- The race is on to build (and power) the vehicles of tomorrow. Fundamental shifts in the policy landscape, along with pent-up demand and high energy prices, have underpinned a surge in global EV sales over the last two years (chart 1).

- Recent developments have amplified the opportunities, but also the threats. From trade wars to material shortages to increasingly viable competition from abroad, auto manufacturers and policymakers alike are increasingly on guard.

- Perhaps the biggest risk—or the most underrated one—is that we might be backing the cars that people want today but cannot afford tomorrow. Over the past few decades, North Americans have opted into much larger (and pricier) vehicles with affordability supported, in part, by longer financing terms. This will eventually butt up against limits.

- Electric vehicles likely need to be a fraction of today’s prices to reach mass market by 2035. The average Canadian would need to see prices drop by over a third—and lower income Canadians by a half—assuming historic spending (and financing) trends hold (chart 2).

- If sticker prices don’t come down substantially from today’s make-and-model distorted highs in North America, only those with deep pockets will be able to afford them tomorrow. First-best is that regional automakers see the writing on the wall and evolve their offerings across the price spectrum over time.

- But manufacturers’ ability to respond in a timely fashion may be constrained by demand, price and policy uncertainty, despite inching open the door to imports from markets that are years’ ahead (and many dollars down) the cost curve.

- North American policymakers may need to consider whether additional and more innovative supports could target these pervasive market failures to incent radically more affordable vehicles down the road.

- In any case, North American policymakers need to ratchet up regional collaboration. Erecting barriers might buy time, but not necessarily edge as the Europeans are learning the hard way.

- A “no-regrets” strategy could be better for the economy, for households’ pocketbooks, and for Canada’s climate goals down the road.

READY, SET, GO

The race is on to build (and power) the vehicles of tomorrow. Fundamental shifts in the policy landscape, along with pent-up demand and high(er) energy prices, have underpinned a surge in electric vehicle sales globally. Spending on electric vehicles was up 50% last year alone. Near-exponential growth of EV sales—up 240% since the onset of the pandemic—looks set to continue. Sales should grow 25% annually on a path to net zero according to the International Energy Agency (IEA).

This is one bright spot on the path to net zero. A fifth of global emissions come from transportation—and about half of this from passenger vehicles (chart 3). These shares are substantially higher for advanced markets like the US where car ownership rates are higher. The IEA has called for a “no-regrets” strategy with respect to the electrification of vehicles—not only given their substantial contribution to emissions, but also their promising and proximate potential for reductions. Even though vehicle emissions need to decline by about 6% annually to be consistent with a pathway to net zero by 2050, this is one of the few sectors where stated policies are broadly consistent with that objective, where implementation gaps are small, and where industry plans equal or exceed those of policymakers according to the IEA’s refreshed pathway.

Policymakers around the world are going all-in on the electrification of vehicles. China has long-deployed a host of subsidies for consumers and manufacturers over the last decade, along with major investments in supporting infrastructure. Europe has leaned heavily on a regulatory-driven approach with progressive tightening of emissions standards since 2019, along with its more recent business-friendly Green Deal Industrial Plan. The US has only recently joined the race with the Inflation Reduction Act offering substantial manufacturing tax credits for domestically-produced EVs, along with consumer purchase incentives scaled to origin. Not to be left behind, Mexico has supplemented its EV sales targets with production ones: 50% of all vehicle production in Mexico is to be electric by 2030.

Canada is toeing the starting line. After years of dabbling with modest purchase incentives, the federal government has established ambitious EV sales mandates, unlocked funds for charging and grid infrastructure, introduced various investment tax credits, and is now rolling out a host of direct subsidies along the EV value chain. The combined tally stands in the tens of billions of dollars and counting as Canada aims to garner a larger share of the prize. Provinces, to varying degrees, are supplementing these efforts with their own measures.

ASLEEP AT THE WHEEL

China is laps ahead of the rest of the world. Last year, EV sales represented almost 30% of all new vehicle sales in China, overtaking even climate-conscious Europeans where just over 20% of auto sales were electric. Chinese consumers purchased almost 6 mn EVs last year—or nearly 60% of the global total—putting it well-ahead of Europe’s 25% market share. The US—the next largest vehicle sales market—has seen modest advances in recent years but EV sales penetration is still single-digit (less than 10% of new vehicle sales are electric). Canada is heading in the right direction but hardly spectacular by either measure (chart 4).

