GOVERNMENTS AND HOUSEHOLDS ALIKE NEED A (BETTER) PLAN

- Canadians are living longer but gains in healthy years are not keeping pace.

- Almost half of seniors 75 years+ have at least one disability, while over a quarter of Canadians aged 85 years+ reside in a long-term care setting despite most Canadians perceiving major failings in these arrangements.

- Canadians want to age in place, but few have a plan—let alone one that factors in health-related considerations—to guide retirement readiness.

- Most Canadians would lean on government provisions should they fall on hard luck, but governments are equally ill-prepared. Health and long-term care systems are already stretched even before factoring in further aging on the horizon. Unhelpfully, they also skew to the most costly and least desired outcomes.

- First-best is a coherent aging policy framework that breaks down silos across healthcare, long-term care, and financial security and is backed by a credible fiscal plan. (Spoiler alert: it likely requires greater investments even after efficiencies.)

- In any case, most Canadians very likely need to save more to preserve the option to age in place and hedge against the risk that policy coordination failures persist.

- The oft-cited $1 mn watermark for retirement at the age of 65 could easily double under a range of plausible scenarios as even modest out-of-pocket expenses to support aging in place would quickly overwhelm most households (chart 1 & 2).

- It is in the government’s interest to help Canadians help themselves. Progress has been made in putting a floor under seniors’ income through government transfers and mandatory programs, but more work is merited in letting market income provide more lift.

85 IS THE NEW 65

Canadians are getting older. Canadians aged 65 years+ now account for nearly one-fifth of the total population (19% or 7.3 mn). This cohort is growing at six times the clip of Canada’s youth and will continue to climb as the last of the Baby Boomers mark their 65th birthday by 2031. The number of Canadians 85 years+ is growing twice as fast as the general population and is expected to triple by 2051 when the last of the Boomers turns 85 (chart 3). Meanwhile, the fastest-growing cohort is 95 years+ (albeit from a low base).

Canadians are also living longer. Over the last two decades alone, Canadian seniors have gained two-and-a-half years in life expectancy. While advances have slowed in recent years, they still translate into an additional month in life expectancy with each passing year. Men, in particular, are benefiting with a 65 year-old man today enjoying a three-year gain in life expectancy (19.5 years) versus a two-year improvement for women over the last two decades. Nevertheless, his female counterpart is still likely to outlive him by almost three years.

IN SICKNESS AND IN HEALTH

Not all of these additional years are healthy ones. Life expectancy adjusted for health (i.e., the number of expected years in full health) has not kept pace with longevity. Only 15 of the 21 years are expected to be in full health for the average 65 year-old today. Again, improvements have mostly accrued to men. A woman’s healthy-year advantage narrows to less than a year. Given her longer expected lifespan, a typical 65 year-old woman is expected to live almost seven years in poor health versus five for men (chart 4). The largest penalty befalls lower income Canadians with three fewer healthy years (for a 65 year-old) relative to their top income quintile peers.

Chronic disease prevalence increases with age and over time. While medical advances in some areas prolong longevity—for example reduced mortality rates from cancers and heart disease—it opens the door for others. The Public Health Agency of Canada (PHAC) documents sharp increases in disease with age with almost three-quarters of seniors (65 years+) having at least one major chronic disease and a third with multiple conditions. By the age of 85, over four-in-five seniors suffer from hypertension, over half from osteoarthritis, and one-quarter from dementia to cite just a few common conditions, while the multiple-morbidity rate climbs to one-half.

The presence of disease is not necessarily indicative of overall wellbeing. For example, over two-thirds of seniors reported their mental health as “very good” or “excellent” in the last Canadian Community Health Survey in 2017–18—slightly higher than working-age Canadians—despite many living with chronic diseases. Clearly, the absence of disease is only one factor in a person’s perception of health with other important factors reflecting economic security, social connectedness, and psychological well-being.

