- Canada is implementing Basel IV on an accelerated timeline relative to key competitors. The Office of the Superintendent of Financial Institutions is requiring Canadian banks to implement these reforms by mid-2026. The United States appears to be reconsidering implementation of some of the Basel reforms while the UK and Europe are fully implementing in 2030 and 2032 respectively.

- Implementation may require banks to shed up to $270 billion in risk-weighted assets to meet the output floor by mid-2026. This would reduce lending to firms and households, including mortgage credit by about 9% of current nominal GDP at a time of elevated financing needs.

- Government-mandated requirements to shed assets (or raise capital) run counter to efforts to raise investment and improve access to the housing market for Canadians. This seems to be another instance of policy inconsistency in the Canadian policymaking landscape.

Canada’s financial system is consistently ranked as one of the most resilient in the world. This is no small part due to the approach the Office of the Superintendent of Financial Institutions (OSFI) has taken in overseeing our financial system. Much like the Bank of Canada, OSFI has a high degree of influence on our country’s financial system through its supervision and regulation of federally regulated financial institutions and pension plans. Though it doesn’t have the visibility of the Bank of Canada and its rate-setting process, OSFI has a large impact on bank lending and the monetary policy transmission mechanism.

Take the implementation of Basel IV for instance. The Basel Accords are a set of international agreements to strengthen the global banking system. They have been negotiated and implemented in waves and have imposed requirements on banks through national regulatory and supervisory agencies such as OSFI in Canada. Previous waves (Basel I, II, and III) laid out liquidity, capital and risk management requirements for banks. Basel IV is in the process of being implemented. It builds on the previous iterations of the Basel Accords in a number of ways, but one aspect in particular is of concern in this note: the output floor.

The output floor determines how banks will calculate risk-weighted assets (RWA), forcing them to shift from an internal model-based approach that is grounded in the lending institution’s loss experience for calculating RWA to a standardized approach, which is generally risk indifferent to bank experience, for calculating these assets. These RWA are used to determine a bank’s capital ratio (the ratio of regulatory capital to RWA). For conservative lenders like Canadian Banks, this change will substantially raise RWA and therefore lead to higher capital requirements. The minimum capital ratio itself is mandated by OSFI and is occasionally adjusted depending on economic conditions.

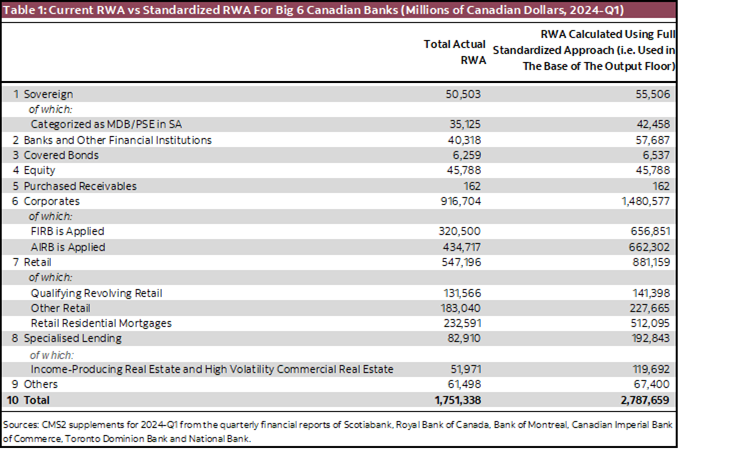

While these may appear to be technical changes, they will have significant impacts on bank behaviour. Table 1 shows the current RWA for Canadian banks and compares them to the RWA from the standardized approach. At present, Canadian banks largely use internal models to calculate RWA. This approach generates substantially lower RWA than the standardized approach, reflecting the historically strong risk management practices of these banks. Owing in part to the large difference between internally determined RWA and those that flow from a standardized approach, Basel IV laid out a timeline for implementation of the standardized approach. OSFI has decided that full Canadian implementation will occur in mid-2026. At that time, RWA in Canadian banks will need to be at least 72.5% of those calculated from a standardized approach. This is the so-called output floor. Currently, the floor is at 65%.

Transitioning from the current 65% to the final 72.5% will impact capital ratios unless actions are taken. This is of course by design, as these regulations are meant to further strengthen capital management in banks. To keep capital ratios at minimum required levels, banks can either raise capital by issuing shares or retaining earnings (through lower dividends for example) or reduce RWA. Recent tax policy changes have reduced earnings by banks making it harder for banks to build capital by retaining earnings. Banks can always raise capital by issuing equity, but this option is unappealing given valuations. As a result, it is likely that banks will choose to shed RWA in order to meet capital requirements.

