CANADA HOUSING MARKET: TREADING LIGHTLY

SUMMARY

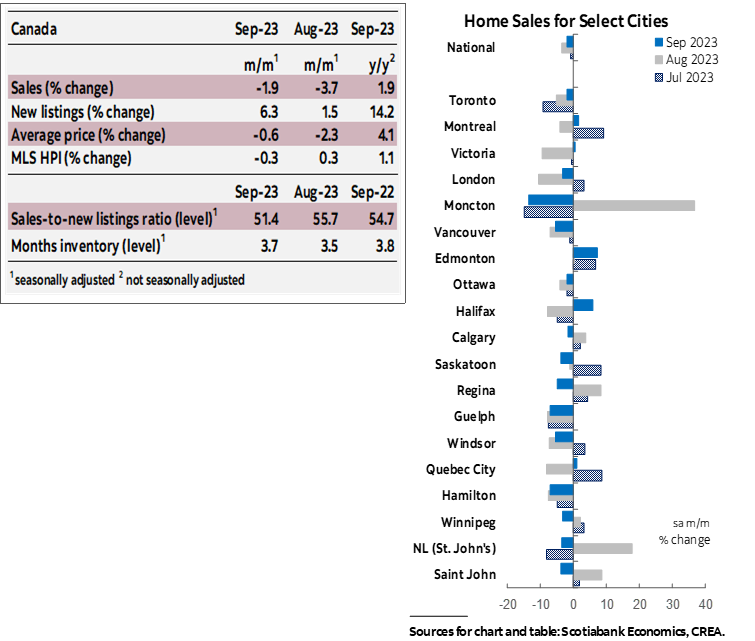

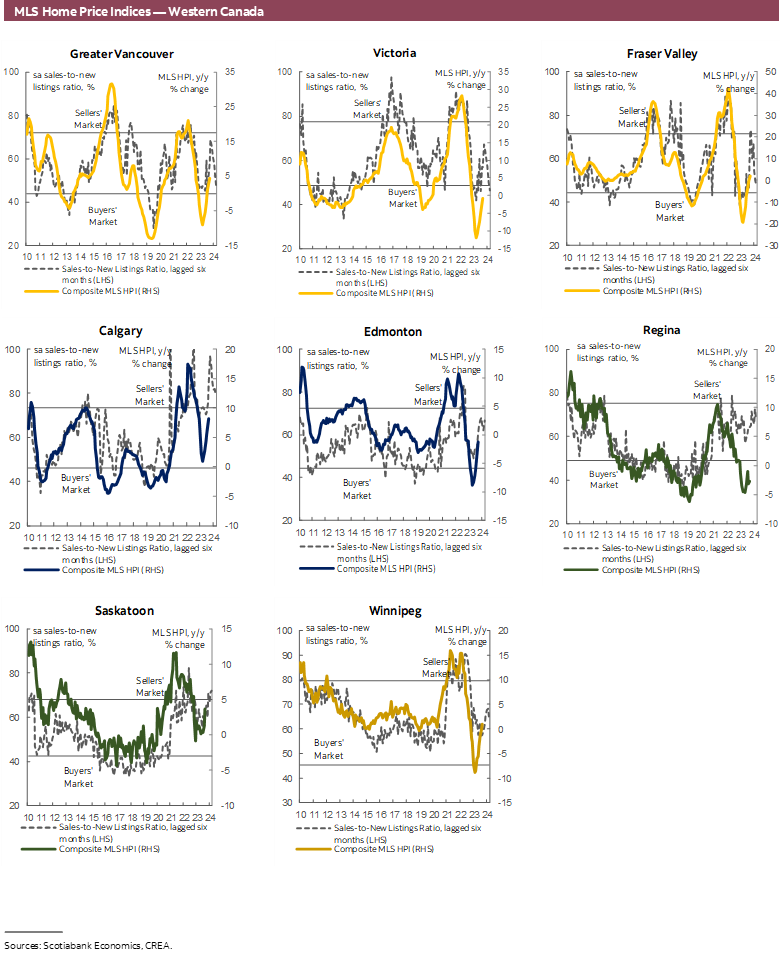

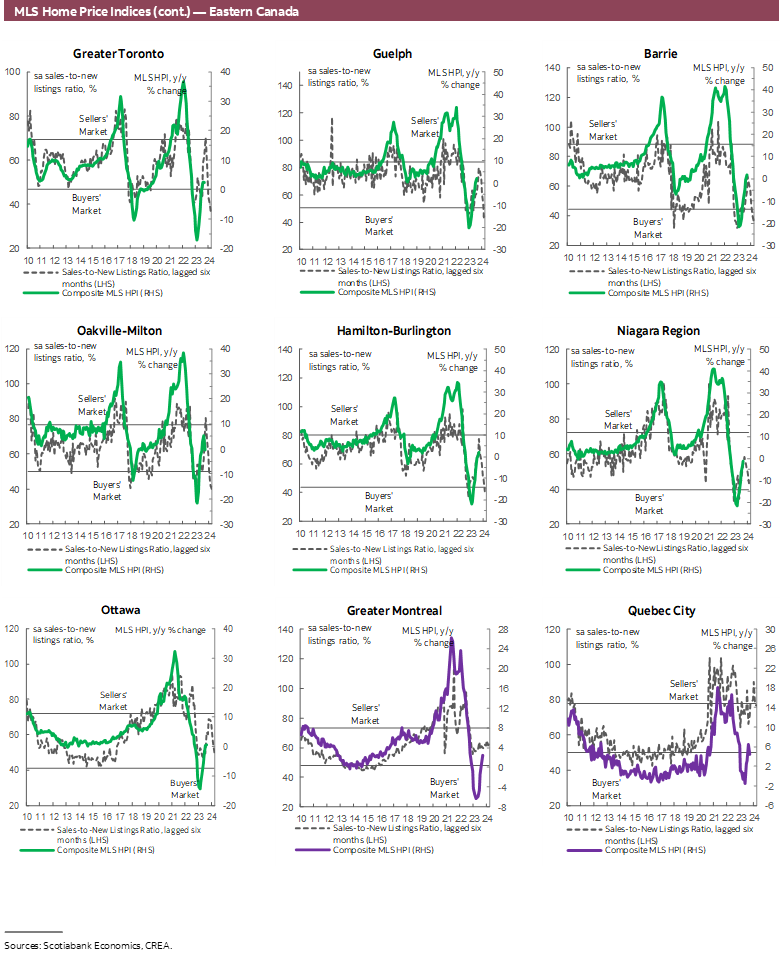

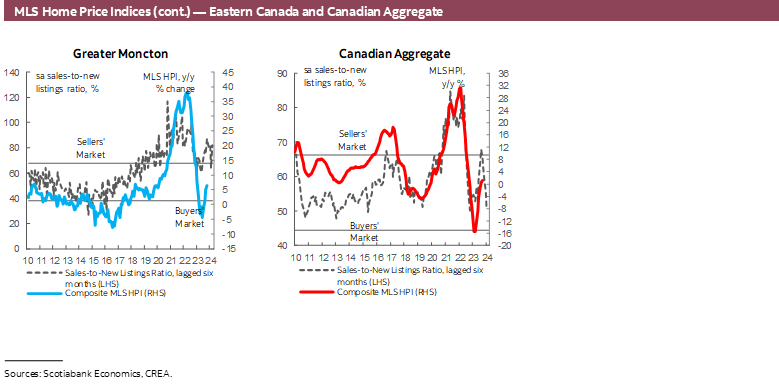

Canadian home sales fell in September by 1.9% (sa m/m) while listings jumped by 6.3%. This significant increase in listings in the face of slowing sales activity further eased the sales-to-new listings ratio, an indicator of how tight the market is. The ratio substantially eased from its recent April peak of 68.3% and now stands at 51.4%—the first time it dips below its long-term average of 55.2% since January of this year and indicating a balanced national market, at least relative to historical deviations. There were 3.7 months of inventory—up from this year’s low of 3.1 in June, but still below its long-term average of around five months.