There is something for nearly everyone in China’s more mature EV market where consumer selection is multiples ahead of other regions. According to the IEA, China boasts 300 EV models—twice that of leading European markets and three times those available in the US (and over 10 times those available in Canada). The vast majority (about 80%) of EV options in the US market are SUVs.

Price points are also more palatable. A small BEV in China (at USD 10 k) costs a third of one sold in the US or Europe (albeit with a lower driving range) according to the IEA. While the gap starts to narrow for larger vehicles, the price premium on SUVs—in the order of 40%—is still substantial even as range differentials close.

China has also largely locked down EV supply chains. According to the IEA, 75% of global battery manufacturing capacity is in China. It also processes almost two-thirds of the world’s lithium (60% of global demand stems from EVs). A 65% surge in automotive lithium-ion demand last year pushed demand for this critical mineral above supply. This is not a lithium-only story as China has cornered the processing market for other important battery inputs (chart 5). Not surprisingly, the country’s batteries confer a price advantage, only amplified by trend growth in battery sizes in markets selling larger vehicles.

LIST OF RISKS IS LONG

Competition risk has risen to the fore as China capitalizes on its EV hegemony. China’s share of global EV exports was 35% last year—a full 10 ppt improvement in one year alone. Europe is feeling the brunt of this with Chinese-manufactured EVs making up 16% of its EV sales in 2022 (a 5 ppt increase over 2021). Not all of these vehicles are from China-headquartered automakers, but the meteoric doubling of Chinese-owned BYD’s global market share in one year (to 18% in 2022)—propelling it to first place—embodies the threat. The next closest rivals sit at 13%, 8%, and 6% global market share (in unit sales).

Rules of the game are being re-written with the rest of the world caught on the back foot. The IMF has warned against a race-to-the-bottom in the context of the US IRA, flagging risks of wasteful spending or—worse—tit-for-tat trade wars. It appears the world may be on that brink now with the European Commission launching an anti-subsidy investigation into Chinese imports and threatens to respond with new tariff measures. Meanwhile, Canada’s federal government has launched consultations on potential retaliatory—or euphemistically “reciprocal”—measures without specifically naming threats. While Europe (and others) are likely in the right, it’s not clear if this will be better for the globally-integrated industry or the environment.

This is all unfolding in a sector with no shortage of other risks. In its inaugural Critical Mineral Market Review, the IEA flags risks related to material shortages and broader supply chain disruptions as nations ramp up green transition ambitions. With the growing concentration of supply in a handful of countries (and companies as the sector integrates vertically) it warns the adequacy of future supply is far from secure. The same source lays bare major technological risk particularly related to betting on battery chemistries, each with substantially different implications for supply chains. The OECD has relatedly warned of a five-fold increase in export restrictions on critical raw materials since 2009.

The list of demand-side risks is equally long and complex. Reams of paper elsewhere have thoroughly documented other headwinds facing consumer adoption from range anxiety to adequate charging (and electricity) infrastructure to cold-weather resilience in chillier climes like Canada.

THE INVISIBLE GORILLA

Perhaps the biggest risk—or the most underrated one—is that we might be backing and building the cars that people want today but cannot afford tomorrow. North Americans have increasingly opted into larger (and pricier) vehicles. About four-in-five vehicles sold in the US and Canada, for example, are “trucks” (including SUVs), a near-reversal in numbers since the 1980s (chart 6). (It doesn’t take an engineering degree to appreciate that larger vehicles require more materials and heavier vehicles require larger batteries in a vicious pound-price spiral.)

Auto prices—electric or otherwise—have been climbing especially in recent years. The average price of all new vehicles in Canada currently stands at $66 k, according to Canadian Black Book, up by over a third since the onset of the pandemic. A battery-electric vehicle (BEV) in Canada fetches almost $73 k today, according to the same source.

