- The stance of the monetary policy rate will effectively tighten through 2023 despite the conditional pause signalled by the Bank of Canada with its latest policy hike on January 25th—and reiterated on March 8th—and our forecast of stability for this rate at 4.5% through 2023.

- This additional tightening will occur through the expected decline in the inflation rate and the resulting increase in the real—inflation adjusted—policy rate, which is what matters for economic conditions.

- For this same reason, the stance of the US monetary policy rate will continue to tighten even after it reaches and stabilizes at our expected cyclical peak of 5.25% from the second to the last quarter of 2023.

- Our view is that the cumulative rise in policy rates so far contributes to slow economic growth, but not enough to re-align the pace of economic activity with what is consistent with central banks’ inflation objective. Additional tightening—as embedded in our outlook—is thus needed.

- From our assessment, this further tightening in the stance of monetary policy to the end of 2023 is equivalent to an additional 150 and 155 basis points hike in policy rates in Canada and the US respectively. This contributes to slow GDP growth in 2023 and 2024 in our outlook in addition to the lagged and intensifying effects from past policy rate hikes.

After reaching multi-decade highs in several economies, including the United States and Canada, headline consumer price inflation started declining in the second half of 2022. Most economists expect this decline to continue with improving supply chains, a cooling global economy from sharp increases in monetary policy rates, and declining prices for energy and other commodities.

The light at the end of the rising-monetary-policy-rates tunnel is now in sight with these weakening inflation pressures. Indeed, with its decision to raise its policy rate by another 25 basis points to 4.5% on January 25th, the Bank of Canada stated its intention to pause if economic and inflation conditions evolve in line with its outlook.1 This rate has been kept unchanged at the Bank’s latest policy announcement on March 8th and this conditional commitment was reiterated. More globally, most forecasters expect central bank policy rates to shortly reach their cyclical peak, and several—including Scotiabank Economics—expect these levels will be maintained for several quarters before they are lowered towards more neutral levels, meaning levels where they neither restrict nor stimulate the economy.

But, assuming this expectation of shortly peaking and stabilizing policy rates do materialize, does it imply the end of the monetary policy tightening cycle? The simple answer to this question is … No!

The reason is that real—inflation adjusted—interest rates matter for economic conditions, not nominal (or posted) rates. The annex provides the rationale of why this is the case. The real interest rate is simply the difference between the nominal interest rate and the inflation rate expected to prevail over the maturity of the loan.

INFLATION AND INTEREST RATE DEVELOPMENTS

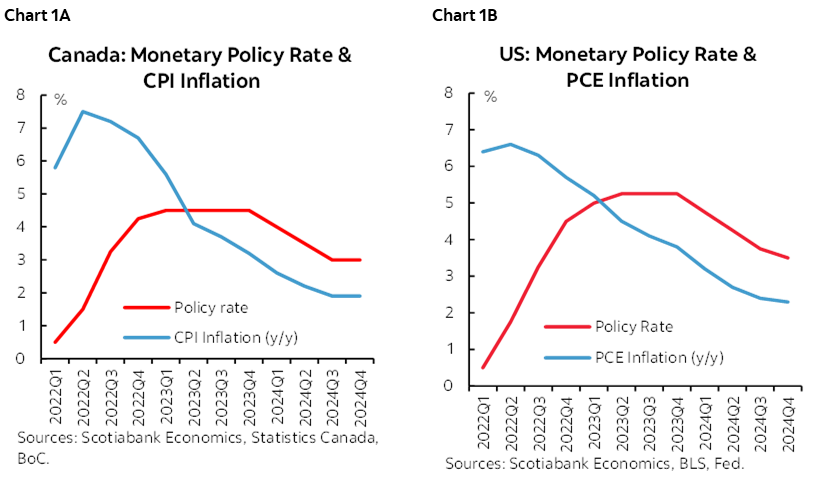

Charts 1A and 1B show our predicted paths to 2024 for consumer price inflation and monetary policy rates in Canada and the United States. The chart shows the headline Consumer Price Index (CPI) for Canada and the price index for Personal Consumer Expenditures (PCE) in the United States.