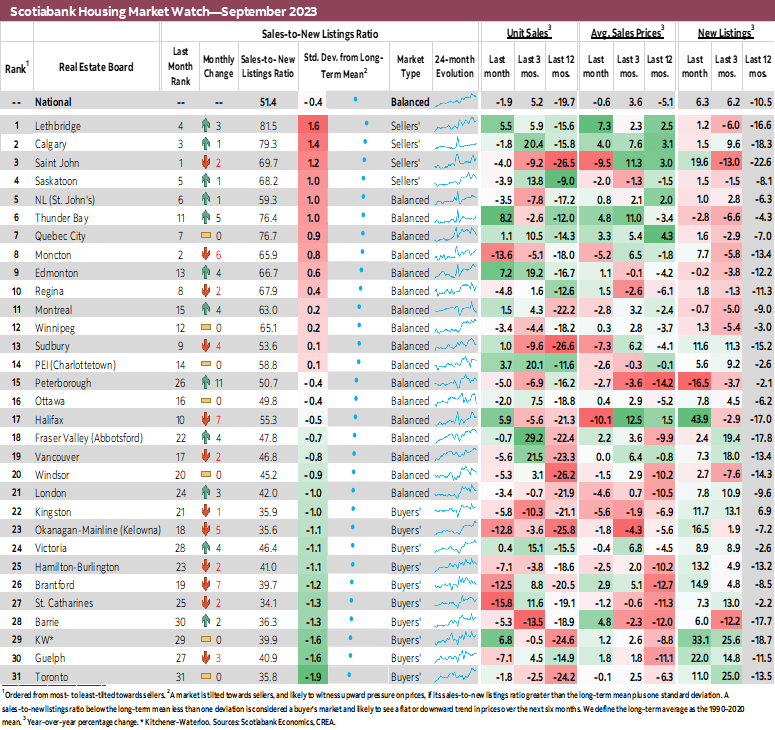

Two-thirds of the local markets we track experienced sales declines while listings increased in almost all of them. Sales declined in 21 of the 31 markets we track, with double-digit declines in St. Catharines, Moncton, Okanagan-Mainline and Brantford. On the other hand, listings increased in 27 of the 31 local markets we track. September’s increase in new listings follows a recent upward trend, with an average monthly increase of around 5% since May. This brings September’s level of new listings to 2% above the 2010–19 average level observed for this month, while September’s level of sales sat 6% below the 2010–19 average level for the month. This catch-up in listings as sales activity retreated further eased market conditions, with 6 Ontario markets along with Okanagan-Mainline and Victoria joining Toronto and Barrie in buyers’ territory. Only 4 of our markets, Lethbridge, Calgary, Saint John and Saskatoon, were in sellers’ territory in September, compared to 6 in August.