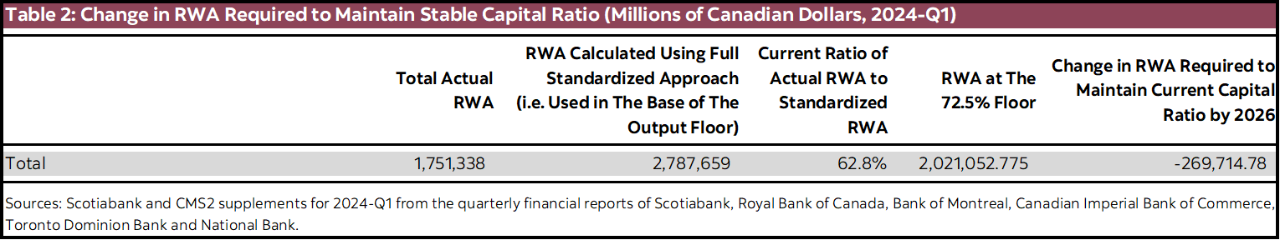

Table 2 demonstrates the impact on bank assets once the 72.5% floor comes into force in 2026. It is based on the most recent financial disclosures for the Big 6 banks in Canada. The last column of the table calculates the change in RWA required to achieve the 72.5% output floor assuming current capital ratios are maintained, and no actions are taken by banks to raise capital. This may be an extreme example, but it helps illustrate the challenge using the current balance sheets of the Big 6 banks.

As a whole, banks would have to shed about $270 billion in assets by 2026 if capital ratios remain unchanged and banks do not raise capital. This represents about 9% of current nominal GDP and would represent a major pull back in lending relative to the current situation. Risk-weighted assets are overwhelmingly in corporate and retail lending. As a result, any asset shedding would likely be concentrated in these areas and would see banks lend less than would otherwise be the case to companies and individuals to meet these objectives. Moreover, as retail lending includes a large component of residential mortgages, banks would likely reduce mortgage financing to meet the regulatory changes. It is of course possible that banks choose to raise capital instead of shedding assets, but even if we assume that a 50/50 split between asset shedding and capital raising, the system would still see banks shed assets worth around 4.5% of GDP.

The potential impacts of these changes raise a number of policy concerns. While it is clear that a more capitalized banking system is a safer system, there is an economic cost to making an already-safe system safer. It is for policymakers to determine if those costs are worth it, but there can be no doubt that moving forward will reduce bank-intermediated credit available to Canadians relative to the current situation.

These impacts must be considered within the context of two key policy challenges in Canada: our weak productivity performance and the deterioration in housing affordability triggered by our chronic inability to create enough housing to meet demographic requirements. The federal and provincial governments have launched a number of initiatives in recent months that seek to improve our productivity performance and close housing gaps. In many ways, these efforts seek to reduce the cost of financing of investments in the hopes that this will boost the residential and non-residential capital stock given the central and well documented role lower-than-necessary investment plays in each challenge.

Governments will argue that there is a determined and concerted effort to tackle these challenges. This may well be true across levels of government, but it is less apparent within the federal apparatus. We have noted in the past the conflict between monetary and fiscal policies and the interest rate impact of mis-calibrated fiscal policies. Another coordination failure appears to be underway, this time between the implementation of Basel IV regulations and federal objectives on the housing and productivity front. Implementation of the output floor could force banks to cut back lending to the very sectors of the economy governments are trying to mobilize financing for. Moreover, a potential reduction in mortgage financing at a time of dramatically rising demographic requirements risks making housing even less accessible to some Canadians despite government efforts to the contrary.

An additional consideration is the timeline associated with implementation of the floor. As noted above, Canada will fully implement the floor in mid-2026. It now appears uncertain if the United States will proceed with implementation of some of the Basel reforms. In the UK, the floor will be fully implemented in 2030. In Europe, transitional arrangements will be in place until 2032. It is clear that Canada is moving to implement these reforms at an accelerated pace relative to our main competitors. While this will mean a more resilient banking system in Canada relative to these countries, it will place Canada at a competitive disadvantage at a time when access to finance is critically important in meeting the needs of Canadians and for transforming our economy.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.