AGING WITH ROSE-COLOURED GLASSES

Canadians might be living longer but they don’t necessarily internalise it. A survey by the Canadian Institute of Actuaries (CIA) shows Canadians tend to underestimate their life expectancy by almost four years. They also underestimate their need for care: less than a quarter expect they’ll need to access a long-term care facility in their lifetime, but statistics suggest closer to 40% of those who live into their nineties will need such care (and three-quarters will be women). Canadians also tend to overestimate their full-health horizon: less than a third expect to experience a disability later in life versus a self-reported disability rate of almost one-half among those over 75 years of age (chart 5).

An overwhelming majority of Canadians want to age in place. The pandemic has reinforced this near-universal desire with Canadians collectively holding the alternatives in low regard. The same CIA survey reports that half of Canadians feel the availability of long-term care is fair to poor, while more than half perceive its quality to be fair to poor. Almost half also assess their ability to afford it as fair to poor.

Yet Canadians tend to significantly underestimate the potential costs of alternatives. Another survey by the National Institute on Aging (NIA) finds that almost half of Canadians believe in-home care costs would cost less than $1,100 per month. That would buy less than an hour a day of support based on agency rates of about $40/hr. The Canadian Medical Association (CMA) benchmarks 22 hours per week as a level of care consistent with keeping patients at home instead of in a long-term care setting. That would roughly translate into $3,500 per month—this is likely a floor since it reflects only general support, not healthcare services. At an extreme, continuous care in the home would run closer to $30 k per month.

The majority of Canadians don’t even have a financial plan for retirement let alone one that builds in a buffer for potential health care costs. Less than half of Canadians undertake financial planning for retirement, according to the aforementioned CIA survey, despite ample studies attributing planning to better outcomes. Less than one-in-three Canadians consider long-term care needs, though only one-in-ten have actually set aside funds to pay for it. The majority would default to government supports—financial, health, and long-term care—despite perceiving major failings in the level, access and quality of care.

FALSE SENSE OF SECURITY

The fiscal footing to support an aging population is far from established. Healthcare spending tallied $331 bn last year—almost 12% of GDP—according to the Canadian Institute of Health Information (CIHI). While seniors constitute 19% of the population, they consume about 45% of healthcare spending. Costs escalate rapidly in senior years with per capita spending on an 85 year-old thrice that of a 65 year-old (chart 6). Governments have recently ramped up healthcare spending, but bigger pressures still lay ahead. By 2051—when the last of the Boomers turn 85—the Parliamentary Budget Officer (PBO) estimates provinces will be spending an additional percentage point of GDP on healthcare.

Long-term care costs are barely reflected in fiscal plans. Long-term care is not universal in Canada and its funding and delivery varies substantially across provinces. Canada spends about $33 bn on long-term care, according to CIHI, with the bulk of it (80%) delivered in an institutional setting (e.g., a long-term care home). The public purse shoulders about three-quarters of costs for institutional care and approximately two-thirds for home- or community-based care with assistance often means-tested. These figures do not include general household support, nor do they account for about 75% of in-home needs that are met through informal support, both of which can be essential to aging in place.

Unmet demand for long-term care is already substantial. The Canadian Medical Association (CMA) puts demand at 1.5 mn (2019): 380 k for facility-based care (including 20% ‘unmet’ demand or folks on waiting lists) and 1.2 mn for homecare (including about 8% unmet). This may very well underestimate gaps as an earlier Statistics Canada study (2018) near-doubled unmet homecare needs among seniors (at 170 k), while over 400 k seniors with disabilities (or 20%) self-reported unmet needs due to costs.

This demand is set to intensify. The same CMA study projects that demand for long-term care will climb to 2.3 mn by 2031 (1.7 mn for homecare and 606 k for institutional care). This would lift costs—appreciating with wages that eclipse inflation—to almost $60 bn by 2031. For illustrative purposes, extending this out to 2051 as the last of the Boomers hit 85 would bring that theoretical demand to $230 bn annually. (Unlike elderly benefits that peak as the last of the Boomers turn 65, health-related costs are driven by the 85-year threshold.) Admittedly this simplistically assumes away labour constraints when job vacancies in relevant sectors already sit well-above other sectors in the economy.

