DISASTERS IMPOSE ECONOMIC COSTS ON COMMUNITIES, WHICH REQUIRE CAPITAL TO MITIGATE. INVESTMENT WILL NEED TO KEEP FLOWING TO MAINTAIN A POSITIVE ECONOMIC OUTLOOK

- Natural disasters are increasing in frequency and severity in Canada, with the total money dedicated to rebuilding after natural disaster growing by over 400% between the 2000s and 2010s.

- The costs of disasters on Canadians go beyond rising insurance premiums. Wages, hours worked and house prices can all be depressed for years after a disaster strikes.

- The reason rebounds occur at all is that capital from insurance providers and governments flows into impacted regions, financing rebuilding efforts. Yet both financiers are showing signs of strain. Insurance providers have suffered historic losses in recent years, and our estimates show governments are spending billions more than initially budgeted on disaster management and relief.

- If this trend continues, capital flows may slow, meaning high-risk communities may be unable to fully rebuild. If that occurs, robust rebounds are less likely, and natural disasters could start materially impacting economic performance.

- The root cause of this strain is not something Canada can fully solve by itself, but it can manage it more effectively. Major investments in resilience projects, the creation of a well-designed national flood insurance program, and collecting more granular/frequent economic data would all be steps in the right direction.

- Improved data collection, in particular, is sorely needed. Identifying the scale of damages disasters bring, their impacts on government and household spending, and investments made in adaptation (to name only a few) currently requires analyzing incomplete or insufficient data. More is needed to understand the full picture.

IF A TREE FALLS IN THE FOREST...

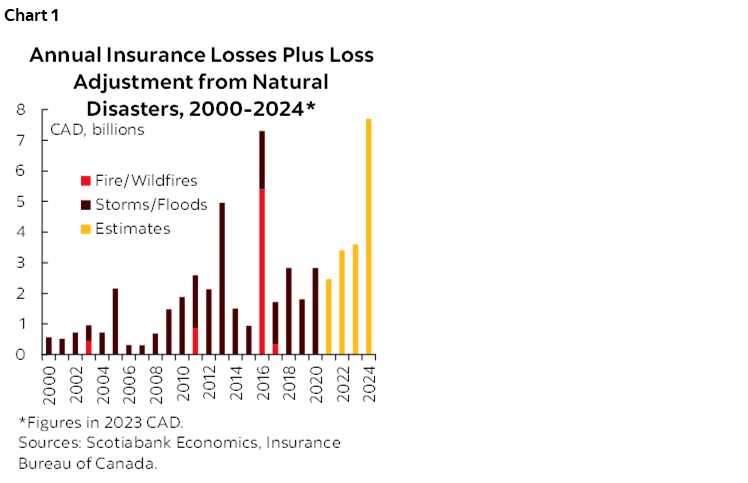

Natural disasters are becoming more frequent and more severe, raising the costs of clean-up in Canada. There were 38% more natural disasters (i.e. floods, wildfires, storms and heat events/droughts) in Canada from 2000–2020 than in the twenty years previous. The amount of damage they incur is also climbing fast. While pinpointing exact estimates for total costs is difficult given the incomplete nature of publicly available data (within the Canadian Disaster Database, less than half of climate-related disasters from 2000–2020 have costs included), what is available suggests clean-up and relief costs grew by over 400% between the 2000s to the 2010s. Insurance claims have been climbing rapidly as well (chart 1). Annually reported losses from the 2020s regularly set new historic records with almost every passing year, with estimates from only a handful of disasters in 2024 alone costing over ten times more than the annual average payout size from 2001–2010 ($7.7B to $701M). A wider range of high-cost events now means that “top loss years” for insurers differ from decades ago, when singular catastrophes tended to be drivers of new records.

