HOUSING MARKET CONTINUES ITS REBOUND

SUMMARY

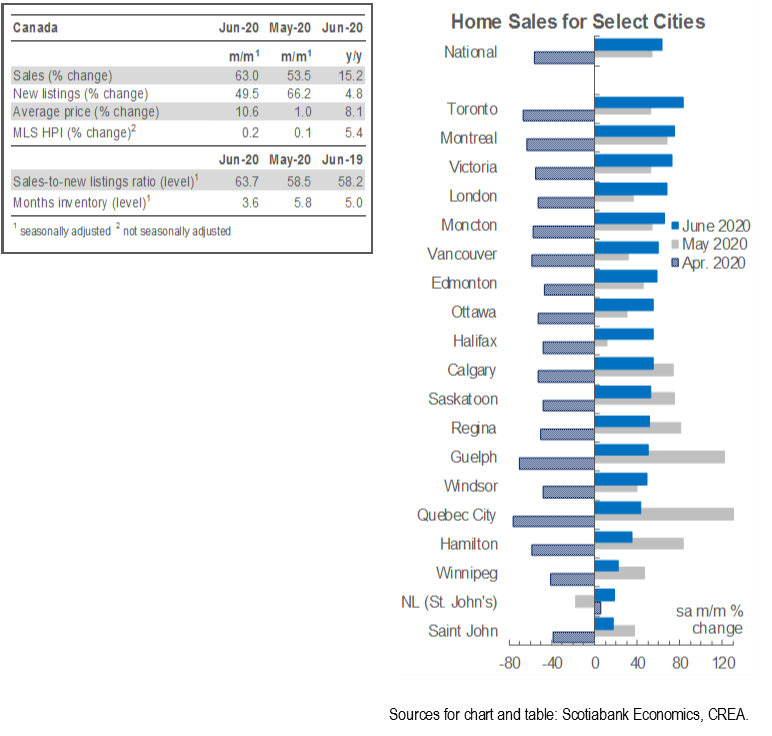

Canadian housing market activity continued to heat up in June amid ongoing easing of COVID-19 restrictions across the country, as repeat home sales and new listings surged 63.0% and 49.5% m/m sa, respectively. The relatively larger surge in sales lifted the national-level sales-to-new-listings ratio to 63.7%—a figure usually consistent with roughly balanced supply and demand conditions, but right on the cusp of sellers’ market territory. The MLS Home Price Index (HPI) continued to climb at a steady pace of 5.4% nsa y/y, in line with gains since February.