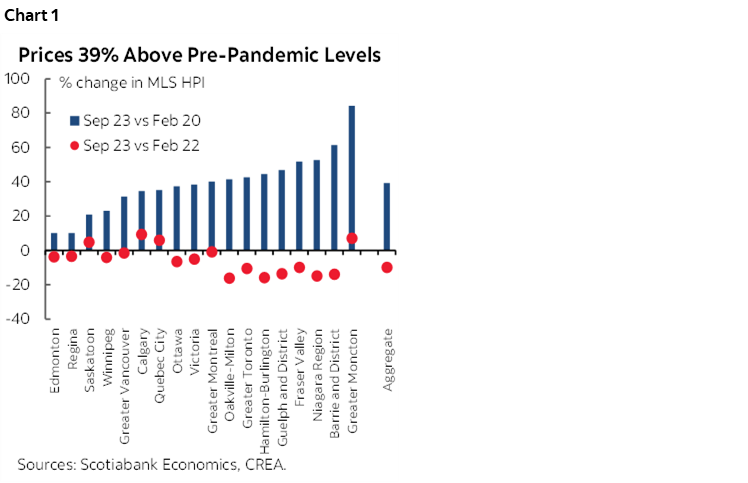

Prices, as measured by the MLS Home Price Index (HPI), edged down by 0.3% (sa m/m) in September—the first monthly decline since March. There were regional differences however, whereby prices increased in over half of the local markets we track, which was offset by declines in the remaining markets. Despite these declines, prices remain well above their pre-pandemic levels across the board, with some markets, namely Calgary, Greater Moncton, Quebec City and Saskatoon, continuing to be above February 2022 levels, the month before the Bank of Canada started hiking, marking the start of a year-long correction in the housing market. At the national level, prices are now only 10% below the February 2022 peak, and around 39% above pre-pandemic levels (chart 1). September’s monthly decline was led by single-family homes, while townhomes and apartments held momentum, increasing by 0.2%.

IMPLICATIONS

National home sales slowed for the second time in a row in September, and prices followed suit, recording the first (albeit small) decline since March of this year. This is in line with what we have been seeing in the market as of late. Increased borrowing costs along with heightened uncertainty about the future outcomes of inflation, interest rates, and the economy have pushed many buyers to the sidelines as they await more clarity.

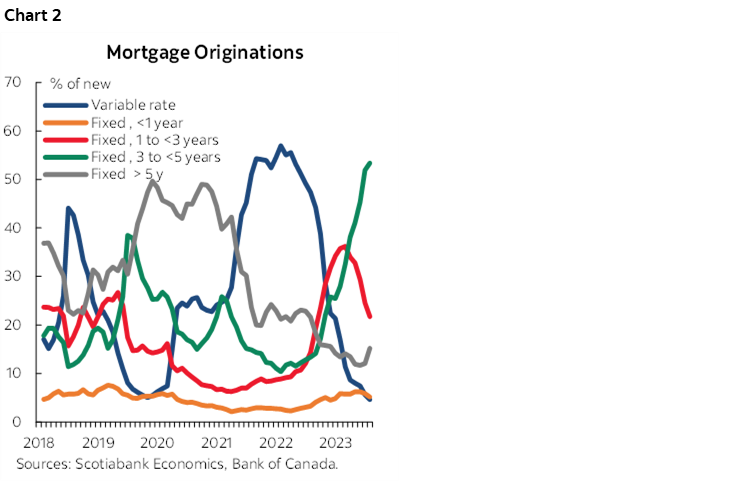

The recent increase in government bond yields might have also played a factor, but likely not a significant one at this stage. The Government of Canada bond yields act as benchmarks for fixed rate mortgages with corresponding terms. Chart 2 shows that fixed rate mortgages with terms between 3 and 5 years have been gaining popularity and now account for the highest share of new mortgages, at over half. This makes sense, a compromise between the previously most popular option, the 5-year term fixed rate mortgage, which would be locking in today’s high rates for 5 years without capturing expected incoming rate cuts, and the variable rate and less than 1-year fixed rate mortgages, which would not provide ease of mind in today’s highly volatile uncertain environment. The yields on the Government of Canada bonds with maturity between 3 and 5 years rose around 30 bps in September. We don’t expect this played a major role in September’s results but it is worth monitoring if bond yields continue to increase or stay at these levels for an extended period and mortgage rates follow suit.

Another thing to remember is that the housing market tends to exacerbate moves in each direction whenever the market turns a corner. A perceived trend of slowing demand and declining prices would only encourage more of both as buyers may hold off for prices to decline further and therefore add to the slowdown in demand at the same time that sellers might rush back into the market to secure sale prices before further declines. The opposite is true—a perceived trend of an uptick in demand and increasing prices might encourage buyers to rush back into the market before prices go up further and in turn add to demand and price pressures.

These are just a couple of many factors impacting housing market outcomes to watch over the next few months as heightened uncertainty persists. Recent strong job and inflation prints have added to the uncertainty on whether the Bank of Canada is done hiking, while other international and geopolitical factors continue to muddy the global outlook.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.