The economic impacts of natural disasters go beyond insurance claims. Damage to property and infrastructure, and the impacts of evacuations and outmigration following a disaster, have notable economic effects. In 2016, wildfires in Fort McMurray deducted a full point from GDP in Q2, and recovery was slowed by destruction to property and infrastructure. A Bank of Canada study also indicated periods following disasters see increases in unemployment rates, and declines in hours worked and real wages that linger for months or years. Housing markets are similarly affected. An Intact Centre for Climate Adaptation study identified that houses in neighborhoods hit by catastrophic flooding sold for an average of 8% less than those in non-affected areas, with listing periods increasing and turnover decreasing markedly. Beyond these costs, disasters can also lower tax revenues, destroy wealth in the form of infrastructure and assets, and impose opportunity costs by requiring capital to be directed towards rebuilding rather than more productive ends. The Canadian Climate Institute estimates that these combined costs could see natural disasters decrease GDP by roughly 0.8% by 2050.

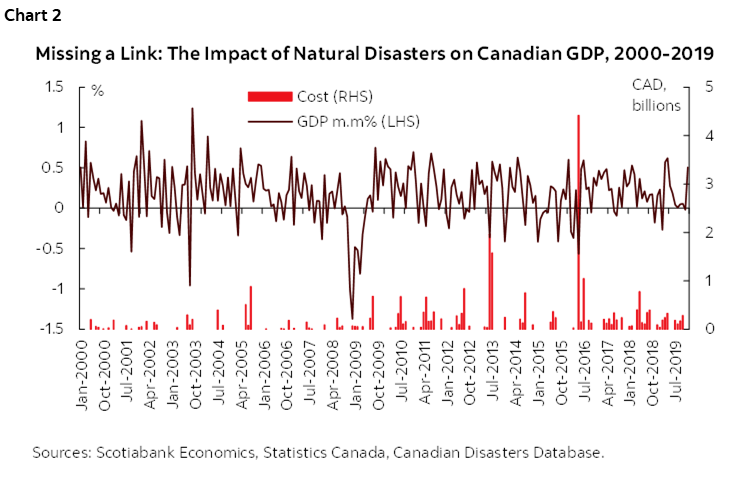

Yet despite these expenses, it can be hard to spot lasting impacts from natural disasters within economic data (chart 2). This murkiness can be attributed to two factors: a lack of sufficiently frequent and granular data to precisely identify the impacts from a single localized disruption, and the reality that the periods of investment and construction following disasters register as growth within the data (even if that growth is lower than it would have been in a hypothetical “no disaster” scenario). Additionally, losses or declines in one sector may be offset by growth in other sectors (ex. a decline in hours worked in retail could be offset by growth in construction). These challenges can hide trends that have tangible, acknowledged impacts. Statistics Canada’s monthly GDP reports have mentioned adverse weather or natural disasters negatively impacting economic performance in roughly one third of prints since the start of 2023, highlighting a discrepancy between the acknowledged short-term impacts of disruption, and what registers in the data.