Current constructs unnecessarily drive costs higher. Unmet support services in the home are boosting demand for institutional care. CIHI estimates that 10% of long-term care residents could be cared for at home with appropriate supports. In turn, chronic unmet demand in long-term care homes is pushing more seniors into hospital settings. In Ontario, for example, over 15% of hospital beds are occupied by alternative-level-of-care seniors. Aging in place is mutually beneficial to households and governments alike, but policy biases skew in the most costly direction (chart 7).

The most likely path ahead is one of growing unmet demand for government-provided health and long-term care services. Simple extrapolations could reasonably see incremental fiscal demands on governments in the order of 2 ppts as a share of GDP by 2051 if long-term care demand were brought on the books (chart 8). In reality, governments will face a host of complex trade-offs in a world of finite resources and a shrinking labour force. More probable, a muddling-through approach likely involves a combination of growing unmet demand, greater means testing for some benefits, and higher taxation.

Betting on the public provision of appropriate long-term care over the long run might be best hedged with a back-up plan. Retirement income can plan an important role in enabling aging in place where public provisions fall short.

IT AIN’T BROKE, BUT NEEDS FIXING

There are many bright spots on Canada’s retirement income landscape. Its policy framework is anchored around two key goals: alleviating poverty among those seniors in greatest need and helping those better off avoid significant declines in retirement living standards. Its foundational pillar provides a minimum level of income (i.e., OAS-GIS) that is financed through general tax revenue. A mandatory earnings-related pillar is financed through obligatory employee and employer contributions (i.e., CPP/QPP). Finally, a voluntary pillar incentivizes retirement savings through preferential tax treatment (e.g., RPPs, RRSP, TFSAs). There have been well-documented reforms over the years that merit credit, including fully funding the middle pillar and putting a financial floor under seniors.

Seniors are less likely to live in poverty relative to the general population. Three-in-five federal household transfer dollars flow to seniors with elderly benefits set to surpass $100 bn by the end of the decade. Elderly payments provide an annual $8 k to 93% of seniors, when, coupled with CPP/QPP benefits, provide an effective after-tax income floor of $16.6 k for near-all seniors according to the 2021 Canadian Income Survey. The median income for all seniors stood just above $33 k—measured at the individual not household level (chart 9).

Seniors generally require lower income in retirement years. A simple rule of thumb is that Canadians need 70% of their working-life income in retirement years. Seniors typically start drawing down savings (instead of accruing them), while consuming less on aggregate in retirement, thus depressing income needs, and in turn reducing tax liabilities. This pattern is observed in the last Survey of Household spending (2019) with current consumption of the average senior household about 30% lower ($48.5 k) than households aged 55–64 years. Beyond 85 years, research out of the US suggests another decline in the order of 30%.

Admittedly, averages mask wide variations across households. Expenditures among the highest income quintile of senior households are twice that of the lowest income households according to more granular national accounts data. (On the other hand, lowest income senior households, on average, benefit from higher post-retirement income relative to pre-retirement years owing to age-based policy supports.) With shelter-related costs comprising a dominant and growing share of expenditures across income brackets and ages, another dividing line can be household structure: poverty rates among single adult households—whether senior or non-senior—stand multiples above the rest of the population (chart 10). Senior females are hit through multiple channels: living longer, facing more unhealthy years, and likely outliving her spouse.

MARKET INCOME MATTERS

Few would disagree that market income is key to a comfortable retirement. Market income can be drawn from pension assets (employee-sponsored or personal-registered), other investment sources or employment. Tax data shows that four-fifths of Canadian seniors drew down a mean $20.8 k annually in after-tax market income in 2021, rivaling near-universal payments under the first two retirement pillars (chart 9, again).

