Next Week's Risk Dashboard

- Canadian consumers could pose tsunami risk to the economy

- US CPI: will core services inflation be rejuvenated?

- ECB to cut, adjust policy rate bands

- BoC’s Macklem to speak on trade post jobs

- Peru’s central bank expected to cut again

- Russia’s central bank may hike again on wartime inflation

- Harris versus Trump round 1

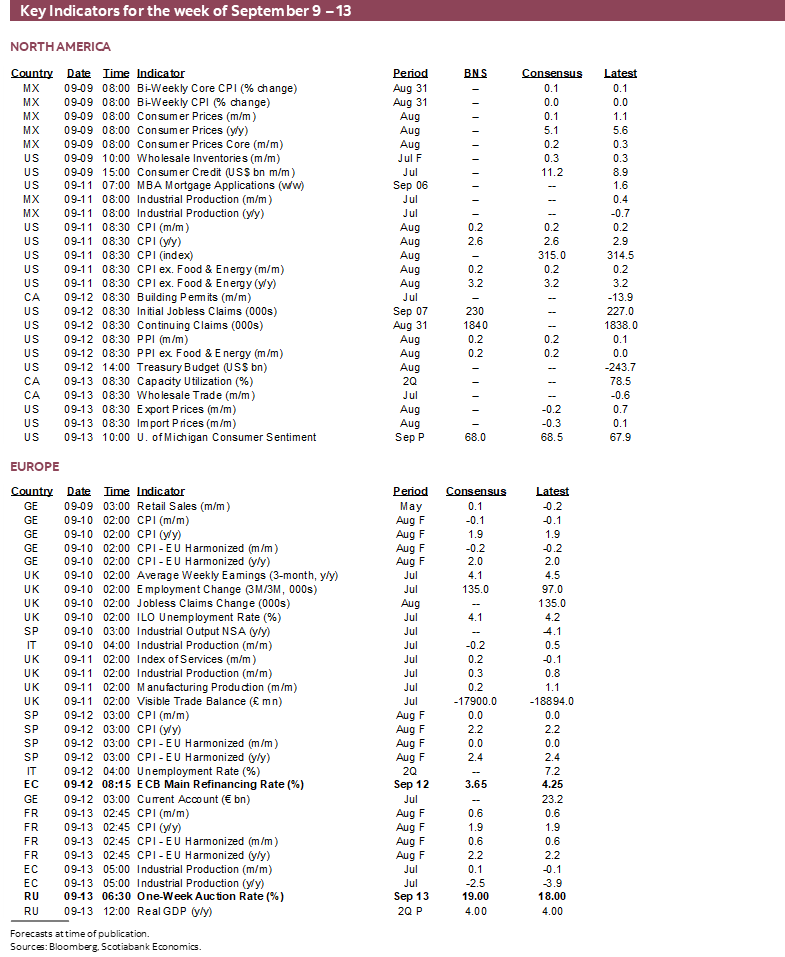

- Other global indicators to focus on China, UK jobs

Chart of the Week

The global week ahead’s main market focal points will include the last US inflation reading before the FOMC’s policy decision the following week, three central bank decisions (ECB, BCRP, Russia), another appearance by BoC Governor Macklem, the first Harris-Trump US Presidential debate, Apple’s new iPhone launch, and a wave of global data releases.

Before delving into this, however, I wanted to elaborate more fully upon views expressed regarding the outlook for the Canadian consumer offered in prior notes.

THE RISKS FACING CANADIAN CONSUMERS ARE NOT THE ONES YOU MIGHT THINK

Tsunamis are a much rarer phenomenon in Canada than other parts of the world. If policymakers are not careful, however, then they risk triggering a big one that hits the economy with powerful effects on inflation and markets. To understand why starts by deprogramming everything you thought you knew about the Canadian consumer from the litany of depressingly bearish voices out there in a point-counterpoint style.

Lots in the Tank

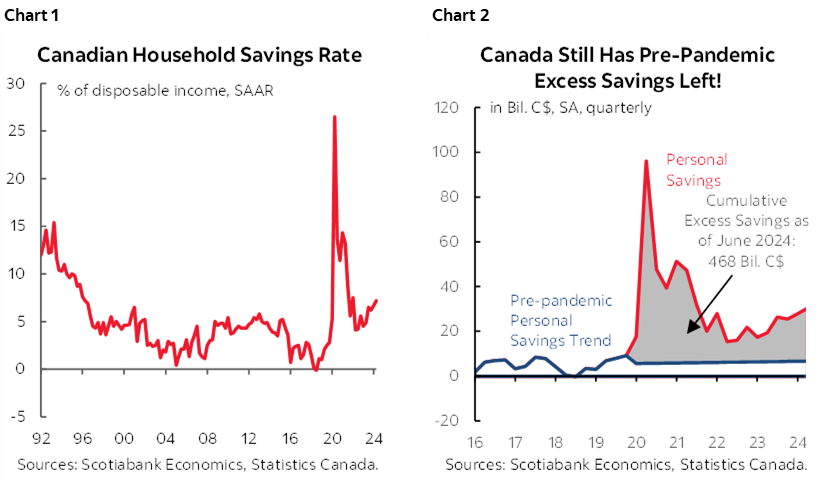

A starting assertion is that Canadian consumers have nothing left in the tank to spend. This is patently false. They are running up a 7.2% household saving rate (chart 1) by contrast to American households with a saving rate under 3% and hence close to nothing in real terms. The cumulative effects of saving more out of their disposable income has allowed Canadian households to run up their stockpile of pandemic-era excess savings each year to almost half a trillion dollars (chart 2) by routinely saving above what a trend line extended from pre-pandemic times through the whole pandemic era would have expected.