After reaching a multi-decade high in summer 2022 in both countries, the annual inflation rate started declining thereafter, but is still at historical highs. We predict this downward trend to continue with the intensifying cooling effect on the economy from past interest rate hikes and those coming in the US by the second quarter of 2023 and easing pressures on production costs from improving supply chains and weakening commodity prices.

Charts 1A and B also show the sharp hike in monetary policy rates in both countries from their March 2022 low to their expected peak in first half of 2023; first quarter in Canada and second quarter in the US. They exhibit relative stability thereafter before declining through 2024.

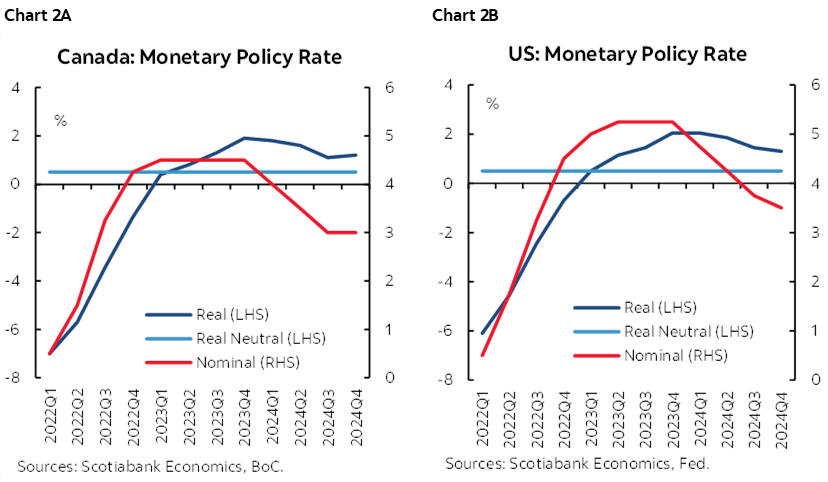

This relative stability in Canadian and US policy rates after reaching their peak masks the continued tightening in the real monetary policy rate until the end of 2023. Despite being an important driver of inflation and economic conditions, expected inflation is unobserved and must be estimated with assumptions. Therefore, to estimate the real policy rate for the purpose of this note, we use our forecast for next quarter’s year-to-year inflation for Canada’s total Consumer Price Index (CPI) and for the US price index for Personal Consumer Expenditures (PCE) respectively.2 These real policy rates are reported in charts 2A and 2B. The charts also show the neutral level of the real policy rate—neither accommodative nor restrictive—that we estimate at 0.5% for both Canada and the United States.

Three key implications from Charts 2A and 2B, and the real policy rate as an indicator of the stance of monetary policy.

Firstly, the real policy rate in Canada and the US was highly accommodative in 2022 despite the sharp rise in both policy rates. Of course, this rise reduced the degree of policy accommodation and GDP growth, but not enough to bring GDP below potential and move inflation towards its objective. We assess that the real policy rate entered its restrictive zone—i.e., exceeding its neutral level—only in this quarter (2023Q1) in both countries.

Secondly, despite the expected stability of the policy rates for most of 2023, monetary policy will continue to tighten by year-end due to the predicted decline in inflation. For Canada, we predict the real policy rate will rise by an additional 150 basis by 2023Q4 and will start declining thereafter with the predicted decline in the Bank of Canada policy rate and the slower decline in inflation. For the US, we expect the real policy rate to tighten by an additional 155 basis points over this period and declines thereafter for similar reasons as for Canada’s policy rate. In addition to the policy rate hikes since early 2022, this additional tightening from the expected decline in inflation contributes to reduce the average annual pace of Canada’s GDP growth in our outlook from 3.4% in 2022 to 0.7% in 2023 and 1.5% in 2024. In the US, GDP growth slows from 2.1% in 2022 to 1.0% in both 2023 and 2024. These growth profiles are sufficient to generate economic conditions that are appropriate to move inflation towards its targeted zone in both economies.