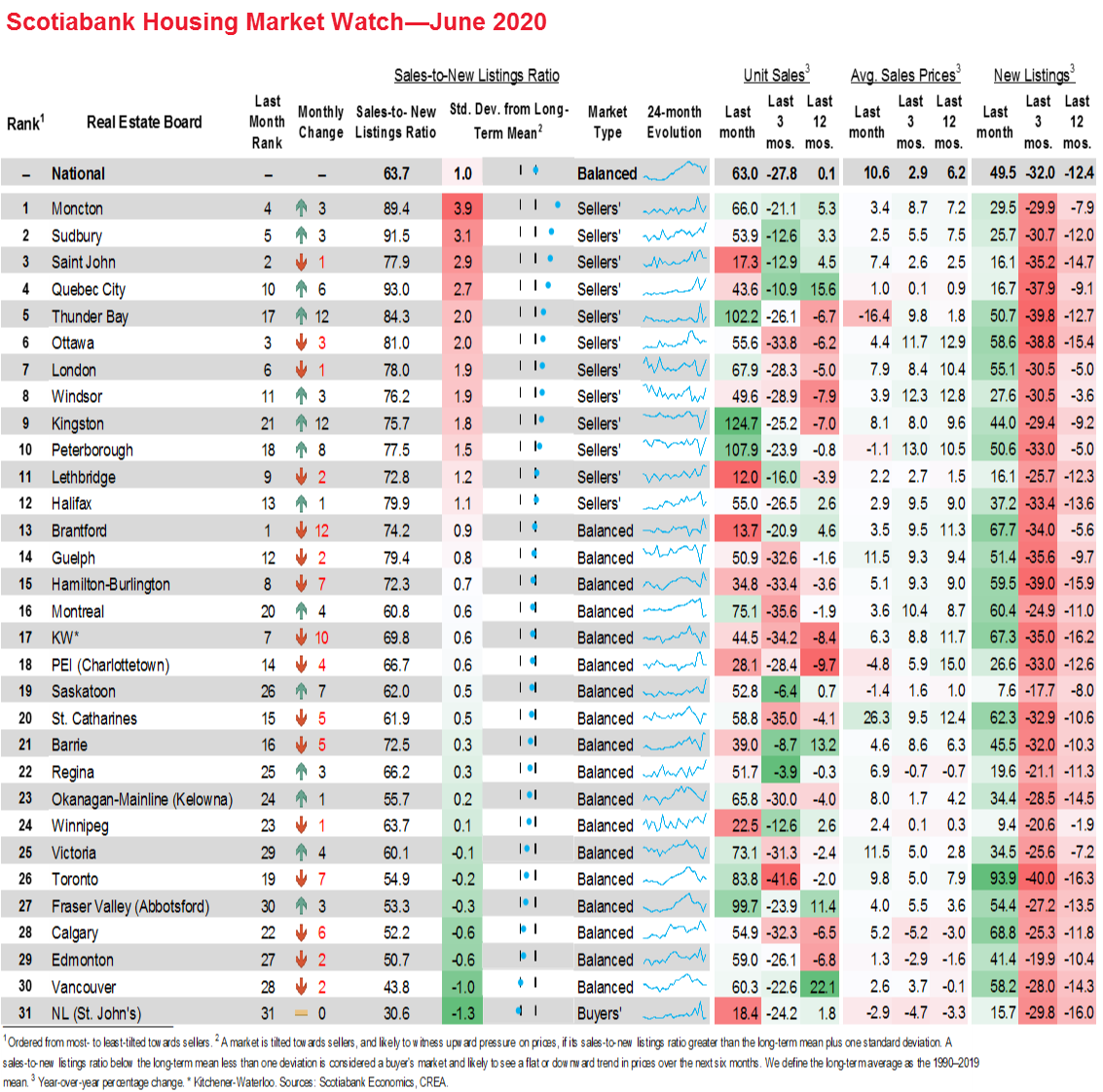

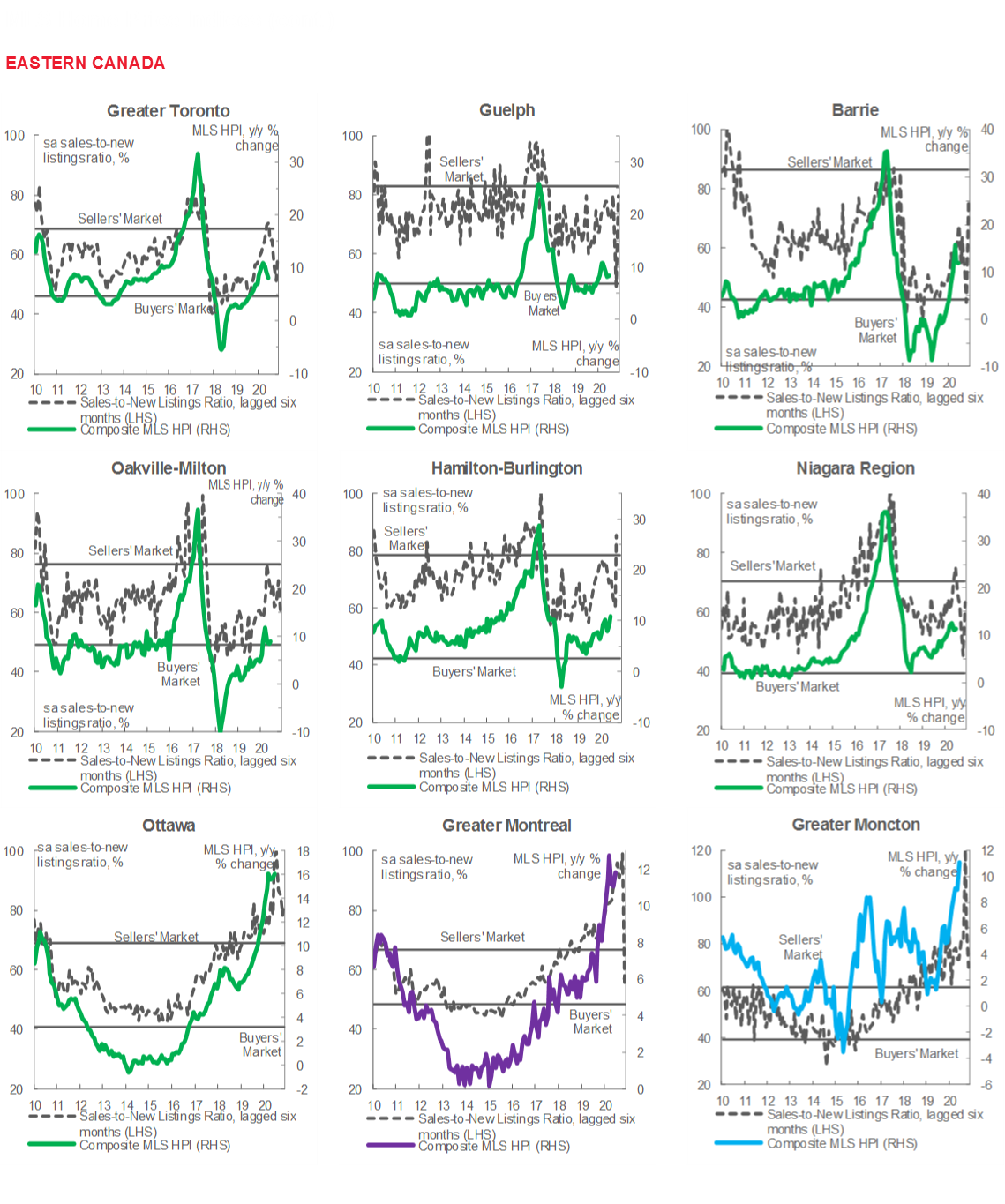

Last month, 17 of the 31 cities for which we maintain data saw the rate of sales gains accelerate versus the prior month, and 12 witnessed record monthly percentage increases in home purchases. Edmonton, Regina, Saskatoon, Kingston, Thunder Bay, Quebec City, and Moncton have already recouped March–April losses, while Sudbury, Winnipeg, Victoria, and Okanagan-Mainline are within 5% of doing so. Though they have rebounded considerably since April’s trough, sales in Toronto (-27%), Montreal (-9%), Vancouver (-15%), Ottawa (-12%), and Calgary (-6.5%) sat further below February levels. In Ontario’s Greater Golden Horseshoe region, sales were generally 15–20% lower than five months ago.

New listings in some cities have bounced back slightly more strongly. Vancouver and Victoria have already made up losses incurred in March and April, as has Montreal and most major centres in the net oil-producing provinces. However, new listings in Ottawa were about 6% below February levels, and listings across centres in the Greater Golden Horseshoe generally sat 10–15% below where they were prior to the imposition of COVID-19 containment measures.