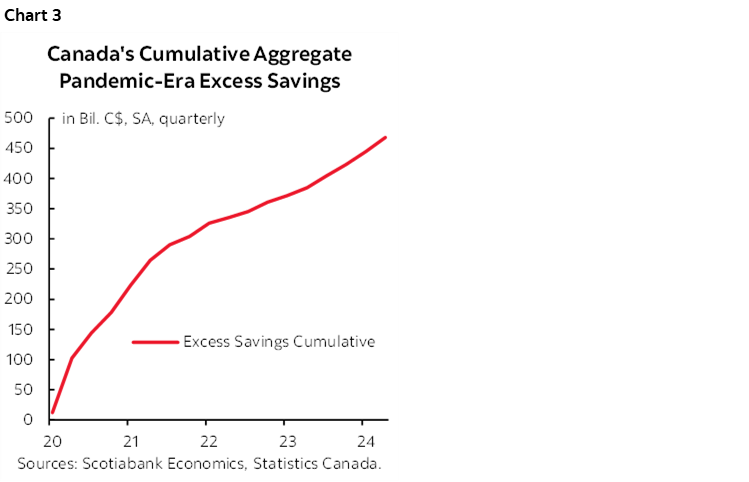

As a result, Canadian households now have almost a half trillion dollars in above-trend savings socked away and it continues to grow rapidly (chart 3).

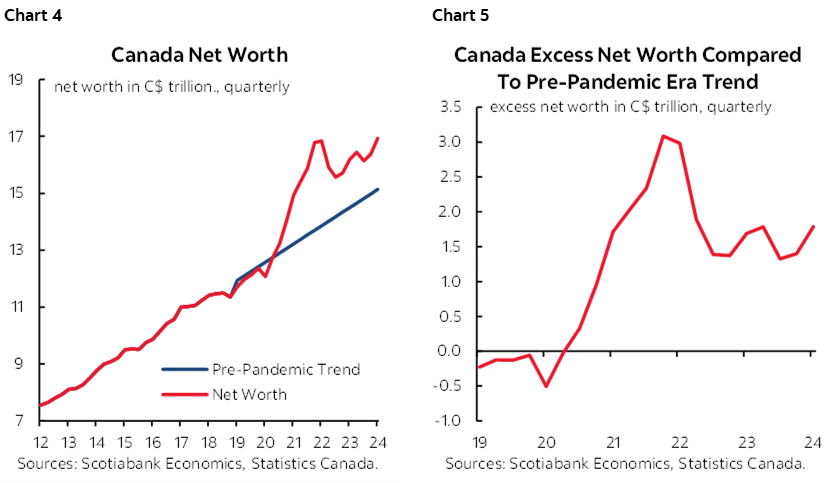

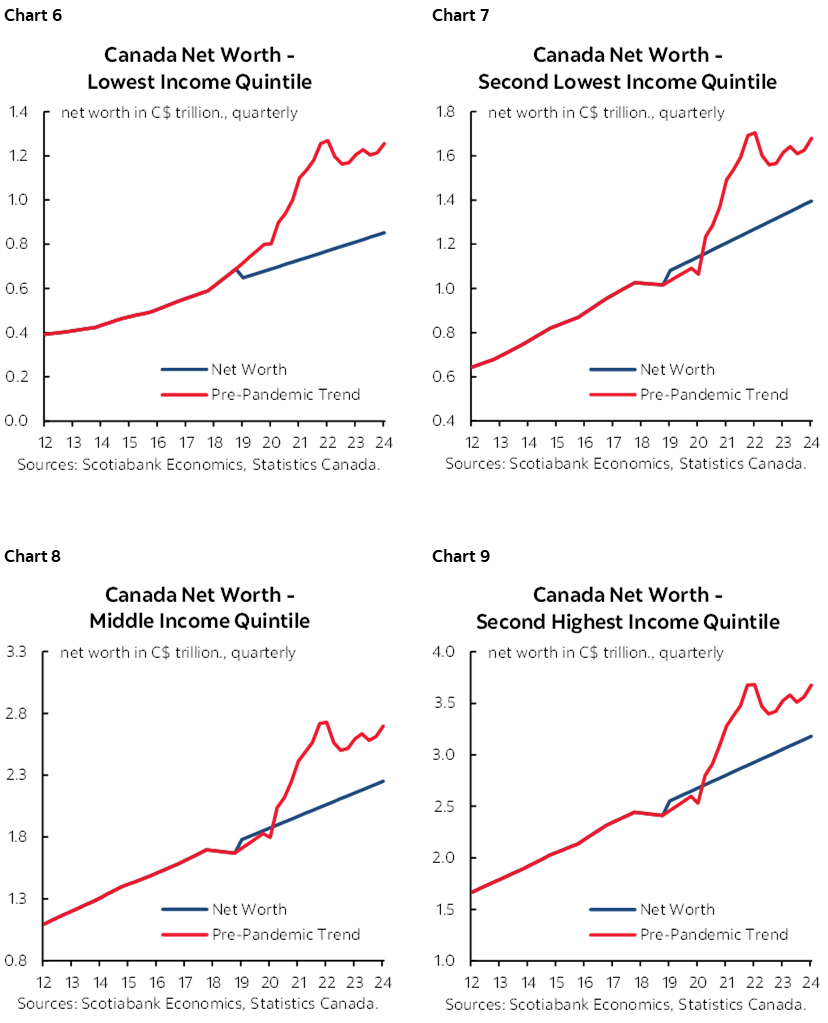

So far the approach taken to estimating savings has only considered what is not spent out of current quarterly disposable income after-taxes and transfers. It does not include changes in asset valuation for financial assets and houses net of changes in debts. For that, we need to look at household net worth in a similar exercise that considers net worth relative to a pre-pandemic trend line which is done in chart 4. Canadians have been running up net worth at a much more rapid pace than previously and the sum total of the incremental gains in net worth is pushing toward C$2 trillion (chart 5).