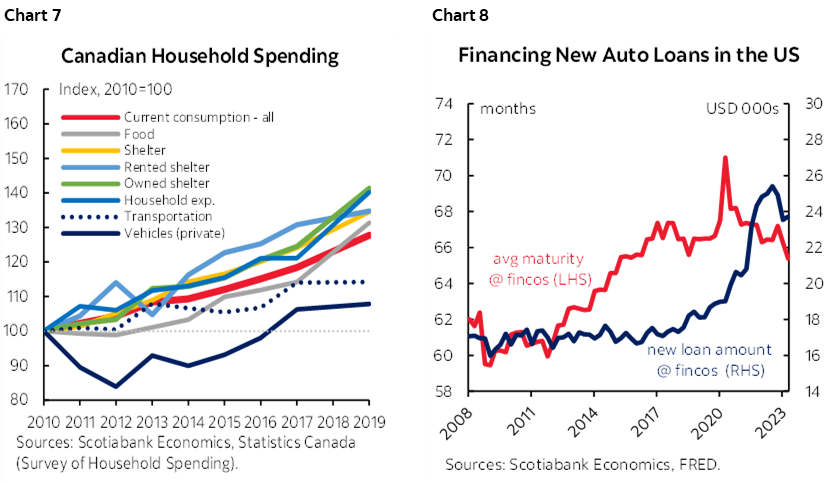

While sticker prices march upward, consumer spending on cars has not kept pace. Annual household spending on private transportation has grown at less than half the pace of household income over the past decade (pre-pandemic), according to Canada’s Survey of Household Spending. Shelter costs, on the other hand, have materially outpaced income growth, particularly for homeowners (chart 7). Americans’ spending on private vehicle ownership has similarly lagged income growth. Affordability has been supported, in part, by longer financing terms with the average maturity of new car loans in the US mostly heading only in one direction (chart 8). There are eventual limits to this model.

While true EV ownership costs may be lower, consumers are not necessarily buying it. Clean Energy Canada estimates that EVs hold a lifetime cost advantage over comparable internal combustion engines, while the federal government estimates its sales targets would save vehicle owners almost $40 bn in net energy costs against $25 bn in ownership costs by 2050. But at peak-gasoline prices with the onset of war last year, less than half of Canadians considered purchasing an electric vehicle according to JD Power. As gasoline prices retreated, so too did consumer deliberations. Only about a third of Canadians would consider an EV purchase in JD Power’s latest survey. The reasons are far more complex than financial alone, but high upfront costs don’t help.

It is not entirely clear where prices go from here. Current North American EV prices are skewed by the dominance of a few luxury models. Some rollback in prices among these market leaders, along with the expected rollout of more affordable brands and models should take some of the pressure off prices, but it’s not a given that innovation alone will substantially bend the cost curve anytime soon given the largely nascent and precarious state of supply chains outside of China.

DOUBLING DOWN ON AMBITION MAY MEAN HALVING THE PRICES

If current price trajectories are largely exogenous and difficult to predict, a better question might be what consumers can afford. We define notional EV purchasing power across households as an annual level of expenditure a household might reasonably redirect towards the purchase of an EV that is consistent with past expenditures on private vehicle purchase (or lease) along with gasoline (though we assume the consumer substantially discounts future energy savings, bound by cashflow constraints). We project this out to 2035 when all new vehicle sales in Canada are mandated electric and translate this notional annual budget into an illustrative vehicle purchase price (making some broad assumptions along the way set out in Annex 1).

Electric vehicle prices likely need to be a fraction of today’s prices to reach mass market by 2035. We estimate middle income quintile Canadian households spent on average $7.6 k in amortized vehicle purchase costs and gasoline in 2022. By our calculations, this demographic, for example, would support an EV purchase price of about $47 k (in today’s dollars) in 2035—or just under two thirds of today’s price point. For Canadian households below that middle-mark, prices could reasonably need to be halved.

The picture is broadly similar south of the border. For regionally integrated auto markets, US vehicle affordability no doubt holds substantial sway in investment decisions regardless of where final assembly takes place. In 2035, middle income quintile American households would support an EV purchase price of about USD 46 k in today’s dollars (chart 9). Current average market pricing is USD 62 k for BEV models in the US according to Black Book.