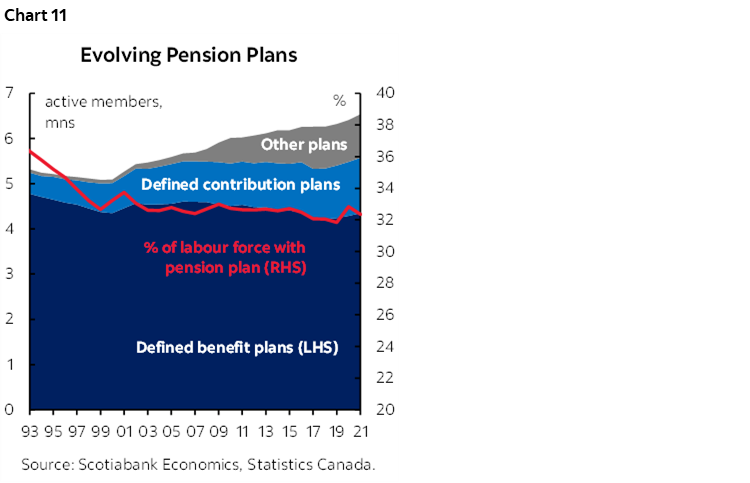

Market income sources are underpinned (for the most part) by improved voluntary wealth accumulation among Canadians. This is owing to a host of well-documented changes ranging from greater policy incentives for voluntary savings to higher female labour force participation to shifts in workforce pensions (though the share of the labour force with plans has stagnated despite growth in numbers) over the past several decades (chart 11). Structurally higher interest rates and stock returns have also provided a lift.

Net wealth of Canadian households has doubled over the last two decades. This measure captures a broader picture of financial wellbeing as it considers not only capital wealth accumulation, but also non-financial wealth (e.g., housing) as well as off-setting liabilities. The median value stood at $329 k in 2019 according to the last Survey of Financial Security. Not surprisingly, seniors enjoy a higher net worth relative to younger cohorts with a lifetime of capital accumulation behind them and homes mostly paid off. Peaking at pre-retirement, the median net worth of 55–64 year-old households stood at $690 k with 70% holding a median value of $350 k in their homes. By retirement age, only 12% held a mortgage against their homes.

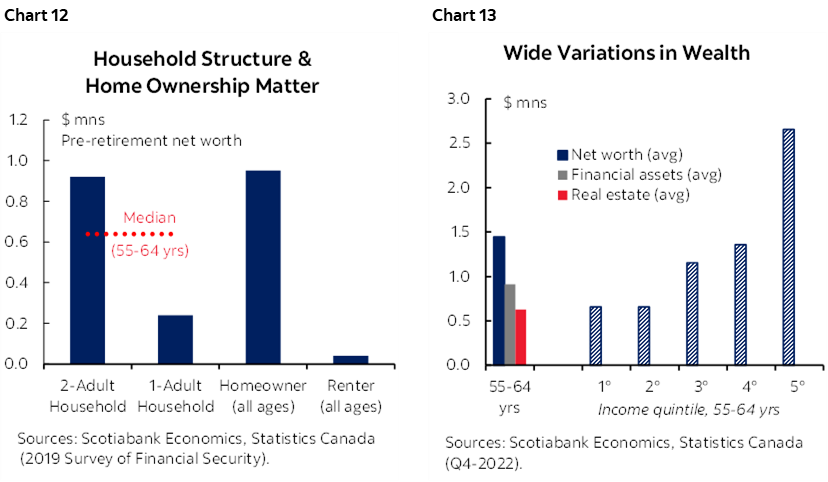

Again, there are enormous variations across households. A two-adult household had a pre-retirement net worth—at $920 k— almost four times that of a single-adult household. The mean net-worth of a homeowner—at $950 k—is almost 25 times greater than a renter (chart 12). More granular (and more recent) data from national accounts—but available only on an average not median basis—not surprisingly shows a wide variation across income brackets. The average net worth of a 55–64 year-old household stood close to $1.5 mn (and financial assets close to $1 mn) whereas the lowest income quintile held half that value and the highest quintile almost four times the net worth (chart 13).

BUT IS IT ENOUGH?