It's Spread Out

Bah, who cares you might say, it’s probably just held by rich households anyway and they don’t spend as much of their incomes as lower income cohorts with higher marginal propensities such that the relatively wealthy can’t lead growth. Wrong on two counts!

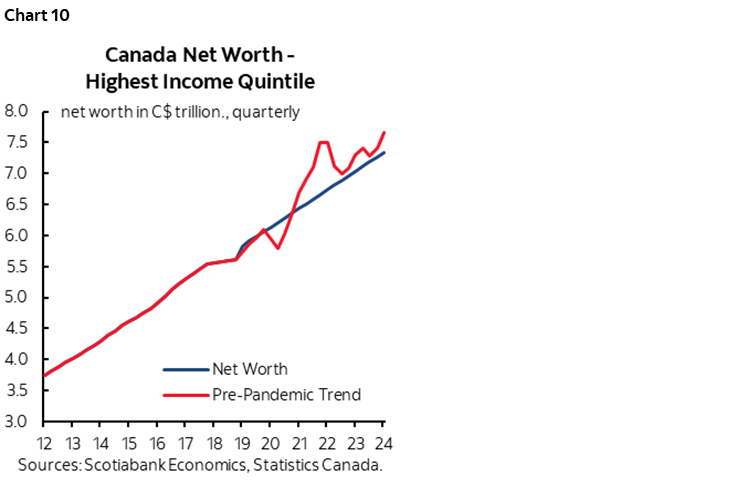

First, check out charts 6–10 that look at deviations from the trend in net worth of various income quintiles which breaks down the earlier chart 4 into income cohorts. Everyone has been invited to this party across all income cohorts.

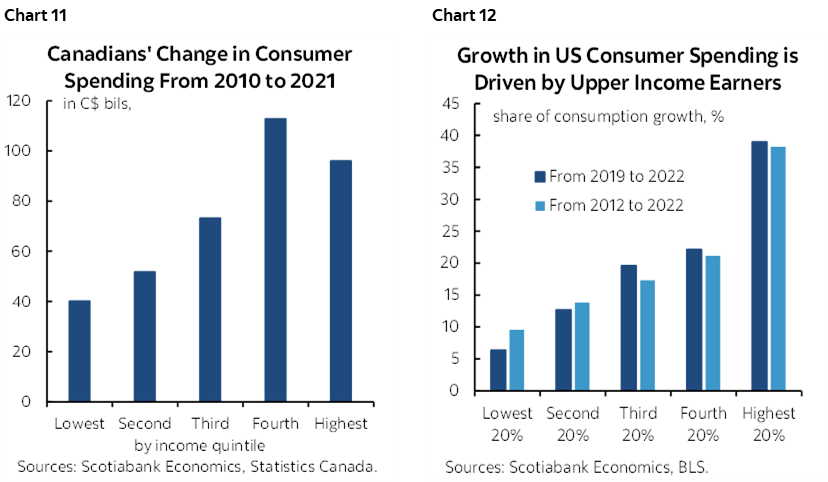

Second, charts 11 and 12 show that 75–80% of growth in consumption in Canada and the US has been among the top three income cohorts and over half has been driven by the top two cohorts.

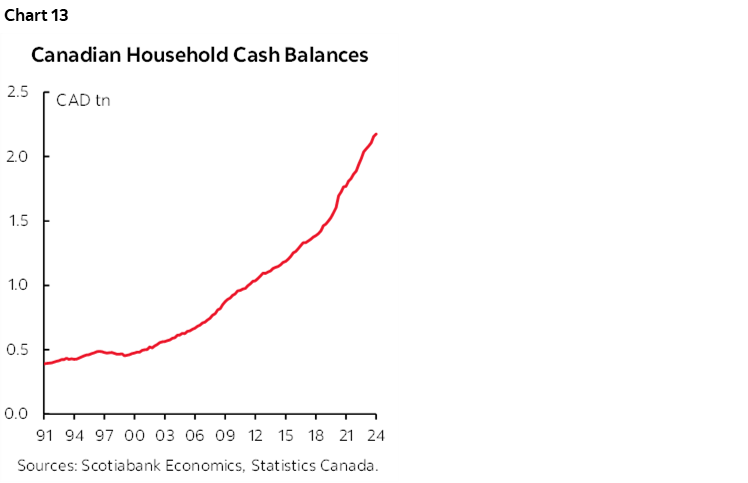

But surely all that wealth is tied up and they can’t spend any. Not true, chart 13 shows that liquid cash holdings of Canadian households have exploded and keep on rising.

It’s Not Just Being Held to Cover Mortgage Resets

Ok, but c’mon, that’s because they’re hoarding it all for mortgage resets. My answer to that is two-fold.