FROM DEFENSE TO OFFENSE

If sticker prices don’t come down substantially from make-and-model distorted highs in the North American EV market today, only those with deep pockets will be able to afford them tomorrow. This should be a wake-up call for regional automakers as they look over the horizon when sales necessarily need to reach the masses. First best, is that they design and deploy a range of vehicle options across the pricing spectrum. (And Scotiabank’s Equity Research has explored the opportunities in this space in depth. See Box 1 for a round-up.)

That may not be enough. Regional automakers’ (and their supply chains’) ability to respond may be constrained by substantial demand, price and policy uncertainty across increasingly fragmented markets and rapidly re-ordering supply chains. Embedded uncertainties include the pace and direction of technological developments, the availability and cost of critical minerals (and energy) security, supporting charging and electrification infrastructure, and the evolution of consumer preferences. These are classic market failures that risk underinvesting in more affordable EV options while opening the door (further) to import risk from markets (read, China) that are better positioned on the cost curve.

This could not only put growth at risk, but could also compromise the pace of progress towards climate goals. The electrification of passenger vehicles in Canada really only pays big emissions dividends into the next decade as the country is starting from a low base and has a large (and aging) stock of vehicles to turn over. About 2% of the 25 mn vehicles on the road in Canada are electric. By 2035, still less than half of the vehicles on the road are projected to be electric (chart 10). Older vehicles are higher-emitting, and it is reasonable to assume that as affordability pressures—for ICE and EV options—persist, the stock of vehicles will age, particularly among lower income vehicle owners. Such externalities suggest markets alone may not deliver optimal societal outcomes.

A true “no-regrets” strategy begs the question if more is needed. North American policymakers may need to consider whether additional and more innovative supports could target some of these pervasive market failures to incent radically more affordable vehicles down the road. Keep in mind, innovation cannot be imposed, rather induced. Scaling to mass market may very well happen, but it might not be domestically-produced vehicles—or at least in the shares our regional economy has come to enjoy. In any case, North American policymakers need to ratchet up regional collaboration. Erecting barriers might buy time, but not necessarily edge as the Europeans are learning the hard way.

This could be better for the economy, for households’ pocketbooks, and for Canada’s climate goals down the road.

ANNEX 1: EV PURCHASE POWER METHODOLOGY & ASSUMPTIONS

We define a notional EV purchase power as the spending budget a consumer might otherwise devote to the purchase of an electric vehicle. For Canada, we use a combination of data from Statistics Canada’s Household Final Consumption Expenditure (HFCE) survey and the Survey of Household Spending (SHS). For the US, we examine data from the U.S. Bureau of Labor Statistics’ Consumer Expenditure Survey (CES). We assume that a households’ electric vehicle purchasing power is equal to current expenditures on private vehicle purchase costs (annualized) plus gasoline costs, however we assume the consumer heavily discounts future energy savings, bound by budget constraints. Absent consensus, we assume other operational costs are the same for ICE and EV and we make no assumptions on relative vehicle lifetimes or residual values. We then project this annual “EV purchase power” out to 2035 using historic growth rates of this basket.

We translate this annual budget into a vehicle purchase price based on the following financing assumptions: a 10% downpayment, a 7 year (84 month) term, and a 5% interest rate—all based (largely) on historic trends with some judgement applied. For comparison purposes, we convert this 2035 vehicle price to today’s dollars. We intentionally focus on affordability in 2035 when 100% of new vehicle sales are mandated to be electric in Canada.

There is clearly enormous uncertainty embedded in many of these assumptions. One risk, for example, is that persistent shelter cost pressures could further erode purchasing capacity for discretionary goods like private vehicle ownership. On the other hand, a longer lifespan and/or higher residual value of EVs could stretch the dollar further through longer financing terms. Similarly, more innovative approaches to capturing future gasoline savings in current purchase decisions could enhance this purchase power. The exercise is intended to be illustrative only, using best-available data, to inform dialogue.

BOX 1: SCOTIABANK’S EQUITY RESEARCH ON MARKET IMPLICATIONS OF THE ELECTRIC VEHICLE TRANSITION

Scotiabank GBM’s Equity Research team has explored the topic of EVs in depth in their reports. What follows is a high-level summary of some of their previously published EV commentary. Please contact Scotiabank Equity Research for more details.