Thirdly, even with the predicted decline in the policy rates—both nominal and real—over 2024 monetary policy will still be restrictive as the real rate will continue to exceed its estimated neutral level. This will contribute to keep growth in average annual GDP below its potential pace in both countries over the entire 2023–2024 horizon.

We can interpret the real policy rate profile from Charts 2A and 2B as Scotiabank Economics’ estimates for the required stance of monetary policy in Canada and the United States to achieve both central banks’ inflation objective. It is of course conditional on our most recent outlook. If economic and inflation conditions evolve differently than we predict, it will lead to a revision of this required path for the real policy rate stance. For instance, if wage growth declines at a slower than expected pace, so could inflation, then requiring the real policy rate to be higher and for potentially longer than expected. This would result in a higher policy rate to eliminate these additional inflation pressures.

ANNEX: ON HOW THE POLICY RATE AFFECTS THE ECONOMY

Monetary policy rates affect the economy and inflation through their impact on interest rates charged to individuals and businesses on their borrowing. When demand for goods and services in the economy outpaces supply, inflation increases which leads an inflation targeting central bank—like in Canada, the United States and several other economies—to raise its policy rate to bring it back within its target range. Consequently, lending rates charged by lenders to individuals and businesses also increase, which raises their borrowing costs. It also makes saving more profitable as deposit rates also rise. Both these effects reduce expenditures by consumers on goods and services and by businesses on investment and production inputs. Inflation then declines as the initial imbalance between demand and supply eventually unwinds.

There is a hidden subtlety to this story. What matters for economic activity is the real—i.e. inflation-adjusted—and not the nominal level of interest rates, and here’s why. We need to look through what economists call the ‘money veil’ and think about borrowing/lending in terms of the volume of goods and services it reallocates between periods rather than in money terms. An individual that borrows money wants to consume a larger volume of goods and services today in exchange of less tomorrow as future financial resources will be used to repay the loan, meaning principal and interest. The latter is thus the cost incurred by the borrower of bringing today one unit of tomorrow’s consumption. Conversely for the lender, the interest rate is the compensation for sacrificing one unit of today’s consumption for more tomorrow.

Intuitive and simple so far, but inflation muddies the waters a bit more. Inflation reduces tomorrow’s purchasing power relative to today, which makes consuming today more appealing as more resources will be needed tomorrow to purchase the same good or service. Therefore, it increases the benefit of borrowing for consuming more today and less tomorrow. Conversely, inflation erodes the lender’s benefit from sacrificing today’s consumption. Therefore, inflation reduces the effective—or real—cost of the loan for the borrower and reduces the real compensation for the lender.

The implication from this example is that a rise in interest rates matched by an equivalent rise in inflation will not alter the benefit of consuming more (less) today for less (more) tomorrow for the borrower (lender). Everything else equal, today’s consumption—thus borrowing and lending—will stay unchanged. If applied to the entire economy, this example implies that the central bank must increase its policy rate by more than the increase in inflation if it wants to cool economic conditions—including consumption, investment—and inflation. The additional twist we need in order to transpose this example to the entire economy is that it is not the actual but the expected inflation rate that matters. The reason is that upon entering a loan contract, both borrowers and lenders factor in their decision a forecast for the price increase that should prevail over the maturity of the loan.

1 This note focuses on the stance of the policy rate, the main instrument used by the Bank of Canada and the US Federal Reserve (and other central banks) to achieve their economic and inflation stabilization objectives. Additional tightening of the broad stance of monetary policy is ongoing and expected to continue through quantitative tightening, meaning the sale of assets held by both central banks, which is affecting market rates.

2 There is no single indicator of inflation expectations, so we needed to select one that is plausible for the purpose of our assessment. We investigated alternative measures, but the conclusion remains that additional tightening in the real policy rate will (and needs to) occur through 2023 to reduce inflation.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.