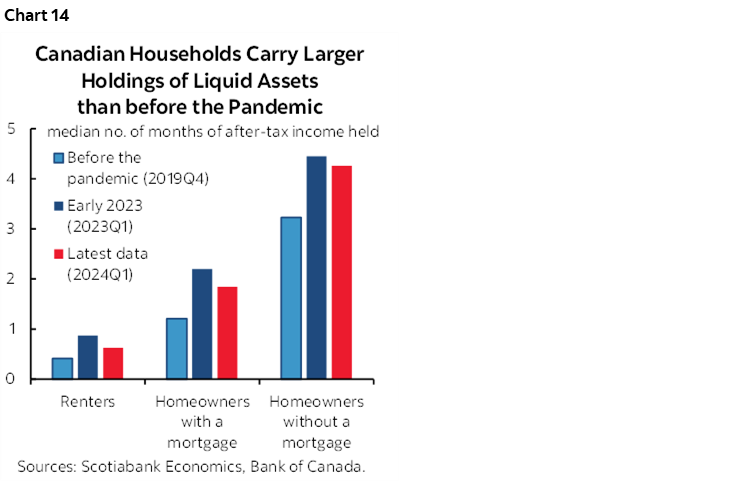

First, the Bank of Canada estimates that most of the liquidity lies in the hands of homeowners without a mortgage and they’ve run it up a lot (chart 14). Homeowners with a mortgage less so.

And secondly, reset schmeset. This was an overstated shock from the beginning, as evidenced by the fact that to this day, the 90-day mortgage arrears ratio remains close to a record low, so do consumer bankruptcies and banks’ mortgage loan loss provisions have merely gone from nothing when rates were dirt cheap back to being in line with historical averages. There has indeed been pain among some homeowners, but it has been an exaggerated macro shock. Furthermore, the 5-year Canada bond yield is a leading indicator of where the popular fixed mortgage rate is likely to eventually go and that GoC yield has dropped by about 160bps (1.6 ppts) from the peak in October 2023 to now. There are other drivers of mortgage rates and as time passes there is likely to be further pass through of falling bond yields. Furthermore, variable rate resets are over and done, and variable rates are falling again with further declines likely coming into year-end.

There is Plenty to Spend Money On

So far we can see that the financials show that Canadian households have the means to spend. Do they have the reason to do so? And by that, I mean is there evidence of pent-up demand?

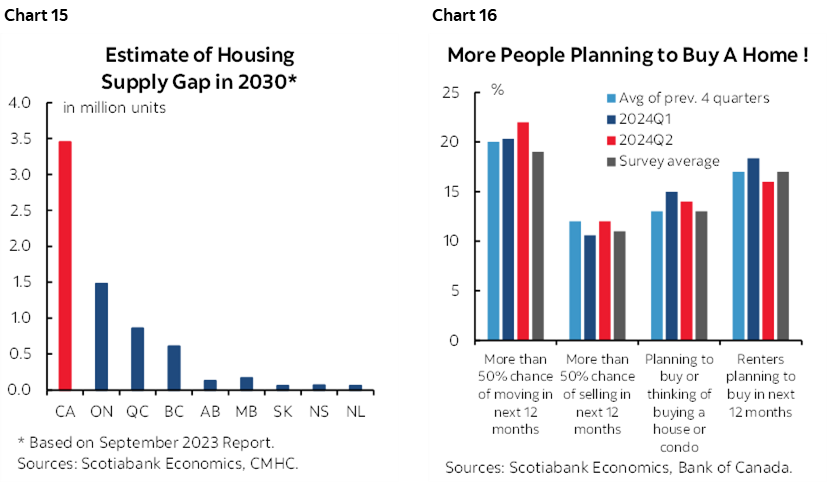

Our models suggest there is some pent-up demand particularly in interest-sensitive sectors, and in my personal opinion, may be underestimating how much. Canada faces a massive structural housing deficit of homes that need to be built to merely keep pace with population and improve affordability (chart 15). We also know from soft survey data that home buying intentions are significant (chart 16). Clearly there have to be more homes to buy in an expansion of the housing stock, but if builders are true to their word about the limiting effects on construction of high hurdle rates, then falling interest rates should be expected to unleash more construction activity.

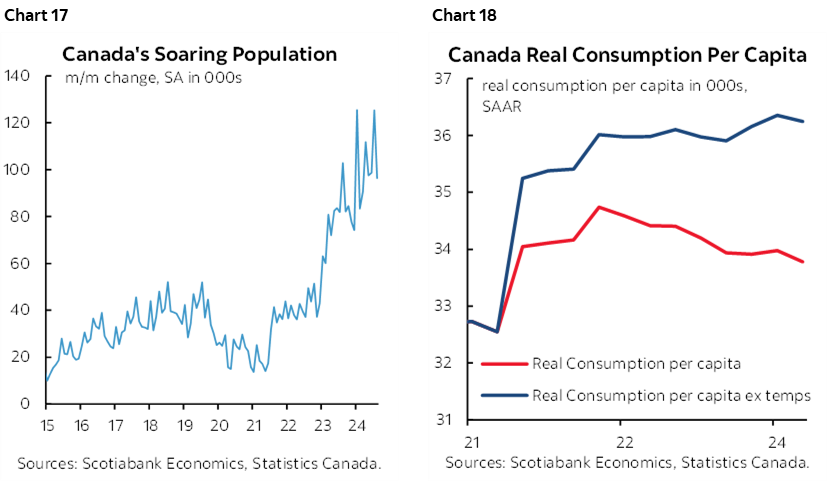

We know that population growth is very strong (chart 17) and consumption is likely to face a catch-up to this strength. Upon arriving in a strange land, newcomers need time to settle in, get a job, start a business, find a place to live, maybe trade up jobs and homes, and spend. Real per capita consumption has been trending lower if we use total population, but growing slowly if we use population excluding temporary residents that include international students, temporary foreign workers and asylum seekers (chart 18). Why exclude these people? Because their contributions to overall spending are modest, and their numbers are in the process of being curtailed.