We recently launched coverage on three Canadian Auto Suppliers. In our report, Shifting Gears (published August 2023), we discuss implications of the EV transition on auto supply chains, particularly on future earnings power of Tier 1. We conclude that in the near term, EVs are content neutral for the suppliers, in that fewer parts will be offset by higher value content. In the medium and long term, suppliers have the opportunity to grab a larger share of the “EV pie” through investments in battery enclosures, electric powertrain, thermal management systems, and other parts.

Affordability has not been an issue so far. Consumers have demonstrated a willingness to pay a premium for EVs. On average in 2021, EVs cost USD 10 k more than ICE before purchase incentives, according to the Natural Resources Defense Council. Global spending on EVs exceeded USD 425 bn in 2022, up 50% y/y, with only 10% of the spending attributed to government support. Moreover, global EV unit sales increased 55% y/y in 2022 compared with the total auto market, which decreased 3%. Scale and a growing number of new entrants offering affordable models will likely continue to drive down the cost of EVs.

– Jonathan Goldman | Associate Analyst

ESG investment research related to EVs. Scotiabank GBM Equity Research’s annual ESG investment research report features the “Scotiabank GBM ESG Analytical Framework,” which comprehensively evaluates sustainability, societal, and stewardship data for more than 1,000 companies in Scotiabank’s Americas footprint. Automakers plus related industrials and materials companies in the S&P/TSX Composite Index, the S&P 500, and the LatAm 100 are competitively ranked and scored based on material ESG factors and risks. Scotiabank’s “ESG Tearsheets” further leverage the Scotiabank GBM ESG Analytical Framework. The ESG Tearsheets are updated quarterly and integrated with Scotiabank GBM company-specific research coverage. Scotiabank GBM also hosts an Annual ESG Conference and Sustainability Summit, which includes expert commentary relevant to EVs and electrification, with key insights and take-aways subsequently detailed in the annual An Attendee’s Notebook publication. Furthermore, each month, the 30 Thoughts report is published, which provides the latest insights into the numbers and narrative of ESG; it also includes detailed tracking of EV sales, energy transition, and affordability trends.

– Patrick Bryden | Analyst

EVs to be a boon for utilities. Earlier this year, we hosted EV-related utility/investor events around the New York and Detroit Auto Shows. As we published after those meetings, we believe that, while utilities face challenges related to EVs, they seem manageable to us and will likely result in upside going forward. We expect utilities to benefit from materially higher demand for electricity (improving asset utilization and boosting revenues), higher peak loads (necessitating more clean generation), and significant grid-level capex needs (to build out the infrastructure required to enable the transition). Some investors think it may take 20 years for electric cars to dominate, and, admittedly, utility capex is unlikely to increase materially until 2030+, but some see inflection points as soon as 2025 and 2030. The pace of growth will depend on political forces, customer preferences and availability of low-cost options, and increased education efforts. Going forward, incentivizing off-peak charging will lower the total cost of ownership for buyers, while non-owners will also benefit from higher volumes and a better utilized generation stack. Still, utilities highlighted the need to care today in order to avoid being bottlenecks, particularly at the grid/distribution level. Fortunately, utilities are already aggressively upgrading grids for other reasons, so the work is not incremental. Overall, we remain bullish on utilities, and see the clean energy transition, including a shift to EVs, as improving visibility into future EPS growth at a pace likely to be faster than ~6%–7% today.

– Andrew Weisel | Analyst

A long and winding road for EVs? In a recent report we questioned the pace of the EV transition and argued that despite constant news on record EV sale levels, investors should not give for granted that a smooth and fast transition from ICE vehicles to EVs is underway. The mismatch between government policies, consumer preferences and OEMs’ ability to transition only increases the risk of lack of coordination and potential delays. Geopolitical tensions may lead to protectionism and, in any case, we think OEMs in the USA and Europe may need to buy some time to develop their own EV industries and value chains. Among other concerns we noted the risk of slowing sales growth of EVs after an initial wave of early adopters and delays on emissions goals by authorities across key auto markets, especially if value chains are not ready on time. We also flagged that affordability of EVs (especially SUVs and pickups) may remain a challenge due to high production costs and the need to amortize massive investments for the transition.

– Alfonso Salazar | Analyst

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.