Even modest health shocks could quickly erode the autonomy to age in place for most Canadians. The CIA benchmarks a typical Canadian couple’s accumulation needs at around $1 mn (adjusted to 2023 dollars) based on average senior household consumption. It would not take much to near-double that amount under any number of reasonable health and/or longevity scenarios (chart 2, again and box 1). Even very light homecare needs (i.e., 5 hrs/week) after age 75 would imply accumulation needs about 1.5 times higher if one lived to 100. Moderate needs (e.g., 22 hours per week) after age 75 would be more reasonable at $1.3 mn if expected longevity were 85 years, but extending this out to a 100-year lifespan amounts to $2.2 mn.

A messier, but perhaps more realistic, scenario—light needs from age 75–85, then moderate care from 85–95 years, and continuous care for a final two years would imply savings needs of $2 mn. As noted earlier, it is a minority of senior Canadian households that enter retirement years with this level of capital amassed, especially if non-financial assets (i.e., housing assets) are netted out.

A bottom-up income approach similarly illustrates the potential shock to household pocketbooks that would render aging in place unaffordable to most. The mean disposable income (i.e., taking into account taxes and transfers) of a senior in Canada amounts to $5,000 per month according to national accounts data. Even very modest in-home care costs borne out-of-pocket detailed in the earlier scenarios would be out of reach for the average senior household—or at least without elevating the risk of prematurely depleting savings (chart 1, again).

This admittedly only paints a broad-stroke picture for illustrative purposes. Enormous heterogeneity across household structures and incomes makes a very big difference in retirement readiness and the ability to withstand a health or longevity shock. It also does not take into consideration implications of income needs for left-behind spouses. The key take-away from this simple exercise is to underscore that most Canadians could not afford such a shock and would suffer either a material deterioration in financial security and/or would face more limited, potentially less-desirable care options.

RETHINKING RETIREMENT

Canada’s best bet is a coherent aging policy framework that breaks down silos across disciplines and is backed by a credible fiscal plan. Recognising inconsistencies would be a first step. The fragmented and siloed health and long-term care systems bias towards the costliest routes to care which are also the least-desired by Canadians. The retirement income systems are anchored to out-dated age structures that lean towards a premature pivot to decumulation despite Canadians living longer. While social safety nets in senior years provide a degree of insurance, they are no where near what it would take to age in place even with very modest, non-medical care needs without government backing. They are also spread too thin across a growing senior population. Looking out to the next decade, cash-strapped governments will likely need to (further) means-test a range of supports across the long-term care and financial security landscape, putting even more pressure on voluntary savings for the rest.

Canada should refresh its retirement policy architecture. A starting point could be a net-neutral approach to better-focusing universal financial supports in the first pillar on those in greatest need, while further enabling market income to provide a greater lift for the rest. Governments could also target glaring gaps: over a third of seniors lack any market-based retirement income (private pension or personal registered); lifetime renters are likely to reach retirement with little or no equity of any type; the chasm between two-adult versus one-adult households is far larger then any age-determined thresholds and disproportionately affects female seniors. Governments may even consider formalizing a fourth pillar in the framework to include non-financial assets. Housing plays an outsized role in Canadians’ net worth, yet there is minimal discussion on how to best leverage this asset in retirement planning.

There is no shortage of ink spilled on possible solutions that could be considered in the context of such a refresh. Ideas targeting the accumulation phase include incentives to work longer, increasing RRSP limits, or complementing traditional registered pension plans with tax-free workplace pensions to encourage voluntary savings among lower to middle income Canadians. The government could also consider potentially new savings incentives specifically targeting renters (for example, distinct contribution incentives to RRSPs or TFSAs and/or incorporating co-contributory features of RESPs or RDSPs). Other proposals aimed at the decumulation phase include longevity-tested RRIF rules (e.g., deferred annuitization ages and minimum amounts), as well as risk-pooling mechanisms (absent a deep long-term care insurance market in Canada) such as dynamic pension pools that would fill a gap between annuities and RRIF drawdowns. There may also be space for more thoughtful approaches to incorporating housing wealth into financial security calculations especially given the relatively low uptake of tools like reverse mortgages or housing lines of credit.