Either way, give it time, and the recency of the out-of-sample population shock that Canada is experiencing may drive pent-up spending on housing and both interest-sensitive spending on goods and less interest-sensitive spending on services. I don’t believe that the lagging effects of this out-of-sample immigration experiment on demand for housing and consumption beyond other drivers like lower interest rates is all being adequately estimated.

It’s difficult to time when this activity may be unleashed, but one reason why models may not sufficiently capture it is that the gradual build-up of excess savings needs a catalyst to trigger its release and that catalyst is declining borrowing costs that may magnify the interest sensitivities of housing demand and consumer spending.

Where this leaves us is on a note of caution to the Bank of Canada. Cut too much too quickly and you’ll bring a tsunami of consumer and housing demand to Canadian shores that could swamp boats from Victoria to St. John’s. The result could set the Bank of Canada’s fight against inflation right back to square one especially in light of other upside risks to inflation. They include the likelihood of further fiscal stimulus into an election year given the poor polling of the Liberals and NDP. Real wage gains as productivity tumbles are another inflation risk and with further wage inflation likely to emanate from collective bargaining negotiations in an economy with triple the unionization rate of the 10% rate stateside.

US CPI INFLATION—UNLIKELY TO MOTIVATE UPSIZING

The US updates CPI inflation figures for the month of August on Wednesday. This will be the last major dual mandate reading before the FOMC delivers its policy decision and updated forecasts the following Wednesday September 18th. There will also be a retail sales report on September 17th and a few other lesser readings.

Most estimates for headline and core inflation are set at 0.2% m/m SA that would contribute toward slowing the year-over-year rates to 2.6% for headline CPI (from 2.9% prior) and with unchanged core at 3.2% y/y. The Cleveland Fed’s ‘nowcasts’ for both measures also sit at 0.2% m/m SA.

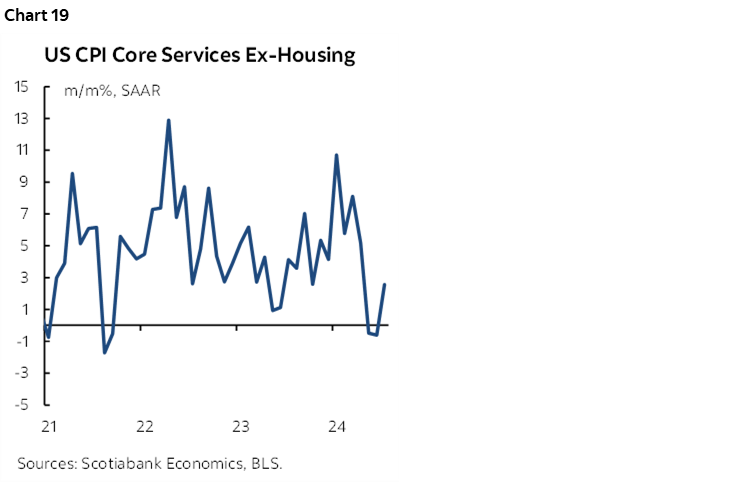

Upside risk could come from a possible further rebound in core service price inflation (chart 19).

It is not expected that the readings will tip the balance on the FOMC’s first rate cut from -25bps (our base case) to -50bps. The FOMC has largely pre-committed to a cut but the tone of Fed-speak, the lack of market dysfunction, and the overall data leans toward our expectation for a quarter-point reduction.

