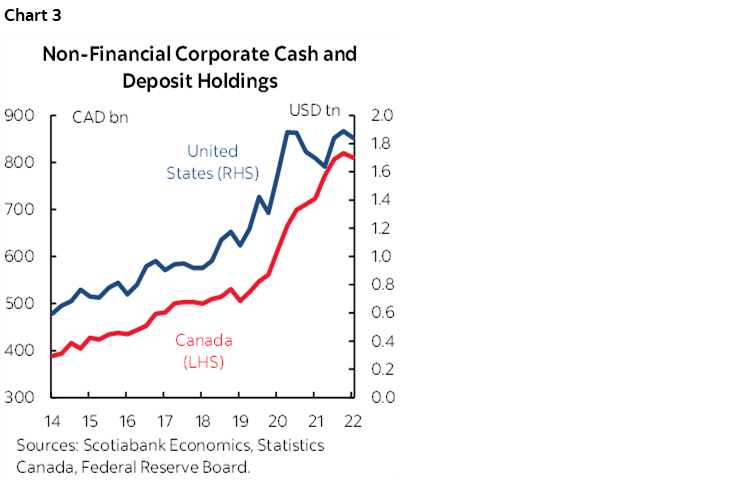

Cash and deposit balances at nonfinancial corporations have soared during the pandemic (chart 3). In Canada, they are about C$270 billion higher than they were before the pandemic struck as stimulus proceeds were combined with more cautious liquidity management. There is bound to be greater competition for such balances in order to fund other requirements such as rising inventories.

In an it-takes-two-to-tango sense, solid capital ratios in the banking system on the heels of the Fed’s recently concluded stress tests (here) offer added downside protection to the economy. Capital ratios are higher than before the pandemic and vastly higher than before the Global Financial Crisis and especially at the largest banks (chart 4).

Balance sheet strengths in the corporate sphere are therefore likely to add to other arguments for why a potential contraction is unlikely to be as severe or as sustained an event as some fear. For instance, labour markets may have fundamentally changed for the long-term. The pandemic response of governments to labour market turmoil probably was not a one-off; they’ve gained experience, confidence and success—at the expense of productivity growth—in terms of rolling out job support programs and the necessary infrastructure that may well be triggered each time future material shocks arise especially if they align with the electoral cycles. Further, the downside to slower-growing labour forces is the difficulty attached to attracting and retaining talent. The upside, however, is that it may be more of a seller’s market today than the buyer’s market for talent when boomers were first entering the labour force in droves in an era marked by frequent restructurings and ammunition for Springsteen’s songs. Let staff go today, and your competition will thank you.

On that note the focus shifts toward the week’s main events.

CENTRAL BANKS—A FEW GEMS

The central bank landscape will be marked by three decisions by regional central banks, FOMC minutes, and surveys that the Bank of Canada considers to be important ahead of its policy decision the following week.

On Monday, the Bank of Canada will release its twin Business Outlook Survey and Canadian Survey of Consumer Expectations. Key will be the measures of inflation expectations that will likely move higher again and drive greater concern at the BoC ahead of the following week’s full set of decisions and communications. Businesses have been raising their expectations for inflation to be well above the BoC’s 2% target on a sustained basis over the next two years (chart 5). Consumers are indicating they expect this to be the case over the full five years ahead (chart 6). A knock against these surveys is their lack of timeliness. The BOS survey period was skewed toward the back half of May while the consumer survey was slanted toward the front half of the month.

The Reserve Bank of Australia is widely expected to deliver another 50bps cash rate target hike on Tuesday. Such a move is largely priced and expected by most economists.

Minutes to the FOMC meeting on June 14th–15th land on Wednesday at the usual 2pmET time. A recap of that meeting is available here. Recall that this meeting’s decisions were set up a couple of days in advance when Fed officials planted guidance with key media about a pivot toward a 75bps rate hike in communications blackout following the prior Friday’s CPI report. Discussions around recession risk may be enhanced. There may be a greater discussion around the nearer-term size and pace of rate hikes, but the revised dot plot indicated a year-end target of 3 ½% for the upper limit of the fed funds target range from 1.75% at present.

Most expect Bank Negara Malaysia to deliver its second quarter point rate hike to 2% on Wednesday. Inflation climbed to 2.8% y/y in May and the ringgit has suddenly depreciated by about 5% to the USD since the Federal Reserve accelerated its pivot from April onward. Currency weakness risks instability and imported inflation.

Peru’s central bank is expected to hike by another 25bps on Thursday and to perhaps trigger a pause thereafter. CPI inflation for June arrives after this publication is being distributed but may further inform the policy stance in the wake of what has already been 525bps of rate hikes starting last August (chart 7).

GLOBAL MACRO—NONFARM THE MAIN EVENT

The line-up of global macroeconomic reports will principally focus upon Friday’s US nonfarm payrolls. A slew of regional gauges will arrive as equity analysts firm up estimates for the commencement of the Q2 US earnings season the following week. Chart 8 shows the current consensus estimates for earnings per share on the S&P500.

US markets will be shut on Monday for the July 4th Independence Day holiday and face a relatively light line-up of calendar-based risk until payrolls. Factory orders during May should follow the already known durable goods reading higher (Tuesday), ISM-services faces downside risk in June’s estimate (Wednesday) and the US trade deficit probably narrowed during May (Thursday) given the already known merchandise component. ADP private payrolls was cancelled for now as the report’s methodology is being worked on with a targeted reintroduction on August 31st.

Nonfarm payrolls for June are guesstimated to have risen by about another 300k as the monthly pace of hiring has ebbed from 714k in February toward still impressive readings in the 400k range ever since. Weekly jobless claims have been rising, and more people indicated they were not working due to COVID (chart 9) or an unusually early spike in the number of parents looking after their children before the end of the school year (chart 10). There has also been a mild deterioration in the Conference Board’s ‘jobs plentiful’ measure within consumer confidence. Also watch wage growth that is expected to post a modest gain of 0.3% m/m that would bring the year-over-year rate down to close to 5%.

Canada also updates jobs and wages for June on Friday. I went with +20k. COVID-19 restrictions have continued to ease (chart 11). A composite measure of mobility and business register data shows that local business conditions improved in most parts of the country between survey reference weeks (chart 12). A manufacturing PMI for June (Monday), trade figures for May (Thursday) and the Ivey PMI for June (Thursday) will round out the line-up.

A batch of inflation readings will arrive from across Asian and Latin American markets. Monday brings out readings from Switzerland, South Korea, Thailand and the Philippines. Colombia releases on Tuesday, Mexico on Thursday and then Chile on Friday. China updates late on Friday evening.

Other significant releases will include German trade, factory orders and industrial output for May throughout the week, along with PMIs from India (Tuesday) and China (private, Monday).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.