Absent such reforms, Canadians likely need to save more (or differently) for retirement and dissave less (or differently) in retirement if they wish to preserve the option to age in place. They may risk leaving something on the table at the end of the day, but it may be the most realistic hedge against health and longevity risk and, importantly, the risk that policy coordination failures persist.

BOX 1: STRESS-TESTING RETIREMENT READINESS

A typical Canadian household would not likely be able to withstand a longevity and/or health-related shock and still preserve the ability to age in place. Clearly there is enormous heterogeneity across households rendering an ‘average’ analysis of limited value to individuals planning for retirement, but it does provide on aggregate a signal to policymakers, financial planners, and Canadian households that the potential financial gaps can be enormous.

We start with an oft-cited (and admittedly simplistic) benchmark that Canadians need $1 mn to retire at age 65. We establish a baseline building on the Canadian Institute of Actuaries (CIA) illustration that a senior couple would need $900 k (in 2019) to retire at 65 years and comfortably draw down $50 k to meet annually consumption needs over the next 20 years. They assume inflation at 2% and conservative investment returns of 3.5%. Annual consumption needs are consistent with the 2019 biannual Survey of Household Spending for senior households. Inflated to 2023 dollars, average spending needs would be closer to $55 k annually, working out to an upfront $1 mn in capital accumulation at the age of retirement. (This level of drawdown would be approximately consistent with a pre-tax income of $65 k.)

We devise four levels of intensity of potential homecare needs. We assume a homecare worker wage of $40/hr (wages generally run between $30–40 / hr with an agency fee on top of that). We assume homecare costs would appreciate with wage inflation at an historic 3% annually. None of the assumptions incorporate additional costs related to medically-trained professional care in the home which would lead to substantially higher costs, but are more likely to be provided publicly.

- “Light care” assumes 5 hrs/week of support in the home—a level consistent with the average utilisation level of homecare at present. We assume government(s) cover 1/3 of the cost, but it is not scalable. This would translate into an annual total cost of $10.4 k, of which about $7 k would be out-of-pocket.

- “Moderate care” assumes 22 hrs/week of support—a threshold that the CMA indicates can make the difference between staying at home versus institutional care for seniors with moderate levels of need. We do not scale the government’s share given current funding biases towards institutional care, rather we assume a ceiling contribution at $6 k annually—about double the current average. This would translate into an annual cost of $43 k with $36 k borne out-of-pocket.

- “Modified continuous care” assumes 45 hrs/week of paid support with the remaining balance (75%) of care provided informally for an individual requiring continuous care. Again, we assume governments would support only $6 k annually with an assumption that institutional care would otherwise be the government’s default option in these higher-needs cases. This would translate into an annual cost of $94 k, of which $88 k would be out-of-pocket.

- “Continuous care” assumes round-the-clock paid support in the home. Again, assuming only modest government support ($6 k), this would translate into $350 k in annual costs (!).

We test capital accumulation needs at retirement under several health and longevity scenarios for illustrative purposes. The same healthy couple in our baseline that requires $1 mn at retirement to fund a $55 k annual drawdown over twenty years (i.e., to 85 years of age) would need slightly more $1.1 mn if one requires light homecare in those final ten years or $1.3 mn if homecare needs are moderate. This quickly escalates in a case where continuous care is required.

The numbers climb further once longevity scenarios are folded into potential care needs. We also assume in all scenarios that household consumption drops by an additional 30% beyond the age of 85 years in an aging-in-place environment with shelter costs largely stable but other discretionary consumption declining. The healthy couple in the baseline would require about $1.3 mn in capital accumulation at age 65 years if they (or one of them) lives to 100 years in a largely healthy and independent state. Light care needs after the age of 75 would drive this number to $1.5 mn, for moderate care needs to $2.2 mn, all the way up to over $9 mn for continuous care. Perhaps a more likely scenario is one of gradual declines—for example, a healthy first decade in retirement, light care needs ages 75–85 years, followed by more moderate needs from ages 85–95, and continuous care in a final two years. Such a scenario would suggest capital accumulation requirements of $2 mn at age 65 years—or twice as much as the baseline of a couple living 20 healthy years to 85.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.