CENTRAL BANKS—THREE DECISIONS

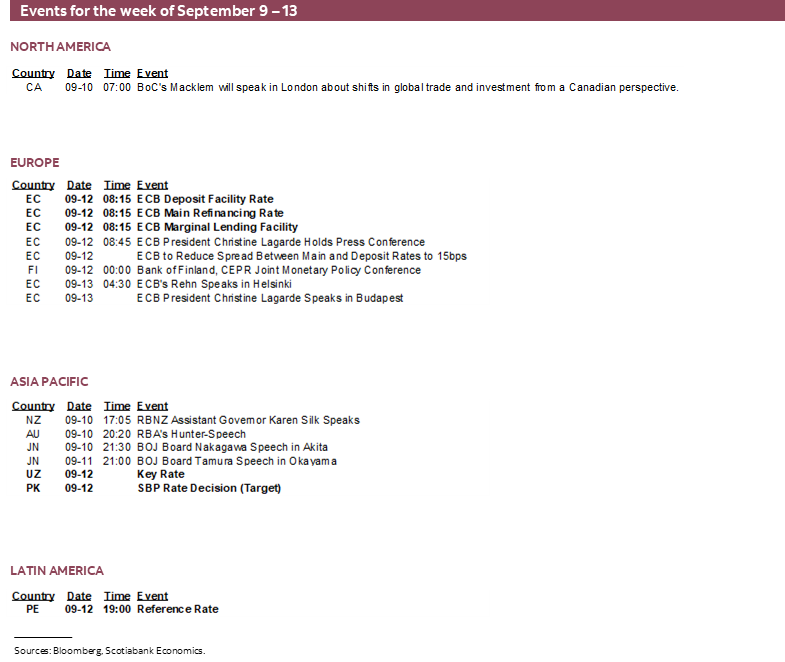

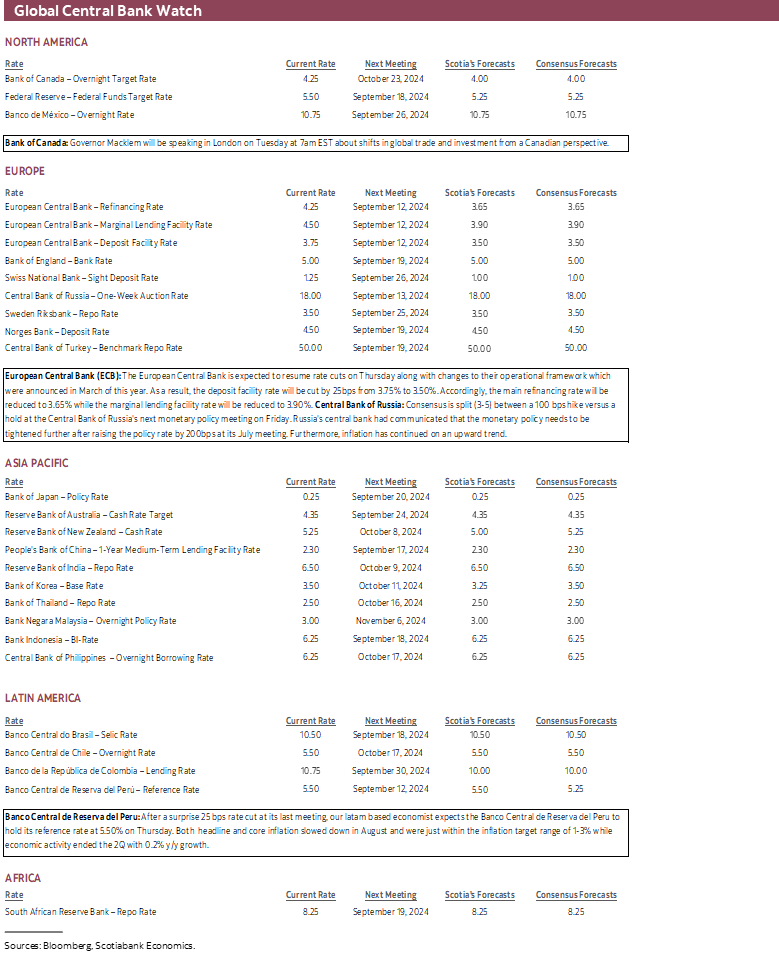

Three central banks will deliver policy decisions this week including the ECB, Peru’s central bank, and the Central Bank of Russia. BoC Governor Macklem will also speak.

ECB to Cut, Adjust Spreads

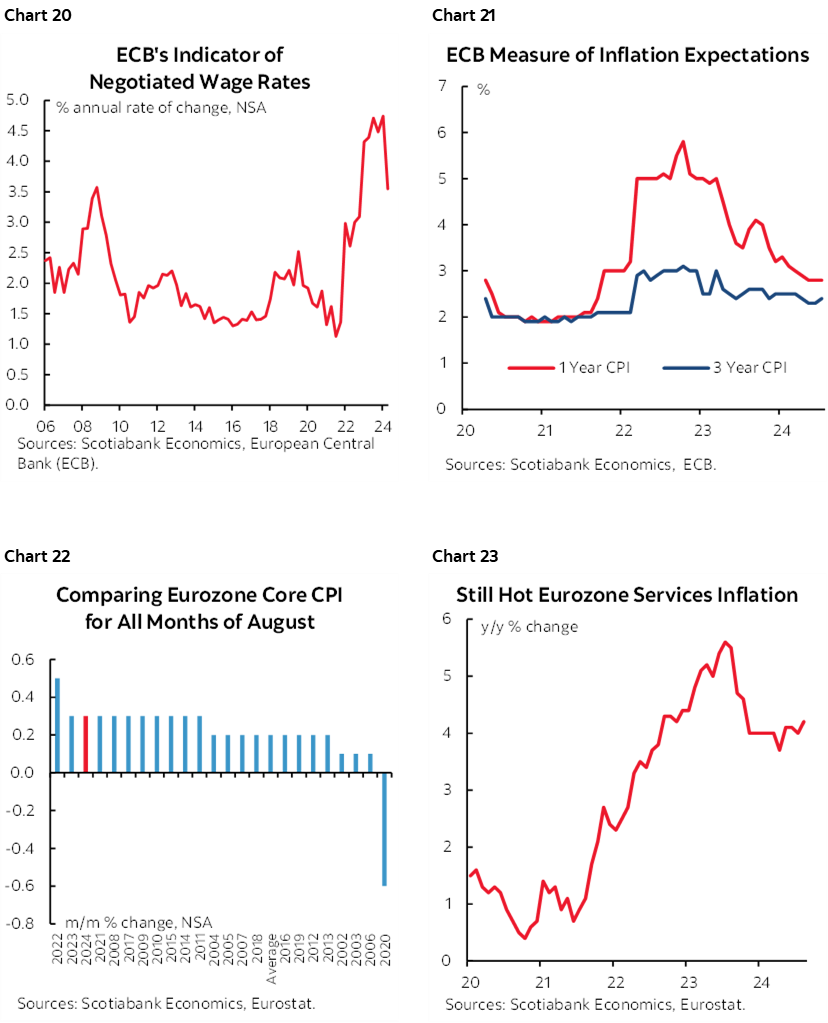

The European Central Bank is expected to deliver the second rate cut of this cycle on Thursday along with changes to their operational framework that were announced in March of this year. As a result, the deposit facility rate will be cut by 25bps from 3.75% to 3.50%. Accordingly, the main refinancing rate will be reduced to 3.65% while the marginal lending facility rate will reduce to 3.90%. Negotiated wage growth has softened since the first rate cut (chart 20), inflation expectations have fallen and recently stabilized (chart 21), and core inflation has fallen to 2.8% y/y. Still, August’s core inflation at the margin was among the hottest months of August on record which is used because the data is not seasonally adjusted (chart 22) and services inflation remains sticky (chart 23). This suggests that the ECB’s forward guidance is likely to remain cautious and data dependent.