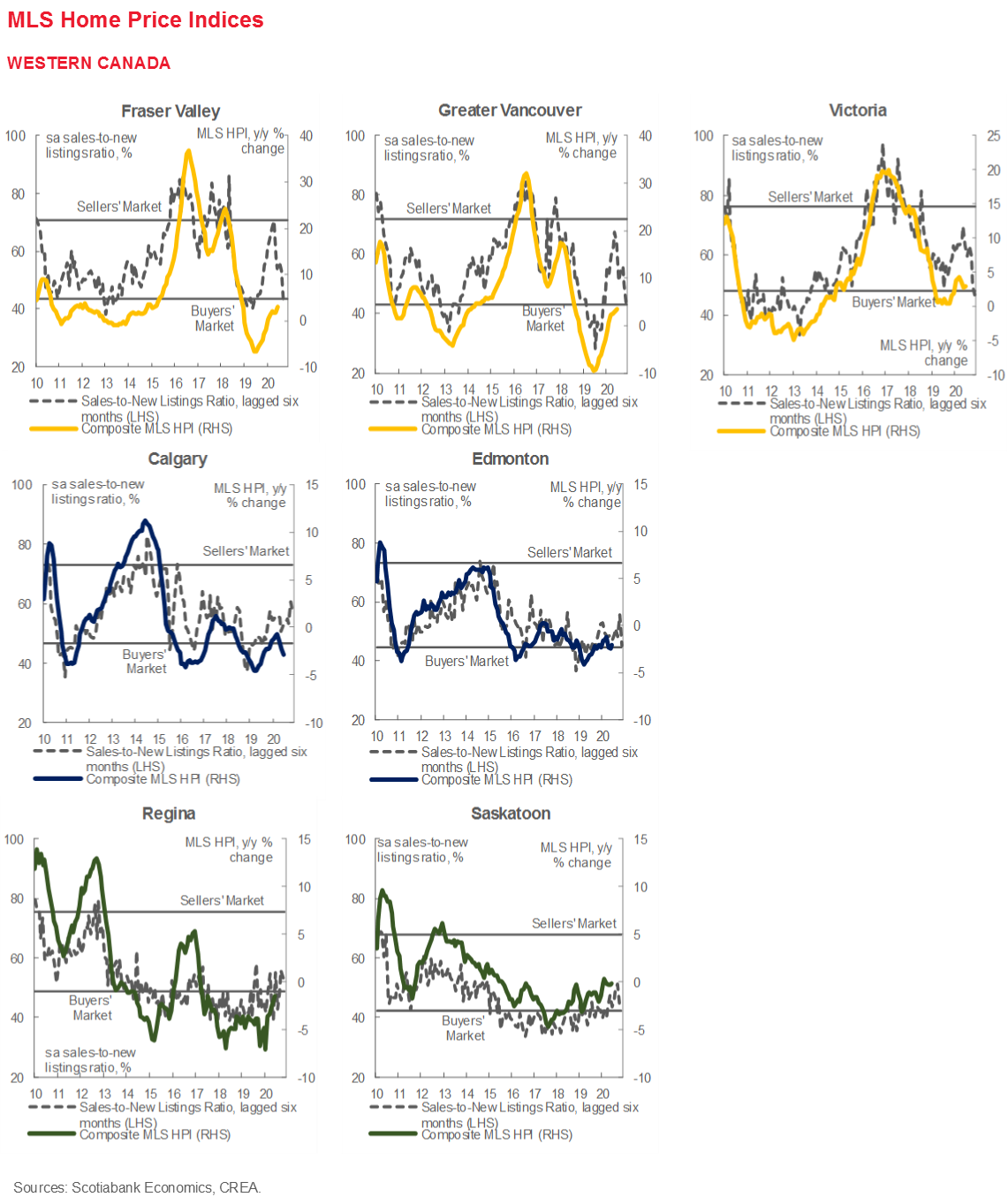

In June, twelve of the centres we monitor were technically in sellers’ market territory, while only St. John’s reported conditions favouring buyers, though ratios continued to largely reflect the timing of local lockdown imposition and easing. MLS HPI gains were generally consistent with those witnessed in recent months, though advances continued to slide somewhat in Toronto—from almost 11% nsa y/y in March to a still-solid y/y rate over 8% in June.

IMPLICATIONS

Further revival in housing activity was expected given continued easing of restrictions across Canada in June, as well as early signals from local real estate boards, but the strength of the recovery has surprised thus far. Though purchase volumes still sat below February 2020 levels in Canada’s four largest cities, we expect further lockdown easing to continue to lift those markets in July. There is particularly strong upside for Ontario, which begins a new phase of its reopening this week. Anticipation of stricter mortgage qualification rules taking effect July 1st may have induced marginal buyers to pull purchases forward—an effect that could be unwound next month. However, consistently declining five-year mortgage rates—which sit at a three-year low—should continue to stimulate demand.

Going forward, we generally expect housing market transactions to follow the course of the virus. To the extent that the Canadian labour market’s recovery and regional re-openings proceed successfully, we suspect that sales will increasingly align with fundamentals. A second wave of COVID-19 and any related containment measures would undermine that trajectory. Persistent weakness in population growth—vis-à-vis border closures, travel restrictions, post-pandemic apprehension about migration, and the shift to online learning—continues to represent a key risk to the outlook. Unwinding of supports such as payment deferrals that have helped cushion the market against COVID-19’s economic fallout will also need to be timed to balance fiscal sustainability and support for both homeowners and prospective buyers. If these measures are halted before the labour market makes a full recovery, an uptick in mortgage arrears and defaults could reasonably be expected (see report here).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.