SURVIVAL OF THE RICHEST

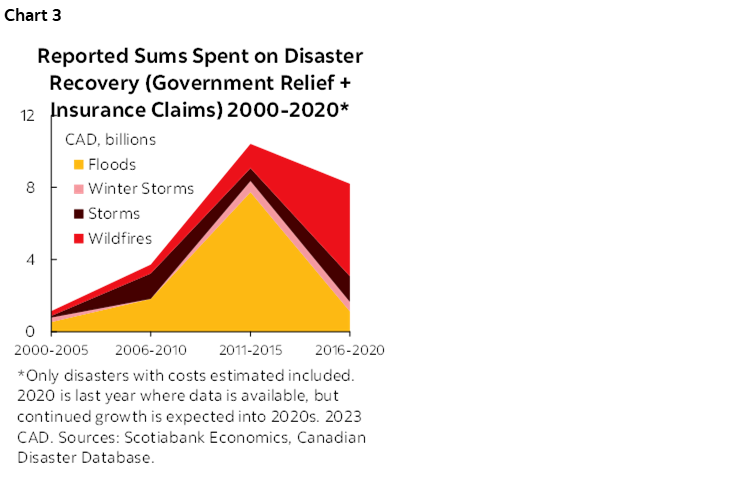

Disruptions are easily navigated when capital is flowing, which is likely the secret to Canada’s economic resilience. A silver lining perspective on data challenges is that a lack of clear, lasting impacts could be evidence that communities rebound rapidly following disasters, a testament to the efficacy of insurance markets and government programs. Broader literature does indicate this may be true, with upcoming Bank of Canada research indicating regions that qualify for federal disaster assistance funding may experience fewer enduring economic effects than those that do not, particularly in provinces with large debt levels whose fiscal firepower is limited. Over the long-run, theory also suggests reinvestment following negative shocks can improve regional output and employment, if new investments represent an improvement in productivity over what was previously there. These claims can be difficult to evaluate given the challenges outlined above, but capital outflows for disaster relief have certainly been increasing (chart 3). These figures do not even represent the full outlays of spending, as unincluded programs such as employment insurance and crop production insurance (both publicly offered) can be, and often are, drawn upon to finance rebuilding or supplement lost income.

UNSUSTAINABLE FINANCE

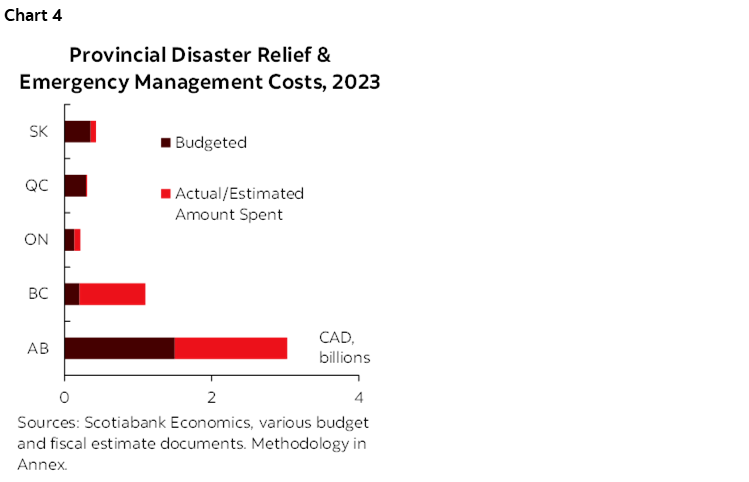

If insurance markets and public spending are the foundation upon which rebounds are built, Canadians (and governments) may be paying more than they think. An assessment of budget and fiscal estimates conducted for this report estimates that provincial expenses incurred for disaster relief and emergency management in 2023–2024 were roughly $5.4B (chart 4). This figure is 5.6x larger than currently available data indicates was spent by provinces on disaster relief over a full twenty-year period, despite the reality that our analysis is limited by available data (it does not include any foregone revenue implications or any capital expenditures to rebuild), and is therefore almost certainly an undercount. Importantly, our analysis indicated that disaster relief and management expenses were over 200% higher than what was originally budgeted, and every province exceeded original budget estimates. The cumulative impacts of all this spending can be substantial enough to affect public finances. Saskatchewan’s mid-year revision from a budget surplus to a deficit in 2023/24 due to unexpectedly high crop insurance payouts that were (partially) linked to drought conditions serves as just one example of the challenges disasters can pose to fiscal management.

High price tags are also afflicting other levels of governments. Adverse and severe weather led to federal crop insurance programs paying out over $4.2B more in 2021–2022 than initially expected. This surplus figure alone is 184% larger than all total private insurance claims from natural disasters in 2021. Costs for municipalities are unclear, but they are likely to grow going forward. The Financial Accountability Office of Ontario estimates that increases in natural disasters will see annual infrastructure costs within the province grow by 8–29%, relative to a stable climate scenario.

Insurance markets have been changing their calculus as claims climb. Insurers in the US have already begun exiting certain markets deemed too costly to operate in, including parts of California and Florida. In Canada, risks are concentrated more in specific assets than entire regions. For example, 90% of flood-risk damages are concentrated in only 10% of homes, accounting for between 1%–22% of houses in each of the provinces and territories. These risks, alongside increases in the number of disasters, have led to premiums rising over the last decade in every province as a response. Another factor is the increasing cost of reinsurance (i.e. insurance for insurance providers). Reinsurance premium increases of 25%–70% in 2023 were high enough that some companies were unable to fully flow through costs to consumers, and instead reduced profits to cover increases. These expenses could add further pressures to insurance markets already under strain, particularly if they continue to climb. Some geographically-concentrated companies have already announced they will simply stop issuing mortgages to homeowners in flood prone areas, as it is increasingly difficult to hedge against risks.