Central Bank of Russia—Another Hike?

Consensus is split (3–5) between a 100bps hike versus a hold at the Central Bank of Russia's next monetary policy meeting on Friday. Russia's central bank had communicated that the monetary policy needs to be tightened further after raising the policy rate by 200bps at its July meeting. Furthermore, inflation has continued on an upward trend and the ruble has depreciated by about 5% to the USD since the July 26th decision.

Banco Central de Reserva del Peru—Hopefully No Surprises

After a surprise 25 bps rate cut at its last meeting, our LatAm based economist expects Banco Central de Reserva del Peru to hold its reference rate at 5.50% on Thursday. A small minority within consensus thinks it may hold at 5.5%. Both headline and core inflation slowed down in August and were just within the inflation target range of 1–3% while economic activity ended 2Q with 0.2% y/y growth. The PEN exchange rate has, however, depreciated by about 2% to the dollar since the last decision on August 8th.

BoC’s Macklem to Speak on Trade

BoC Governor Macklem will speak on Tuesday in London before the Canada-UK Chamber of Commerce. His topic will be “Global trade from a Canadian perspective.” His speech will land at 8:10amET and there will be a full press conference starting at 9:30amET or so. I don’t expect significantly different core messages on macro and monetary policy topics than what he shared in his recent press conference recapped here. He may be asked if the ensuing jobs report changed his mind (recap here) but I’d be surprised if he doesn’t sound somewhat constructive.

