- The BoE is liking what it sees, but it’s not yet ready to cut nor say when it may. As expected, the bank kept its policy rate steady at 5.25% but the 2 cut 7 hold vote split gave the bank’s communications a more dovish tilt than expected. We maintain our forecast of a June start to rate cuts with a 25bps move due then.

- Overall, the BoE is feeling “optimistic that things are moving in the right direction”, but it was careful to leave its key guidance paragraphs mostly unchanged. The BoE expecting a faster unwinding of second-round inflationary pressures is key in gaining confidence to start rate cuts.

- Bailey said “a June cut is neither ruled out nor a fait accompli”. Two CPI prints and one jobs report (due next week), among other important data, await until the next decision to swing the balance of voters in favour of a cut or a hold. If not in June, it’s difficult to see the BoE waiting past August to begin its easing cycle.

The BoE is liking what it sees, but it’s not yet ready to cut nor say when it may. Today, the monetary policy committee (MPC) held the Bank Rate unchanged at 5.25%, as was widely expected. The 2–7 vote split, with Ramsden joining all-time dove Dhingra in favour of a 25bps rate cut was somewhat surprising but was a possibility teed up by analysts ahead of the decision. The decision was roughly in line with expectations, so we maintain our forecast of a 25bps cut at each of the five remaining meetings of 2024 (beginning in June), to total 125bps by year-end.

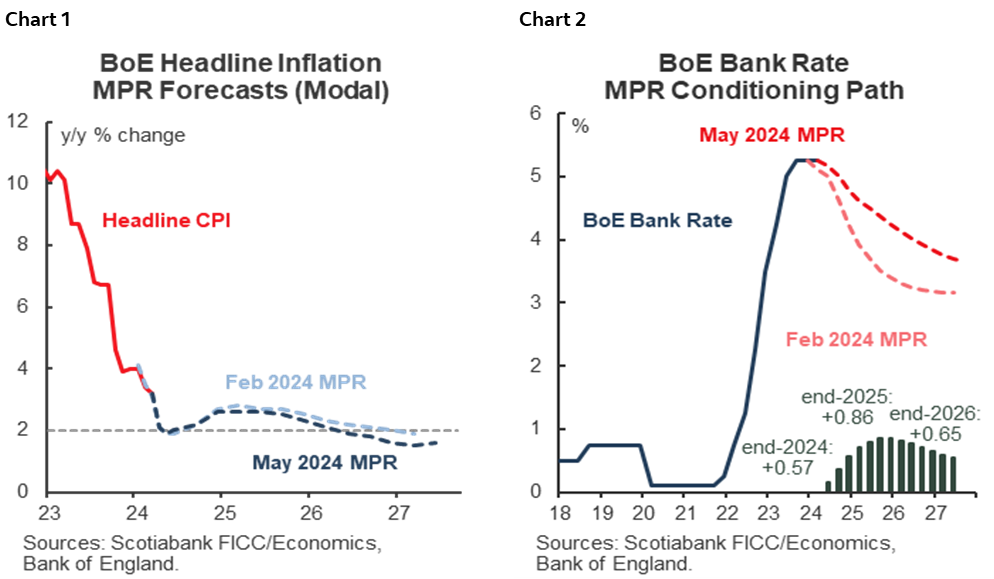

With no major changes to guidance that would tee up a June start to rate cuts, the more dovish than expected vote breakdown was the more gilts-supportive component of the BoE’s statement and Monetary Policy Report (MPR). The new MPR projections show a deep and long-lasting undershooting of inflation in the medium-term (chart 1), but near-term projections were revised only slightly lower. The MPR also shows marginally stronger—but still underwhelming—GDP growth forecasts over the projection horizon. But, these revisions were generally expected, and the big inflation undershoot has a highly restrictive market-implied policy rate path to blame (chart 2).