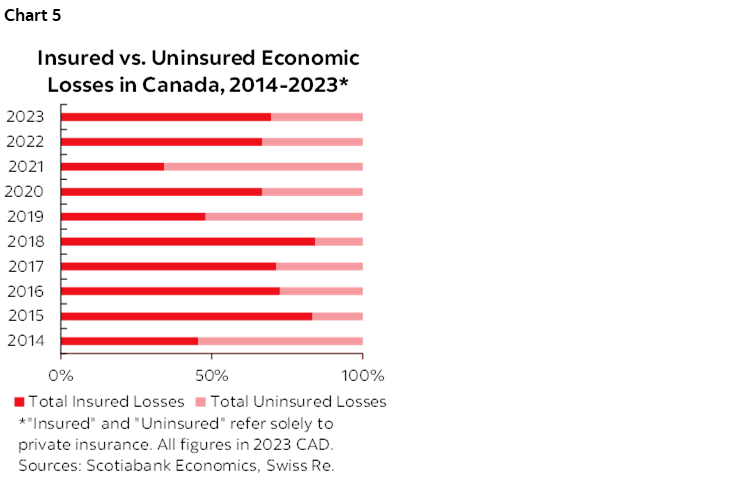

Households, the final payee in the climbing cost triple crown, are a question mark when it comes to scale of impacts. A rule of thumb known as “the insurance gap” indicates that for every $1 in insured losses, there are $3–$4 in uninsured losses borne by governments, businesses and individuals. Exact figures can be debated—SwissRe estimates 41% of damages incurred by natural disasters in Canada from 2014–2023 were not covered by insurance providers (chart 5)—but it is evident that uninsured damages are regularly incurred. Repairing these damages would presumably be financed through government spending occurring through the channels detailed above, or direct spending from households and businesses. Studies show changes in household debt are highest amongst those who are unable to receive public support through disaster relief channels, or when damages exceed the financial support received from public funding. It is likely expenses from homeowners are higher for those living in homes that are uninsurable due to flood risk, as is the case for the aforementioned 1.5M Canadian homes scattered throughout the provinces and territories.

Whatever the final price tag, climate change is likely to make things worse. Public Safety Canada estimates that total insured and uninsured losses are projected to reach an annual average of $15.4B by 2030. Assuming the insurance gap ratio holds, that would see average annual insurance losses of $3.1B – $3.9B within five years, with the remaining $11.5B – $12.3B borne by governments, households and businesses. These higher costs may mean financiers under strain need to make hard decisions about how much support to offer impacted households in high-risk regions, which could create challenges. In economic parlance, more frequent disasters will erode the capital stock more rapidly, and the rate of destruction may exceed the rate of replacement, particularly if an elevated risk of future destruction reduces incoming capital flows. If this point is reached, Canadian communities may begin to experience disasters in different ways. Insurable communities may continue to follow robust rebound trajectories, while neighborhoods built on floodplains, homes at risk of wildfires, and others experience declines following disasters. Home values, amongst other factors, would be impacted if communities proved unable to access or afford insurance (a pre-condition for securing a mortgage), which will have impacts on labour markets, migration, and household savings in turn. Over the long-run, lower economic performance could be expected, and declines could prove difficult to reverse.