OTHER GLOBAL MACRO

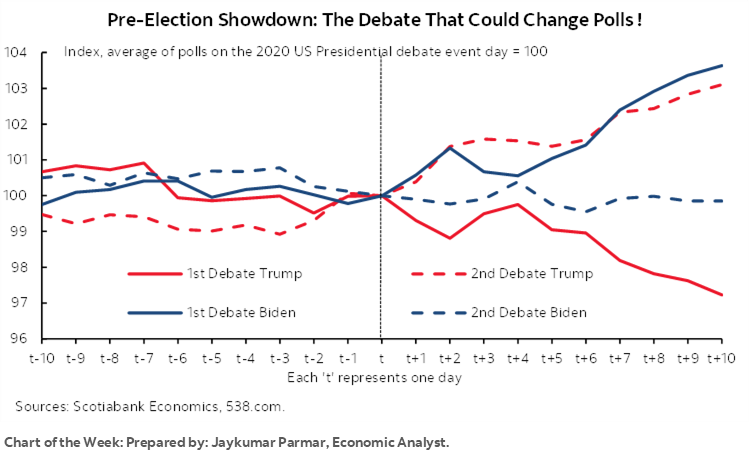

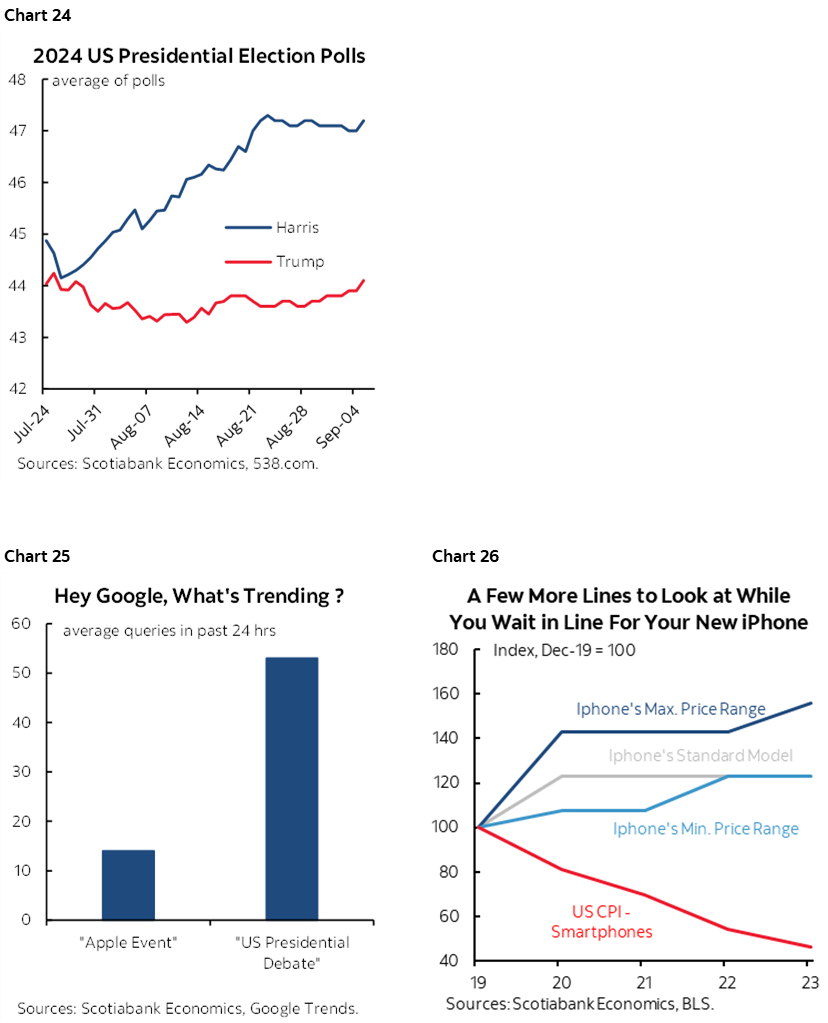

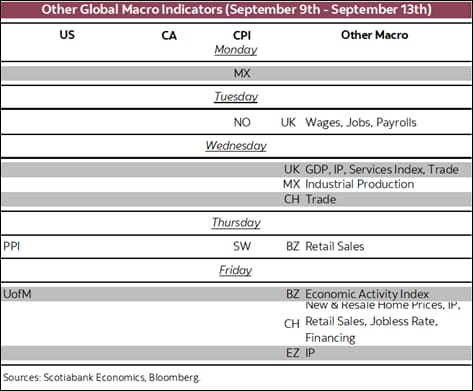

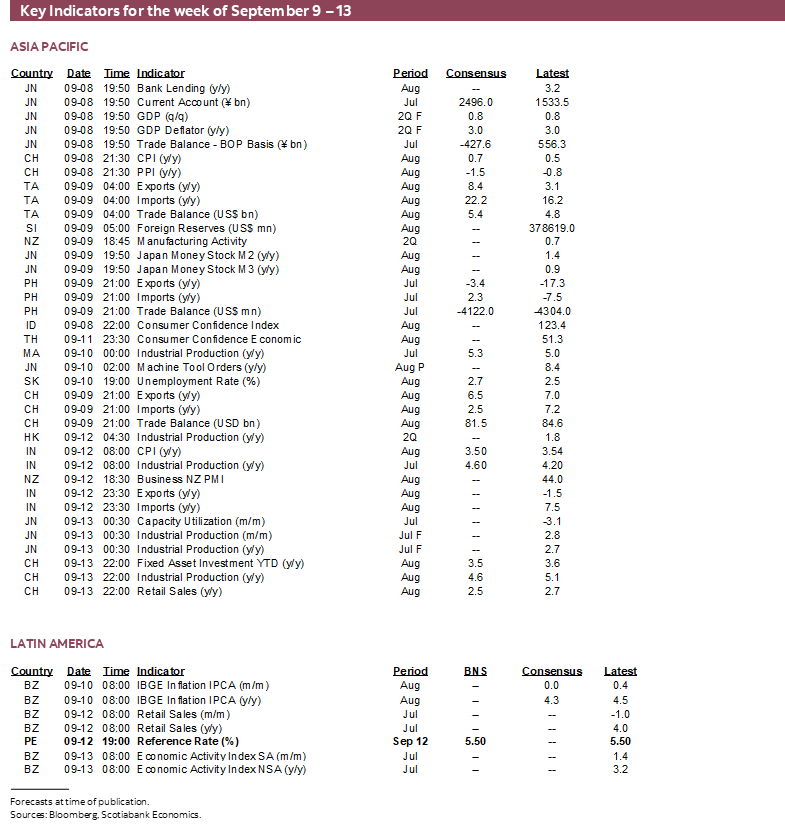

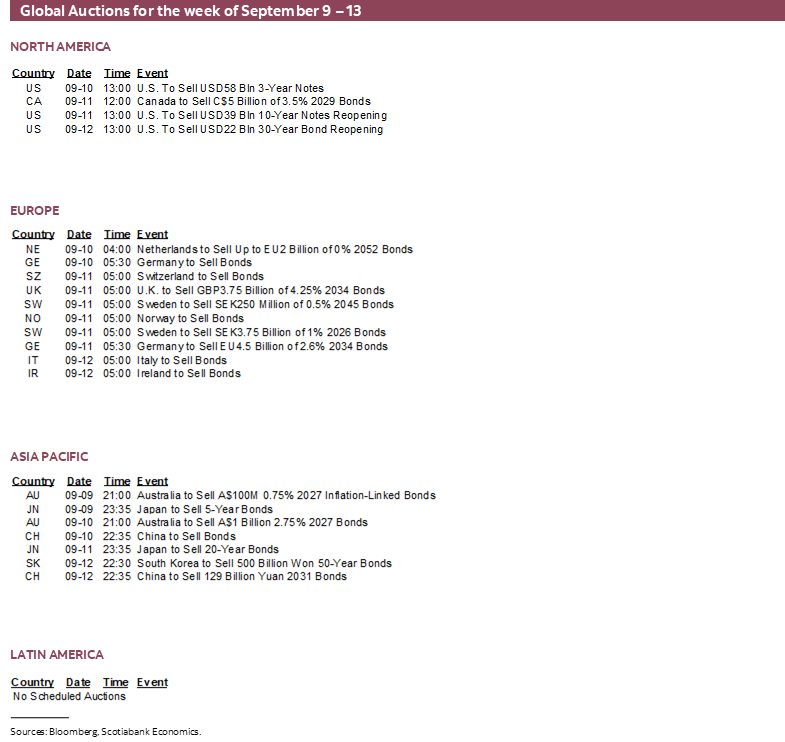

Other developments this week will include waves of global economic indicators summarized in the accompanying table and that I’ll write more about over the course of the week. The first Harris-versus-Trump Presidential debate will be held on Tuesday night as Harris widens her polling lead (chart 24). Jay Parmar’s chart of the week reminds us of what happened in the 2020 first and second debates and chart 25 shows that Apple’s new iPhone launch faces some tough competition early in the week amid speculation surrounding its price (chart 26). The main focal points for global markets will be data out of China and the UK.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.