Overall, the BoE is feeling “optimistic that things are moving in the right direction”, and this assessment is peppered throughout the statement, minutes, MPR, and during the press conference. On the other hand, the BoE was careful to leave its key guidance paragraphs mostly unchanged, with only a small noteworthy inclusion “the Committee will consider forthcoming data releases and how these inform the assessment that the risks from inflation persistence are receding”. This is the BoE firming up its data-dependent guidance, with Bailey highlighting in his presser that between now and the June decision there are two CPI releases and one jobs report on tap.

In the MPR, the BoE’s change to its view on the persistence of inflationary pressures is a key development that builds greater comfort in beginning the easing cycle if not in June, then in August. The MPR notes that “based on the latest evidence […], the best collective judgement of the Committee is that these second-round effects on domestic prices and wages are likely to fade slightly faster than assumed previously”. This new judgement is supported by falling inflation expectations and a looser jobs market prompting lower wage growth. Furthermore, the BoE’s lower inflation profile also reflects a lower import price pass-through—with Bailey highlighting that PMI respondents note difficulties in passing on higher costs—that is particularly evident in the first half of the outlook when compared to the February MPR.

Bailey’s presser gave a lot of interesting headlines, and though he may have taken some unneeded liberties in the face of preying markets, he overall struck a clear data dependent tone. First, he said that “a June cut is neither ruled out nor a fait accompli”, which markets took as push back against cut expectations at the next meeting; more so because Bloomberg flashed ‘fait accompli’ as ‘planned’ (French-speaking traders got a few free bps on that). Bailey is not going to say either way, and in his words “each meeting is a new decision”.

Gov Bailey said that the Bank Rate may fall more sharply than markets expect. One look at how the market-implied policy path that was used in the modal projection (chart 2, again) impacts the inflation path implies the same. But, markets also jumped on this for another leg lower in UK yields. Truisms of them needing to make policy “less restrictive” and that “it is likely we will need to cut the Bank Rate” shouldn’t be market-moving but, combined with the previously mentioned comments, gave the presser an overall dovish feel.

Finally, the BoE statement did not touch on possible changes to QT policy, against the expectation of some due to worries of tight liquidity conditions. Bailey said in his presser that he doesn’t conclude that increased use of short-term repo facilities is an issue and Dep Gov of Banking and Markets, Ramsden, said that he’s comfortable with the usage, which is as intended and the facility is doing its job. Both Ramsden and Broadbent (Dep Gov of Monetary Policy) also said that they see QT continuing alongside rate cuts. No QT policy changes shouldn’t be surprising given the BoE’s strict adherence to previously laid-out guidelines. So, see you in September when it’s time for the next review of the pace of QT (currently £100bn from October 2023 to September 2024).

Market Impact (14.30UK/9.30ET)

The net result of today’s BoE’s communications for UK assets were gains in GBP rates (lower yields), with these more pronounced in the front end and turning relatively modest further out the curve, and a weaker GBP on the crosses. GBP traders had to deal with a sharp leg lower in US yields on a greater-than-expected initial jobless claims print as well as the ongoing supply-induced pressure in the long-end amid heavy issuance over the week (10s are still up 2/3bps on the day).

At writing, markets have lifted June cuts by 2bps pricing to 13bps (call it toss-up odds), and December 2024 pricing by 4bps to what we still see as a very low 58bps in implied cumulative cuts. UK 2s yields are down about 3bps since pre-statement levels but 10s are roughly unchanged with maybe some contagion from a swing higher in German yields (in thin Ascension Day markets) possibly contributing. In any case, a steepening move is a fair reaction to today’s BoE decision (though the twist steepening is a bit disappointing, but note bunds are up 4bps compared to 1.5bps in UK 10s). The GBP is unchanged on the day against the USD around 1.25 after an initial 40pips dip to the mid 1.24s, an only about 0.1% weaker in EURGBP terms on the day (0.2% since pre-BoE). They’re all modest moves that we think should deepen as markets become more confident on BoE cuts in 2024.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.