An ounce of prevention is worth a pound of cure, but governments have not been spending even that much. The economic benefits of investments in resilience and adaptation are most clearly seen in future avoided costs, with the Canadian Climate Institute estimating that every $1 proactively invested in adaptation could avoid $13–$15 in future direct and indirect economic costs related to disruption and repair. A study from the US Federal Reserve echoes this finding, identifying that households spend less following disasters if they live in homes retrofitted to minimize the impacts of adverse weather events. There is no precise Canadian estimate of how much will need to be spent on adaptation in the coming years, as it will depend on warming and emissions trajectories, but one Insurance Bureau of Canada study indicates that municipalities alone will need to spend over $5B annually to retrofit infrastructure. Adding up all resilience commitments made by the federal government since 2015 amounts to only $6.5B, which evidently falls short, particularly given that much of the money committed in recent years has not yet been spent. Some of the lack of spending by different levels of governments may be attributable to fiscal sensitivities, with a MorningStar analysis indicating Canadian municipalities could face near-to-medium-term debt pressures if major infrastructure spending occurs. Yet other studies have identified that high volumes of natural disasters could increase municipal borrowing costs, making clear that adverse financial impacts will be incurred whether actions are proactive or reactive.

NO GETTING OUT OF THIS ONE

This is a problem we will need to manage. In the absence of increased action to reduce global GHGs, natural disasters are likely to get more frequent and expensive moving forward. A combination of efforts to improve the resilience of communities and households, and manage cost increases from disaster relief, will be required. Step one is to collect and publish more frequent and granular data to assess the economic impacts of disasters, and the full costs of disaster relief. Without it, determining government-wide spending on managing disasters, conducting evaluations, or even identifying which households are currently falling between the cracks of government relief and private insurance, is near impossible. Step two is identifying ways to maintain incoming capital flows to communities following disasters where appropriate, lest their long-run economic outlook be jeopardized. A rapid rollout of the already-announced National Flood Insurance program would allow homes at high risk of flooding to receive coverage in a manner that did not put the balance sheets of private insurance companies at risk. Smart design, such as coverage exclusions for new construction on floodplains, can help mitigate moral hazard and better align the incentives of all parties. This policy priority should be maintained regardless of the outcome of the upcoming federal election. Additionally, since governments will continue to be called upon to back-stop losses, they will need to carefully monitor fiscal positions. Contingency and reserve funds are already being tapped to fund disaster relief efforts, which is unlikely to change as long as costs exceed budgeted sums. Dedicating more capital towards, and implementing measures to de-risk private investment into, resilience projects will be essential to maintaining fiscal stability in coming years, offering a potential double dividend of facilitating private investment while also reducing disaster management expenses.

Finally, questions as to whether to invest in rebuilding in high-risk areas are increasingly being posed. These are difficult questions with wide-ranging implications, but at a minimum, discussions held to answer them should be informed. Federal and provincial governments should incorporate projections of worsening climate impacts into budgetary processes. If risk is expected to increase, then budgets for disaster management and relief should either be increased, or strategic decisions made about which communities will receive which degrees of funding, as has occurred in Quebec. Natural disasters will become a more frequent and expensive reality for Canadians going forward, and the country will need to change the way it responds to find a more financially sustainable path to prosperity in a warmer world. Tragically, this era of hard conversations and difficult choices is only just beginning.

ANNEX

Methodology for budgeted vs. actual/expected disaster relief costs: Costs represent only emergency management and disaster relief expenditures, not capital pledged for rebuilding or resilience/adaptation measures following a disaster. For each province, budgets were reviewed to identify line items that specified disaster relief and/or emergency management costs specifically pertaining to natural disasters (i.e. excluding police, residential firefighting, etc.). For provinces where line items were not specified in budgets, annual reports from government departments were used, or supplementary estimate documents from 2022/2023 were assessed, to calculate the percentage of each provincial department’s total budget that accounted for disaster relief the previous year. These percentages were then multiplied by total departmental expenditures in 2023/24 to estimate total volumes spent. Analysis only includes expenses that were explicitly identified as a line item in a given document, meaning certain costs have likely been excluded. For example, wildland firefighting expenses were included for every province, but public crop insurance program payouts were only included for Saskatchewan and Alberta. Potential revenue impacts resulting from disruptions were also excluded. Other programs, such as federal unemployment insurance, were also excluded due to lack of sufficiently granular data.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.